## Forex and Global News

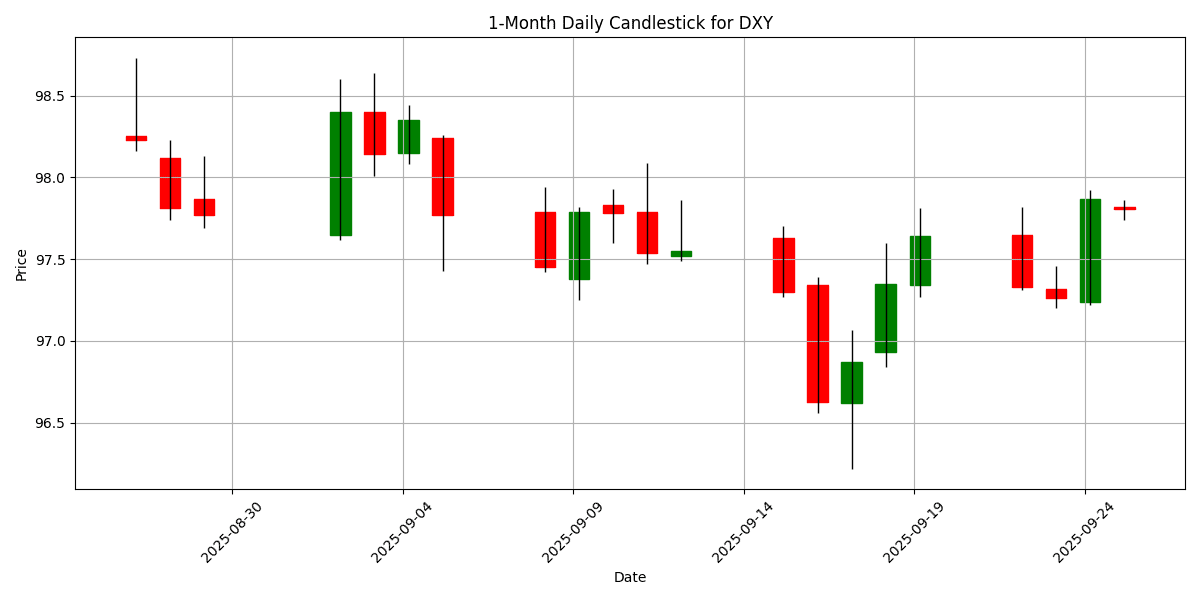

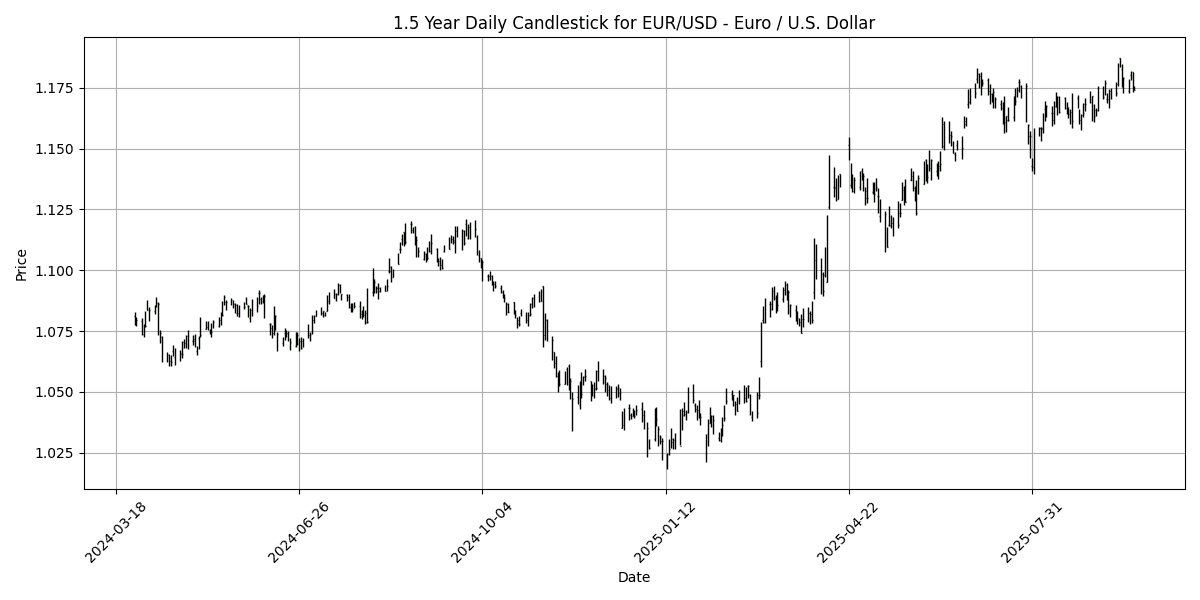

In today’s forex and global news, the market sentiment remains cautious as investors await key economic data from the U.S., particularly the weekly jobless claims which could influence the Federal Reserve’s monetary policy. The EUR/USD pair has stabilized around 1.1750 after a bearish trend, erasing earlier weekly gains due to mounting pressure. Meanwhile, the DXY is slightly up at 97.81, reflecting a daily change of 0.0604%.

In commodities, gold prices are struggling to regain momentum after a correction from record highs of $3,791, as traders look for direction from upcoming U.S. data and Fed commentary. The geopolitical landscape also remains tense, with China urging its companies to avoid aggressive pricing strategies in the U.S. market, potentially impacting trade relations.

Additionally, the UK banking sector is pressing for policy stability ahead of a critical budget, indicating growing impatience for reforms. Overall, the forex market is navigating through a mix of economic indicators and geopolitical developments, contributing to a cautious atmosphere among traders.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-09-25 | 02:00 | 🇪🇺 | Medium | GfK German Consumer Climate (Oct) | -22.3 | -23.3 |

| 2025-09-25 | 03:30 | 🇨🇭 | High | SNB Interest Rate Decision (Q3) | 0.00% | 0.00% |

| 2025-09-25 | 03:30 | 🇨🇭 | Medium | SNB Monetary Policy Assessment | ||

| 2025-09-25 | 04:00 | 🇨🇭 | Medium | SNB Press Conference | ||

| 2025-09-25 | 04:00 | 🇪🇺 | Medium | ECB Economic Bulletin | ||

| 2025-09-25 | 08:30 | 🇺🇸 | Medium | Continuing Jobless Claims | 1,930K | |

| 2025-09-25 | 08:30 | 🇺🇸 | Medium | Core Durable Goods Orders (MoM) (Aug) | -0.1% | |

| 2025-09-25 | 08:30 | 🇺🇸 | Medium | Core PCE Prices (Q2) | 2.50% | |

| 2025-09-25 | 08:30 | 🇺🇸 | High | Durable Goods Orders (MoM) (Aug) | -0.3% | |

| 2025-09-25 | 08:30 | 🇺🇸 | High | GDP (QoQ) (Q2) | 3.3% | |

| 2025-09-25 | 08:30 | 🇺🇸 | Medium | GDP Price Index (QoQ) (Q2) | 2.0% | |

| 2025-09-25 | 08:30 | 🇺🇸 | Medium | Goods Trade Balance (Aug) | -95.70B | |

| 2025-09-25 | 08:30 | 🇺🇸 | High | Initial Jobless Claims | 233K | |

| 2025-09-25 | 08:30 | 🇺🇸 | Medium | Retail Inventories Ex Auto (Aug) | ||

| 2025-09-25 | 09:00 | 🇺🇸 | Medium | FOMC Member Williams Speaks | ||

| 2025-09-25 | 10:00 | 🇺🇸 | Medium | Existing Home Sales (MoM) (Aug) | ||

| 2025-09-25 | 10:00 | 🇺🇸 | High | Existing Home Sales (Aug) | 3.96M | |

| 2025-09-25 | 10:00 | 🇺🇸 | Medium | FOMC Member Bowman Speaks | ||

| 2025-09-25 | 13:00 | 🇺🇸 | Medium | 7-Year Note Auction | ||

| 2025-09-25 | 13:00 | 🇺🇸 | Medium | Fed Vice Chair for Supervision Barr Speaks | ||

| 2025-09-25 | 15:30 | 🇺🇸 | Medium | FOMC Member Daly Speaks | ||

| 2025-09-25 | 16:30 | 🇺🇸 | Medium | Fed’s Balance Sheet | ||

| 2025-09-25 | 19:30 | 🇯🇵 | Medium | Tokyo Core CPI (YoY) (Sep) | 2.8% |

On September 25, 2025, key economic events are set to impact FX markets, particularly focusing on the Euro (EUR), Swiss Franc (CHF), and US Dollar (USD).

The GfK German Consumer Climate index for October showed an actual reading of -22.3, surpassing expectations of -23.3. This unexpected improvement may lend support to the EUR, suggesting a slight uptick in consumer confidence amid ongoing economic challenges.

In Switzerland, the Swiss National Bank (SNB) is expected to maintain its interest rate at 0.00% during the Q3 decision, with no surprises anticipated. The subsequent monetary policy assessment and press conference may provide additional insights into the SNB’s outlook, potentially impacting the CHF if any shifts in tone regarding inflation or economic growth are noted.

For the USD, a series of critical economic indicators will be released at 08:30 AM ET, including Core Durable Goods Orders and GDP data, with forecasts suggesting slight contractions. Any deviations from these expectations could lead to volatility in the USD. Notably, FOMC members are scheduled to speak throughout the day, which may further influence market sentiment surrounding US monetary policy.

Overall, the EUR may strengthen slightly against the USD, while the CHF remains stable ahead of the SNB’s announcements.

## Major FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1740 | -0.0681 | -0.4331 | -0.7301 | 1.0462 | 0.4087 | 8.6936 | 12.82 | 4.9039 | 1.1680 | 1.1584 | 1.1137 | 56.38 | 0.0034 |

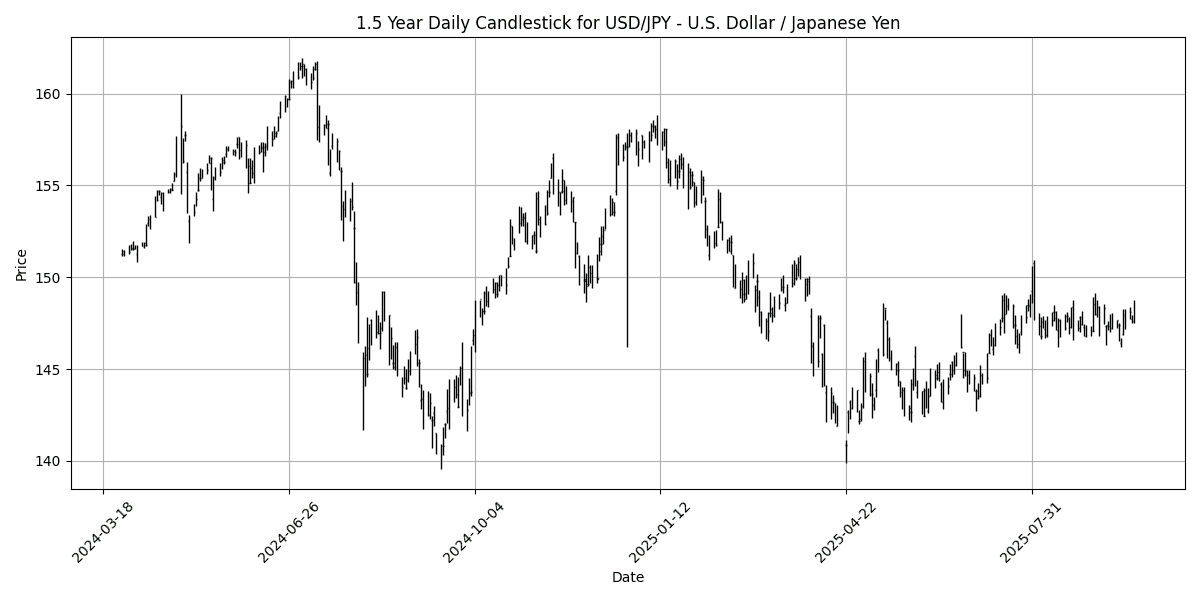

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 148.74 | -0.0430 | 0.5326 | 1.2553 | 0.6176 | 2.7928 | -1.4001 | -5.2613 | 4.0374 | 147.66 | 146.30 | 148.65 | 46.64 | 0.0319 |

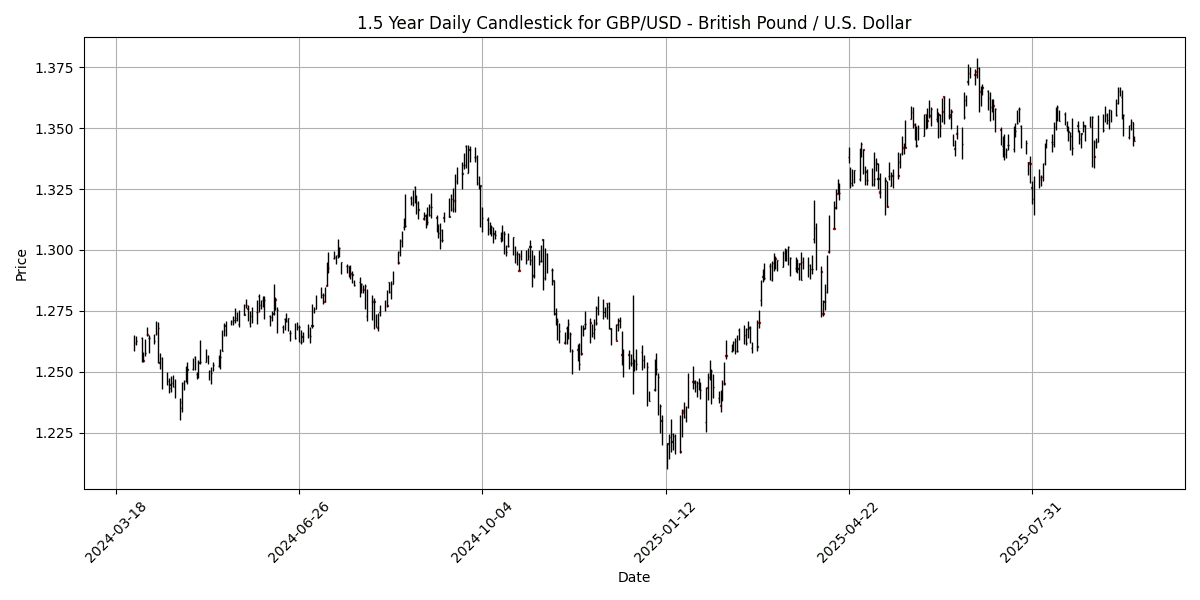

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3447 | -0.0372 | -0.8042 | -1.3407 | -0.0484 | -2.0238 | 3.8216 | 7.1551 | 0.1465 | 1.3472 | 1.3489 | 1.3114 | 50.20 | 0.0009 |

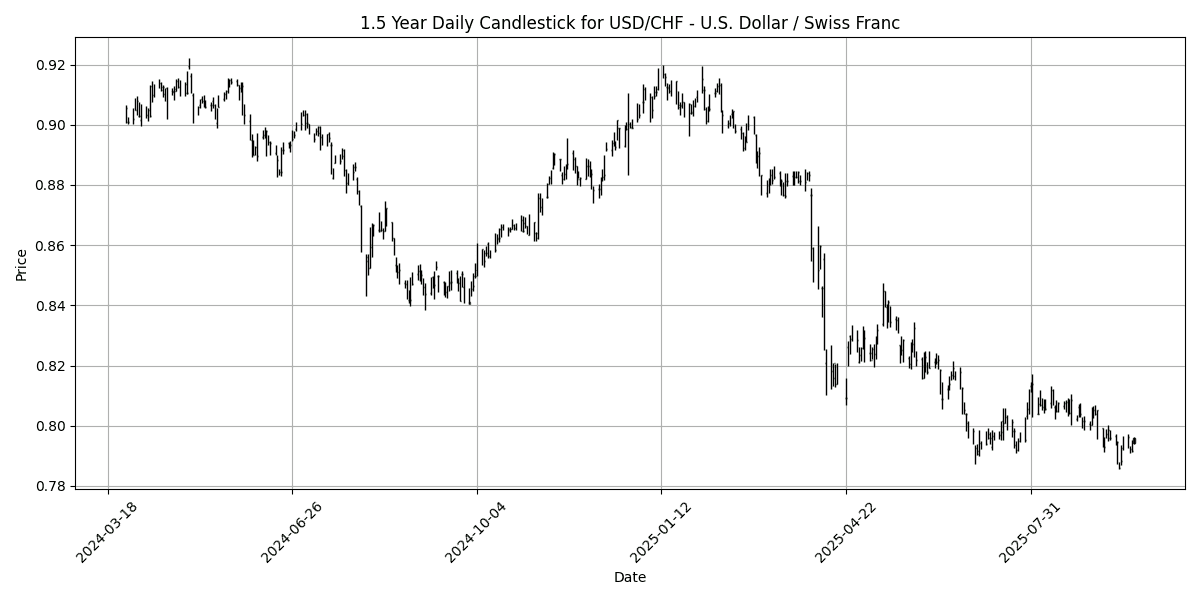

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7958 | 0.1384 | 0.4151 | 0.9463 | -1.2863 | -0.6355 | -9.7118 | -11.8950 | -5.4319 | 0.8013 | 0.8081 | 0.8453 | 41.04 | -0.0029 |

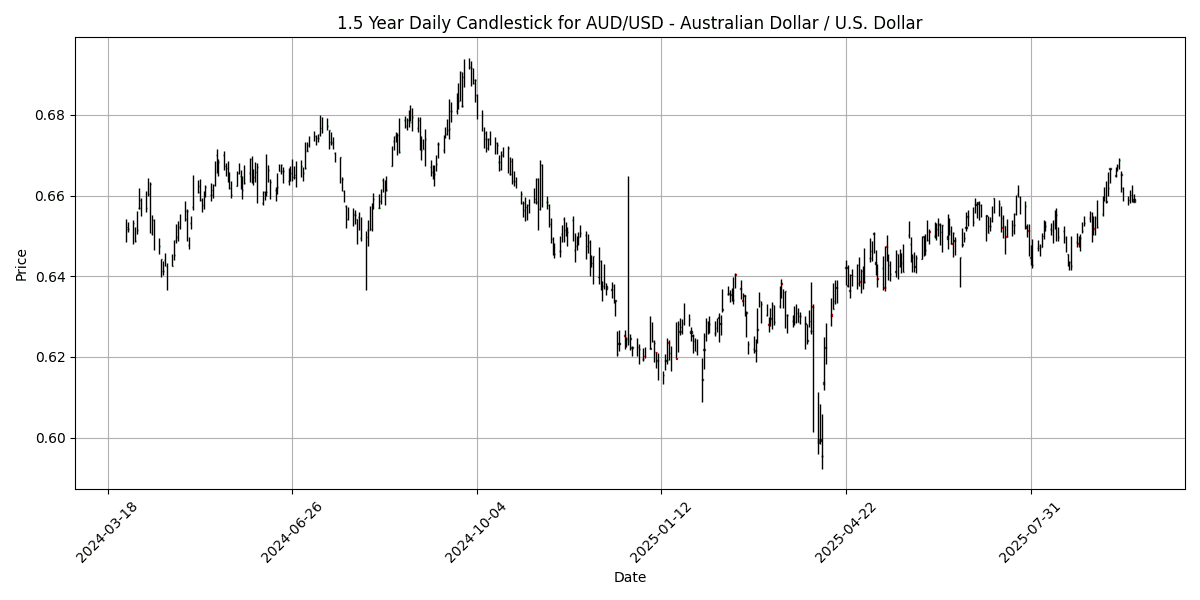

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6591 | 0.0455 | -0.4065 | -0.9245 | 1.6957 | 0.6828 | 4.5926 | 5.9646 | -4.5530 | 0.6541 | 0.6517 | 0.6400 | 59.66 | 0.0024 |

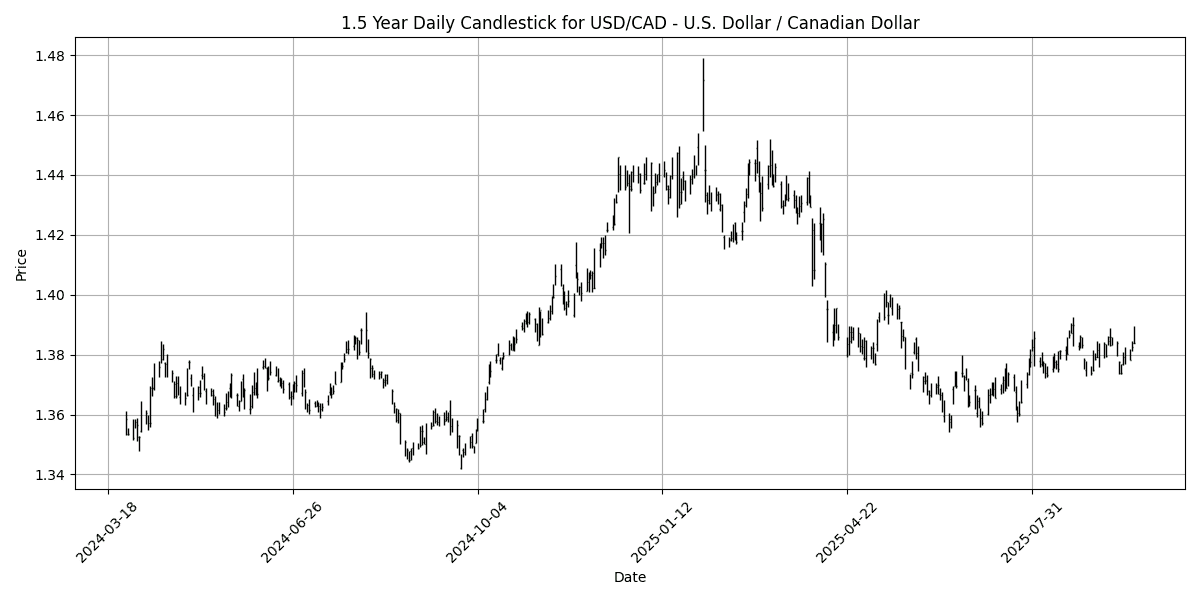

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3899 | 0.0216 | 0.7773 | 0.9376 | 0.2865 | 1.8757 | -2.8551 | -3.1415 | 3.5616 | 1.3779 | 1.3760 | 1.4008 | 55.78 | 0.0006 |

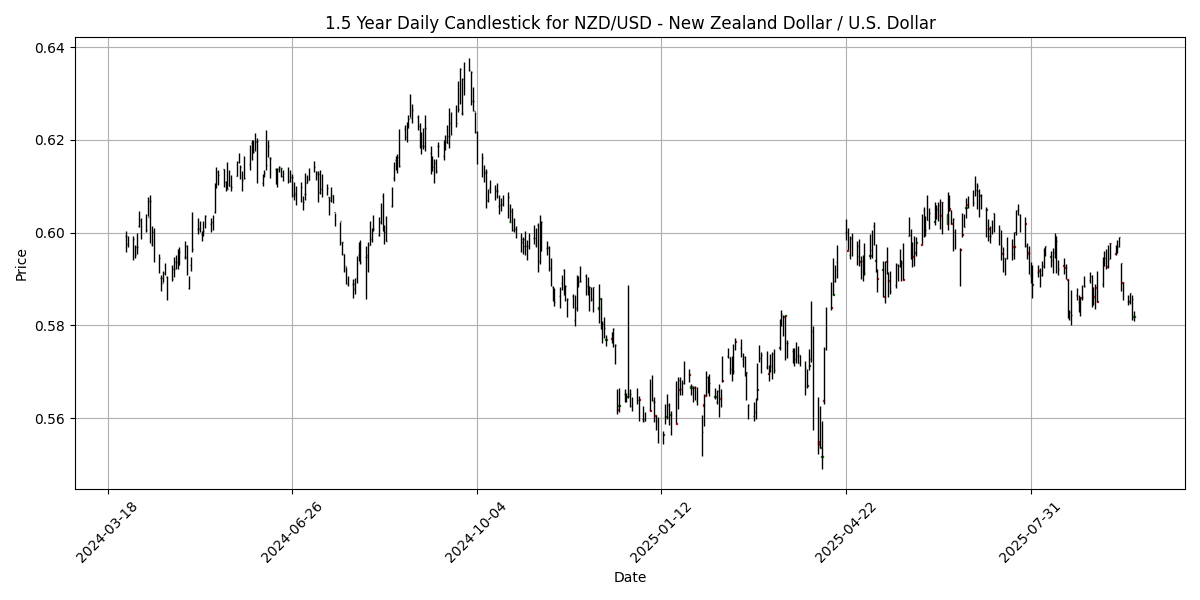

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5820 | 0.0516 | -1.2102 | -1.9243 | -0.4989 | -3.9444 | 1.4572 | 3.1967 | -8.3781 | 0.5920 | 0.5958 | 0.5839 | 46.39 | -0.0014 |

The current analysis of key FX pairs reveals a generally neutral market sentiment, with no pairs exhibiting extreme overbought or oversold conditions. The EUR/USD pair shows an RSI of 56.38 and a positive MACD, indicating a stable bullish momentum without nearing overbought territory. Similarly, the USD/JPY and GBP/USD pairs maintain RSI levels of 46.64 and 50.20, respectively, reflecting a balanced market.

Conversely, the USD/CHF pair is notably bearish with an RSI of 41.04 and a negative MACD, suggesting potential weakness. In contrast, the AUD/USD and USD/CAD pairs exhibit moderate bullishness with RSIs of 59.66 and 55.78, respectively, but remain below the overbought threshold.

Overall, while some pairs are leaning towards bullishness, none are currently in overbought or oversold conditions, indicating a potential for sideways movement or consolidation in the near term. Traders should remain vigilant for

## Cross FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8727 | -0.0458 | 0.3507 | 0.5855 | 1.0924 | 2.4536 | 4.6528 | 5.2473 | 4.7106 | 0.8668 | 0.8585 | 0.8486 | 65.73 | 0.0017 |

| EUR/JPY | EURJPY | 174.57 | -0.1133 | 0.0768 | 0.4939 | 1.6816 | 3.1976 | 7.1549 | 6.8427 | 9.1126 | 172.42 | 169.42 | 165.27 | 65.56 | 0.6099 |

| EUR/CHF | EURCHF | 0.9341 | 0.0857 | -0.0161 | 0.2017 | -0.2414 | -0.2350 | -1.8916 | -0.6171 | -0.8134 | 0.9357 | 0.9358 | 0.9391 | 42.51 | -0.0007 |

| EUR/AUD | EURAUD | 1.7811 | -0.1178 | -0.0123 | 0.2014 | -0.6027 | -0.2626 | 3.9178 | 6.4487 | 9.9085 | 1.7857 | 1.7773 | 1.7386 | 56.84 | -0.0016 |

| GBP/JPY | GBPJPY | 200.03 | -0.0615 | -0.2608 | -0.0879 | 0.5848 | 0.7348 | 2.3874 | 1.5361 | 4.2041 | 198.90 | 197.31 | 194.71 | 55.90 | 0.3085 |

| GBP/CHF | GBPCHF | 1.0703 | 0.1403 | -0.3649 | -0.3825 | -1.3166 | -2.6159 | -6.2497 | -5.5632 | -5.2723 | 1.0794 | 1.0901 | 1.1069 | 34.13 | -0.0029 |

| AUD/JPY | AUDJPY | 98.00 | 0.0112 | 0.1011 | 0.2968 | 2.3006 | 3.4780 | 3.1154 | 0.3913 | -0.7223 | 96.55 | 95.31 | 95.07 | 58.04 | 0.4261 |

| AUD/NZD | AUDNZD | 1.1324 | 0.0265 | 0.8909 | 1.0142 | 2.1994 | 4.9004 | 3.0945 | 2.6939 | 4.1703 | 1.1040 | 1.0932 | 1.0961 | 73.83 | 0.0061 |

| CHF/JPY | CHFJPY | 186.88 | -0.1891 | 0.1079 | 0.3114 | 1.9393 | 3.4600 | 9.2233 | 7.5284 | 10.02 | 184.24 | 181.01 | 175.99 | 68.35 | 0.7873 |

| NZD/JPY | NZDJPY | 86.53 | -0.0046 | -0.6954 | -0.7023 | 0.1041 | -1.2507 | 0.0289 | -2.2480 | -4.7003 | 87.43 | 87.16 | 86.72 | 42.20 | -0.1003 |

Currently, the AUD/NZD pair stands out with an RSI of 73.83, indicating an overbought condition that may prompt a corrective pullback. In contrast, the GBP/CHF pair shows an oversold condition with an RSI of 34.13 and a bearish MACD, suggesting potential for a rebound. The EUR/CHF is also in oversold territory (RSI 42.51), with a negative MACD, indicating weakness. Other pairs like EUR/GBP and EUR/JPY remain in neutral territory, with RSIs around 65, suggesting a continuation of current trends. Traders should monitor these indicators closely for potential entry and exit points.

## Exotics and Emerging

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.47 | 0.0379 | 0.1715 | 0.4046 | 1.1333 | 4.0495 | 9.1174 | 17.46 | 21.56 | 40.94 | 40.18 | 38.41 | 77.37 | 0.1493 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.35 | 0.1484 | 0.0460 | -0.1565 | -1.5023 | -2.8683 | -4.7077 | -7.5492 | 0.6895 | 17.63 | 17.75 | 18.13 | 25.70 | -0.1036 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.16 | 0.4059 | 0.8467 | 1.1957 | -0.9852 | -1.1374 | -4.8802 | -5.7969 | -1.2376 | 32.23 | 32.46 | 33.18 | 46.89 | -0.1142 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.3999 | 0.0980 | 0.6013 | 1.2524 | -1.9707 | -1.1369 | -5.8933 | -14.7311 | -6.7427 | 9.5115 | 9.5492 | 10.02 | 43.08 | -0.0531 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 9.9374 | 0.0393 | 0.6943 | 1.3148 | -1.9023 | -1.1842 | -5.2051 | -12.2728 | -4.3611 | 10.10 | 10.12 | 10.54 | 36.53 | -0.0702 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.3591 | 0.0740 | 0.4481 | 0.7448 | -1.0399 | -0.3416 | -7.9432 | -11.2700 | -4.5662 | 6.3918 | 6.4455 | 6.7189 | 36.46 | -0.0210 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.42 | 0.0570 | 0.3229 | 0.6320 | -1.3902 | -2.4118 | -9.1633 | -10.7051 | -4.5820 | 18.63 | 18.85 | 19.57 | 23.06 | -0.0956 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6334 | 0.0523 | 0.5518 | 1.0114 | -0.8509 | 0.1905 | -6.1907 | -11.5330 | -4.3356 | 3.6442 | 3.6745 | 3.8151 | 40.26 | -0.0117 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 333.90 | 0.2652 | 1.3317 | 1.3283 | -2.3493 | -2.3122 | -10.1352 | -15.4708 | -5.2086 | 338.30 | 344.17 | 362.16 | 31.82 | -2.6367 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.69 | 0.0430 | 0.4515 | 0.6739 | -2.0641 | -2.1331 | -10.3629 | -14.3440 | -7.5829 | 20.95 | 21.27 | 22.37 | 31.99 | -0.1253 |

In the current analysis of key FX pairs, USD/TRY is significantly overbought with an RSI of 77.37, alongside a bullish MACD and MA50 above both MA100 and MA200, indicating potential for a corrective pullback. Conversely, USD/ZAR is oversold with an RSI of 25.70 and a bearish MACD, suggesting a potential reversal or recovery opportunity. Other pairs, such as USD/MXN and USD/HUF, also display oversold conditions with RSIs below 30, warranting caution. Overall, traders should closely monitor these indicators to identify potential entry and exit points amidst prevailing market conditions.