## Forex and Global News

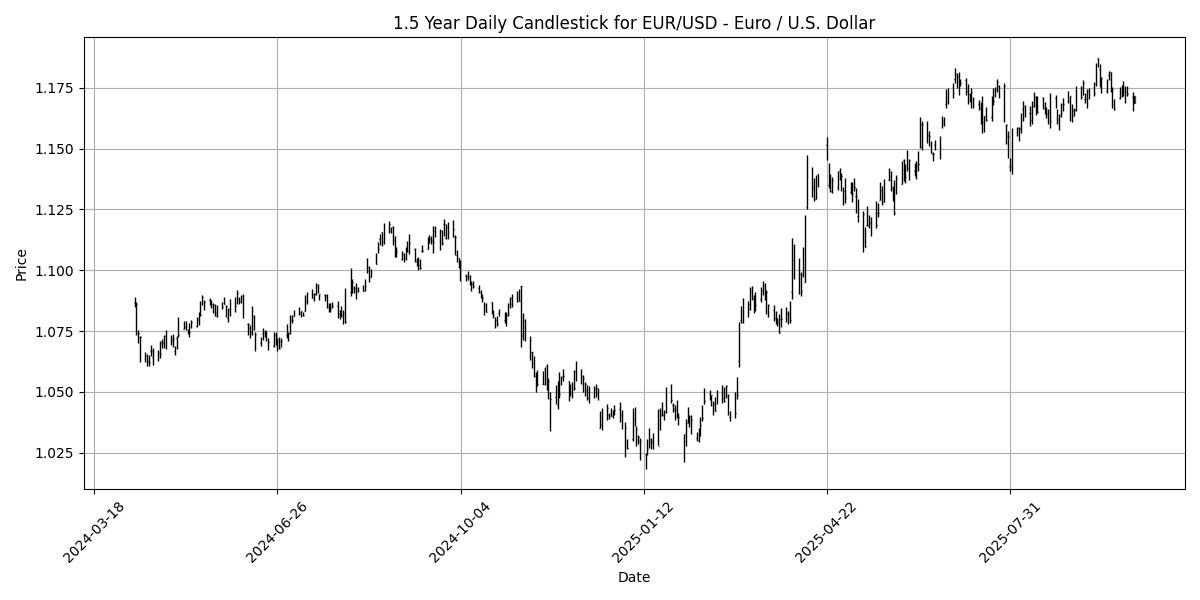

In the forex market today, the Euro (EUR) weakened against the U.S. Dollar (USD), with the EUR/USD pair dropping to approximately 1.1705. This decline was influenced by ongoing political turmoil in France, following the resignation of Prime Minister Sebastien Lecornu and his cabinet, raising concerns about stability and fiscal management. Meanwhile, the USD remained firm, buoyed by persistent U.S. government shutdown developments, which have not significantly rattled investor sentiment.

The Japanese Yen (JPY) has been less impacted by these events, with the Nikkei 225 reaching record highs, reflecting positive market sentiment despite broader geopolitical tensions. In commodity markets, gold prices have seen an uptick in India, aligning with global trends as investors seek safe-haven assets amid uncertainty.

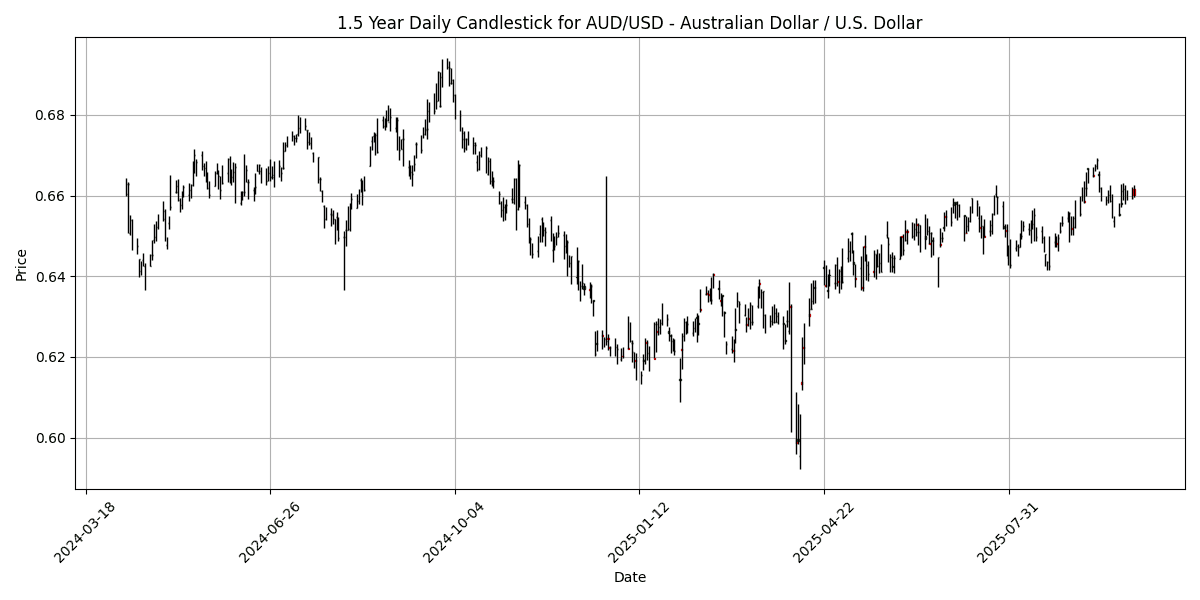

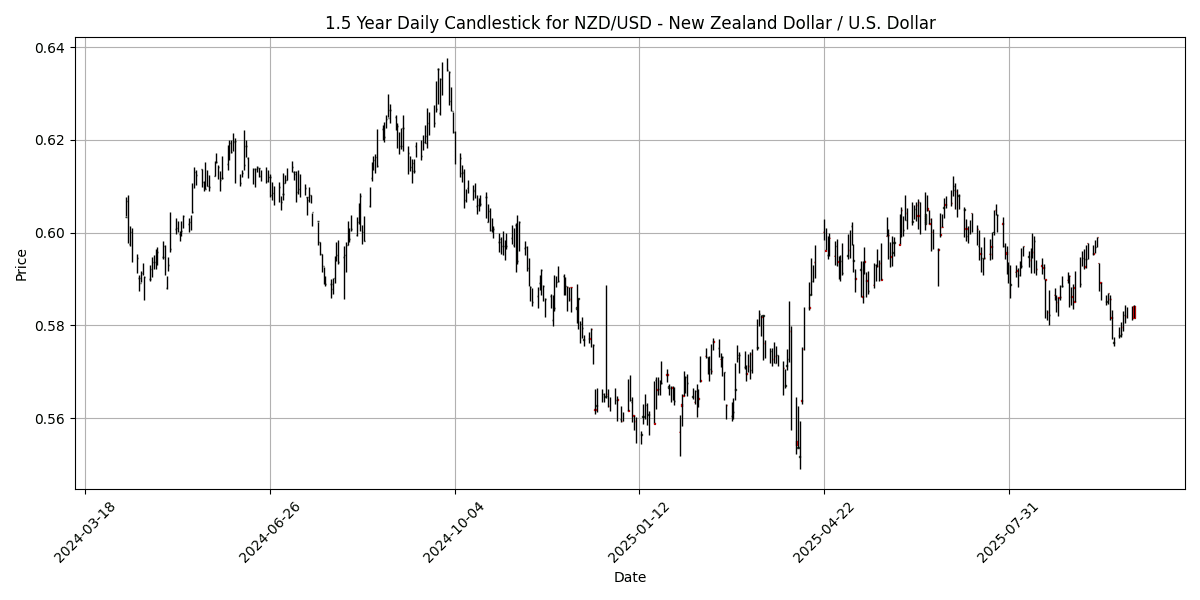

Additionally, the World Bank’s upgraded growth forecast for China to 4.8% has provided some support for the Australian Dollar (AUD) and New Zealand Dollar (NZD), although the latter faced resistance near its 200-day SMA, retreating to 0.5830 against the USD.

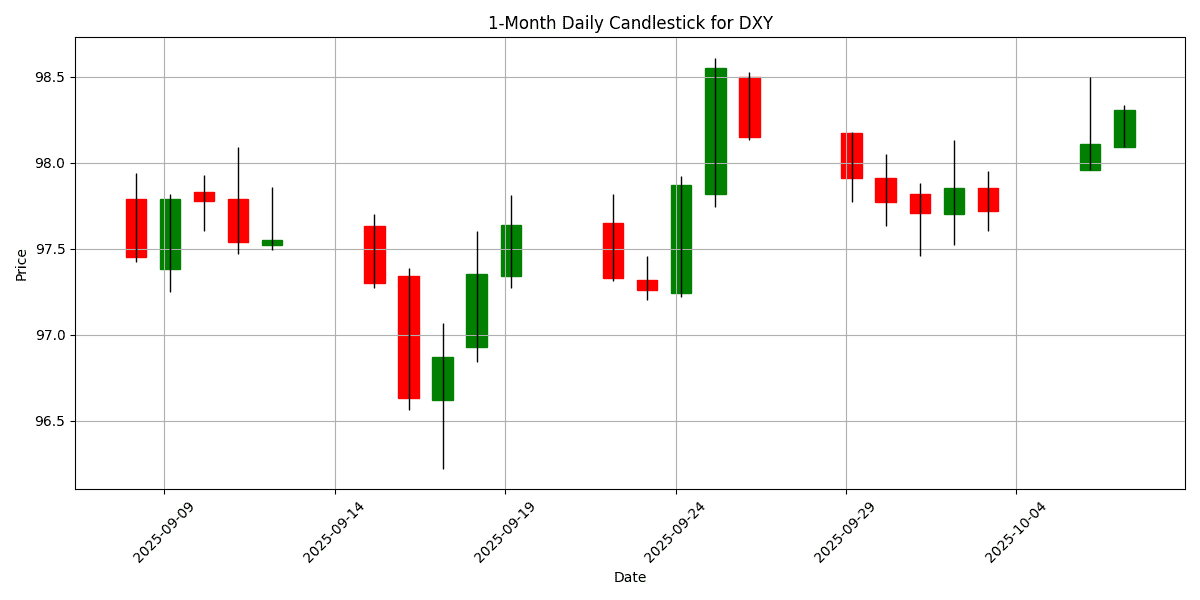

The DXY index stands at 98.31, reflecting a daily change of 0.1457%.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-07 | 02:00 | 🇬🇧 | Medium | Halifax House Price Index (YoY) (Sep) | 1.3% | 2.2% |

| 2025-10-07 | 02:00 | 🇬🇧 | Medium | Halifax House Price Index (MoM) (Sep) | -0.3% | 0.2% |

| 2025-10-07 | 02:00 | 🇪🇺 | Medium | German Factory Orders (MoM) (Aug) | -0.8% | 1.2% |

| 2025-10-07 | 05:00 | 🇬🇧 | Medium | Mortgage Rate (GBP) (Sep) | ||

| 2025-10-07 | 08:30 | 🇺🇸 | Medium | Exports (Aug) | ||

| 2025-10-07 | 08:30 | 🇺🇸 | Medium | Imports (Aug) | ||

| 2025-10-07 | 08:30 | 🇺🇸 | Medium | Trade Balance (Aug) | -61.40B | |

| 2025-10-07 | 08:30 | 🇨🇦 | Medium | Trade Balance (Aug) | -5.70B | |

| 2025-10-07 | 10:00 | 🇺🇸 | Medium | FOMC Member Bostic Speaks | ||

| 2025-10-07 | 10:00 | 🇨🇦 | Medium | Ivey PMI (Sep) | 51.2 | |

| 2025-10-07 | 10:05 | 🇺🇸 | Medium | FOMC Member Bowman Speaks | ||

| 2025-10-07 | 11:00 | 🇺🇸 | Medium | NY Fed 1-Year Consumer Inflation Expectations (Se | ||

| 2025-10-07 | 11:30 | 🇺🇸 | Medium | FOMC Member Kashkari Speaks | ||

| 2025-10-07 | 12:00 | 🇺🇸 | Medium | EIA Short-Term Energy Outlook | ||

| 2025-10-07 | 12:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-07 | 12:10 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-10-07 | 13:00 | 🇺🇸 | Medium | 3-Year Note Auction | ||

| 2025-10-07 | 13:00 | 🇺🇸 | Medium | Atlanta Fed GDPNow (Q3) | 3.8% | |

| 2025-10-07 | 15:00 | 🇺🇸 | Medium | Consumer Credit (Aug) | 12.90B | |

| 2025-10-07 | 16:30 | 🇺🇸 | Medium | API Weekly Crude Oil Stock | ||

| 2025-10-07 | 19:50 | 🇯🇵 | Medium | Adjusted Current Account (Aug) | 2.45T | |

| 2025-10-07 | 19:50 | 🇯🇵 | Medium | Current Account n.s.a. (Aug) | 3.540T | |

| 2025-10-07 | 20:30 | 🇦🇺 | Medium | Building Approvals (MoM) (Aug) | -6.0% | |

| 2025-10-07 | 20:30 | 🇦🇺 | Medium | NAB Business Confidence (Sep) | ||

| 2025-10-07 | 21:00 | 🇳🇿 | High | RBNZ Interest Rate Decision | 2.75% | |

| 2025-10-07 | 21:00 | 🇳🇿 | Medium | RBNZ Rate Statement |

On October 7, 2025, several key economic events are set to influence FX markets, particularly for the GBP, EUR, and USD.

At 02:00 ET, the Halifax House Price Index for GBP showed a disappointing annual increase of 1.3%, significantly below the forecast of 2.2%. The monthly change was also negative at -0.3%, compared to an expected rise of 0.2%. This underperformance could lead to bearish sentiment for the GBP as it reflects a weakening housing market.

In the Eurozone, German Factory Orders data released at 02:00 ET reported a sharp decline of -0.8%, contrasting with the anticipated growth of 1.2%. This unexpected downturn may exert downward pressure on the EUR as it signals potential economic stagnation.

The USD will be closely watched at 08:30 ET with the Trade Balance data expected at -$61.40 billion, alongside import and export figures. Additionally, speeches from FOMC members throughout the day may provide further insights into monetary policy direction, impacting the USD.

Finally, the RBNZ’s interest rate decision at 21:00 ET is anticipated to influence the NZD, with expectations of maintaining rates at 2.75%. Any surprises here could lead to significant volatility in the NZD.

## Major FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1689 | -0.2134 | -0.3840 | -0.3618 | 0.2753 | -0.3033 | 6.7288 | 12.33 | 6.5102 | 1.1683 | 1.1626 | 1.1189 | 31.15 | 0.0004 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 150.62 | 0.2062 | 2.4068 | 1.3648 | 1.5151 | 2.5700 | 2.1873 | -4.0587 | 1.2115 | 147.87 | 146.55 | 148.34 | 69.62 | 0.4086 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3451 | -0.2373 | -0.2165 | 0.1023 | 0.0485 | -0.9885 | 4.8774 | 7.1870 | 2.4818 | 1.3466 | 1.3501 | 1.3148 | 34.21 | -0.0017 |

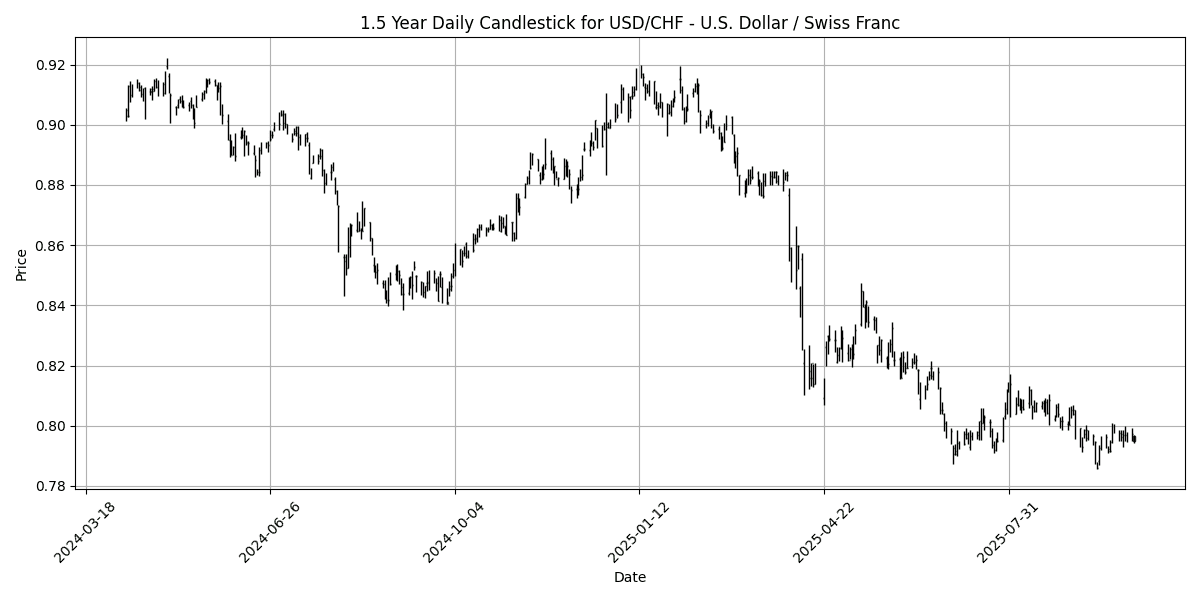

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7967 | 0.2264 | -0.0264 | -0.0627 | -1.0470 | 0.1043 | -6.8677 | -11.7953 | -7.2191 | 0.8012 | 0.8050 | 0.8413 | 68.62 | -0.0008 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6598 | -0.3474 | -0.2645 | 0.2434 | 1.1653 | 1.1262 | 7.5712 | 6.0772 | -2.9790 | 0.6547 | 0.6530 | 0.6413 | 33.81 | 0.0010 |

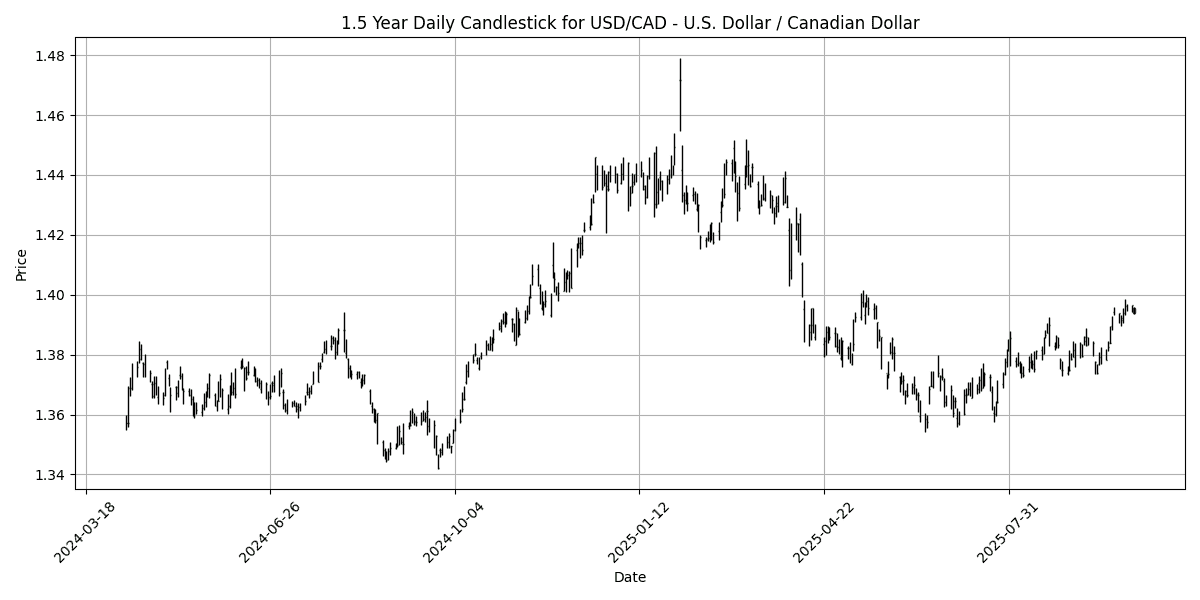

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3954 | 0.0789 | 0.1040 | 0.2716 | 1.0062 | 2.0895 | -1.0446 | -2.7582 | 2.7601 | 1.3825 | 1.3760 | 1.3990 | 85.26 | 0.0043 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5817 | -0.4109 | -0.0826 | 0.6137 | -0.5828 | -2.9463 | 3.1895 | 3.1435 | -5.5802 | 0.5889 | 0.5950 | 0.5844 | 24.24 | -0.0029 |

In the current forex landscape, several key pairs exhibit notable overbought and oversold conditions based on RSI, MACD, and moving average crossovers.

The USD/CAD pair is significantly overbought with an RSI of 85.26, indicating potential price exhaustion. The MACD remains positive, suggesting bullish momentum, but traders should be cautious of a potential reversal. Conversely, the EUR/USD and GBP/USD pairs are in oversold territory with RSIs of 31.15 and 34.21, respectively. Both pairs have negative MACD values, indicating bearish sentiment, but the oversold conditions may present buying opportunities for contrarian traders.

The USD/JPY and USD/CHF pairs are approaching overbought levels, with RSIs of 69.62 and 68.62, respectively. While the MACD remains positive for both, traders should monitor for signs of a pullback. Meanwhile, the AUD/USD and NZD/USD pairs are also oversold, with RS

## Cross FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8689 | 0.0461 | -0.1735 | -0.4810 | 0.2180 | 0.6953 | 1.7674 | 4.7890 | 3.9466 | 0.8675 | 0.8611 | 0.8506 | 48.63 | 0.0014 |

| EUR/JPY | EURJPY | 176.03 | 0.0068 | 1.9997 | 0.9810 | 1.7774 | 2.2462 | 9.0544 | 7.7375 | 7.8068 | 172.73 | 170.38 | 165.81 | 63.33 | 0.5321 |

| EUR/CHF | EURCHF | 0.9311 | 0.0322 | -0.4192 | -0.4565 | -0.7853 | -0.2111 | -0.6074 | -0.9363 | -1.1687 | 0.9359 | 0.9356 | 0.9390 | 43.13 | -0.0007 |

| EUR/AUD | EURAUD | 1.7720 | 0.1696 | -0.0919 | -0.6220 | -0.8488 | -1.3841 | -0.7433 | 5.9049 | 9.8363 | 1.7846 | 1.7800 | 1.7433 | 61.80 | -0.0017 |

| GBP/JPY | GBPJPY | 202.59 | -0.0301 | 2.1820 | 1.4726 | 1.5627 | 1.5555 | 7.1685 | 2.8361 | 3.7232 | 199.10 | 197.84 | 194.88 | 62.83 | 0.3006 |

| GBP/CHF | GBPCHF | 1.0716 | -0.0093 | -0.2337 | 0.0280 | -0.9886 | -0.8815 | -2.3252 | -5.4485 | -4.9081 | 1.0788 | 1.0866 | 1.1043 | 46.85 | -0.0025 |

| AUD/JPY | AUDJPY | 99.32 | -0.1608 | 2.0917 | 1.6092 | 2.6424 | 3.6763 | 9.8778 | 1.7424 | -1.8470 | 96.74 | 95.63 | 95.08 | 53.00 | 0.3097 |

| AUD/NZD | AUDNZD | 1.1342 | 0.0706 | -0.1778 | -0.3234 | 1.7567 | 4.1975 | 4.2521 | 2.8571 | 2.7616 | 1.1116 | 1.0975 | 1.0974 | 72.87 | 0.0072 |

| CHF/JPY | CHFJPY | 189.02 | -0.0249 | 2.4208 | 1.4399 | 2.5755 | 2.4571 | 9.7263 | 8.7591 | 9.0723 | 184.54 | 182.08 | 176.58 | 64.19 | 0.7042 |

| NZD/JPY | NZDJPY | 87.57 | -0.2233 | 2.2823 | 1.9572 | 0.8918 | -0.4830 | 5.4134 | -1.0788 | -4.4768 | 87.06 | 87.17 | 86.63 | 48.71 | -0.1857 |

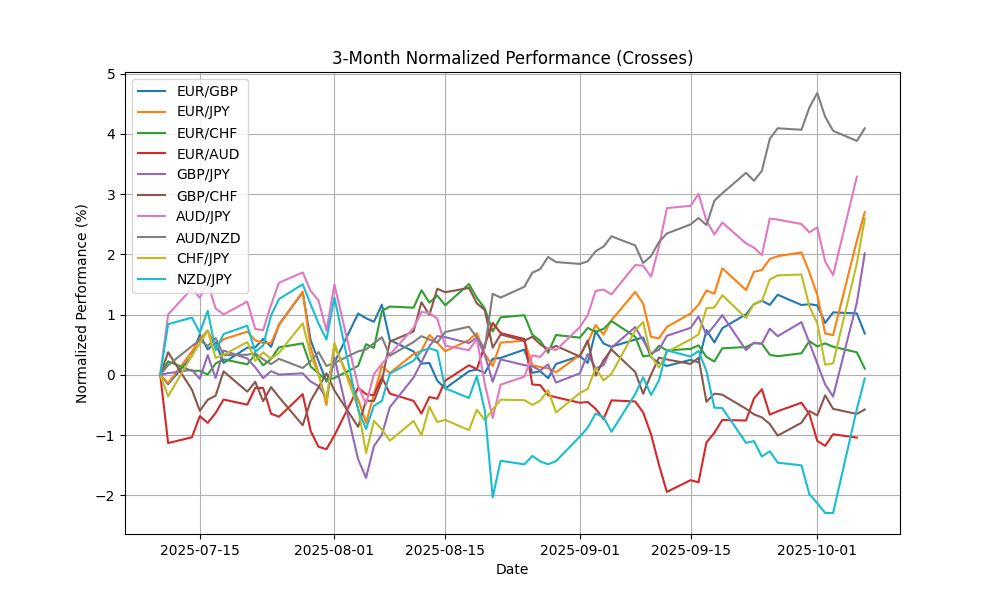

In the current analysis of key FX pairs, the AUD/NZD stands out as overbought with an RSI of 72.87, indicating potential weakness ahead. Conversely, EUR/CHF and GBP/CHF are in oversold territory with RSIs of 43.13 and 46.85, respectively, suggesting possible upward corrections. The MACD readings for these pairs indicate bearish momentum, particularly for EUR/CHF and GBP/CHF, which may attract buyers if price action aligns. Meanwhile, pairs like EUR/JPY and GBP/JPY are neutral but show bullish MACD signals, indicating potential for upward movement. Traders should monitor these conditions closely for reversal opportunities.

## Exotics and Emerging

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.69 | 0.0192 | 0.2185 | 0.2607 | 1.0607 | 4.1356 | 9.8046 | 18.07 | 21.79 | 41.12 | 40.41 | 38.68 | 93.46 | 0.1637 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.21 | 0.3235 | 0.0298 | -0.2232 | -2.9993 | -3.1735 | -11.3357 | -8.2772 | -1.4971 | 17.55 | 17.67 | 18.08 | 41.99 | -0.0887 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.50 | 0.2468 | 0.3396 | 0.9003 | 0.7127 | -0.3373 | -4.7759 | -4.8010 | -2.4024 | 32.24 | 32.39 | 33.10 | 79.58 | 0.0776 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.3829 | 0.0800 | 0.1012 | -0.3620 | -0.7435 | -1.4513 | -5.7930 | -14.8853 | -9.5409 | 9.4822 | 9.5229 | 9.9589 | 58.80 | -0.0164 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 9.9342 | 0.1472 | 0.2041 | -0.4948 | -1.3647 | -1.5646 | -7.7111 | -12.3011 | -6.8933 | 10.07 | 10.08 | 10.49 | 60.47 | -0.0206 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.3878 | 0.2134 | 0.4024 | 0.3994 | -0.2492 | 0.3858 | -6.2960 | -10.8696 | -5.9884 | 6.3893 | 6.4197 | 6.6838 | 68.97 | -0.0018 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.37 | 0.1723 | -0.0798 | 0.0474 | -1.9123 | -1.3144 | -9.6680 | -10.9756 | -4.7154 | 18.59 | 18.76 | 19.49 | 55.83 | -0.0600 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6397 | 0.2617 | 0.2976 | 0.1178 | -0.1506 | 0.5834 | -5.7916 | -11.3796 | -7.4626 | 3.6444 | 3.6609 | 3.7950 | 67.51 | -0.0006 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 332.67 | 0.2933 | 0.4156 | -0.1537 | -1.3001 | -2.4914 | -9.5086 | -15.7815 | -8.9787 | 336.87 | 341.71 | 359.39 | 61.09 | -1.2826 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.79 | 0.1691 | 0.6449 | 0.4285 | -0.8206 | -1.0095 | -9.0519 | -13.9466 | -9.9260 | 20.90 | 21.15 | 22.24 | 51.55 | -0.0547 |

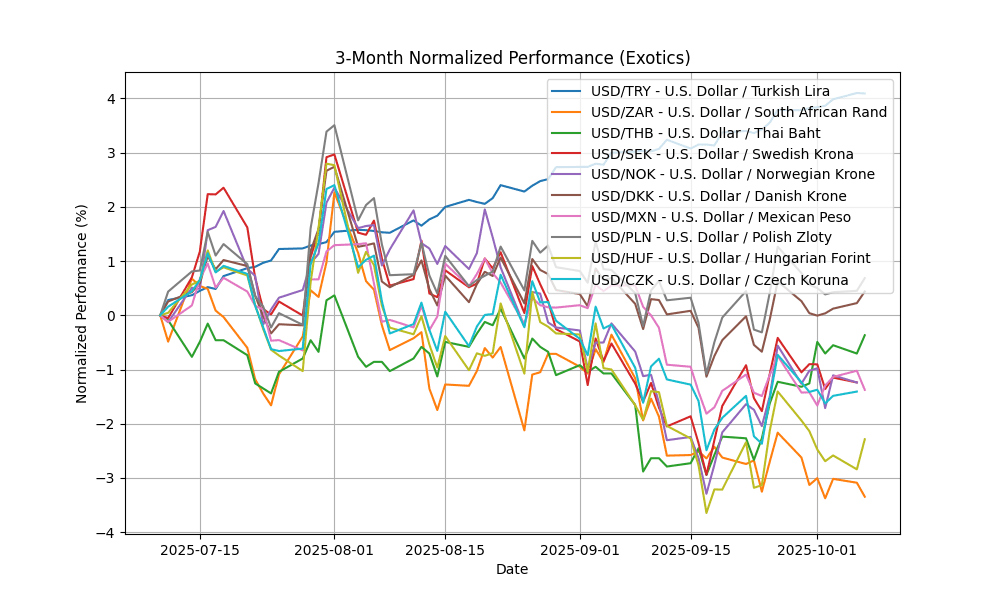

In the current analysis of key FX pairs, USD/TRY exhibits extreme overbought conditions with an RSI of 93.46, indicating potential corrective pressure ahead. The MACD remains positive, suggesting ongoing bullish momentum, yet caution is warranted. Conversely, USD/ZAR shows bearish signals with an RSI of 41.99 and a negative MACD, indicating a lack of upward momentum. The USD/THB pair, with an RSI of 79.58, is also overbought, while USD/DKK (RSI 68.97) is approaching overbought territory. Overall, traders should be vigilant of potential reversals in overbought pairs while considering the bearish outlook in USD/ZAR.