European Markets Decline; FTSE 100 Gains Amid Mixed Economic Signals

European Trading Session Report | October 22, 2025 | Markets analysis during European hours (8:00 AM – 5:00 PM UTC)

📊 Market Commentary

### European Market Commentary: October 17, 2024

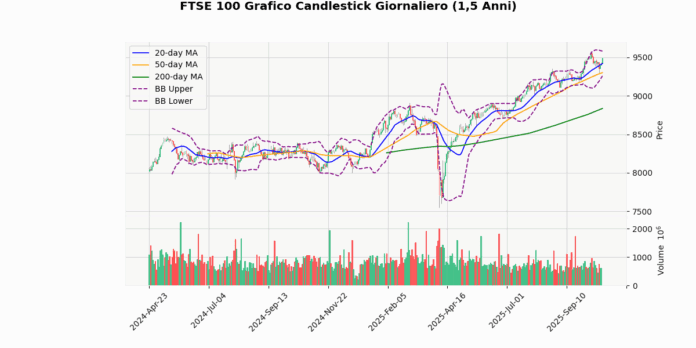

European equities traded lower in a cautious session, weighed down by persistent inflationary pressures and mixed corporate earnings, though the FTSE 100 bucked the trend amid resilient UK data. The Euro Stoxx 50 declined 0.42%, reflecting broad-based selling in financials and industrials, while the DAX eased 0.24% as German exporters grappled with a firmer euro. The CAC 40 underperformed with a 0.68% drop, hit by luxury goods and energy sectors amid subdued consumer demand signals. In contrast, the FTSE 100 rose 0.71%, supported by defensive utilities and consumer staples, buoyed by steady UK inflation at 3.8% in September, which tempered expectations for an imminent Bank of England rate cut.

Key drivers included UK fiscal policy shifts, with proposals to target tax avoidance among high-net-worth individuals and a near-7% hike in the real living wage signaling tighter labor costs and potential margin squeezes for businesses. Banking woes intensified as major lenders reported profit hits from credit exposures, underscoring vulnerabilities in non-bank financing amid “shadow banking” uncertainties. Political tensions in Turkey rattled regional sentiment, amplifying risk aversion in emerging-linked assets. On the IPO front, a consumer goods firm’s planned £400 million London listing offered a glimmer of capital market optimism, potentially aiding mid-cap recovery.

Currency dynamics favored the pound against the euro, with EUR/GBP climbing 0.35% as sterling gained traction from sticky inflation, pushing GBP/USD down 0.39% versus a broadly stronger dollar. EUR/USD slipped 0.06%, pressured by ECB hawkishness on wage growth and Eurozone PMI softness, while USD/CHF dipped 0.04% as safe-haven flows eased slightly. The Swiss franc held steady, reflecting neutral positioning amid subdued volatility.

Overnight, mixed US earnings left the S&P 500 flat (up 0.00%), the Dow up 0.47%, and Nasdaq down 0.06%, with Asian markets subdued on China stimulus doubts, setting a tentative tone for Europe. Gold’s slip signaled fading haven demand, while investor sentiment remains guarded—positioning leans defensive, with flows into bonds and cash as rate cut bets waver. Upcoming ECB commentary and UK wage data will be pivotal for directional cues.

)

🇪🇺 European Indices Performance

Performance: (Today Last – Yesterday Close) / Yesterday Close × 100

| Index | Price | Daily (%) |

|---|---|---|

| Euro Stoxx 50 | 5663.15 | -0.42 |

| DAX | 24271.87 | -0.24 |

| CAC 40 | 8203.00 | -0.68 |

| FTSE 100 | 9493.92 | +0.71 |

🇺🇸 US Markets (Previous Close)

Performance: (Yesterday – 2 Days Ago) / 2 Days Ago × 100

| Index | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6735.35 | +0.00 |

| Dow Jones | 46924.74 | +0.47 |

| Nasdaq 100 | 25127.13 | -0.06 |

💱 Currency Pairs Performance

Performance: (Today Last – Today Open) / Today Open × 100

| Pair | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.16 | -0.06 |

| GBP/USD | 1.33 | -0.39 |

| USD/JPY | 151.72 | -0.14 |

| EUR/GBP | 0.87 | +0.35 |

| USD/CHF | 0.80 | -0.04 |

| AUD/USD | 0.65 | +0.05 |

| USD/CAD | 1.40 | -0.09 |

🛢️ Commodities Performance

Performance: (Close – Previous Close) / Previous Close × 100

| Commodity | Price | Daily (%) |

|---|---|---|

| Gold | 4117.50 | +0.73 |

| Silver | 47.91 | +0.98 |

| Crude Oil (WTI) | 58.26 | +0.76 |

| Brent Oil | 62.32 | +1.63 |

| Natural Gas | 3.46 | -0.55 |

₿ Cryptocurrency Performance

Performance: (Close – Previous Close) / Previous Close × 100

| Crypto | Price | Daily (%) |

|---|---|---|

| Bitcoin | 108381.99 | -0.09 |

| Ethereum | 3861.23 | -0.40 |

📅 Today’s Economic Calendar

High and medium importance events. Times in US Eastern Time (ET).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-22 | 02:00 | 🇬🇧 | Medium | CPI (MoM) (Sep) | 0.0% | |

| 2025-10-22 | 02:00 | 🇬🇧 | High | CPI (YoY) (Sep) | 3.8% | 4.0% |

| 2025-10-22 | 02:00 | 🇬🇧 | Medium | CPIH (YoY) | 4.1% | |

| 2025-10-22 | 02:00 | 🇬🇧 | Medium | PPI Input (MoM) (Sep) | -0.1% | 0.3% |

| 2025-10-22 | 07:00 | 🇪🇺 | Medium | ECB’s De Guindos Speaks | ||

| 2025-10-22 | 08:25 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-10-22 | 10:30 | 🇺🇸 | High | Crude Oil Inventories | 2.200M | |

| 2025-10-22 | 10:30 | 🇺🇸 | Medium | Cushing Crude Oil Inventories | ||

| 2025-10-22 | 11:00 | 🇪🇺 | Medium | German Buba Vice President Buch Speaks | ||

| 2025-10-22 | 13:00 | 🇺🇸 | Medium | 20-Year Bond Auction | ||

| 2025-10-22 | 16:00 | 🇬🇧 | Medium | BoE Deputy Governor Woods Speaks | ||

| 2025-10-22 | 16:00 | 🇺🇸 | Medium | Fed Vice Chair for Supervision Barr Speaks |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.