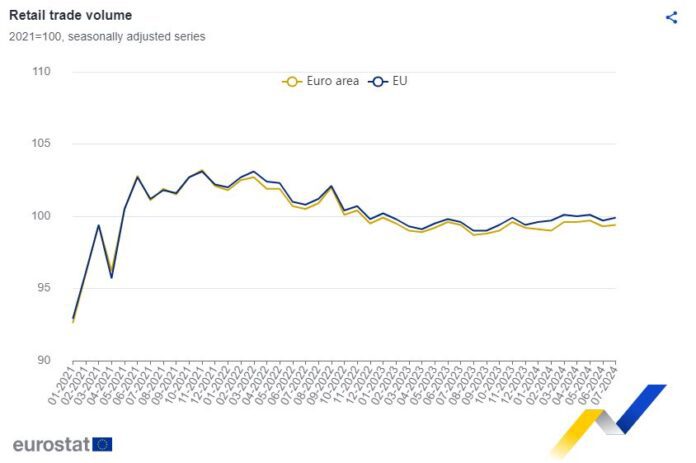

Retail sales in the Eurozone showed a slight decline in July 2024, falling by 0.1% compared to the same month in 2023, while the broader European Union (EU) saw a modest increase of 0.4% over the same period. These figures come from the latest report by Eurostat, the statistical office of the European Union, reflecting the ongoing challenges and disparities within the region’s retail sector.

On a monthly basis, the seasonally adjusted retail trade volume increased by 0.1% in the Eurozone and by 0.2% in the EU in July 2024 compared to June 2024. This uptick follows a decrease in June 2024, where retail trade volumes fell by 0.4% in both the Eurozone and the EU, highlighting a slight recovery in consumer activity.

Sectoral Performance

In the Eurozone, the retail trade volume for food, drinks, and tobacco grew by 0.4% in July 2024 compared to the previous month, while non-food products (excluding automotive fuel) saw a marginal increase of 0.1%. However, the volume of automotive fuel in specialized stores decreased by 1.0%, reflecting a shift in consumer spending patterns.

In the broader EU, the trends were somewhat similar, with retail trade volume for food, drinks, and tobacco rising by 0.5%, and non-food products (excluding automotive fuel) increasing by 0.2%. The decline in automotive fuel sales was more pronounced in the EU, with a 1.4% drop in specialized stores.

National Trends

Significant variations were observed among EU Member States. Croatia led the monthly increases with a 2.9% rise in retail trade volume, followed by Austria and Slovakia, both at +1.8%, and Slovenia at +1.6%. Conversely, Luxembourg saw the largest monthly decrease at -2.1%, with Romania (-1.8%) and Cyprus (-1.1%) also experiencing notable declines.

Annual Comparisons

Comparing July 2024 to July 2023, the retail trade sector in the Eurozone showed mixed results. The volume of trade decreased by 0.7% for food, drinks, and tobacco, while non-food products (excluding automotive fuel) saw a slight increase of 0.2%. Automotive fuel sales remained stable.

In the EU, the annual performance was slightly more positive, with a 0.9% increase in non-food products (excluding automotive fuel) and a 0.4% decline in food, drinks, and tobacco sales. Automotive fuel in specialized stores also saw a slight decline of 0.4%.

Luxembourg stood out with the highest annual increase in total retail trade volume at +10.3%, followed by Croatia (+7.9%) and Bulgaria (+6.8%). On the other hand, Belgium experienced the largest decrease at -4.4%, with Estonia (-3.1%) and Finland (-2.1%) also reporting significant annual