European Indices Rise Slightly; FTSE 100 Tops with 0.32% Gain

European Trading Session Report | October 21, 2025 | Markets analysis during European hours (8:00 AM – 5:00 PM UTC)

📊 Market Commentary

### European Market Commentary: Modest Gains Amid Fiscal and Policy Headwinds

European equities edged higher in a subdued trading session, buoyed by the previous night’s robust US market performance, where the S&P 500 rose 1.07%, the Dow Jones climbed 1.12%, and the Nasdaq 100 surged 1.30%. This positive spillover from Wall Street, coupled with a rebound in Asian markets following recent selloffs, fostered cautious optimism among investors. However, gains were tempered by ongoing concerns over fiscal pressures and political uncertainties in the Eurozone, alongside a strengthening US dollar that weighed on regional currencies.

Key indices reflected this mixed sentiment. The FTSE 100 led with a 0.32% advance, supported by resilient UK consumer sectors despite reports of borrowing reaching a five-year high, signaling potential strains on household finances and broader fiscal sustainability. The CAC 40 followed at 0.21%, driven by selective buying in banking stocks amid discussions of successful merger strategies, even as past failures like BBVA’s bid underscore integration challenges. Germany’s DAX rose modestly by 0.08%, but political tensions—exemplified by leadership tests within the ruling coalition—curbed enthusiasm, particularly in export-sensitive industrials. The Euro Stoxx 50 eked out a 0.07% gain, with green energy and renewables providing pockets of strength; for instance, solar financing developments in Germany highlighted sector resilience, while steelmakers race to scale sustainable production to evade pitfalls seen in battery manufacturing peers.

Sector trends leaned toward defensive plays, with financials and utilities outperforming amid ECB scrutiny. ECB Chief Economist Philip R. Lane’s remarks on monetary policy transmission emphasized the role of financial conditions and credit dynamics, reinforcing expectations of a measured easing path despite sticky inflation. This comes as Eurozone data points to uneven growth, potentially influencing the central bank’s September pivot.

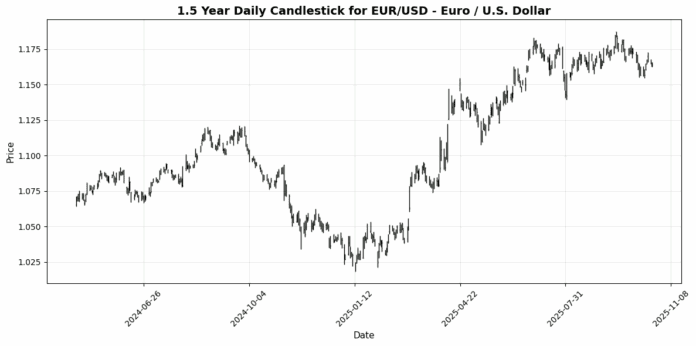

In FX markets, the euro depreciated 0.17% against the dollar, reflecting diminished yield appeal and political risks in Germany, while sterling mirrored this slide at -0.17%, pressured by elevated UK debt levels that could complicate fiscal policy. The Swiss franc weakened slightly versus the USD (-0.09% on USD/CHF), but retained safe-haven undertones amid global AI investment warnings from financial heavyweights, which spotlight Europe’s lag in tech innovation.

Investor positioning remains prudent, with flows favoring quality names in renewables and bonds—evidenced by Wall Street’s interest in Europe’s e-trading opportunities under new regulations. Overall

🇪🇺 European Indices Performance

Performance: (Today Last – Yesterday Close) / Yesterday Close × 100

| Index | Price | Daily (%) |

|---|---|---|

| Euro Stoxx 50 | 5685.17 | +0.07 |

| DAX | 24278.04 | +0.08 |

| CAC 40 | 8223.04 | +0.21 |

| FTSE 100 | 9433.57 | +0.32 |

🇺🇸 US Markets (Previous Close)

Performance: (Yesterday – 2 Days Ago) / 2 Days Ago × 100

| Index | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6735.13 | +1.07 |

| Dow Jones | 46706.58 | +1.12 |

| Nasdaq 100 | 25141.02 | +1.30 |

💱 Currency Pairs Performance

Performance: (Today Last – Today Open) / Today Open × 100

| Pair | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.16 | -0.17 |

| GBP/USD | 1.34 | -0.17 |

| USD/JPY | 151.17 | +0.30 |

| EUR/GBP | 0.87 | 0.00 |

| USD/CHF | 0.79 | +0.09 |

| AUD/USD | 0.65 | -0.57 |

| USD/CAD | 1.41 | +0.26 |

🛢️ Commodities Performance

Performance: (Close – Previous Close) / Previous Close × 100

| Commodity | Price | Daily (%) |

|---|---|---|

| Gold | 4286.80 | -1.14 |

| Silver | 49.09 | -3.98 |

| Crude Oil (WTI) | 57.23 | -0.50 |

| Brent Oil | 60.79 | -0.36 |

| Natural Gas | 3.40 | +0.15 |

₿ Cryptocurrency Performance

Performance: (Close – Previous Close) / Previous Close × 100

| Crypto | Price | Daily (%) |

|---|---|---|

| Bitcoin | 107913.89 | -2.42 |

| Ethereum | 3884.57 | -2.42 |

📅 Today’s Economic Calendar

High and medium importance events. Times in US Eastern Time (ET).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-21 | 00:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-21 | 03:00 | 🇪🇺 | Medium | ECB’s Lane Speaks | ||

| 2025-10-21 | 06:30 | 🇬🇧 | Medium | BoE Gov Bailey Speaks | ||

| 2025-10-21 | 07:00 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-10-21 | 07:30 | 🇺🇸 | Medium | Business Inventories (MoM) (Aug) | 0.1% | |

| 2025-10-21 | 07:30 | 🇺🇸 | Medium | Retail Inventories Ex Auto (Aug) | 0.3% | |

| 2025-10-21 | 07:30 | 🇺🇸 | Medium | US Leading Index (MoM) (Sep) | 0.1% | |

| 2025-10-21 | 08:30 | 🇨🇦 | Medium | Core CPI (YoY) (Sep) | ||

| 2025-10-21 | 08:30 | 🇨🇦 | Medium | Core CPI (MoM) (Sep) | ||

| 2025-10-21 | 08:30 | 🇨🇦 | Medium | CPI (MoM) (Sep) | -0.1% | |

| 2025-10-21 | 09:00 | 🇺🇸 | Medium | Fed Waller Speaks | ||

| 2025-10-21 | 13:00 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-10-21 | 15:30 | 🇺🇸 | Medium | Fed Waller Speaks | ||

| 2025-10-21 | 16:30 | 🇺🇸 | Medium | API Weekly Crude Oil Stock | ||

| 2025-10-21 | 17:00 | 🇺🇸 | Medium | TIC Net Long-Term Transactions (Aug) | ||

| 2025-10-21 | 18:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-21 | 19:50 | 🇯🇵 | Medium | Adjusted Trade Balance | -0.11T | |

| 2025-10-21 | 19:50 | 🇯🇵 | Medium | Exports (YoY) (Sep) | 4.6% | |

| 2025-10-21 | 19:50 | 🇯🇵 | Medium | Trade Balance (Sep) | 22.0B |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.