## Forex and Global News

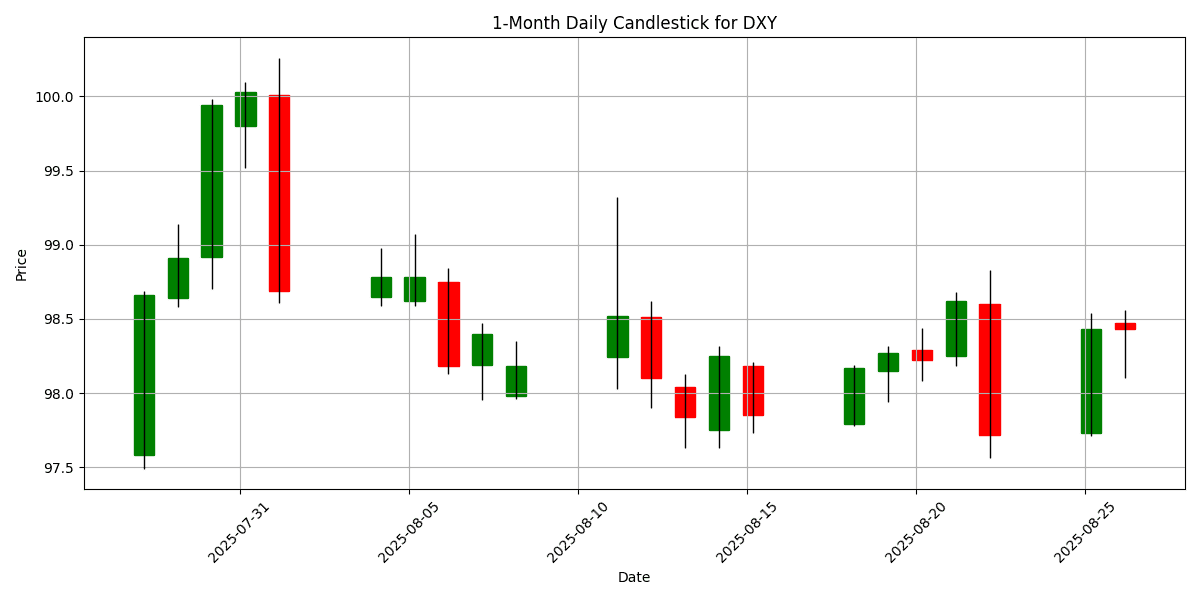

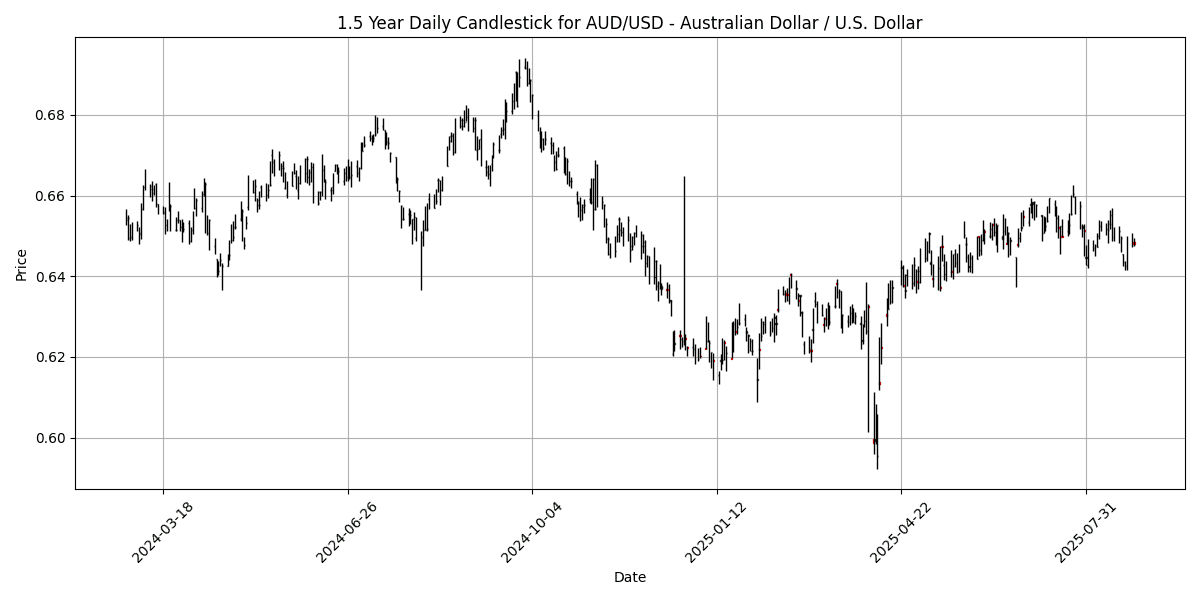

In a turbulent day for the forex market, the U.S. Dollar Index (DXY) saw a slight correction to 98.30, influenced by President Trump’s announcement to remove Federal Reserve Governor Lisa Cook, which raised concerns about the Fed’s independence. This uncertainty led to a rise in gold prices, with XAU/USD climbing to near $3,375 as investors sought safe-haven assets. Meanwhile, Trump’s threats of a 200% tariff on Chinese magnets further pressured the Australian Dollar (AUD), which depreciated against the USD for the second consecutive session.

European markets opened lower amid political instability in France, with the CAC 40 index dropping 2% due to a no-confidence vote over budget disputes, contributing to a bearish sentiment across the eurozone. The GBP and JPY remained relatively stable, absorbing global developments without significant movement. Overall, market sentiment reflects heightened geopolitical tensions and economic uncertainty, particularly surrounding U.S.-China relations and domestic U.S. monetary policy.

DXY price: 98.43, daily change: 0.0224%.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-08-26 | 01:00 | 🇯🇵 | Medium | BoJ Core CPI (YoY) | 2.0% | 2.4% |

| 2025-08-26 | 08:30 | 🇺🇸 | Medium | Core Durable Goods Orders (MoM) (Jul) | 0.2% | |

| 2025-08-26 | 08:30 | 🇺🇸 | High | Durable Goods Orders (MoM) (Jul) | -9.4% | |

| 2025-08-26 | 09:00 | 🇺🇸 | Medium | S&P/CS HPI Composite – 20 n.s.a. (YoY) (Jun) | 2.1% | |

| 2025-08-26 | 09:00 | 🇺🇸 | Medium | S&P/CS HPI Composite – 20 n.s.a. (MoM) (Jun) | ||

| 2025-08-26 | 10:00 | 🇺🇸 | High | CB Consumer Confidence (Aug) | 96.4 | |

| 2025-08-26 | 11:30 | 🇺🇸 | Medium | Atlanta Fed GDPNow (Q3) | 2.3% | |

| 2025-08-26 | 12:00 | 🇬🇧 | Medium | BoE MPC Member Mann Speaks | ||

| 2025-08-26 | 13:00 | 🇺🇸 | Medium | 2-Year Note Auction | ||

| 2025-08-26 | 14:30 | 🇨🇦 | Medium | BoC Gov Macklem Speaks | ||

| 2025-08-26 | 16:30 | 🇺🇸 | Medium | API Weekly Crude Oil Stock | ||

| 2025-08-26 | 21:30 | 🇦🇺 | Medium | Construction Work Done (QoQ) (Q2) | 1.0% |

On August 26, 2025, several key economic events are poised to impact foreign exchange markets.

The Bank of Japan (BoJ) reported a Core CPI (YoY) of 2.0%, falling short of the anticipated 2.4%. This unexpected decline may weaken the Japanese yen (JPY), as it suggests reduced inflationary pressure, potentially influencing future monetary policy decisions.

In the U.S., the Durable Goods Orders (MoM) for July are projected to show a significant contraction of -9.4%, which could indicate weakening manufacturing activity. This data, alongside the Core Durable Goods Orders forecast of 0.2%, will be critical for assessing the overall economic health and may lead to a bearish sentiment on the U.S. dollar (USD) if the results align with expectations.

Additionally, the CB Consumer Confidence index for August is forecasted at 96.4, which, if met, could provide a modest boost to the USD by reflecting consumer sentiment stability.

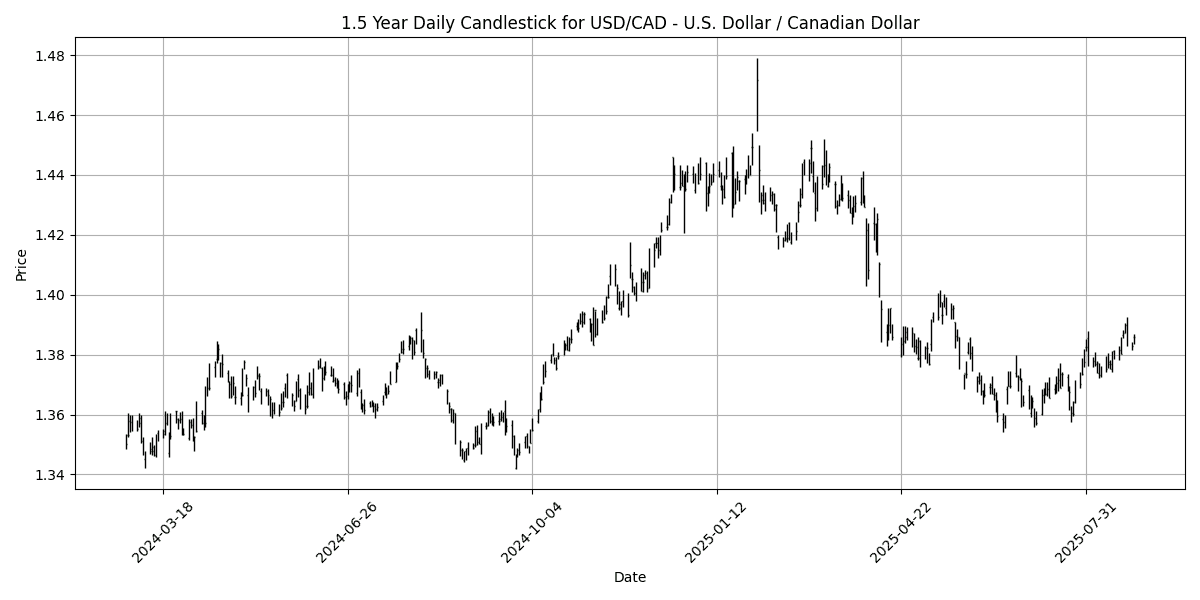

Market participants will also be attentive to comments from Bank of England MPC member Mann and Bank of Canada Governor Macklem, as their insights may offer clues on future monetary policy directions, impacting the GBP and CAD respectively.

Overall, today’s data releases and speeches are likely to create volatility in the JPY, USD, GBP, and CAD currencies.

## Major FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

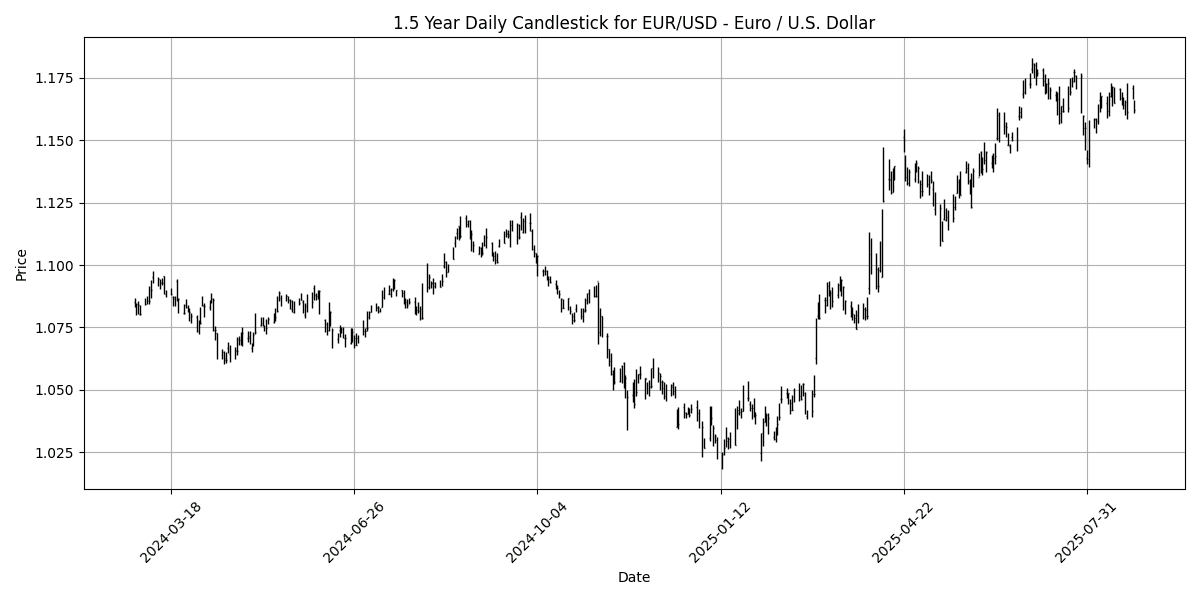

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1620 | -0.0344 | -0.2725 | -0.4143 | -1.1580 | 2.4954 | 10.79 | 11.66 | 3.8619 | 1.1654 | 1.1485 | 1.1005 | 53.05 | 0.0007 |

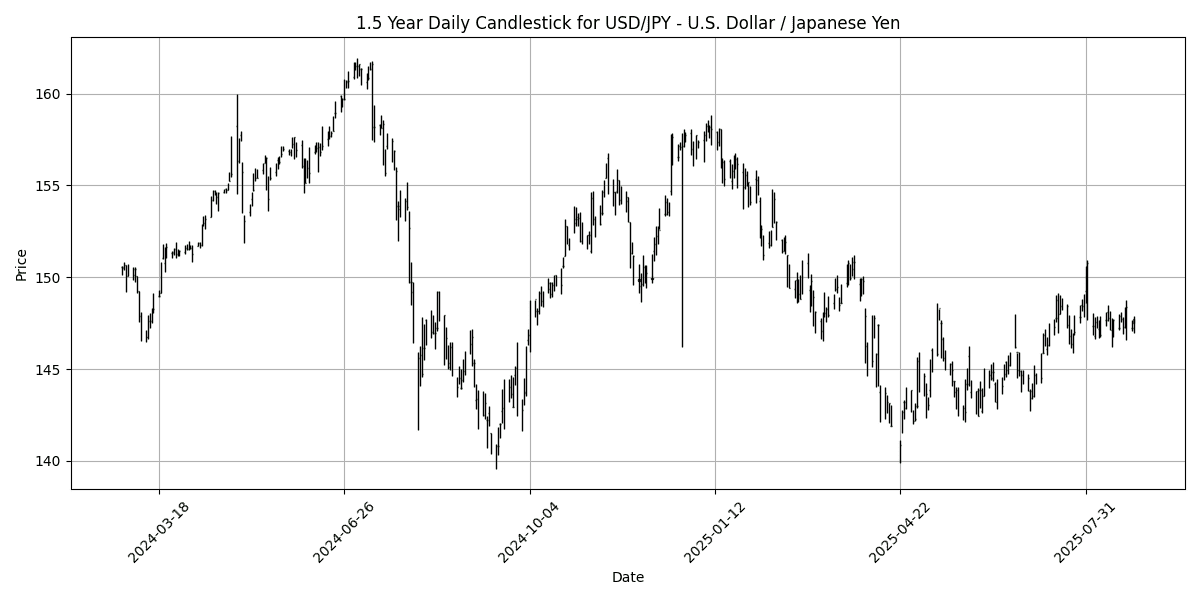

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 147.53 | -0.1320 | 0.1439 | -0.2610 | 0.3571 | 2.3256 | -0.8788 | -6.0289 | 2.4514 | 146.81 | 145.52 | 149.17 | 49.81 | 0.1654 |

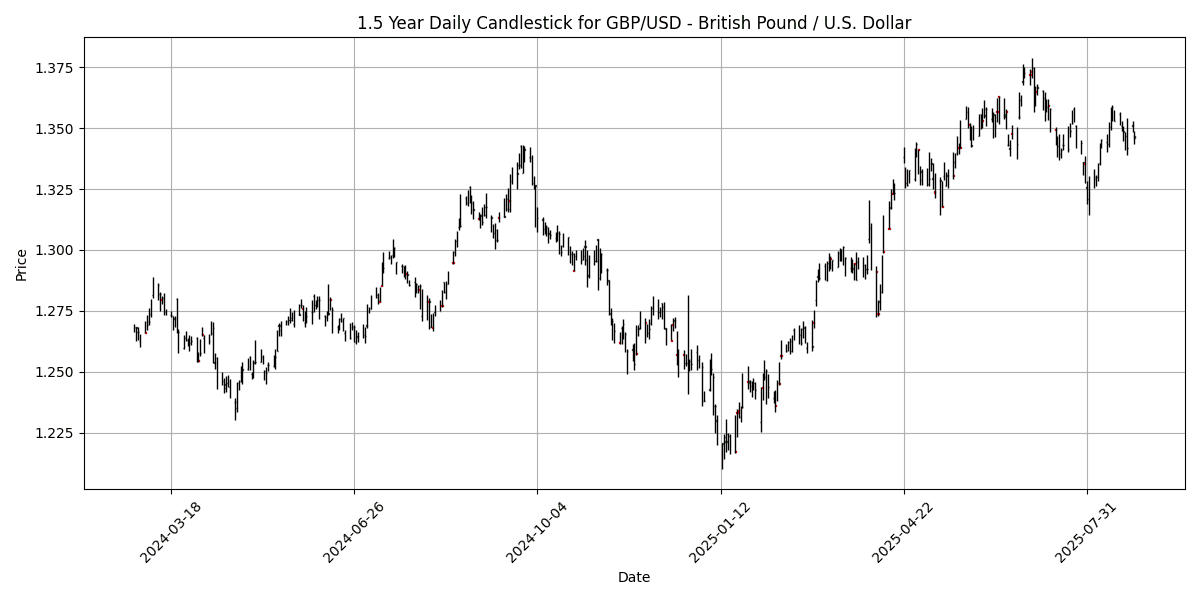

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3467 | 0.0743 | 0.0046 | -0.3051 | -0.3186 | -0.3428 | 6.1873 | 7.3145 | 1.9250 | 1.3496 | 1.3416 | 1.3021 | 62.48 | 0.0008 |

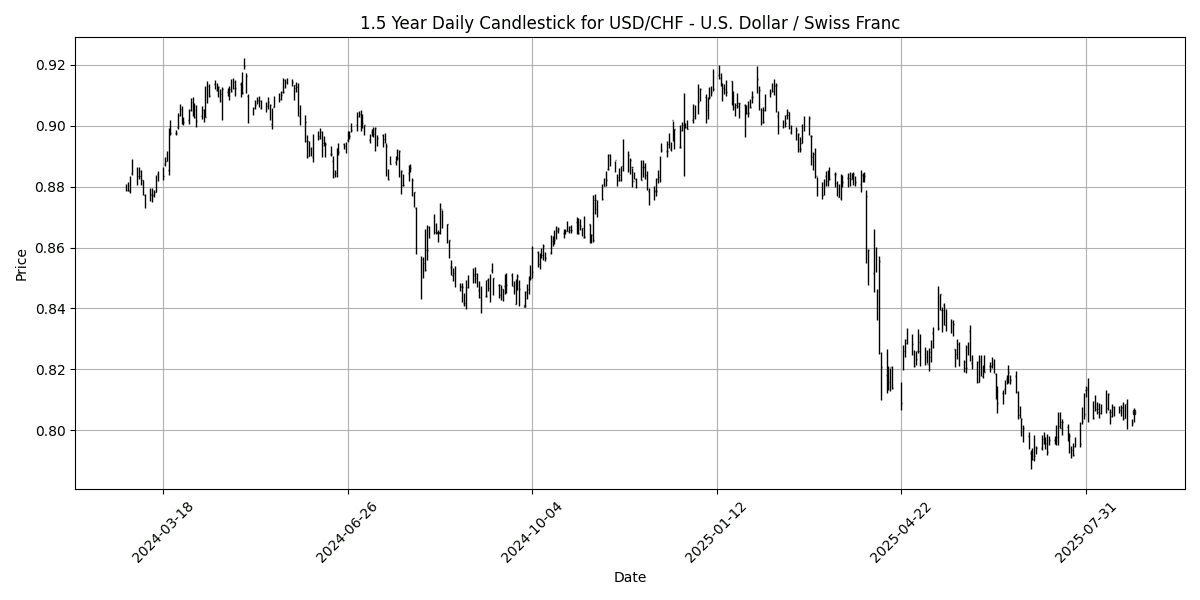

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8066 | 0.0869 | 0.3059 | -0.1003 | 1.4757 | -2.4974 | -9.8066 | -10.6993 | -4.8057 | 0.8032 | 0.8149 | 0.8550 | 49.57 | 0.0006 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6480 | -0.0925 | 0.6821 | -0.2279 | -1.7762 | 0.5100 | 2.6814 | 4.1801 | -4.5347 | 0.6516 | 0.6458 | 0.6387 | 51.03 | -0.0014 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3859 | 0.0217 | -0.0995 | 0.4123 | 1.6011 | 0.3548 | -3.3273 | -3.4203 | 2.5985 | 1.3725 | 1.3786 | 1.4036 | 61.76 | 0.0039 |

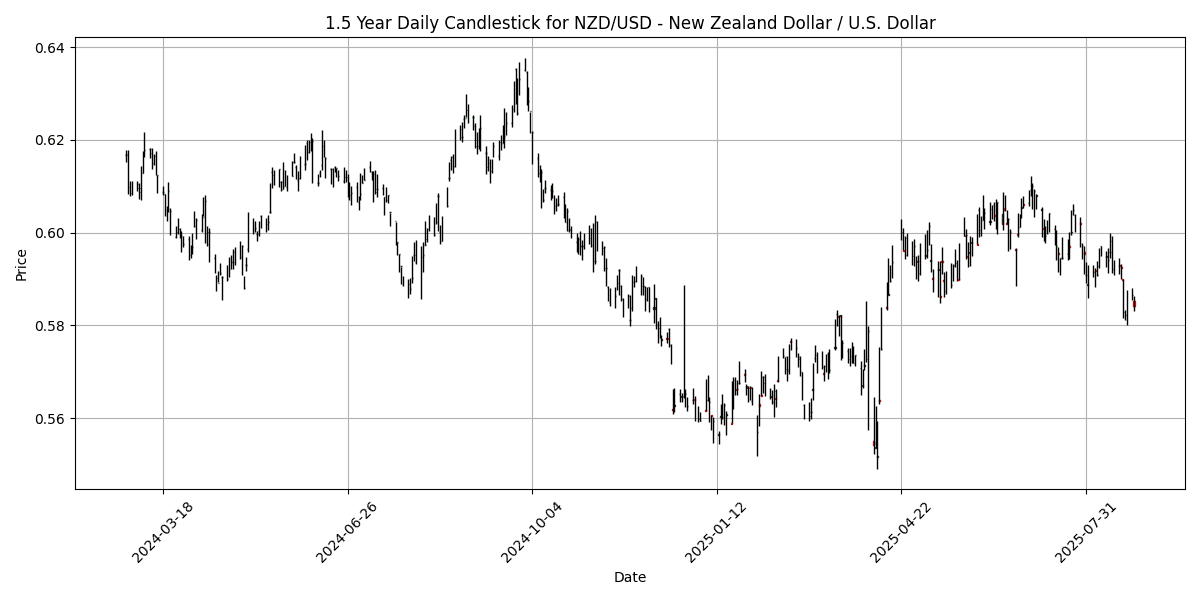

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5842 | -0.1879 | 0.2370 | -1.3806 | -3.2319 | -1.7838 | 2.4932 | 3.5868 | -6.1389 | 0.5974 | 0.5950 | 0.5834 | 40.95 | -0.0034 |

In the current forex landscape, several key currency pairs exhibit notable conditions based on RSI, MACD, and moving averages. The EUR/USD remains neutral with an RSI of 53.05 and a MACD close to zero, suggesting consolidation without overbought or oversold pressures. Conversely, the GBP/USD, with an RSI of 62.48, is approaching overbought territory, indicating potential upward momentum but caution is warranted as it nears resistance levels.

The USD/CAD also shows bullish sentiment with an RSI of 61.76, while the USD/JPY remains stable, reflecting a balanced market with an RSI of 49.81. The AUD/USD and NZD/USD present bearish signals, particularly the latter with an RSI of 40.95 and a negative MACD, suggesting oversold conditions that could attract buyers looking for value. Overall, traders should monitor these indicators closely for potential reversals or continuation patterns in these pairs.

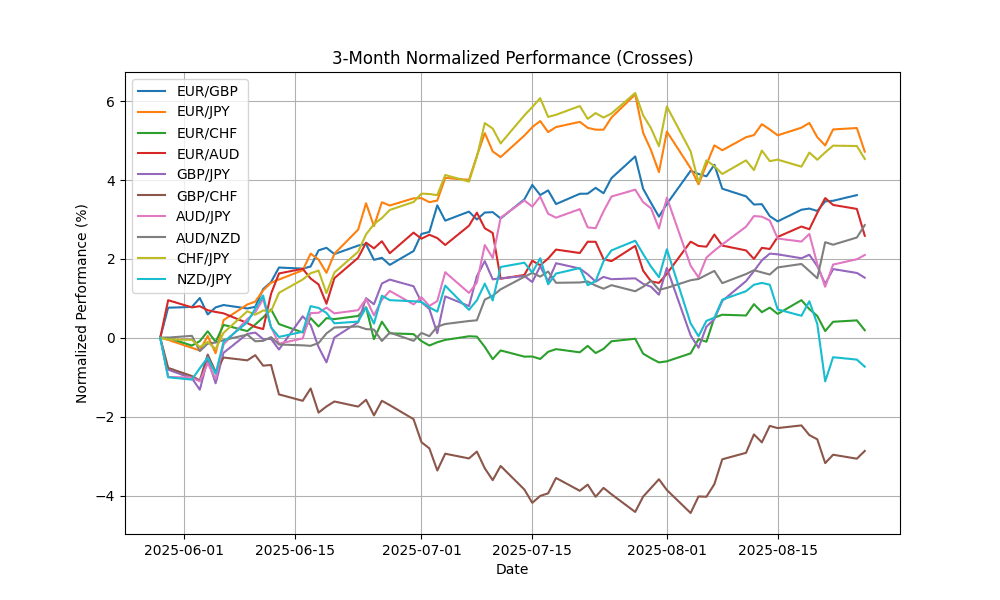

## Cross FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8627 | -0.1042 | -0.2982 | -0.1216 | -0.8619 | 2.8383 | 4.3155 | 4.0413 | 1.8873 | 0.8633 | 0.8558 | 0.8446 | 39.66 | 0.0002 |

| EUR/JPY | EURJPY | 171.39 | -0.1532 | -0.1491 | -0.6901 | -0.8188 | 4.8628 | 9.7941 | 4.9007 | 6.3905 | 171.07 | 167.12 | 163.96 | 54.76 | 0.2981 |

| EUR/CHF | EURCHF | 0.9370 | 0.0534 | 0.0171 | -0.5350 | 0.2772 | -0.0864 | -0.1077 | -0.3085 | -1.1541 | 0.9359 | 0.9356 | 0.9387 | 54.65 | 0.0013 |

| EUR/AUD | EURAUD | 1.7935 | 0.0670 | -0.9258 | -0.1637 | 0.6295 | 2.0008 | 7.9154 | 7.1898 | 8.8190 | 1.7884 | 1.7782 | 1.7226 | 53.81 | 0.0050 |

| GBP/JPY | GBPJPY | 198.66 | -0.0568 | 0.1553 | -0.5716 | 0.0363 | 1.9716 | 5.2548 | 0.8426 | 4.4216 | 198.09 | 195.22 | 194.05 | 68.26 | 0.3411 |

| GBP/CHF | GBPCHF | 1.0861 | 0.1475 | 0.3224 | -0.4090 | 1.1474 | -2.8368 | -4.2324 | -4.1691 | -2.9783 | 1.0838 | 1.0930 | 1.1114 | 65.31 | 0.0014 |

| AUD/JPY | AUDJPY | 95.56 | -0.2141 | 0.7963 | -0.5195 | -1.4306 | 2.8189 | 1.7548 | -2.1091 | -2.2203 | 95.64 | 93.96 | 95.22 | 50.82 | -0.0986 |

| AUD/NZD | AUDNZD | 1.1089 | 0.0812 | 0.4247 | 1.1456 | 1.5049 | 2.3140 | 0.1644 | 0.5627 | 1.6877 | 1.0906 | 1.0853 | 1.0949 | 71.37 | 0.0039 |

| CHF/JPY | CHFJPY | 182.90 | -0.2062 | -0.1568 | -0.1538 | -1.0900 | 4.9576 | 9.9127 | 5.2366 | 7.6314 | 182.76 | 178.60 | 174.66 | 50.56 | 0.0700 |

| NZD/JPY | NZDJPY | 86.17 | -0.3031 | 0.3774 | -1.6449 | -2.8864 | 0.4969 | 1.5953 | -2.6648 | -3.8466 | 87.68 | 86.57 | 86.96 | 38.48 | -0.3938 |

Currently, the forex landscape presents several noteworthy overbought and oversold conditions. The AUD/NZD pair, with an RSI of 71.37, indicates overbought conditions, suggesting potential for a corrective pullback. Conversely, the NZD/JPY is oversold with an RSI of 38.48, and a bearish MACD, indicating potential for a rebound. The GBP/JPY and GBP/CHF pairs are approaching overbought territory, with RSIs of 68.26 and 65.31, respectively, which may signal weakening momentum. Meanwhile, EUR/GBP remains neutral with an RSI of 39.66, suggesting limited immediate volatility. Traders should monitor these indicators closely for potential trading opportunities.

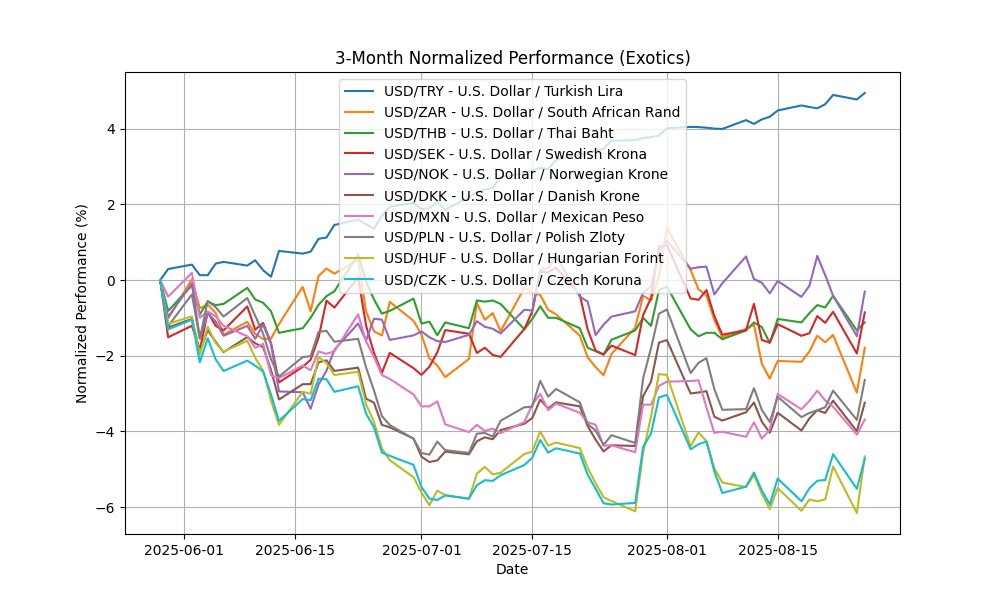

## Exotics and Emerging

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.03 | 0.0624 | 0.2830 | 0.3535 | 1.2128 | 5.0387 | 12.53 | 16.21 | 20.59 | 40.34 | 39.53 | 37.69 | 79.14 | 0.1902 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.64 | 0.1828 | -0.1432 | 0.1064 | 0.1715 | -1.6915 | -3.9363 | -5.9771 | -0.5468 | 17.76 | 18.04 | 18.17 | 40.30 | -0.0554 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.43 | -0.0924 | -0.3993 | -0.2461 | 0.4647 | -0.8257 | -3.8826 | -5.0060 | -4.4772 | 32.48 | 32.80 | 33.43 | 53.58 | 0.0086 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.6112 | 0.2252 | 0.2743 | 0.5546 | 0.8873 | -0.0759 | -9.6488 | -12.8143 | -5.7661 | 9.5809 | 9.6251 | 10.19 | 45.79 | -0.0063 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.19 | 0.6103 | -0.4339 | -0.1490 | 0.6696 | 0.3666 | -8.6534 | -10.0676 | -2.6573 | 10.15 | 10.24 | 10.66 | 45.81 | 0.0006 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4240 | 0.0202 | 0.2810 | 0.4301 | 1.1749 | -2.3303 | -9.6491 | -10.3645 | -3.6665 | 6.4037 | 6.4996 | 6.7944 | 47.24 | -0.0037 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.67 | -0.0621 | -0.5243 | -0.5073 | 0.7107 | -3.0250 | -8.4556 | -9.5089 | -2.8209 | 18.75 | 19.15 | 19.76 | 46.93 | -0.0158 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6714 | 0.1801 | 0.7483 | 0.9048 | 1.5208 | -1.9310 | -6.8700 | -10.6078 | -3.7040 | 3.6510 | 3.7083 | 3.8626 | 45.62 | -0.0030 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 342.16 | 0.2012 | 1.2059 | 1.2104 | 1.2517 | -3.8930 | -10.1022 | -13.3790 | -2.6793 | 341.88 | 349.54 | 367.98 | 47.33 | -1.0426 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 21.13 | 0.0583 | 0.5947 | 0.8271 | 1.2863 | -3.7715 | -11.0189 | -12.5479 | -5.5429 | 21.11 | 21.57 | 22.70 | 46.74 | -0.0349 |

In the current analysis of key FX pairs, USD/TRY is exhibiting overbought conditions with an RSI of 79.14, indicating potential price corrections may be imminent. The positive MACD at 0.1902 supports bullish momentum, yet the stark divergence from moving averages suggests caution. Conversely, USD/ZAR shows bearish characteristics with an RSI of 40.30 and a negative MACD of -0.0554, indicating potential oversold conditions. The remaining pairs, including USD/THB, USD/SEK, and USD/NOK, are positioned within neutral ranges, reflecting stability but lack of strong directional bias. Traders should monitor USD/TRY for reversal signals while considering USD/ZAR for potential buying opportunities.