European Indices Mixed, CAC 40 Leads Gains

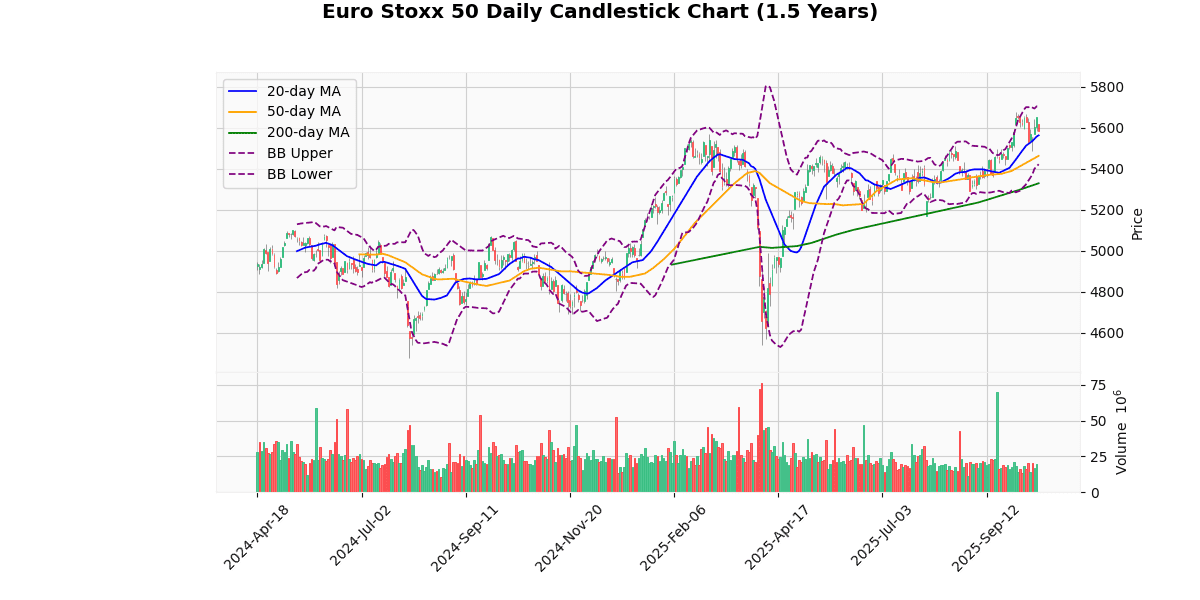

Euro Stoxx 50 Technical Analysis

The Euro Stoxx 50 index is currently trading at 5583.07, slightly above its 20-day moving average (MA20) of 5562.42 and well above its 50-day (MA50) and 200-day (MA200) moving averages, indicating a bullish trend in the medium to long term. The index is positioned between the middle and upper bands of its Bollinger Bands, suggesting moderate volatility.

The Relative Strength Index (RSI) at 54.87 indicates neither overbought nor oversold conditions, supporting a stable market sentiment. However, the Moving Average Convergence Divergence (MACD) at 46.08 is below its signal line at 50.24, hinting at potential bearish momentum in the short term.

Key resistance is near the recent 52-week high at 5674.55, while support is forming around the MA20 and further at the lower Bollinger Band at 5421.47. The index’s performance relative to its recent highs and lows shows resilience but faces immediate overhead challenges.

Technical Metrics

| Metric | Value |

|---|---|

| Current Price | 5583.07 |

| Today’s Change (%) | -1.22 |

| 20-day MA | 5562.42 |

| % from 20-day MA | 0.37 |

| 50-day MA | 5462.27 |

| % from 50-day MA | 2.21 |

| 200-day MA | 5328.46 |

| % from 200-day MA | 4.78 |

| Bollinger Upper | 5703.38 |

| % from BB Upper | -2.11 |

| Bollinger Lower | 5421.47 |

| % from BB Lower | 2.98 |

| RSI (14) | 54.87 |

| MACD | 46.08 |

| MACD Signal | 50.24 |

| 3-day High | 5652.11 |

| % from 3-day High | -1.22 |

| 3-day Low | 5566.97 |

| % from 3-day Low | 0.29 |

| 52-week High | 5674.55 |

| % from 52-week High | -1.61 |

| 52-week Low | 4540.22 |

| % from 52-week Low | 22.97 |

| YTD High | 5674.55 |

| % from YTD High | -1.61 |

| YTD Low | 4540.22 |

| % from YTD Low | 22.97 |

| ATR (14) | 61.23 |

The Euro Stoxx 50 index exhibits a bullish trend, currently trading above its 20-day, 50-day, and 200-day moving averages, indicating sustained upward momentum. Immediate support is established around the recent 3-day low of 5566.97, with more robust support near the 20-day MA at 5562.42. Resistance is seen at the recent 3-day high of 5652.11, approaching the 52-week high of 5674.55. Market sentiment leans positive, supported by a moderate RSI of 54.87, though the MACD below its signal suggests some caution.

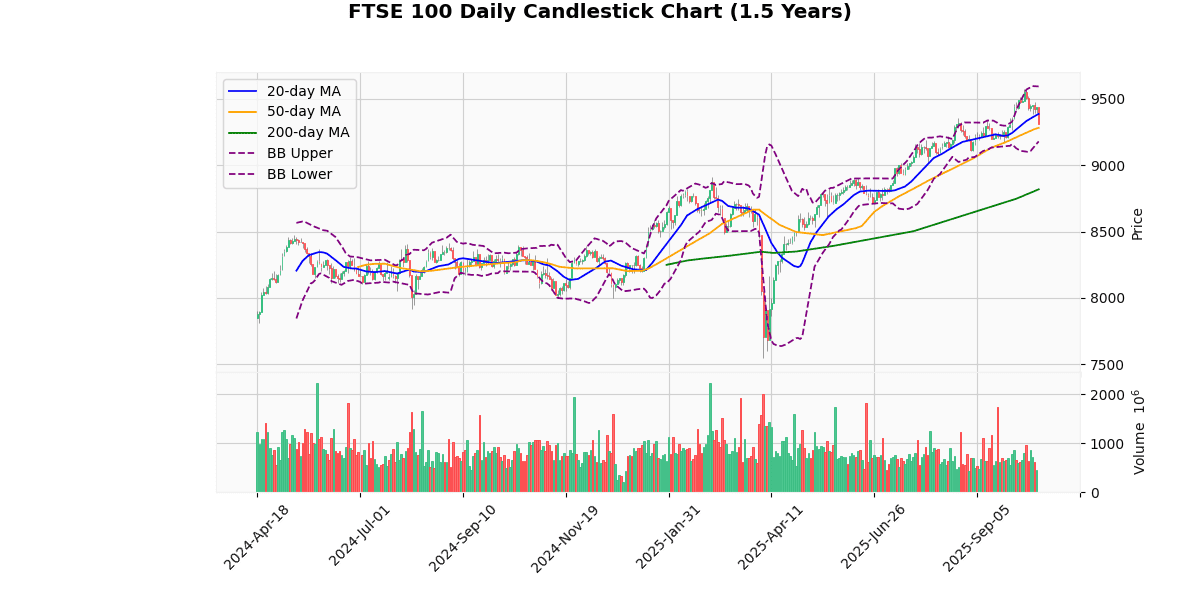

FTSE 100 Technical Analysis

The FTSE 100 is currently trading at 9308.4, showing a slight decline today and positioning just below the 20-day moving average (MA20) of 9386.42, indicating a potential short-term bearish sentiment. However, it remains above the 50-day (MA50 at 9281.72) and significantly above the 200-day moving averages (MA200 at 8818.1), suggesting a longer-term bullish trend. The index is near the lower Bollinger Band (9179.22), which could act as a support level.

The Relative Strength Index (RSI) at 44.82 is nearing the oversold territory, hinting at a possible reversal or stabilization soon. The Moving Average Convergence Divergence (MACD) at 46.02 below its signal line at 61.5 also supports the short-term bearish momentum. The proximity to the 3-day low (9308.37) and the recent underperformance compared to the 3-day high (9474.3) further underline the current cautious market stance.

Technical Metrics

| Metric | Value |

|---|---|

| Current Price | 9308.40 |

| Today’s Change (%) | -1.35 |

| 20-day MA | 9386.42 |

| % from 20-day MA | -0.83 |

| 50-day MA | 9281.72 |

| % from 50-day MA | 0.29 |

| 200-day MA | 8818.10 |

| % from 200-day MA | 5.56 |

| Bollinger Upper | 9593.61 |

| % from BB Upper | -2.97 |

| Bollinger Lower | 9179.22 |

| % from BB Lower | 1.41 |

| RSI (14) | 44.82 |

| MACD | 46.02 |

| MACD Signal | 61.50 |

| 3-day High | 9474.30 |

| % from 3-day High | -1.75 |

| 3-day Low | 9308.37 |

| % from 3-day Low | N/A |

| 52-week High | 9577.10 |

| % from 52-week High | -2.81 |

| 52-week Low | 7544.80 |

| % from 52-week Low | 23.38 |

| YTD High | 9577.10 |

| % from YTD High | -2.81 |

| YTD Low | 7544.80 |

| % from YTD Low | 23.38 |

| ATR (14) | 70.74 |

The FTSE 100 exhibits a neutral to slightly bearish trend, currently trading below the 20-day moving average but above the 50-day and 200-day averages, indicating mixed signals. The index is near its 3-day low and has declined from recent highs, as reflected by the negative MACD below its signal line and an RSI under 50, suggesting mild bearish momentum. Immediate support is at the lower Bollinger band (9179.22), with resistance near the 20-day moving average (9386.42). Market sentiment appears cautious.

CAC 40 Technical Analysis

The CAC 40 index is currently exhibiting bullish momentum, trading at 8188.59, which is a new 3-day high and just shy of its 52-week and year-to-date high at 8257.88. The index is positioned above all key moving averages (MA20 at 7950.84, MA50 at 7860.49, MA200 at 7799.97), indicating a strong upward trend. The price is slightly above the upper Bollinger Band (8155.0), suggesting potential overextension in the short term.

The Relative Strength Index (RSI) at 66.43 indicates bullish momentum without being overbought. The MACD at 63.32 above its signal line at 51.66 supports the continuation of the upward trend. The Average True Range (ATR) of 101.83 points to high volatility, aligning with the significant price movements observed. Overall, the technical indicators suggest sustained bullishness, but caution is warranted near the 52-week high resistance level.

Technical Metrics

| Metric | Value |

|---|---|

| Current Price | 8188.59 |

| Today’s Change (%) | 1.38 |

| 20-day MA | 7950.84 |

| % from 20-day MA | 2.99 |

| 50-day MA | 7860.49 |

| % from 50-day MA | 4.17 |

| 200-day MA | 7799.97 |

| % from 200-day MA | 4.98 |

| Bollinger Upper | 8155.00 |

| % from BB Upper | 0.41 |

| Bollinger Lower | 7746.67 |

| % from BB Lower | 5.70 |

| RSI (14) | 66.43 |

| MACD | 63.32 |

| MACD Signal | 51.66 |

| 3-day High | 8188.59 |

| % from 3-day High | N/A |

| 3-day Low | 7825.97 |

| % from 3-day Low | 4.63 |

| 52-week High | 8257.88 |

| % from 52-week High | -0.84 |

| 52-week Low | 6763.76 |

| % from 52-week Low | 21.07 |

| YTD High | 8257.88 |

| % from YTD High | -0.84 |

| YTD Low | 6763.76 |

| % from YTD Low | 21.07 |

| ATR (14) | 101.83 |

The CAC 40 index exhibits a bullish trend, currently trading above its key moving averages (MA20, MA50, MA200) and near its recent 52-week high. The index has breached the upper Bollinger Band, suggesting strong upward momentum. The RSI at 66.43 indicates a slightly overbought condition but remains below the typical overbought threshold of 70. Immediate resistance is near the 52-week high of 8257.88, with support around the MA20 at 7950.84. Market sentiment appears positive, supported by a bullish MACD above its signal line.

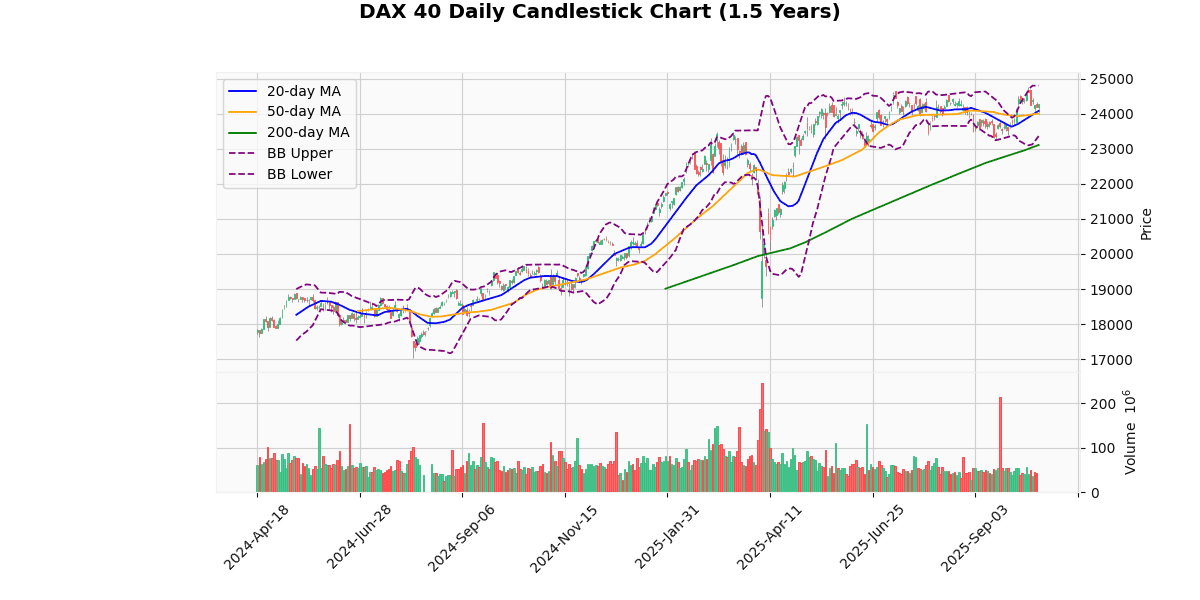

DAX 40 Technical Analysis

The DAX 40 index is currently positioned above its key moving averages (MA20 at 24077.6, MA50 at 23999.76, and MA200 at 23106.33), indicating a bullish trend in the medium to long term. The index’s current price of 24272.19 is near the upper Bollinger Band (24797.02), suggesting potential resistance or overbought conditions. However, the Relative Strength Index (RSI) at 55.09 does not yet signal extreme overbought conditions, providing room for potential upside.

The MACD value of 135.34 above its signal line at 127.29 supports the continuation of the current upward momentum. The index is trading close to its 52-week and year-to-date highs, indicating strong recent performance but also potential resistance near these levels. The Average True Range (ATR) of 253.2 points to ongoing volatility, suggesting cautious trading around these key resistance zones. Overall, the technical setup favors bullish sentiment but advises vigilance near current price levels due to potential pullbacks.

Technical Metrics

| Metric | Value |

|---|---|

| Current Price | 24272.19 |

| Today’s Change (%) | 0.38 |

| 20-day MA | 24077.60 |

| % from 20-day MA | 0.81 |

| 50-day MA | 23999.76 |

| % from 50-day MA | 1.14 |

| 200-day MA | 23106.33 |

| % from 200-day MA | 5.05 |

| Bollinger Upper | 24797.02 |

| % from BB Upper | -2.12 |

| Bollinger Lower | 23358.18 |

| % from BB Lower | 3.91 |

| RSI (14) | 55.09 |

| MACD | 135.34 |

| MACD Signal | 127.29 |

| 3-day High | 24339.27 |

| % from 3-day High | -0.28 |

| 3-day Low | 23986.93 |

| % from 3-day Low | 1.19 |

| 52-week High | 24771.34 |

| % from 52-week High | -2.02 |

| 52-week Low | 18489.91 |

| % from 52-week Low | 31.27 |

| YTD High | 24771.34 |

| % from YTD High | -2.02 |

| YTD Low | 18489.91 |

| % from YTD Low | 31.27 |

| ATR (14) | 253.20 |

The DAX 40 index exhibits a bullish trend, currently trading above its 20-day, 50-day, and 200-day moving averages, indicating strong upward momentum. The index is positioned between its Bollinger Bands, suggesting moderate volatility. Key resistance is near the 52-week high of 24,771.34, with immediate resistance at the upper Bollinger Band around 24,797.02. Support is established at the 20-day moving average of 24,077.6. Market sentiment is positive, reflected by an RSI of 55.09, suggesting moderate buying interest.

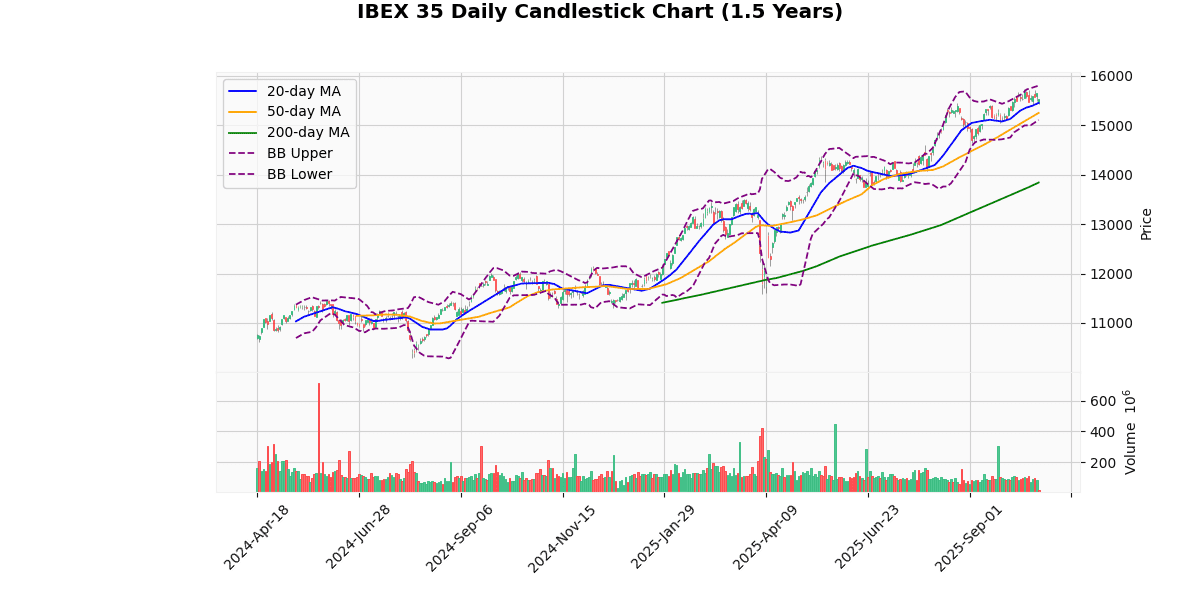

IBEX 35 Technical Analysis

The IBEX 35 is currently positioned at 15520.0, showing a slight decline of 0.8 points today. The index is trading above all its key moving averages (MA20 at 15451.91, MA50 at 15248.29, and MA200 at 13840.37), indicating a strong bullish trend in the medium to long term. The index is also positioned between the middle and upper bands of the Bollinger Bands, suggesting moderate volatility.

The Relative Strength Index (RSI) at 55.63 points to neither overbought nor oversold conditions, supporting a stable market sentiment. However, the Moving Average Convergence Divergence (MACD) at 122.56, below its signal line at 134.2, hints at potential slowing momentum or a near-term pullback.

Key resistance is near the recent 52-week high at 15732.7, while support can be found around the 20-day moving average and further at the lower Bollinger Band. The index’s performance relative to its moving averages and recent price highs/lows suggests cautious optimism with a watch on potential shifts in momentum indicated by the MACD.

Technical Metrics

| Metric | Value |

|---|---|

| Current Price | 15520.00 |

| Today’s Change (%) | -0.80 |

| 20-day MA | 15451.91 |

| % from 20-day MA | 0.44 |

| 50-day MA | 15248.29 |

| % from 50-day MA | 1.78 |

| 200-day MA | 13840.37 |

| % from 200-day MA | 12.14 |

| Bollinger Upper | 15799.14 |

| % from BB Upper | -1.77 |

| Bollinger Lower | 15104.68 |

| % from BB Lower | 2.75 |

| RSI (14) | 55.63 |

| MACD | 122.56 |

| MACD Signal | 134.20 |

| 3-day High | 15719.80 |

| % from 3-day High | -1.27 |

| 3-day Low | 15431.20 |

| % from 3-day Low | 0.58 |

| 52-week High | 15732.70 |

| % from 52-week High | -1.35 |

| 52-week Low | 11295.00 |

| % from 52-week Low | 37.41 |

| YTD High | 15732.70 |

| % from YTD High | -1.35 |

| YTD Low | 11456.20 |

| % from YTD Low | 35.47 |

| ATR (14) | 164.02 |

The IBEX 35 shows a bullish trend, as evidenced by its current price (15,520) being above all key moving averages (MA20, MA50, MA200), indicating sustained upward momentum. The index is trading close to its 52-week and year-to-date highs, suggesting strong market sentiment. Immediate resistance is near the recent high at 15,732.7, with support around the 20-day moving average at 15,451.91. The RSI at 55.63 points to neither overbought nor oversold conditions, supporting potential stability or continued growth.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.