European Markets Mixed: DAX Gains Amidst Currency Fluctuations

European Trading Session Report | November 03, 2025 | Markets analysis during European hours (8:00 AM – 5:00 PM UTC)

📊 Market Commentary

### European Market Commentary: Mixed Session Amid Wage Pressures and Global Trade Signals

European markets opened with a subdued tone on Wednesday, reflecting a blend of domestic wage concerns and external trade developments. The Euro Stoxx 50 edged lower by 0.06%, weighed down by defensive sectors amid uncertainty over labor costs encroaching on entry-level professional pay, signaling potential inflationary pressures in the UK and broader Eurozone. In contrast, Germany’s DAX climbed 0.25%, buoyed by industrial resilience, while the FTSE 100 gained 0.17% on banking sector support despite calls to curb regulatory scrutiny on UK lenders. The CAC 40 dipped 0.22%, with consumer and financial stocks underperforming as merger funding explorations in professional services highlighted integration challenges.

Key drivers included lingering ECB policy debates, with investors parsing recent Eurozone data for signs of wage-driven inflation that could delay rate cuts. Political stability remains a wildcard, particularly in fragmented national landscapes, though no major disruptions emerged today. Sector trends favored energy, up modestly on oil’s ascent as producers signal pauses in output hikes amid surplus outlooks, providing a hedge against geopolitical risks. Financials showed resilience, countering narratives of excessive oversight, while asset management faced headwinds from escalating warnings on private credit exposures.

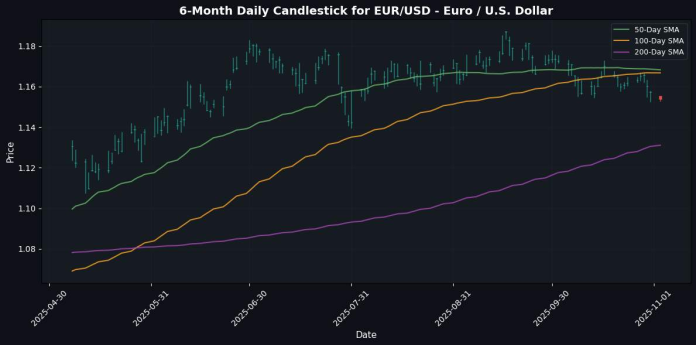

Currency dynamics underscored a softer euro and pound against the dollar. EUR/USD slipped 0.03%, reflecting ECB caution versus Fed hawkishness, while GBP/USD eased 0.03% amid UK wage squeeze headlines eroding sterling’s appeal. The EUR/GBP pair ticked up 0.01%, hinting at relative euro strength. CHF gained ground with USD/CHF rising 0.07%, as safe-haven flows persisted amid global volatility. Broader FX moves, including AUD/USD’s 0.11% advance, pointed to commodity-linked optimism.

Overnight, US markets closed higher, with the Nasdaq 100 up 0.48% on tech momentum and the S&P 500 gaining 0.26%, setting a cautiously positive tone for Europe despite tariff pause signals on China-bound shipping, which eased trade war fears. Asian sessions were mixed, with critical minerals demand driving rare earth proxies higher, influencing European miners.

Overall sentiment leans neutral, with investors positioning defensively in bonds and defensives, awaiting clearer ECB guidance. Positioning suggests selective rotation into cyclicals if wage data softens, though global trade frictions could cap upside. (Word count: 348)

🇪🇺 European Indices Performance

Performance: (Today Last – Yesterday Close) / Yesterday Close × 100

| Index | Price | Daily (%) |

|---|---|---|

| Euro Stoxx 50 | 5658.68 | -0.06 |

| DAX | 24017.42 | +0.25 |

| CAC 40 | 8103.18 | -0.22 |

| FTSE 100 | 9734.09 | +0.17 |

🇺🇸 US Markets (Previous Close)

Performance: (Yesterday – 2 Days Ago) / 2 Days Ago × 100

| Index | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6840.20 | +0.26 |

| Dow Jones | 47562.87 | +0.09 |

| Nasdaq 100 | 25858.13 | +0.48 |

💱 Currency Pairs Performance

Performance: (Today Last – Today Open) / Today Open × 100

| Pair | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.15 | -0.03 |

| GBP/USD | 1.31 | -0.03 |

| USD/JPY | 154.13 | -0.04 |

| EUR/GBP | 0.88 | +0.01 |

| USD/CHF | 0.81 | +0.07 |

| AUD/USD | 0.66 | +0.11 |

| USD/CAD | 1.40 | +0.04 |

₿ Cryptocurrency Performance

Performance: (Close – Previous Close) / Previous Close × 100

| Crypto | Price | Daily (%) |

|---|---|---|

| Bitcoin | 107538.05 | -2.80 |

| Ethereum | 3712.71 | -5.07 |

📅 Today’s Economic Calendar

High and medium importance events. Times in US Eastern Time (ET).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-11-03 | 02:30 | 🇨🇭 | Medium | CPI (MoM) (Oct) | -0.3% | -0.1% |

| 2025-11-03 | 03:15 | 🇪🇺 | Medium | HCOB Spain Manufacturing PMI (Oct) | 52.1 | 51.8 |

| 2025-11-03 | 03:30 | 🇨🇭 | Medium | procure.ch Manufacturing PMI (Oct) | 47.7 | |

| 2025-11-03 | 03:45 | 🇪🇺 | Medium | HCOB Italy Manufacturing PMI (Oct) | 49.3 | |

| 2025-11-03 | 03:50 | 🇪🇺 | Medium | HCOB France Manufacturing PMI (Oct) | 48.3 | |

| 2025-11-03 | 03:55 | 🇪🇺 | Medium | HCOB Germany Manufacturing PMI (Oct) | 49.6 | |

| 2025-11-03 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Manufacturing PMI (Oct) | 50.0 | |

| 2025-11-03 | 04:30 | 🇬🇧 | Medium | S&P Global Manufacturing PMI (Oct) | 49.6 | |

| 2025-11-03 | 07:00 | 🇪🇺 | Medium | ECB’s Lane Speaks | ||

| 2025-11-03 | 09:45 | 🇺🇸 | High | S&P Global Manufacturing PMI (Oct) | 52.2 | |

| 2025-11-03 | 10:00 | 🇺🇸 | Medium | ISM Manufacturing Employment (Oct) | ||

| 2025-11-03 | 10:00 | 🇺🇸 | High | ISM Manufacturing PMI (Oct) | 49.4 | |

| 2025-11-03 | 10:00 | 🇺🇸 | High | ISM Manufacturing Prices (Oct) | 62.4 | |

| 2025-11-03 | 12:00 | 🇺🇸 | Medium | FOMC Member Daly Speaks | ||

| 2025-11-03 | 12:20 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-11-03 | 13:30 | 🇨🇦 | Medium | BoC Gov Macklem Speaks | ||

| 2025-11-03 | 22:30 | 🇦🇺 | High | RBA Interest Rate Decision (Nov) | 3.60% | |

| 2025-11-03 | 22:30 | 🇦🇺 | Medium | RBA Rate Statement | ||

| 2025-11-03 | 23:30 | 🇦🇺 | Medium | RBA Monetary Policy Statement |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.