🌍 European Markets Slide as US Trading Gains Momentum Amid Mixed Economic Signals

European markets approaching close (still trading) • US markets actively trading • Analysis based on last 8 hours

📊 Market Overview

As European markets approach the close, the FTSE 100 has dipped by 0.44%, reflecting investor caution amid ongoing economic uncertainties. Key drivers include the European Central Bank’s recent decision to hold interest rates steady, which has fueled concerns about economic stagnation in the region. Additionally, the GBP remains under pressure, with market sentiment influenced by the UK’s fiscal challenges and a soft undertone noted by analysts at Scotiabank. The EUR/GBP pair is trading slightly lower, reverting early gains as fiscal woes in the UK weigh on the Euro.

Meanwhile, US markets are currently active, with the Nasdaq 100 up by 0.32%. The positive performance can be attributed to a resilient tech sector as investors react to Federal Reserve officials’ comments regarding the economy. Fed officials, including Cleveland President Beth Hammack and Atlanta President Raphael Bostic, are participating in discussions that highlight the tensions between inflation control and economic growth, contributing to a cautious yet optimistic market sentiment in the US.

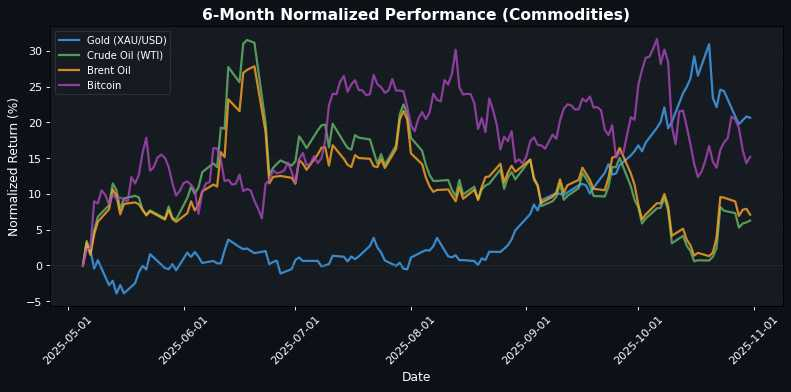

Correlations between the USD and major currencies are also evident today; the Canadian Dollar is under pressure against the stronger US Dollar following the Fed’s cautious tone, while the Japanese Yen steadies amid signs of fatigue in its recent uptrend against the USD. Commodities like gold and silver are holding steady, with gold remaining flat above $4,000, pressured by the stronger dollar and cautious Fed outlooks.

Overall, market sentiment remains mixed as investors balance optimism from US tech gains against European economic concerns, highlighting a complex cross-market dynamic as we head into the weekend.

🇪🇺 European Markets (Approaching Close)

| Name | Price | Daily (%) |

|---|---|---|

| EuroStoxx 50 | 5662.04 | -0.65% |

| DAX | 23958.30 | -0.67% |

| FTSE 100 | 9717.25 | -0.44% |

| CAC 40 | 8121.07 | -0.44% |

🇺🇸 US Markets (Currently Active)

| Name | Price | Daily (%) |

|---|---|---|

| S&P 500 | 6826.65 | +0.06% |

| Dow Jones | 47430.60 | -0.19% |

| Nasdaq 100 | 25817.70 | +0.32% |

🌏 Asian Markets

| Name | Price | Daily (%) |

|---|---|---|

| Nikkei 225 | 52411.34 | +2.12% |

| Shanghai Composite | 3954.79 | -0.81% |

| Hang Seng | 25906.65 | -1.43% |

💱 FX & Commodities

| Name | Price | Daily (%) |

|---|---|---|

| EUR/USD | 1.15 | -0.32% |

| GBP/USD | 1.31 | -0.14% |

| USD/JPY | 154.08 | +0.00% |

| Gold (XAU/USD) | 3995.30 | -0.15% |

| Crude Oil (WTI) | 60.71 | +0.23% |

| Brent Oil | 64.50 | -0.77% |

| Bitcoin | 109134.55 | +0.77% |

🌍 Geopolitics and Market Drivers

Current geopolitical and macroeconomic factors are significantly influencing market dynamics. The U.S. Federal Reserve’s mixed signals, with officials like Hammack and Logan indicating reluctance to cut rates further despite economic momentum, contribute to market uncertainty. This cautious stance has bolstered the U.S. Dollar, impacting currencies like the Canadian Dollar, which is weakened by wider spreads and a strong USD demand.

Geopolitically, tensions are rising, particularly with China’s aggressive stance on rare earth materials, as highlighted by U.S. Treasury’s Bessent, which may affect supply chains and market stability. The European Central Bank’s decision to maintain rates amid UK fiscal challenges adds to the pressure on the Euro and British Pound, with the latter maintaining a soft undertone.

In commodities, gold remains flat near $4,000, constrained by a stronger dollar, while silver holds steady amidst U.S. fiscal uncertainties. Overall, geopolitical tensions, central bank policies, and economic data releases are creating a complex environment for investors navigating these market shifts.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.