## Forex and Global News

In today’s forex market, the euro (EUR) remains under pressure, with EUR/USD trading at 1.1575 after hitting a two-month low of 1.1540, influenced by ongoing political instability in France. The Japanese yen (JPY) is also facing headwinds as the EUR/JPY pair drops to around 176.70, reflecting a bearish sentiment following Komeito’s exit from Japan’s ruling coalition, which raises concerns over political stability. The British pound (GBP) is experiencing a bearish correction, falling below the 203.00 level against the yen, aiming for support at 202.40.

In commodities, gold (XAU/USD) continues to struggle below the $4,000 mark, maintaining a negative bias despite attempts to rebound from recent lows, as geopolitical risks and Federal Reserve policy expectations loom large.

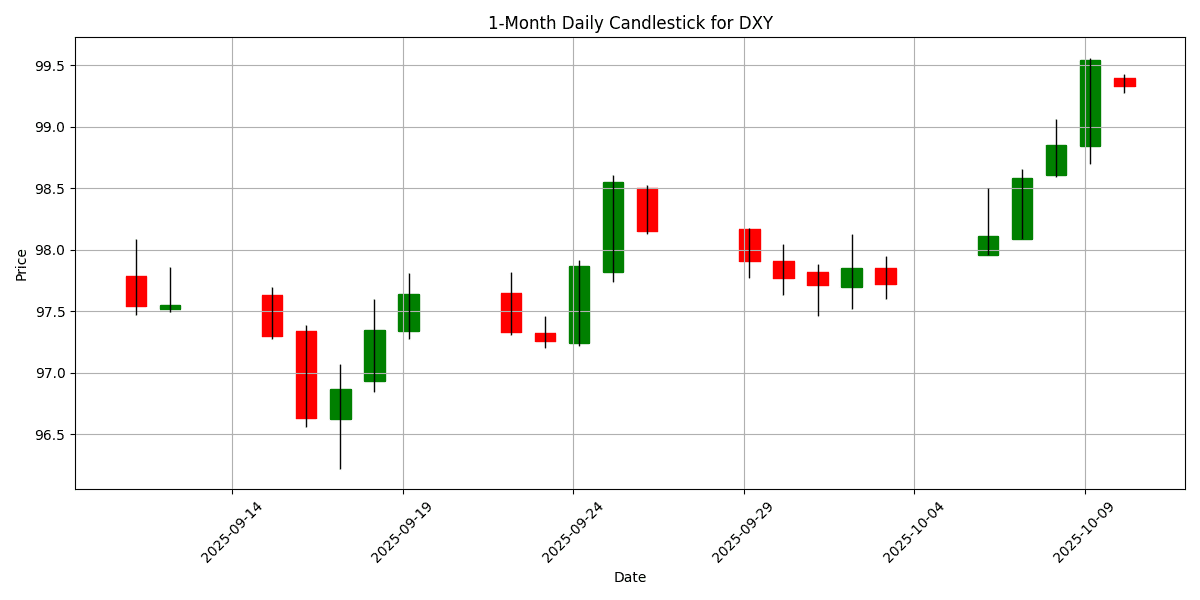

Overall, market sentiment is cautious amid these geopolitical developments and political upheavals, impacting major currencies and commodities. The U.S. Dollar Index (DXY) is trading at 99.33, reflecting a daily change of 0.0272%.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-10 | 03:00 | 🇨🇭 | Medium | SECO Consumer Climate | -37 | -38 |

| 2025-10-10 | 08:30 | 🇨🇦 | Medium | Employment Change (Sep) | 2.8K | |

| 2025-10-10 | 08:30 | 🇨🇦 | Medium | Unemployment Rate (Sep) | 7.2% | |

| 2025-10-10 | 10:00 | 🇺🇸 | Medium | Michigan 1-Year Inflation Expectations (Oct) | ||

| 2025-10-10 | 10:00 | 🇺🇸 | Medium | Michigan 5-Year Inflation Expectations (Oct) | ||

| 2025-10-10 | 10:00 | 🇺🇸 | Medium | Michigan Consumer Expectations (Oct) | 51.7 | |

| 2025-10-10 | 10:00 | 🇺🇸 | Medium | Michigan Consumer Sentiment (Oct) | 54.1 | |

| 2025-10-10 | 12:01 | 🇷🇺 | Medium | CPI (MoM) (Sep) | ||

| 2025-10-10 | 12:01 | 🇷🇺 | Medium | CPI (YoY) (Sep) | ||

| 2025-10-10 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Oil Rig Count | ||

| 2025-10-10 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Total Rig Count | ||

| 2025-10-10 | 14:00 | 🇺🇸 | Medium | Federal Budget Balance (Sep) | 50.0B |

On October 10, 2025, several key economic events are poised to impact foreign exchange (FX) markets.

At 03:00 ET, the SECO Consumer Climate for Switzerland reported at -37, slightly better than the forecast of -38. This may provide a modest boost to the Swiss Franc (CHF) as it suggests a less pessimistic outlook among consumers.

At 08:30 ET, Canada will release its Employment Change and Unemployment Rate for September, with expectations set at a gain of 2.8K jobs and an unemployment rate of 7.2%. Any significant deviation from these forecasts could lead to volatility in the Canadian Dollar (CAD).

The U.S. data at 10:00 ET, including Michigan Consumer Sentiment expected at 54.1 and Consumer Expectations at 51.7, will be closely watched. Stronger-than-expected sentiment could support the U.S. Dollar (USD), while weak figures could raise concerns about economic growth.

Lastly, the Federal Budget Balance for September is anticipated at a surplus of $50 billion, which could further influence USD dynamics. Overall, the day’s events suggest a cautious trading environment, with potential for significant currency movements depending on the data releases.

## Major FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

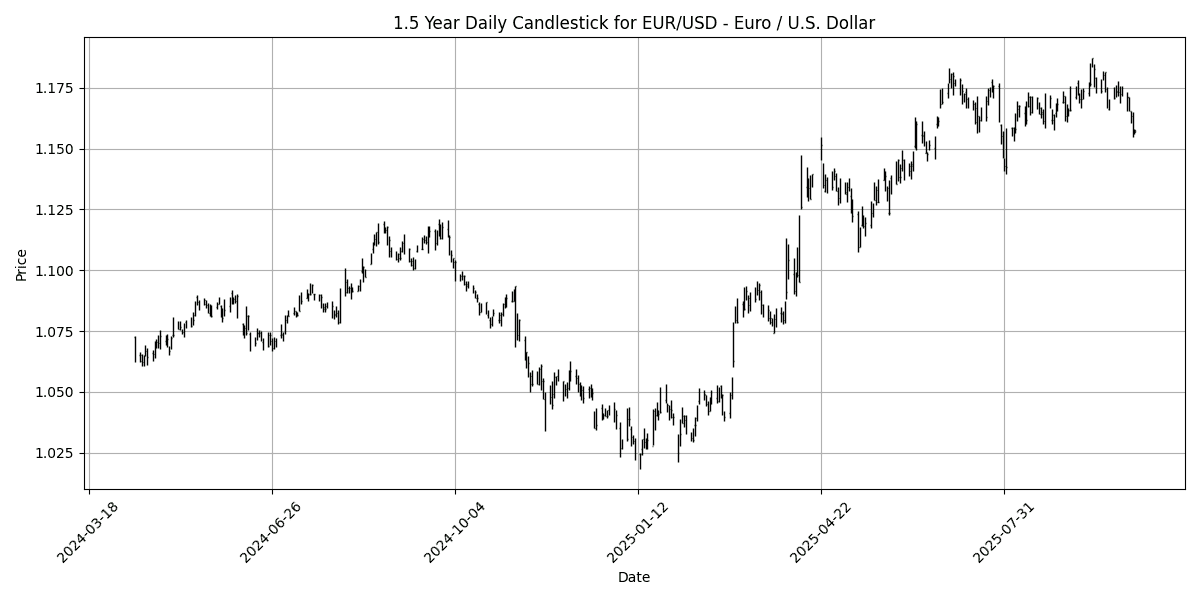

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1577 | 0.0865 | -1.2632 | -1.2632 | -1.0745 | -1.0745 | 2.8350 | 11.25 | 5.7906 | 1.1692 | 1.1636 | 1.1207 | 32.64 | -0.0017 |

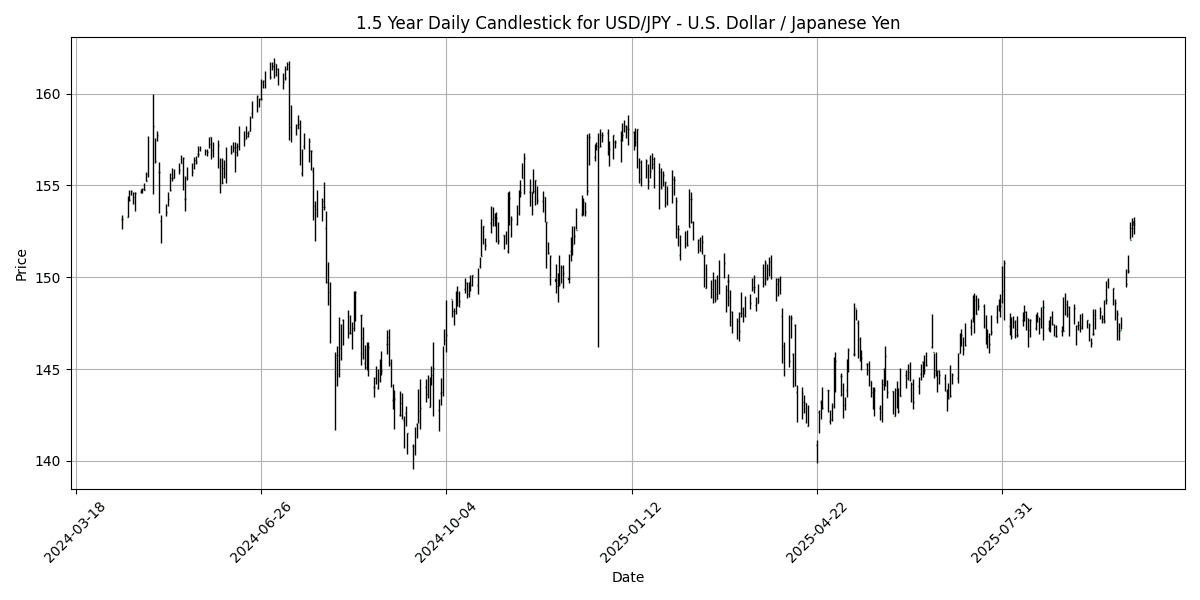

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 152.83 | -0.1274 | 3.8593 | 3.8593 | 3.6888 | 4.4713 | 6.3180 | -2.6536 | 2.4598 | 148.04 | 146.81 | 148.26 | 71.03 | 1.0690 |

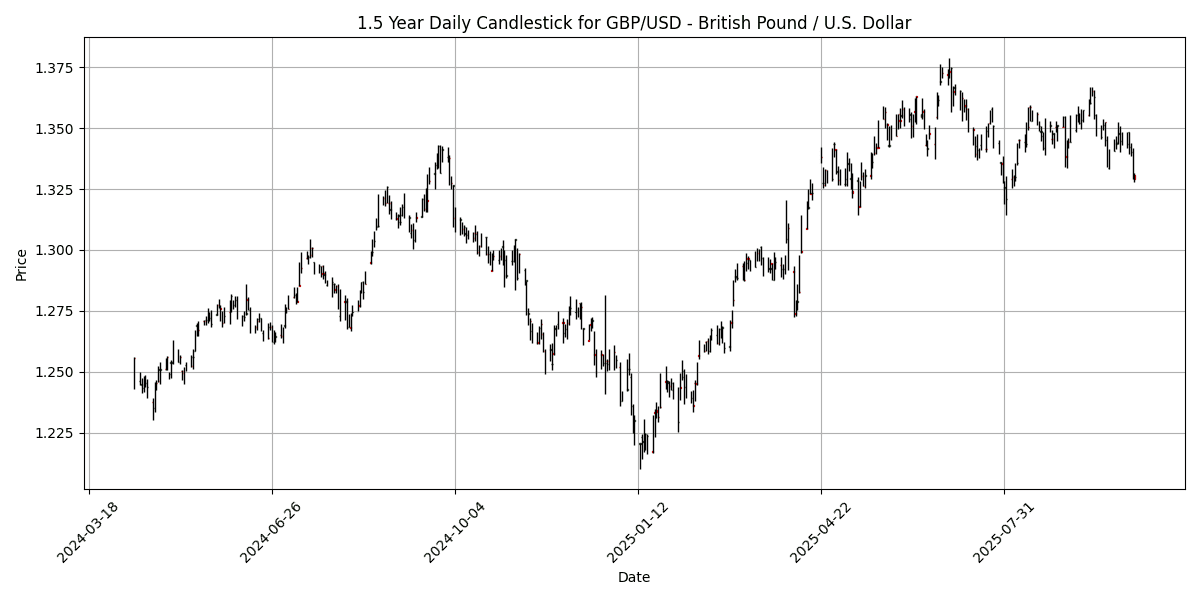

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3292 | -0.0602 | -1.1501 | -1.1501 | -1.6944 | -2.1177 | 2.3085 | 5.9200 | 1.7117 | 1.3473 | 1.3500 | 1.3161 | 37.32 | -0.0031 |

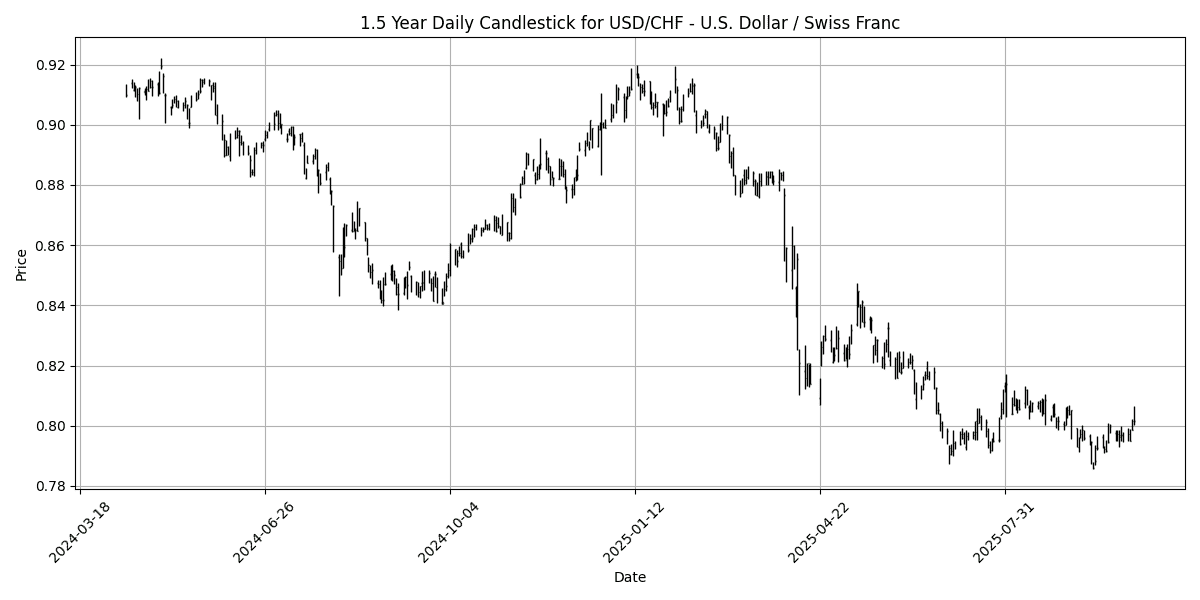

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8056 | -0.0868 | 1.0765 | 1.0765 | 1.0410 | 1.1146 | -1.8471 | -10.8100 | -6.3767 | 0.8008 | 0.8044 | 0.8403 | 64.58 | -0.0003 |

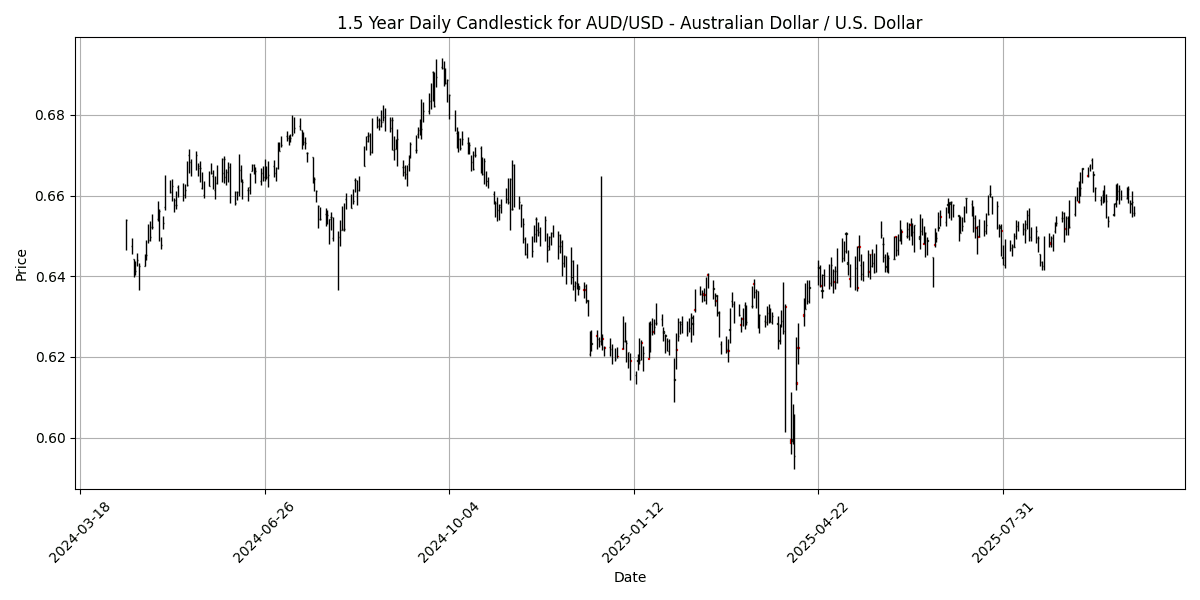

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6556 | -0.0610 | -0.6379 | -0.6379 | -0.4359 | -0.5763 | 5.3444 | 5.4019 | -2.4027 | 0.6554 | 0.6535 | 0.6418 | 43.84 | 0.0004 |

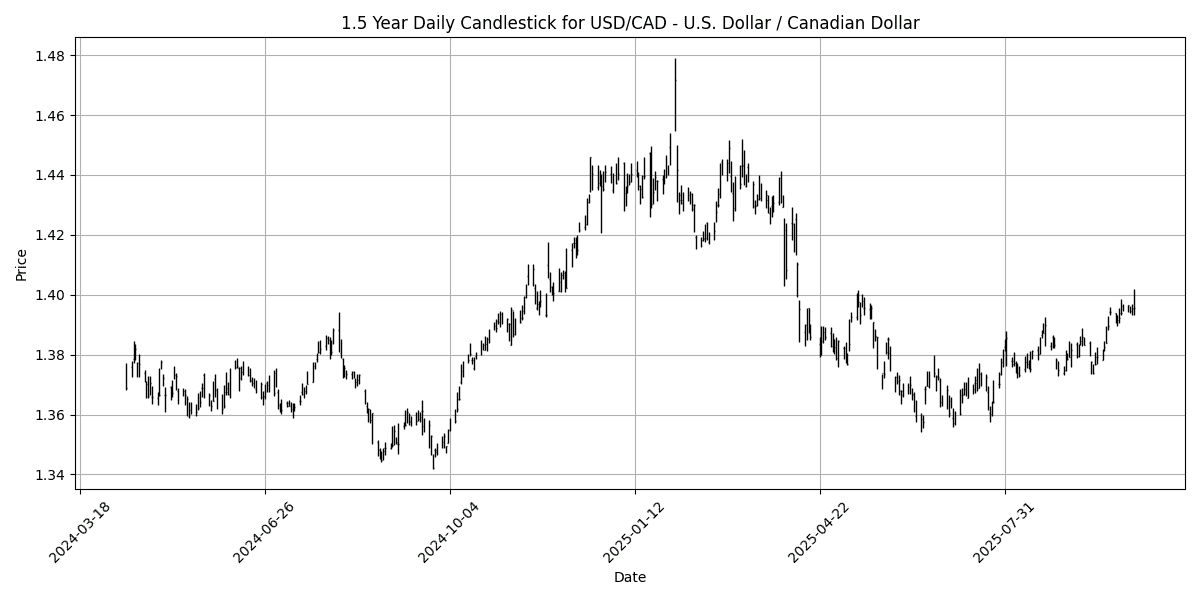

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4021 | 0.0143 | 0.4305 | 0.4305 | 1.2595 | 2.6706 | 0.5018 | -2.2913 | 2.2736 | 1.3831 | 1.3761 | 1.3985 | 80.15 | 0.0043 |

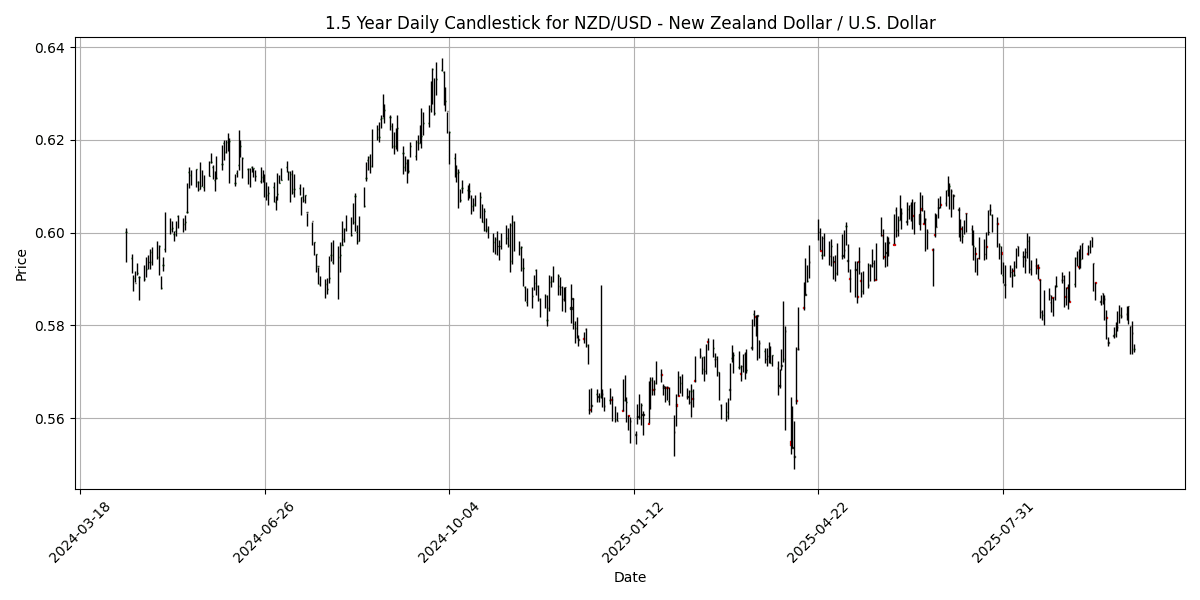

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5750 | 0.0174 | -1.1943 | -1.1943 | -2.9700 | -4.8283 | 0.0368 | 1.9555 | -5.2860 | 0.5882 | 0.5946 | 0.5846 | 32.89 | -0.0032 |

Analyzing the current technical indicators for key FX pairs reveals distinct overbought and oversold conditions.

The USD/JPY is nearing overbought territory with an RSI of 71.03 and a positive MACD of 1.0690, indicating strong bullish momentum. This suggests potential for a price correction if buying pressure wanes. Conversely, the USD/CAD is significantly overbought at an RSI of 80.15, accompanied by a positive MACD, signaling an imminent pullback as the market may be saturated with buyers.

On the other hand, the EUR/USD and NZD/USD exhibit oversold conditions with RSIs of 32.64 and 32.89, respectively, and negative MACDs, indicating bearish momentum. These pairs may present buying opportunities as they approach potential reversal points. GBP/USD and AUD/USD remain in neutral territory, with RSIs of 37.32 and 43.84, suggesting a lack of decisive movement. Overall, traders should closely

## Cross FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8708 | 0.1610 | -0.1296 | -0.1296 | 0.6124 | 1.0619 | 0.5044 | 5.0181 | 4.0084 | 0.8678 | 0.8619 | 0.8512 | 47.52 | 0.0007 |

| EUR/JPY | EURJPY | 176.91 | -0.0390 | 2.5393 | 2.5393 | 2.5678 | 3.3552 | 9.3232 | 8.2773 | 8.4001 | 172.99 | 170.67 | 165.94 | 67.21 | 0.9078 |

| EUR/CHF | EURCHF | 0.9324 | 0.0107 | -0.2247 | -0.2247 | -0.0857 | 0.0172 | 0.9102 | -0.7980 | -0.9665 | 0.9360 | 0.9356 | 0.9389 | 41.11 | -0.0009 |

| EUR/AUD | EURAUD | 1.7661 | 0.1474 | -0.6173 | -0.6173 | -0.6173 | -0.4711 | -2.3612 | 5.5522 | 8.4328 | 1.7843 | 1.7805 | 1.7448 | 34.83 | -0.0033 |

| GBP/JPY | GBPJPY | 203.14 | -0.1892 | 2.6680 | 2.6680 | 1.9334 | 2.2685 | 8.7817 | 3.1168 | 4.2219 | 199.35 | 198.07 | 194.94 | 67.12 | 0.8835 |

| GBP/CHF | GBPCHF | 1.0707 | -0.1585 | -0.0914 | -0.0914 | -0.6588 | -1.0270 | 0.4230 | -5.5279 | -4.7750 | 1.0785 | 1.0855 | 1.1034 | 47.93 | -0.0019 |

| AUD/JPY | AUDJPY | 100.15 | -0.1854 | 3.1729 | 3.1729 | 3.2005 | 3.8404 | 11.97 | 2.5916 | -0.0339 | 97.01 | 95.92 | 95.12 | 72.84 | 0.7623 |

| AUD/NZD | AUDNZD | 1.1400 | -0.0701 | 0.5560 | 0.5560 | 2.6075 | 4.4606 | 5.2965 | 3.3831 | 3.0346 | 1.1133 | 1.0985 | 1.0977 | 71.84 | 0.0069 |

| CHF/JPY | CHFJPY | 189.73 | -0.0348 | 2.7809 | 2.7809 | 2.6594 | 3.3464 | 8.3592 | 9.1671 | 9.4618 | 184.89 | 182.56 | 176.81 | 67.47 | 1.2380 |

| NZD/JPY | NZDJPY | 87.85 | -0.1171 | 2.6071 | 2.6071 | 0.5897 | -0.5828 | 6.3459 | -0.7659 | -2.9744 | 87.06 | 87.22 | 86.62 | 62.97 | 0.0834 |

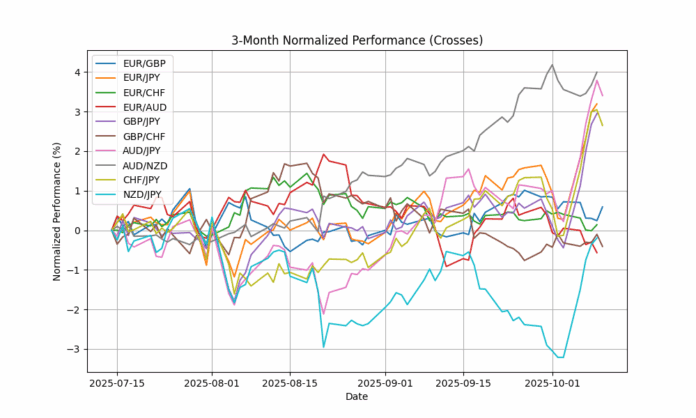

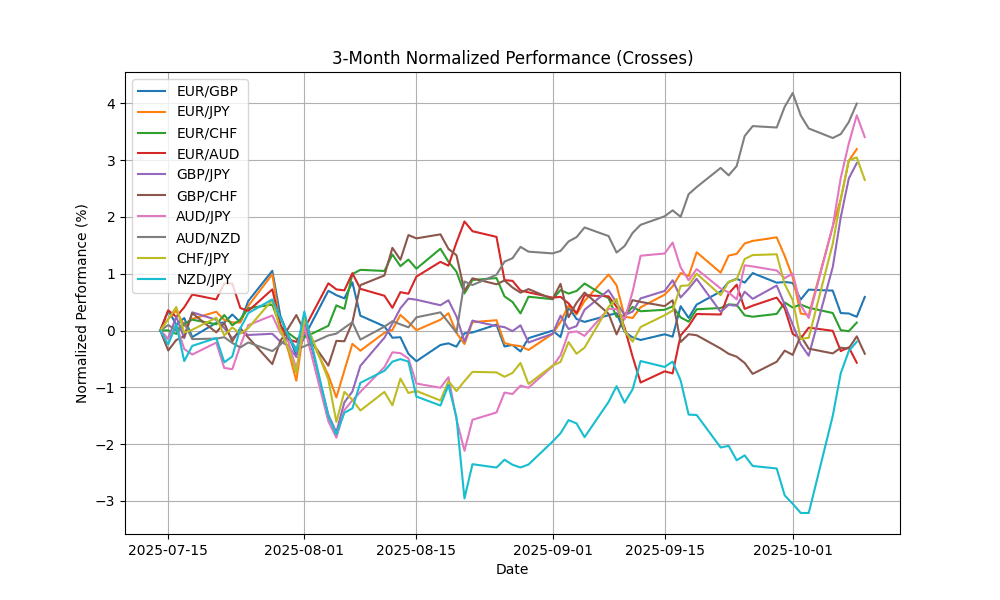

In the current analysis of key FX pairs, the AUD/JPY and AUD/NZD are exhibiting overbought conditions with RSI values above 70, indicating potential reversals. The MACD for both pairs remains positive, suggesting underlying bullish momentum. Conversely, EUR/CHF and EUR/AUD are in oversold territory with RSI readings below 30, compounded by negative MACD values, which may indicate further downside potential. The GBP/JPY and EUR/JPY are approaching overbought levels, yet their MACD remains bullish, indicating a continuation of upward momentum. Traders should closely monitor these dynamics for potential trading opportunities and reversals in the coming sessions.

## Exotics and Emerging

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.82 | -0.0038 | 0.4289 | 0.4289 | 1.3648 | 4.1368 | 9.9507 | 18.45 | 22.08 | 41.19 | 40.49 | 38.77 | 95.80 | 0.1702 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.27 | 0.3534 | -0.0284 | -0.0284 | -1.5308 | -2.5715 | -11.3981 | -7.9910 | -2.1236 | 17.52 | 17.66 | 18.07 | 39.40 | -0.0949 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.71 | -0.0611 | 0.8323 | 0.8323 | 2.9912 | 0.3682 | -3.2821 | -4.1858 | -2.4165 | 32.23 | 32.38 | 33.08 | 79.86 | 0.1246 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.5264 | -0.0797 | 1.4150 | 1.4150 | 1.5174 | 0.3035 | -3.0427 | -13.5836 | -8.3280 | 9.4658 | 9.5162 | 9.9347 | 58.94 | -0.0092 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.09 | 0.1629 | 1.1158 | 1.1158 | 1.1056 | 0.1241 | -6.3844 | -10.9575 | -6.3846 | 10.05 | 10.08 | 10.47 | 58.96 | -0.0147 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4508 | -0.0867 | 1.3050 | 1.3050 | 1.1281 | 1.1711 | -2.7321 | -9.9905 | -5.3652 | 6.3841 | 6.4143 | 6.6727 | 68.02 | 0.0101 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.40 | 0.0892 | -0.0668 | -0.0668 | -1.2017 | -1.0836 | -10.6570 | -10.8205 | -5.4848 | 18.57 | 18.74 | 19.47 | 48.02 | -0.0586 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6770 | -0.0652 | 1.2845 | 1.2845 | 1.2524 | 1.2732 | -2.7643 | -10.4715 | -6.3392 | 3.6415 | 3.6588 | 3.7906 | 62.95 | 0.0020 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 337.41 | -0.1465 | 1.7358 | 1.7358 | 0.5127 | -0.9395 | -6.1593 | -14.5815 | -7.4118 | 336.40 | 341.32 | 358.82 | 63.99 | -0.5077 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 21.01 | -0.2725 | 1.5659 | 1.5659 | 1.0097 | -0.1008 | -5.6032 | -13.0359 | -9.2139 | 20.87 | 21.11 | 22.19 | 64.97 | -0.0089 |

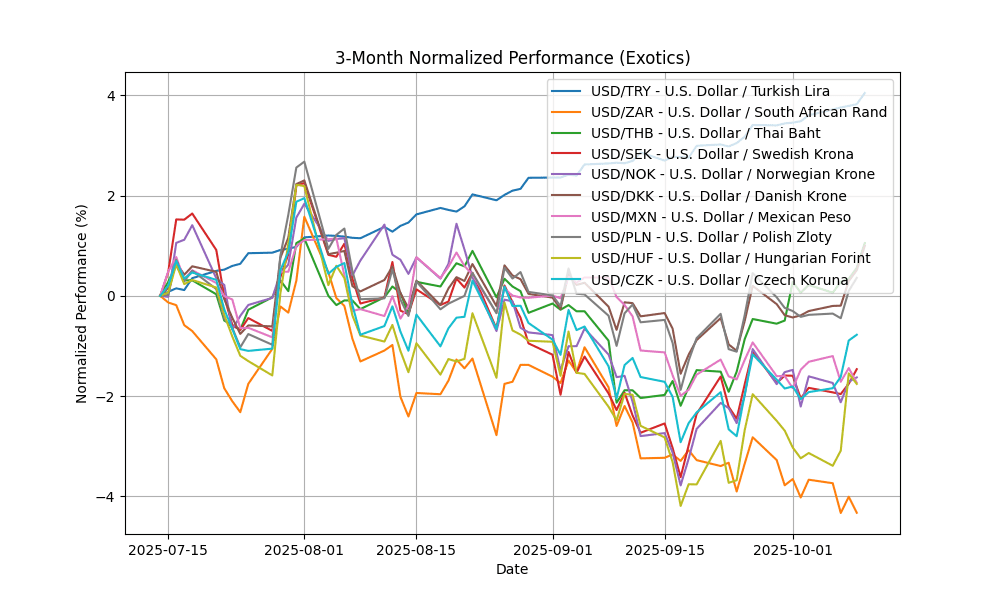

In the current forex landscape, USD/TRY is significantly overbought with an RSI of 95.80, indicating potential for a correction, despite a bullish MACD of 0.1702. Conversely, USD/ZAR shows oversold conditions with an RSI of 39.40 and a bearish MACD at -0.0949, suggesting possible upward momentum. USD/THB, with an RSI of 79.86, is also overbought, though its MACD remains positive, indicating strong bullish sentiment. Other pairs like USD/DKK and USD/PLN are nearing neutral territory, while USD/NOK and USD/SEK show bearish tendencies. Traders should monitor these indicators closely for potential reversals or trend continuations