## Forex and Global News

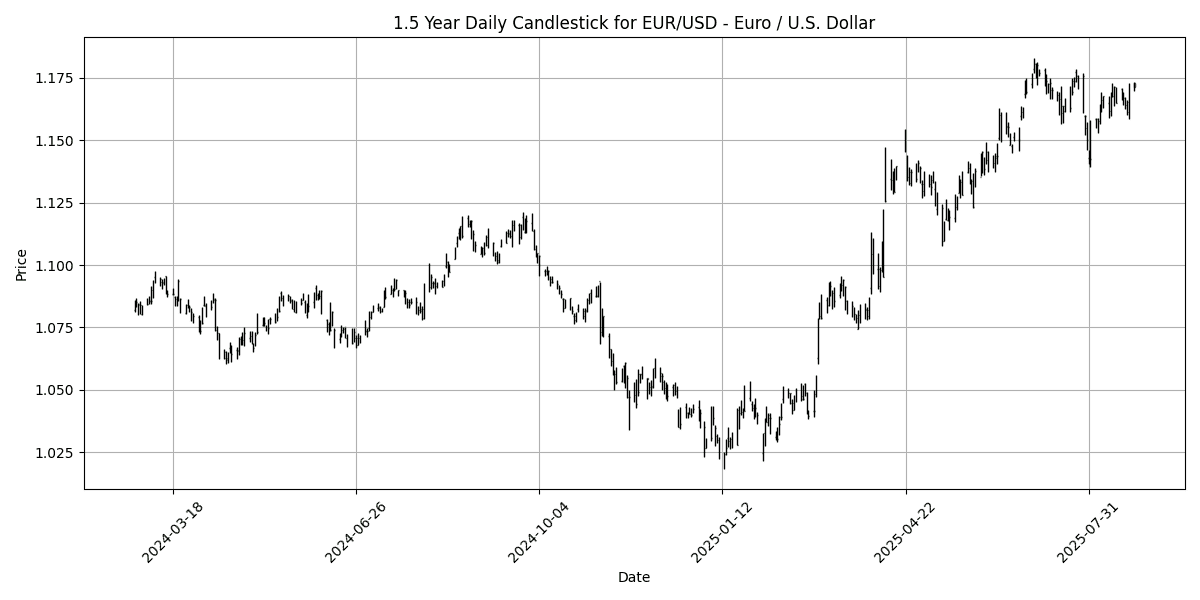

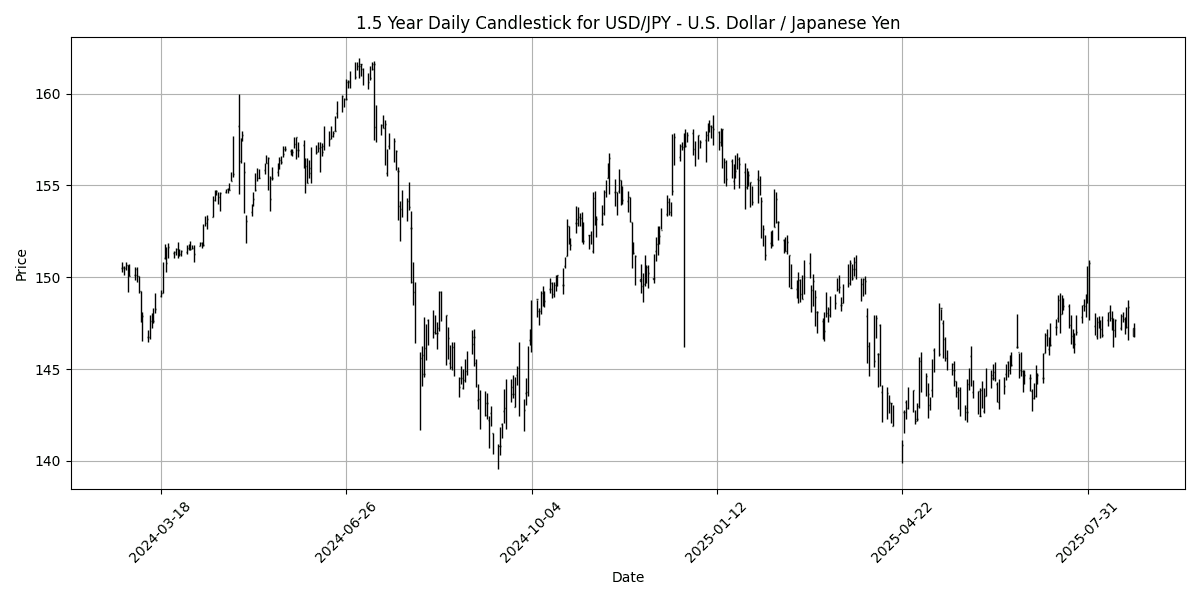

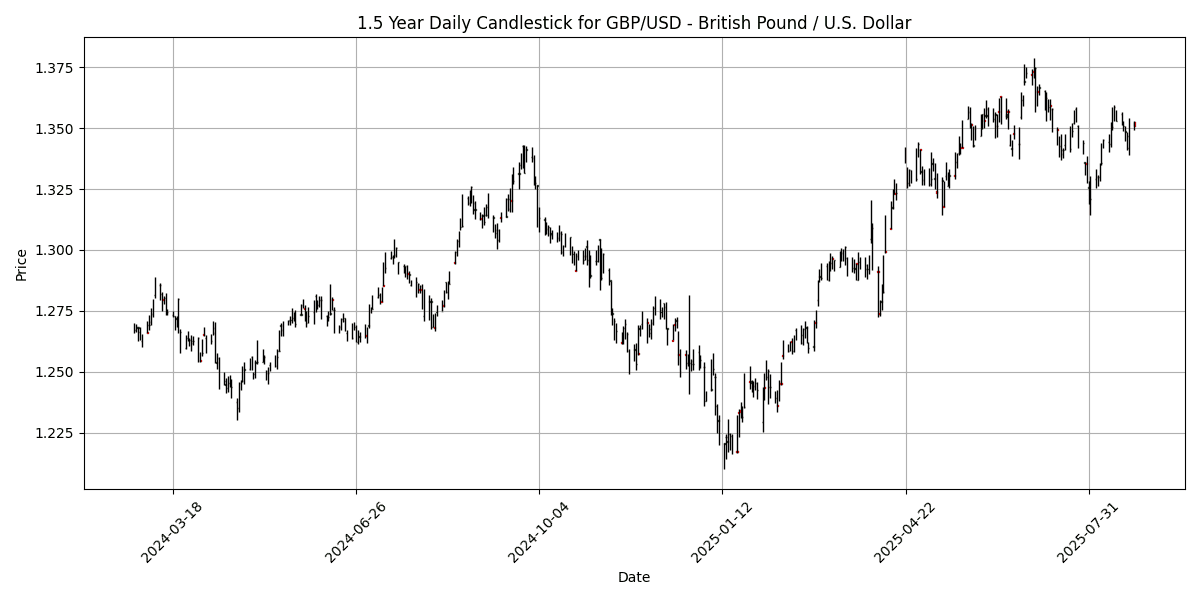

The forex market is reacting to several key developments as traders await further clarity from the Federal Reserve following Chair Jerome Powell’s dovish remarks at the Jackson Hole Economic Symposium. The USD/JPY pair has seen some upward movement, trading near 147.50, although capped by hawkish signals from the Bank of Japan. Meanwhile, GBP/USD is under pressure, trading around 1.3495, as renewed demand for the US Dollar weighs on the pair. The EUR/USD has also pulled back to around 1.1700 after reaching four-week highs, reflecting a broader retracement in the wake of Powell’s speech.

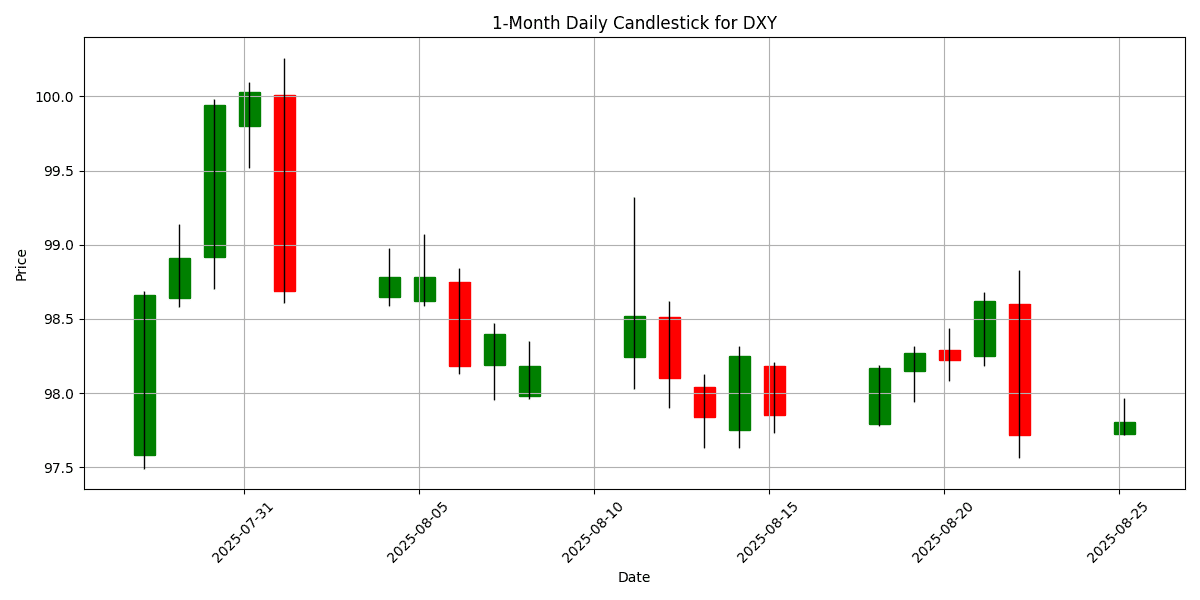

In Asia, the People’s Bank of China set the USD/CNY reference rate at 7.1161, a slight adjustment from the previous fix, while China’s stock market continues to rise, driven by households with record savings. Commodities such as gold are experiencing profit-taking, with prices retreating below $3,370 after a volatile session. Overall, market sentiment remains cautious as traders digest the implications of US monetary policy and global economic indicators. The DXY is currently at 97.80, down 0.0572%.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-08-25 | 01:00 | Medium | Core CPI (YoY) (Jul) | 0.50% | ||

| 2025-08-25 | 01:00 | Medium | CPI (YoY) (Jul) | 0.6% | 0.7% | |

| 2025-08-25 | 02:30 | 🇨🇭 | Medium | Employment Level (Q2) | 5.532M | |

| 2025-08-25 | 04:00 | 🇪🇺 | Medium | German Business Expectations (Aug) | 90.2 | |

| 2025-08-25 | 04:00 | 🇪🇺 | Medium | German Current Assessment (Aug) | 86.7 | |

| 2025-08-25 | 04:00 | 🇪🇺 | Medium | German Ifo Business Climate Index (Aug) | 88.7 | |

| 2025-08-25 | 08:00 | 🇺🇸 | Medium | Building Permits (Jul) | 1.354M | |

| 2025-08-25 | 09:30 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-08-25 | 10:00 | 🇺🇸 | High | New Home Sales (Jul) | 635K | |

| 2025-08-25 | 10:00 | 🇺🇸 | Medium | New Home Sales (MoM) (Jul) | ||

| 2025-08-25 | 19:15 | 🇺🇸 | Medium | FOMC Member Williams Speaks | ||

| 2025-08-25 | 21:30 | 🇦🇺 | Medium | RBA Meeting Minutes |

On August 25, 2025, several key economic events are expected to influence FX markets.

The Singaporean data releases at 01:00 ET include the Core CPI YoY for July, which came in at 0.50%, and the overall CPI YoY, reported at 0.6%, slightly below the forecast of 0.7%. This underperformance may exert downward pressure on the Singapore Dollar (SGD) as it suggests weaker inflationary pressures.

Moving to Europe, the German Ifo Business Climate Index and related metrics will be released at 04:00 ET, with expectations set at 88.7 for the index, 90.2 for Business Expectations, and 86.7 for Current Assessment. Any significant deviation from these forecasts could impact the Euro (EUR), particularly if the data indicates a deteriorating business sentiment.

In the U.S., Building Permits and New Home Sales figures will be reported at 08:00 ET and 10:00 ET, respectively. The forecasts for these indicators are crucial for the USD, as stronger housing data could bolster expectations for economic resilience.

Lastly, speeches from FOMC member Williams at 19:15 ET may provide insights into future monetary policy, further influencing the USD. Overall, markets will be closely monitoring these releases for potential volatility in currency pairs.

## Major FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1715 | -0.0341 | 0.6225 | 0.0719 | -0.3499 | 2.8671 | 11.32 | 12.58 | 5.3776 | 1.1653 | 1.1479 | 1.1000 | 61.18 | 0.0011 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 147.26 | 0.1333 | -0.3195 | -0.0034 | 0.1728 | 3.2274 | -1.2202 | -6.2015 | 0.7230 | 146.75 | 145.51 | 149.21 | 52.83 | 0.1913 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3510 | -0.0592 | 0.1721 | -0.3421 | -0.0003 | -0.4070 | 6.5925 | 7.6571 | 3.1475 | 1.3498 | 1.3412 | 1.3017 | 66.91 | 0.0009 |

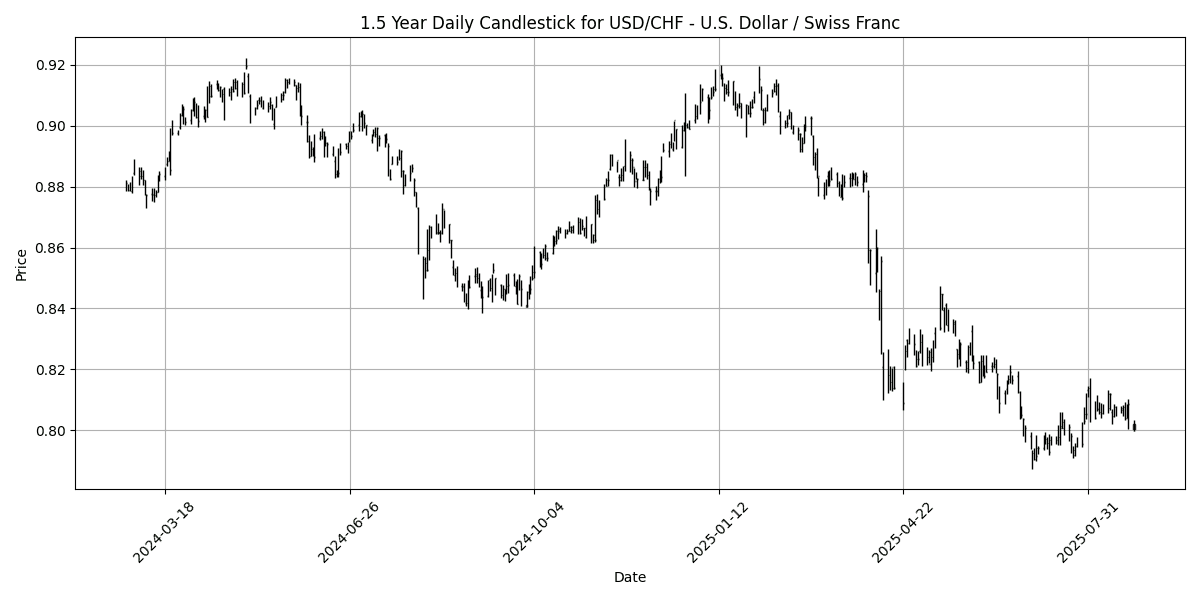

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8022 | 0.0000 | -0.6896 | -0.5455 | 0.9222 | -2.2208 | -10.1076 | -11.1864 | -5.8119 | 0.8033 | 0.8155 | 0.8554 | 42.73 | 0.0006 |

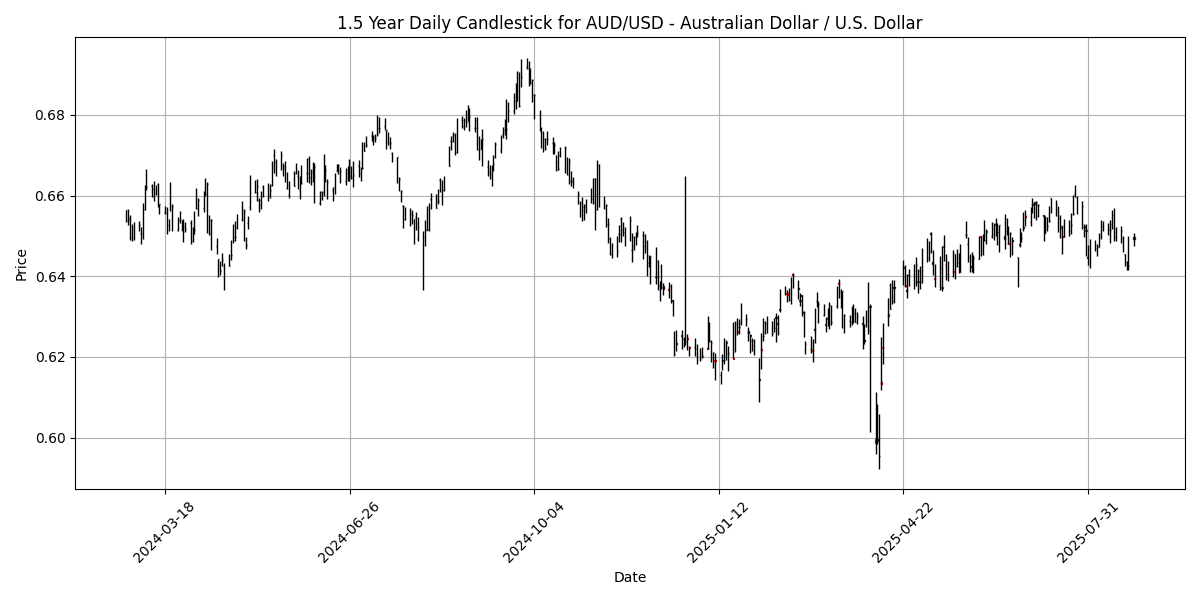

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6497 | 0.0924 | 0.6569 | -0.2451 | -1.5185 | 0.2468 | 2.2686 | 4.4534 | -3.1484 | 0.6517 | 0.6457 | 0.6387 | 53.33 | -0.0014 |

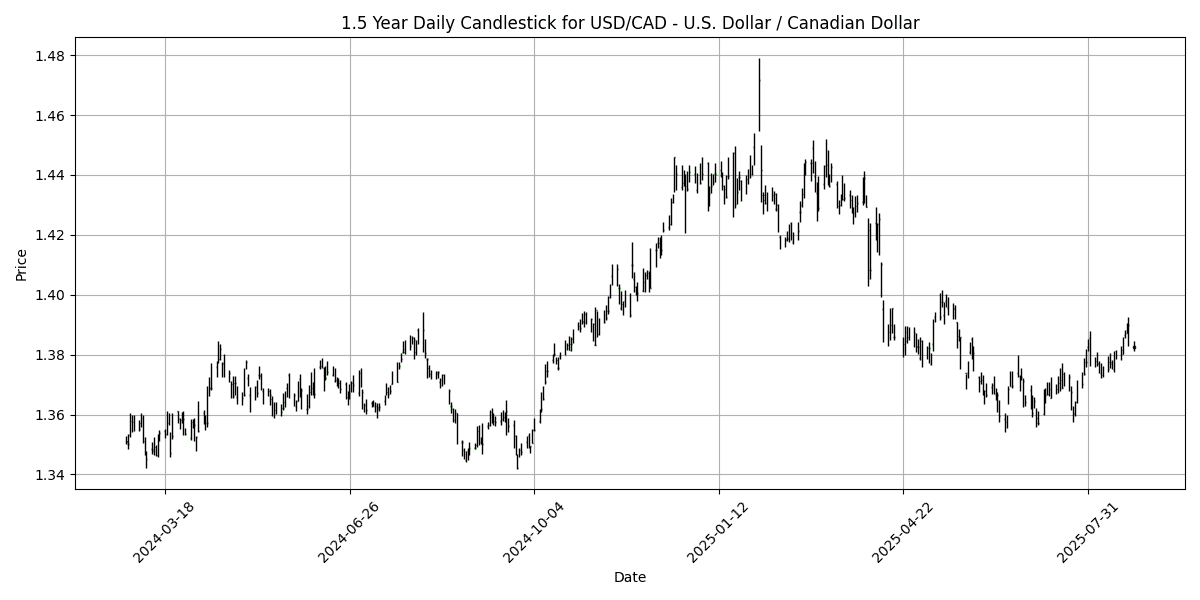

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3828 | 0.0072 | -0.2741 | 0.0941 | 1.3738 | 0.6712 | -3.3054 | -3.6363 | 1.6511 | 1.3719 | 1.3788 | 1.4036 | 58.57 | 0.0038 |

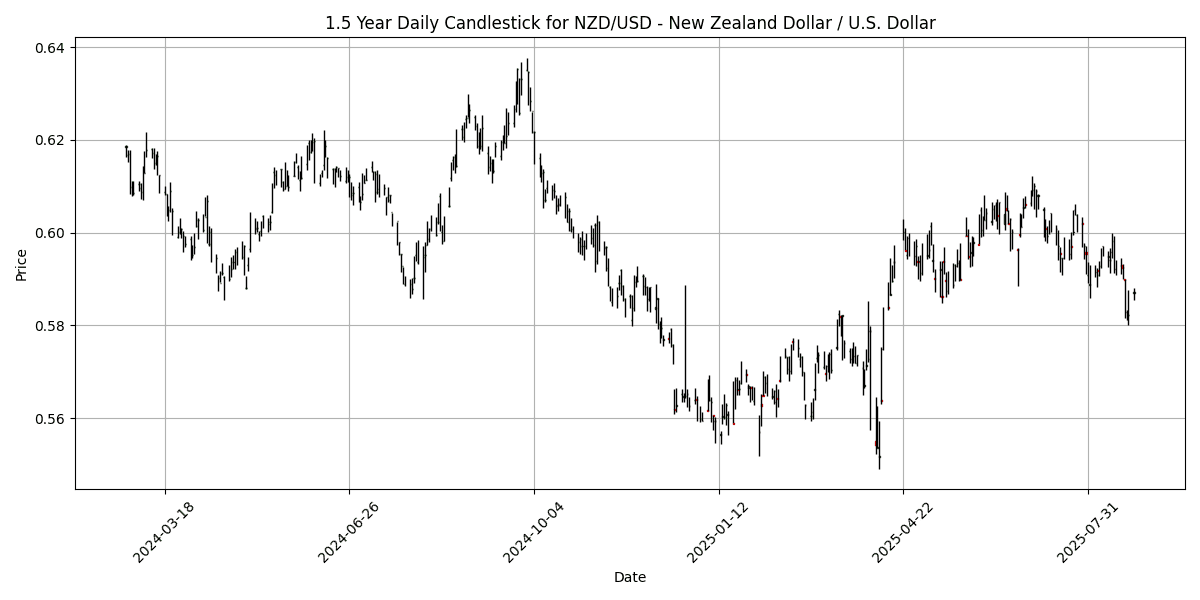

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5871 | 0.0682 | -0.4525 | -0.9715 | -2.7516 | -2.0635 | 2.4413 | 4.1010 | -4.4371 | 0.5979 | 0.5949 | 0.5834 | 43.68 | -0.0031 |

Analyzing the current conditions of key FX pairs reveals a mixed sentiment across the market. The EUR/USD pair, with an RSI of 61.18, is approaching overbought territory but remains neutral, complemented by a positive MACD of 0.0011. The GBP/USD pair, at an RSI of 66.91, is nearing overbought levels, suggesting potential resistance ahead, although its MACD remains marginally positive.

Conversely, the USD/CHF pair shows oversold characteristics with an RSI of 42.73 and a weakening MACD, indicating bearish momentum. The AUD/USD and NZD/USD pairs also reflect bearish conditions, with their respective RSIs of 53.33 and 43.68, compounded by negative MACD readings, suggesting further downside risk.

Overall, while the EUR/USD and GBP/USD exhibit bullish tendencies, caution is warranted in pairs like USD/CHF, AUD/USD, and NZD/USD, which may present opportunities for bearish trades as they

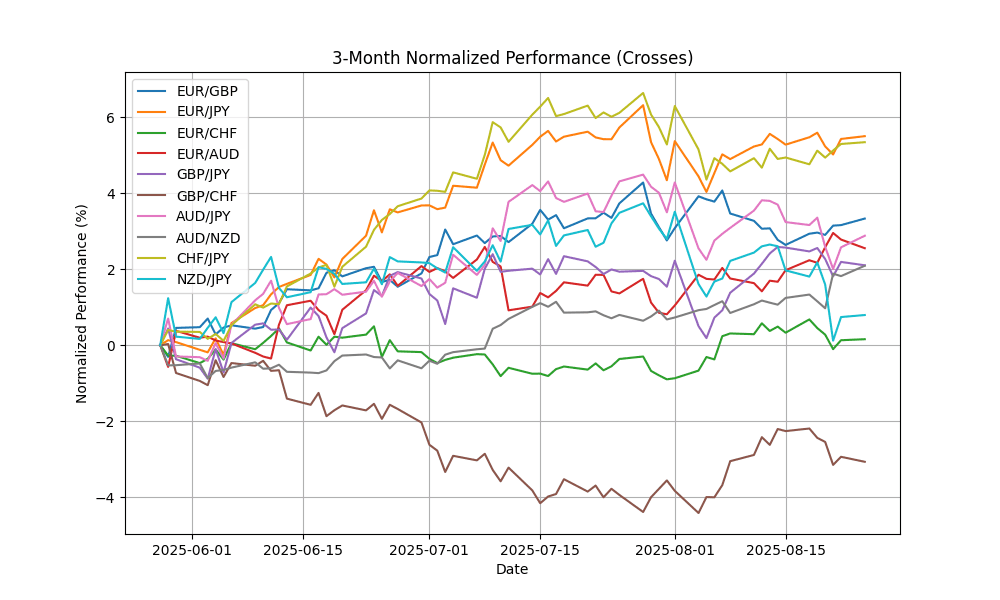

## Cross FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8668 | 0.0231 | 0.4124 | 0.3822 | -0.3907 | 3.2556 | 4.4186 | 4.5357 | 2.1351 | 0.8633 | 0.8558 | 0.8446 | 40.32 | 0.0003 |

| EUR/JPY | EURJPY | 172.44 | 0.1080 | 0.2570 | 0.0273 | -0.2158 | 6.1465 | 9.9433 | 5.5384 | 6.0982 | 170.98 | 167.02 | 163.92 | 71.40 | 0.3865 |

| EUR/CHF | EURCHF | 0.9393 | -0.0319 | -0.1180 | -0.5158 | 0.5233 | 0.5384 | 0.0479 | -0.0638 | -0.7974 | 0.9360 | 0.9357 | 0.9387 | 58.04 | 0.0016 |

| EUR/AUD | EURAUD | 1.8031 | -0.1219 | -0.0316 | 0.3043 | 1.1682 | 2.6209 | 8.8717 | 7.7636 | 8.8027 | 1.7879 | 1.7778 | 1.7218 | 63.13 | 0.0056 |

| GBP/JPY | GBPJPY | 198.91 | 0.0805 | -0.1601 | -0.3562 | 0.1652 | 2.7984 | 5.2878 | 0.9726 | 3.9100 | 198.05 | 195.15 | 194.04 | 75.08 | 0.3887 |

| GBP/CHF | GBPCHF | 1.0835 | -0.0738 | -0.5379 | -0.8973 | 0.9052 | -2.6356 | -4.1897 | -4.3985 | -2.8669 | 1.0841 | 1.0934 | 1.1116 | 62.77 | 0.0015 |

| AUD/JPY | AUDJPY | 95.62 | 0.2180 | 0.2863 | -0.2733 | -1.3718 | 3.4322 | 0.9939 | -2.0507 | -2.4932 | 95.62 | 93.93 | 95.25 | 56.84 | -0.0831 |

| AUD/NZD | AUDNZD | 1.1065 | 0.0181 | 1.1102 | 0.7503 | 1.2852 | 2.3542 | -0.1597 | 0.3451 | 1.3408 | 1.0900 | 1.0851 | 1.0948 | 70.16 | 0.0034 |

| CHF/JPY | CHFJPY | 183.57 | 0.1511 | 0.3861 | 0.5547 | -0.7283 | 5.5845 | 9.8943 | 5.6215 | 6.9539 | 182.66 | 178.48 | 174.62 | 64.31 | 0.1058 |

| NZD/JPY | NZDJPY | 86.42 | 0.2122 | -0.7875 | -0.9933 | -2.5990 | 1.0796 | 1.1707 | -2.3768 | -3.7682 | 87.70 | 86.55 | 86.98 | 45.44 | -0.3410 |

In the current analysis, EUR/JPY and GBP/JPY exhibit overbought conditions, with RSI readings of 71.40 and 75.08, respectively, indicating potential price corrections. Both pairs also show positive MACD values, suggesting bullish momentum, although caution is warranted due to overbought levels. Conversely, EUR/GBP remains neutral with an RSI of 40.32 and a MACD near zero, indicating a stable trend without extreme conditions. AUD/NZD is approaching overbought territory with an RSI of 70.16, while other pairs like AUD/JPY and NZD/JPY are in neutral to slightly bearish territory, highlighting varied market dynamics across these currencies.

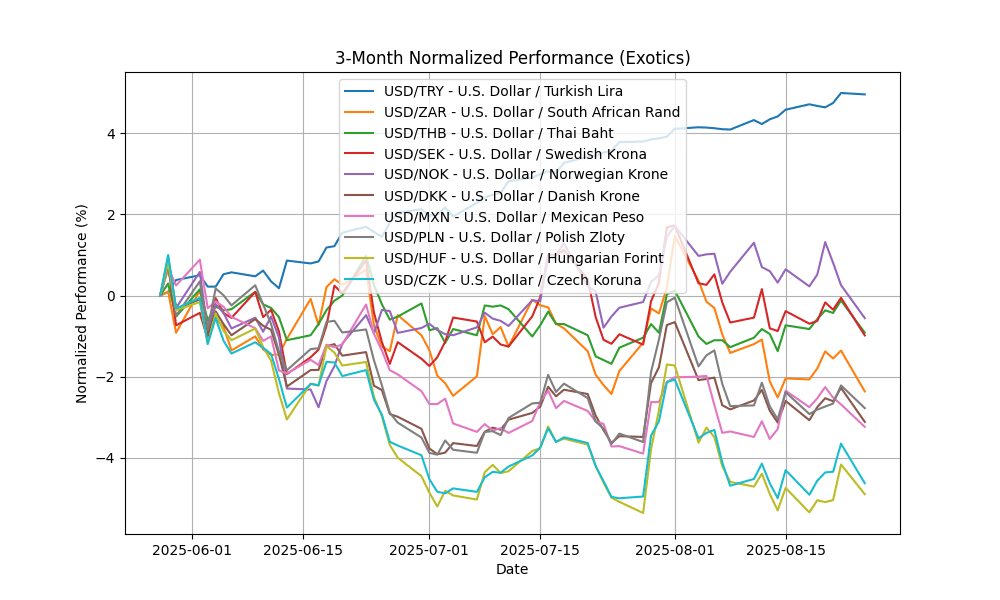

## Exotics and Emerging

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 40.99 | 0.1578 | 0.3046 | 0.2328 | 1.1301 | 5.1295 | 12.43 | 16.11 | 20.72 | 40.31 | 39.50 | 37.65 | 80.68 | 0.1923 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.52 | 0.4109 | -1.0002 | -0.3015 | -0.5121 | -1.7268 | -4.8237 | -6.6187 | -2.6695 | 17.76 | 18.05 | 18.17 | 30.17 | -0.0523 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.40 | 0.0309 | -0.5525 | -0.0925 | 0.3718 | -0.5525 | -4.0171 | -5.0939 | -6.0597 | 32.48 | 32.82 | 33.45 | 53.82 | 0.0157 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.5239 | 0.2220 | -0.8155 | -0.2914 | -0.0291 | 0.2041 | -10.0617 | -13.6063 | -6.9251 | 9.5789 | 9.6271 | 10.20 | 39.66 | -0.0084 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.09 | 0.2334 | -1.8477 | -0.7782 | -0.2554 | 0.0178 | -9.0776 | -10.8939 | -4.6017 | 10.14 | 10.24 | 10.67 | 37.86 | 0.0032 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.3738 | 0.0361 | -0.5785 | -0.0237 | 0.3843 | -2.6659 | -10.0946 | -11.0649 | -5.0317 | 6.4043 | 6.5029 | 6.7975 | 39.19 | -0.0059 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.63 | 0.2297 | -1.0043 | -0.5009 | 0.4917 | -3.2000 | -8.9347 | -9.7057 | -4.4150 | 18.75 | 19.16 | 19.77 | 38.49 | -0.0109 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6399 | 0.2230 | -0.0386 | 0.1513 | 0.6498 | -2.2017 | -7.4570 | -11.3748 | -5.4569 | 3.6516 | 3.7099 | 3.8649 | 38.08 | -0.0046 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 338.60 | 0.4063 | 0.2051 | 0.4730 | 0.1983 | -4.2042 | -11.1256 | -14.2802 | -4.3178 | 342.03 | 349.78 | 368.21 | 35.95 | -1.2451 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.94 | 0.0134 | -0.2772 | 0.2994 | 0.3907 | -4.0943 | -11.5542 | -13.3211 | -7.1280 | 21.11 | 21.58 | 22.72 | 40.28 | -0.0482 |

In the current analysis of key FX pairs, USD/TRY shows extreme overbought conditions with an RSI of 80.68, coupled with a positive MACD, indicating strong bullish momentum. Conversely, USD/ZAR is approaching oversold territory with an RSI of 30.17 and a negative MACD, suggesting potential bearish continuation. Other pairs, including USD/SEK, USD/NOK, and USD/DKK, exhibit weak momentum with RSIs below 40, indicating a lack of buying interest. The MA crossovers across these pairs reinforce the prevailing trends, with USD/TRY distinctly outperforming while USD/ZAR may present a reversal opportunity as it nears oversold levels.