💱 Forex Report: Japanese Yen and South African Rand Losing Ground

📊 US Dollar Index (DXY)

Current Level: 99.73 (+0.20%)

The currency markets are currently influenced by a mix of monetary policy outlooks, safe-haven demand dynamics, and economic indicators. The US Dollar Index (DXY) has shown a slight uptick of 0.20%, reflecting a cautious optimism among investors regarding the Federal Reserve’s monetary policy after recent interest rate cuts. Notably, Dallas Fed President Lorie Logan’s comments suggest a reluctance to further rate cuts in December, which has provided some support to the dollar.

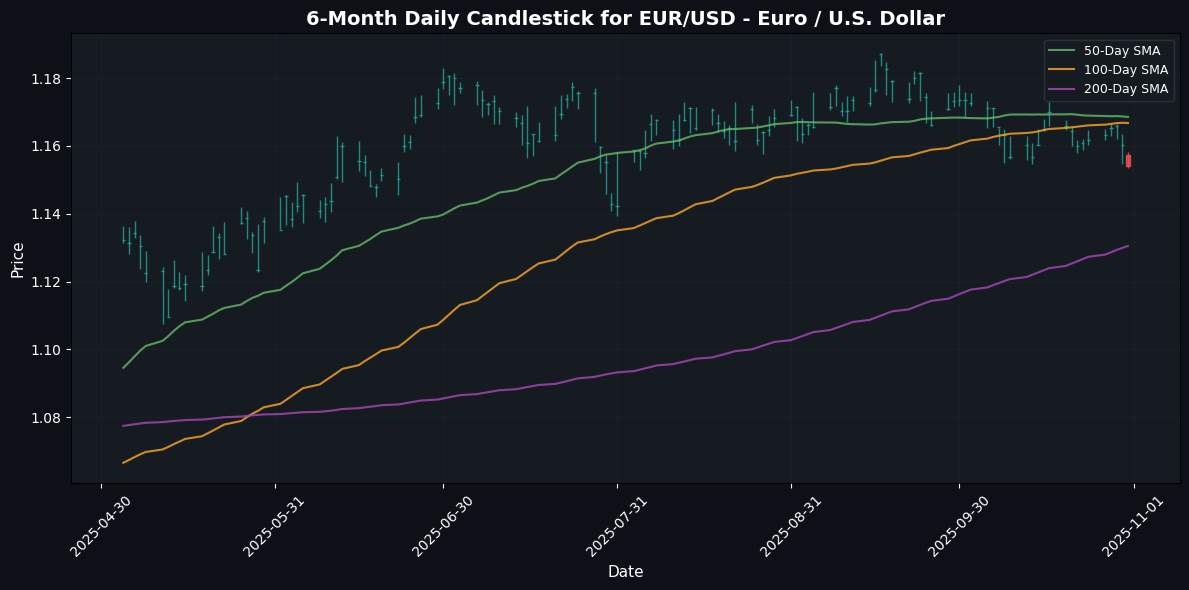

In the Eurozone, the Euro (EUR) is experiencing mixed performance against the Swiss Franc (CHF) and the US Dollar (USD). The EUR/CHF pair has risen to a two-week high as the Swiss Franc weakens amid declining safe-haven demand. However, the EUR/USD remains under pressure due to moderating inflation figures in the Eurozone, trading near key support levels. ECB policymaker Villeroy emphasized the need for flexibility in monetary policy, hinting at potential future actions, which may further influence Euro valuation.

Gold remains range-bound as investors navigate the Fed’s outlook and the recent US-China trade truce, highlighting its continued status as a safe haven despite recent price fluctuations. Additionally, USD/CHF is also trading near a two-week high, reflecting the interplay of Fed caution and the Swiss National Bank’s dovish stance.

Overall, the FX market is characterized by a cautious sentiment as investors weigh economic indicators and central bank communications, shaping currency movements in the near term.

📅 Today’s Economic Calendar

No significant economic events scheduled for today.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1539 | -0.55% | -0.68% | -0.53% | -2.13% | -1.31% | +10.44% | +3.72% | +5.79% | 1.1685 | 1.1667 | 1.1305 | 42.89 | -0.00 |

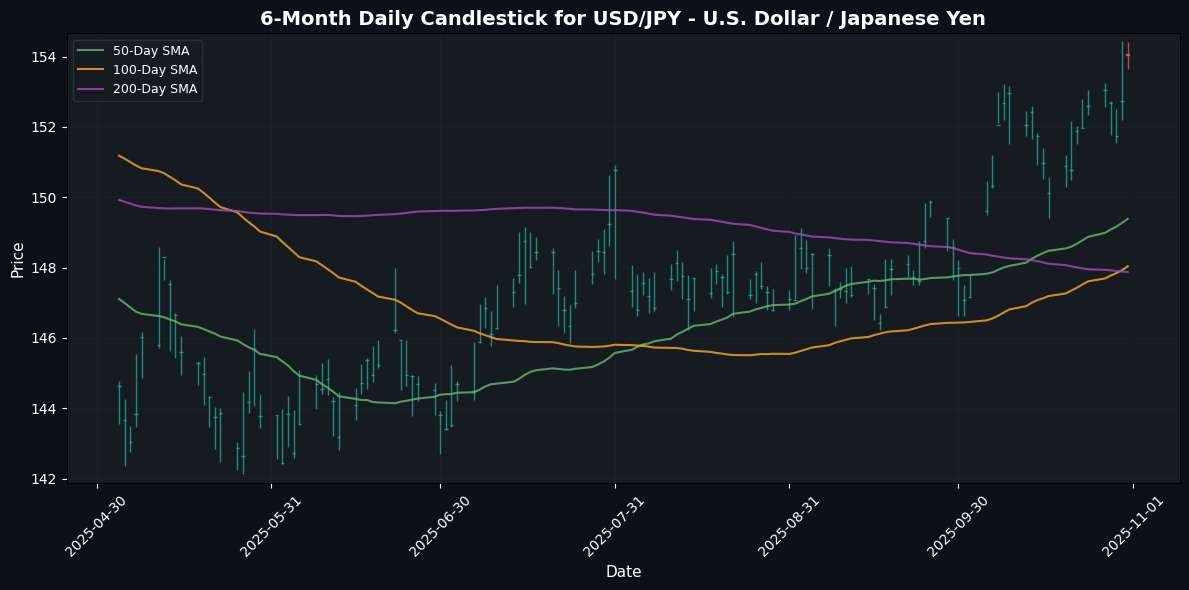

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 154.0340 | +0.86% | +0.94% | +1.41% | +4.11% | +6.45% | +1.38% | +6.65% | -1.31% | 149.3851 | 148.0360 | 147.8776 | 60.39 | 1.05 |

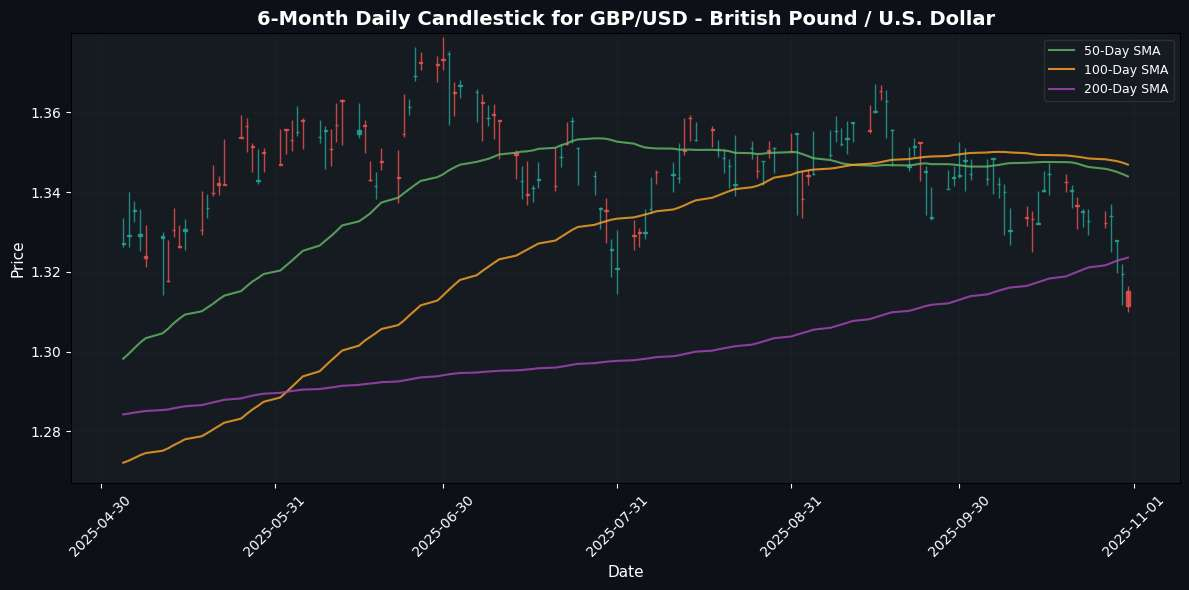

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3115 | -0.61% | -1.59% | -1.87% | -3.25% | -4.44% | +3.88% | -0.60% | +2.38% | 1.3440 | 1.3469 | 1.3236 | 28.16 | -0.01 |

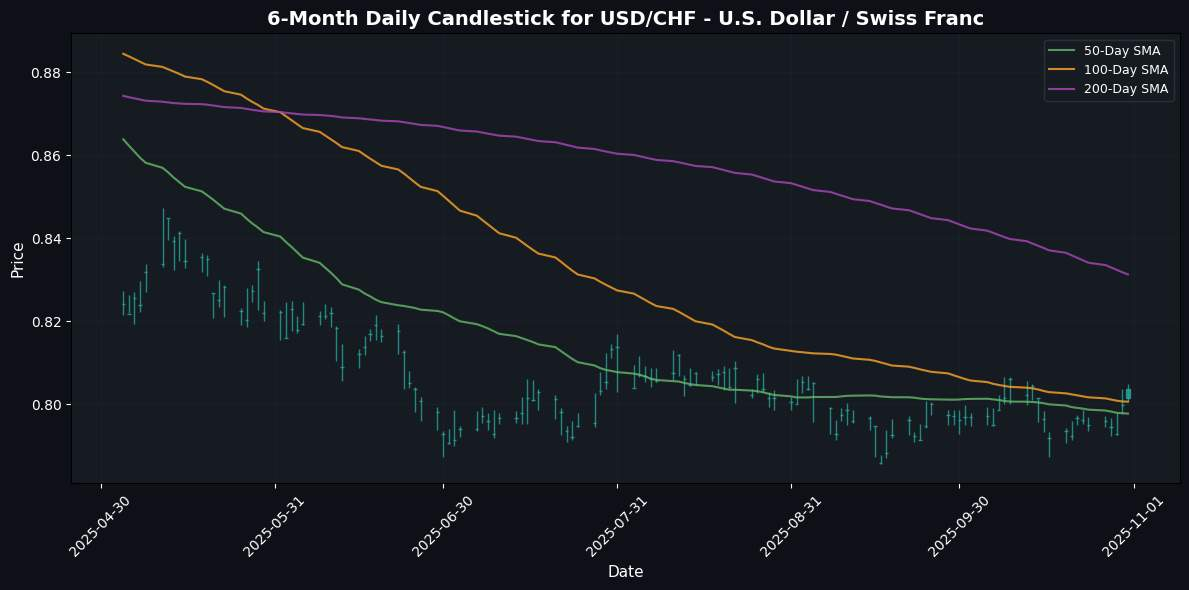

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8038 | +0.50% | +1.09% | +0.89% | +1.42% | +0.36% | -11.05% | -4.52% | -10.20% | 0.7978 | 0.8006 | 0.8313 | 51.89 | 0.00 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6549 | -0.42% | +0.53% | +0.88% | -1.04% | +0.04% | +3.09% | -3.45% | -2.11% | 0.6562 | 0.6540 | 0.6441 | 59.52 | -0.00 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4015 | +0.53% | +0.20% | -0.04% | +1.61% | +2.72% | -1.23% | +3.99% | +2.83% | 1.3898 | 1.3806 | 1.3956 | 52.88 | 0.00 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5729 | -0.62% | -0.46% | -0.24% | -2.76% | -5.45% | +0.41% | -8.30% | -7.51% | 0.5828 | 0.5905 | 0.5856 | 50.63 | -0.00 |

In the recent trading session, the USD exhibited strong performance across major currency pairs, particularly against the JPY, CAD, and CHF, with gains of +0.86%, +0.53%, and +0.50% respectively. This bullish trend suggests that the U.S. Dollar is benefiting from a positive market sentiment, likely driven by robust economic data or expectations surrounding U.S. monetary policy. Conversely, the NZD, GBP, and EUR have underperformed against the USD, indicating weakness in these currencies with declines of -0.62%, -0.61%, and -0.55%. This divergence highlights a potential shift in investor confidence, favoring the U.S. Dollar amidst prevailing economic concerns in other regions.

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8796 | +0.04% | +0.91% | +1.35% | +1.15% | +3.27% | +6.30% | +4.33% | +3.32% | 0.8694 | 0.8662 | 0.8538 | 70.10 | 0.00 |

| EUR/JPY | EURJPY | 177.6980 | +0.28% | +0.23% | +0.85% | +1.87% | +5.05% | +11.95% | +10.60% | +4.39% | 174.5365 | 172.7000 | 167.0890 | 60.94 | 0.84 |

| EUR/CHF | EURCHF | 0.9271 | -0.13% | +0.37% | +0.32% | -0.76% | -0.98% | -1.80% | -1.00% | -5.03% | 0.9321 | 0.9340 | 0.9379 | 40.47 | -0.00 |

| EUR/AUD | EURAUD | 1.7619 | -0.13% | -1.19% | -1.39% | -1.09% | -1.34% | +7.14% | +7.43% | +8.07% | 1.7806 | 1.7840 | 1.7544 | 36.23 | -0.00 |

| GBP/JPY | GBPJPY | 201.9890 | +0.24% | -0.68% | -0.49% | +0.72% | +1.72% | +5.30% | +6.01% | +1.03% | 200.7344 | 199.3687 | 195.6418 | 45.41 | 0.47 |

| GBP/CHF | GBPCHF | 1.0539 | -0.16% | -0.53% | -1.01% | -1.89% | -4.11% | -7.61% | -5.10% | -8.07% | 1.0720 | 1.0783 | 1.0989 | 27.13 | -0.00 |

| AUD/JPY | AUDJPY | 100.8570 | +0.42% | +1.45% | +2.29% | +3.01% | +6.49% | +4.50% | +2.95% | -3.40% | 98.0167 | 96.7982 | 95.2275 | 65.93 | 0.63 |

| AUD/NZD | AUDNZD | 1.1432 | +0.19% | +0.99% | +1.13% | +1.85% | +5.90% | +2.67% | +5.29% | +5.93% | 1.1259 | 1.1076 | 1.1001 | 62.31 | 0.00 |

| CHF/JPY | CHFJPY | 191.6500 | +0.40% | -0.14% | +0.55% | +2.66% | +6.10% | +14.00% | +11.70% | +9.92% | 187.2341 | 184.8883 | 178.1672 | 70.20 | 1.31 |

| NZD/JPY | NZDJPY | 88.2270 | +0.25% | +0.48% | +1.17% | +1.25% | +0.68% | +1.82% | -2.21% | -8.72% | 87.0313 | 87.3733 | 86.5457 | 62.99 | 0.29 |

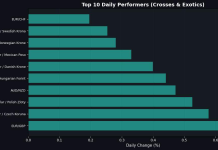

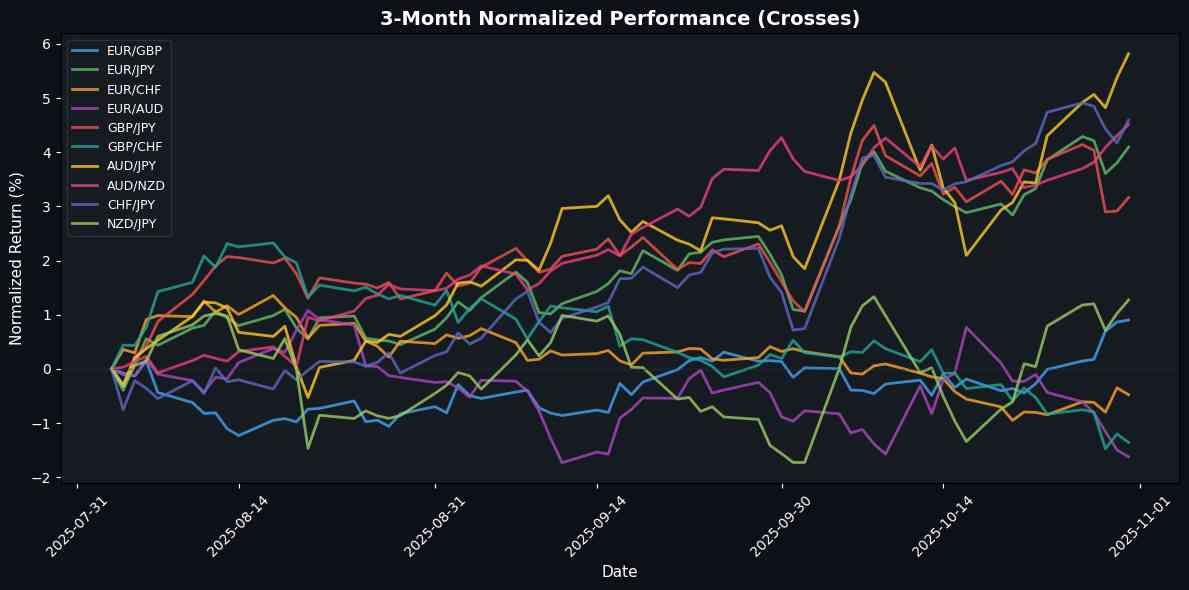

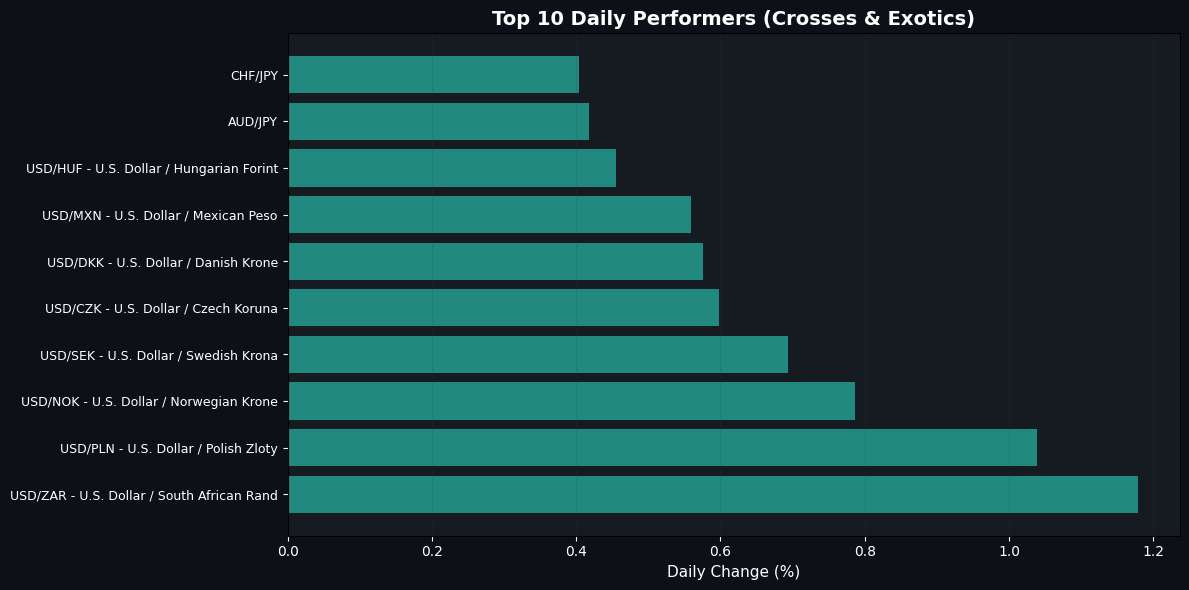

In today’s trading session, the top performers, particularly AUD/JPY and CHF/JPY, exhibited upward momentum, reflecting a strengthening of the Australian and Swiss currencies against the Japanese yen, possibly driven by positive economic sentiment in those regions. The EUR/JPY also showed modest gains, indicating sustained interest in the Euro relative to the yen amidst ongoing geopolitical developments. Conversely, the weakest performers, including GBP/CHF and EUR/CHF, faced downward pressure, suggesting a pullback in demand for the British pound and Euro against the Swiss franc, potentially linked to concerns over economic stability and interest rate differentials. Overall, the market appears to be favoring currencies with stronger economic fundamentals, while the Euro’s performance remains subdued against more stable currencies like the Swiss franc.

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.8910 | -0.02% | -0.33% | -0.18% | +1.19% | +5.11% | +15.43% | +22.71% | +30.18% | 41.5324 | 40.9034 | 39.2595 | 60.76 | 0.13 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.3649 | +1.18% | +0.25% | -0.13% | +0.14% | -2.78% | -5.60% | -2.59% | -6.22% | 17.3815 | 17.5756 | 17.9780 | 47.87 | -0.03 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.3200 | -0.25% | -1.46% | -1.64% | +1.35% | -0.65% | -3.92% | -5.06% | -11.63% | 32.2866 | 32.3815 | 32.9368 | 40.85 | 0.05 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.4702 | +0.69% | +1.00% | +0.45% | +1.35% | -0.40% | -11.63% | -7.11% | -8.99% | 9.4131 | 9.4955 | 9.8007 | 44.64 | -0.00 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.0916 | +0.79% | +1.25% | +0.32% | +2.26% | +0.35% | -9.50% | -3.92% | -3.40% | 9.9920 | 10.0664 | 10.3641 | 48.66 | 0.01 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4731 | +0.58% | +0.69% | +0.55% | +2.25% | +1.45% | -9.32% | -3.46% | -5.33% | 6.3893 | 6.3976 | 6.6125 | 57.63 | 0.01 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.5690 | +0.56% | +0.95% | +0.73% | +1.12% | -1.64% | -8.25% | -5.57% | +4.91% | 18.4782 | 18.6184 | 19.3016 | 53.86 | 0.00 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6901 | +1.04% | +1.37% | +1.03% | +2.12% | +1.75% | -6.99% | -4.40% | -5.72% | 3.6393 | 3.6460 | 3.7526 | 54.16 | 0.00 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 336.3750 | +0.46% | +0.22% | +0.31% | +2.08% | -1.59% | -12.35% | -4.87% | -5.98% | 334.7208 | 338.4725 | 353.6680 | 45.95 | 0.04 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 21.1040 | +0.60% | +0.91% | +0.85% | +2.45% | -0.18% | -11.99% | -6.25% | -6.62% | 20.8252 | 20.9748 | 21.9145 | 59.50 | 0.04 |

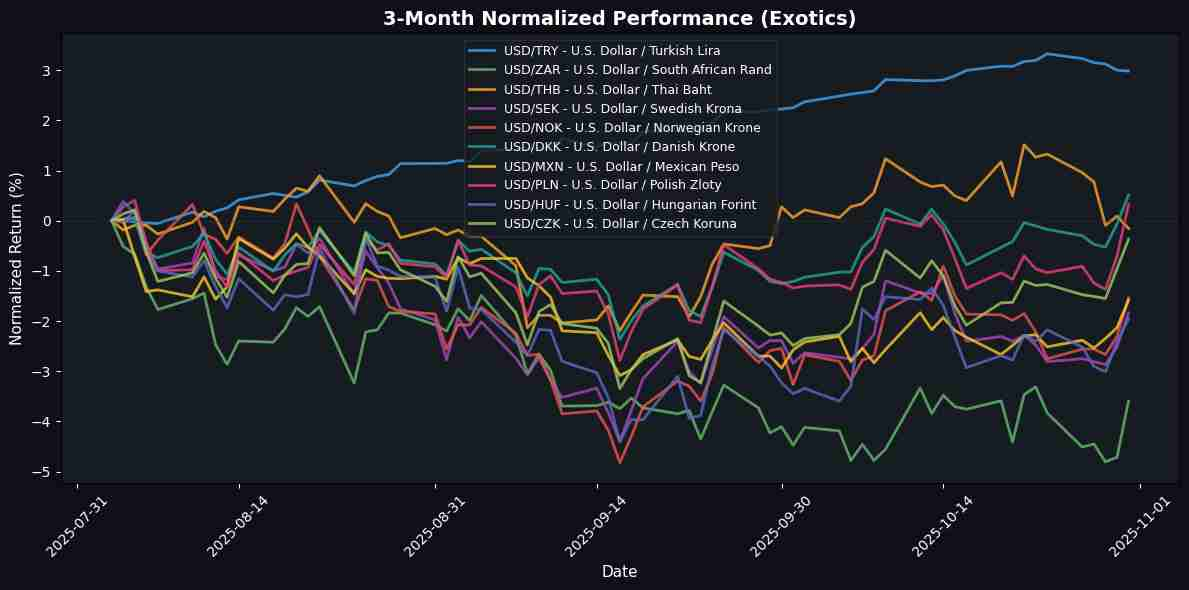

In the recent trading session, the USD/ZAR pair showed robust strength, gaining 1.18%, likely driven by favorable U.S. economic data and a weakening South African economy. The USD/PLN also performed well, increasing by 1.04%, as the U.S. dollar remains attractive amid geopolitical uncertainties in Eastern Europe. The USD/NOK’s 0.79% rise can be attributed to higher oil prices bolstering the Norwegian economy, although the dollar’s overall dominance plays a critical role. Conversely, the USD/THB and USD/TRY displayed relative weakness, with minor declines of -0.25% and -0.02%, respectively, suggesting a stabilization in emerging market currencies despite ongoing inflationary pressures.

🏆 Top Daily Performers (Crosses & Exotics)

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.