European Indices Decline

European Trading Session Report | November 04, 2025 | Markets analysis during European hours (8:00 AM – 5:00 PM UTC)

📊 Market Commentary

### European Market Commentary: 6 March 2024

European equities extended losses during today’s trading session, reflecting a risk-off sentiment amid heightened political uncertainties and global valuation concerns. The Euro Stoxx 50 declined 1.32%, dragged down by banking and industrial sectors, while the DAX fell 1.48% on broader manufacturing weakness in Germany. France’s CAC 40 shed 1.21%, with consumer discretionary stocks under pressure from softening economic data, and the FTSE 100 posted a milder 0.69% drop, buoyed somewhat by defensive utilities amid UK fiscal jitters. Sector trends highlighted vulnerabilities in financials, as merger and acquisition setbacks in major Italian lenders underscored ongoing integration challenges, contributing to a broader drag on the Stoxx 600 Banks index.

Key drivers included mounting expectations of UK tax hikes in the upcoming Budget, with Chancellor Rachel Reeves signaling potential increases in income taxes and other levies to address fiscal gaps. This fueled sterling’s depreciation, with GBP/USD slipping 0.20% to test multi-month lows, while gilts rallied as investors sought safe-haven yields. Political developments amplified caution, as Prime Minister Starmer’s rhetoric stoked fears of austerity measures, weighing on consumer-facing sectors across the region. On the continental front, ECB President Christine Lagarde’s comments on Bulgaria’s eurozone integration offered a mild positive for Eastern European peripherals, but failed to offset broader Eurozone data disappointments, including stagnant inflation readings that tempered rate-cut hopes.

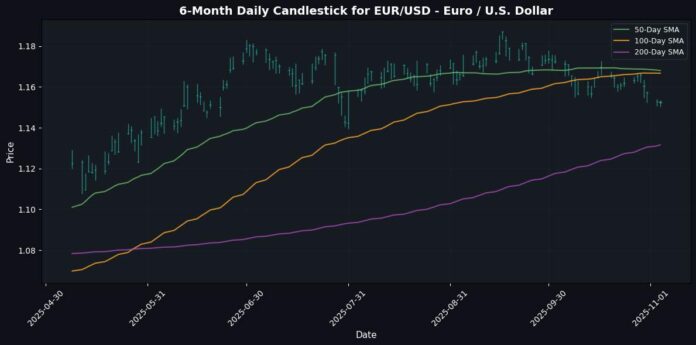

Currency dynamics were mixed: the euro held steady against the dollar, with EUR/USD edging up 0.06%, supported by relative ECB policy stability, though EUR/GBP rose 0.25% on the pound’s woes. The Swiss franc remained resilient, with USD/CHF dipping 0.02%, as haven flows persisted amid global insurer risks and immigration policy frictions spilling over from the US.

Overnight, a mixed US close—with the S&P 500 up 0.17%, Dow down 0.48%, and Nasdaq gaining 0.44%—highlighted tech resilience but flagged sky-high valuations, echoing Wall Street’s caution. Asian markets followed suit with declines, amplifying European selling pressure on open. Investor positioning has turned defensive, with funds rotating into bonds and gold; living will exercises for systemically important banks added to financial sector unease, including spillover from Liechtenstein’s trust issues to Caribbean jurisdictions. Overall sentiment remains fragile, with focus shifting to upcoming Eurozone GDP figures for fresh directional

European Indices Performance

| Index | Price | Daily (%) |

|---|---|---|

| Euro Stoxx 50 | 5604.20 | -1.32 |

| DAX | 23774.12 | -1.48 |

| CAC 40 | 8011.83 | -1.21 |

| FTSE 100 | 9634.43 | -0.69 |

US Markets (Previous Close)

| Index | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6851.97 | +0.17 |

| Dow Jones | 47336.68 | -0.48 |

| Nasdaq 100 | 25972.94 | +0.44 |

💱 Currency Pairs Performance

Performance: (Today Last – Today Open) / Today Open × 100

| Pair | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.15 | +0.06 |

| GBP/USD | 1.31 | -0.20 |

| USD/JPY | 153.66 | -0.35 |

| EUR/GBP | 0.88 | +0.25 |

| USD/CHF | 0.81 | -0.02 |

| AUD/USD | 0.65 | -0.37 |

| USD/CAD | 1.41 | +0.04 |

🛢️ Commodities Performance

Performance: (Close – Previous Close) / Previous Close × 100

| Commodity | Price | Daily (%) |

|---|---|---|

| Gold | 4009.50 | +0.23 |

| Silver | 47.73 | -0.32 |

| Crude Oil (WTI) | 60.49 | -0.92 |

| Brent Oil | 63.89 | -1.54 |

₿ Cryptocurrency Performance

Performance: (Close – Previous Close) / Previous Close × 100

| Crypto | Price | Daily (%) |

|---|---|---|

| Bitcoin | 104498.05 | -1.92 |

| Ethereum | 3507.52 | -2.63 |

📅 Today’s Economic Calendar

High and medium importance events. Times in US Eastern Time (ET).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-11-04 | 02:40 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-11-04 | 03:00 | 🇪🇺 | Medium | Spanish Unemployment Change (Oct) | 22.1K | 5.2K |

| 2025-11-04 | 03:00 | 🇧🇷 | Medium | IPC-Fipe Inflation Index (MoM) (Oct) | 0.27% | |

| 2025-11-04 | 03:00 | 🇳🇿 | Medium | RBNZ Financial Stability Report | ||

| 2025-11-04 | 05:00 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-11-04 | 06:35 | 🇺🇸 | Medium | FOMC Member Bowman Speaks | ||

| 2025-11-04 | 07:00 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-11-04 | 07:00 | 🇧🇷 | Medium | Industrial Production (YoY) (Sep) | ||

| 2025-11-04 | 08:30 | 🇺🇸 | Medium | Exports (Aug) | ||

| 2025-11-04 | 08:30 | 🇺🇸 | Medium | Imports (Aug) | ||

| 2025-11-04 | 08:30 | 🇺🇸 | Medium | Trade Balance (Aug) | -60.40B | |

| 2025-11-04 | 08:30 | 🇨🇦 | Medium | Trade Balance (Sep) | ||

| 2025-11-04 | 10:00 | 🇺🇸 | Medium | Factory Orders (MoM) | 1.4% | |

| 2025-11-04 | 10:00 | 🇺🇸 | High | JOLTS Job Openings (Sep) | ||

| 2025-11-04 | 12:00 | 🇺🇸 | Medium | Atlanta Fed GDPNow (Q4) | ||

| 2025-11-04 | 12:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-11-04 | 15:00 | 🇳🇿 | Medium | RBNZ Financial Stability Report | ||

| 2025-11-04 | 16:30 | 🇺🇸 | Medium | API Weekly Crude Oil Stock | ||

| 2025-11-04 | 17:00 | 🇳🇿 | Medium | RBNZ Gov Orr Speaks | ||

| 2025-11-04 | 18:50 | 🇯🇵 | Medium | Monetary Policy Meeting Minutes | ||

| 2025-11-04 | 19:00 | 🇳🇿 | Medium | RBNZ Press Conference | ||

| 2025-11-04 | 20:45 | 🇨🇳 | Medium | Caixin Services PMI (Oct) | 52.6 | |

| 2025-11-04 | 22:35 | 🇯🇵 | Medium | 10-Year JGB Auction |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.