## Forex and Global News

Market sentiment remains cautious as traders anticipate the U.S. Federal Reserve’s upcoming interest rate decision, with expectations leaning towards a cut. The Fed’s quarterly dot plot will be crucial for gauging future monetary policy. In the UK, inflation remains elevated ahead of the Bank of England’s meeting, suggesting rates may hold steady. This economic backdrop has led to a mixed performance for major currencies, with the GBP facing pressure amid ongoing geopolitical tensions and the U.S.-UK relationship dynamics influenced by President Trump’s state visit.

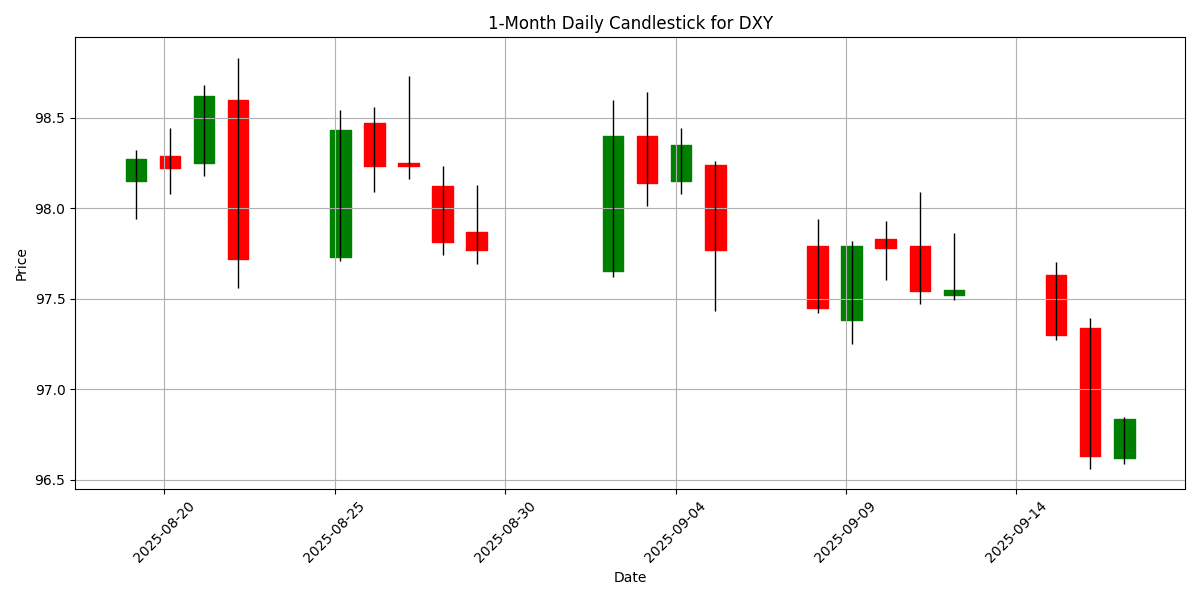

Meanwhile, European stocks opened higher, reflecting optimism ahead of the Fed’s decision. The DXY index stands at 96.83, marking a slight daily change of 0.0868%. Geopolitical developments, including the U.S.-China tensions over TikTok and Russia’s military exercises involving U.S. officials, add further complexity to the forex landscape. As traders navigate these factors, the outlook remains uncertain, particularly for currencies like the EUR and JPY, which are sensitive to shifts in U.S. monetary policy and global economic conditions.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-09-17 | 02:00 | 🇬🇧 | High | CPI (YoY) (Aug) | 3.8% | 3.8% |

| 2025-09-17 | 02:00 | 🇬🇧 | Medium | CPI (MoM) (Aug) | 0.3% | 0.3% |

| 2025-09-17 | 03:30 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-09-17 | 05:00 | 🇪🇺 | Medium | Core CPI (YoY) (Aug) | 2.3% | |

| 2025-09-17 | 05:00 | 🇪🇺 | High | CPI (YoY) (Aug) | 2.1% | |

| 2025-09-17 | 05:00 | 🇪🇺 | Medium | CPI (MoM) (Aug) | 0.2% | |

| 2025-09-17 | 08:30 | 🇺🇸 | Medium | Building Permits (Aug) | 1.370M | |

| 2025-09-17 | 08:30 | 🇺🇸 | Medium | Housing Starts (MoM) (Aug) | ||

| 2025-09-17 | 08:30 | 🇺🇸 | Medium | Housing Starts (Aug) | 1.370M | |

| 2025-09-17 | 08:30 | 🇨🇦 | Medium | Foreign Securities Purchases (Jul) | -1.32B | |

| 2025-09-17 | 09:45 | 🇨🇦 | Medium | BoC Rate Statement | ||

| 2025-09-17 | 09:45 | 🇨🇦 | High | BoC Interest Rate Decision | 2.50% | |

| 2025-09-17 | 10:30 | 🇺🇸 | High | Crude Oil Inventories | 1.400M | |

| 2025-09-17 | 10:30 | 🇺🇸 | Medium | Cushing Crude Oil Inventories | ||

| 2025-09-17 | 10:30 | 🇨🇦 | Medium | BOC Press Conference | ||

| 2025-09-17 | 11:30 | 🇺🇸 | Medium | Atlanta Fed GDPNow (Q3) | 3.4% | |

| 2025-09-17 | 13:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-09-17 | 14:00 | 🇺🇸 | Medium | Interest Rate Projection – 1st Yr (Q3) | ||

| 2025-09-17 | 14:00 | 🇺🇸 | Medium | Interest Rate Projection – 2nd Yr (Q3) | ||

| 2025-09-17 | 14:00 | 🇺🇸 | Medium | Interest Rate Projection – 3rd Yr (Q3) | ||

| 2025-09-17 | 14:00 | 🇺🇸 | Medium | Interest Rate Projection – Current (Q3) | ||

| 2025-09-17 | 14:00 | 🇺🇸 | Medium | Interest Rate Projection – Longer (Q3) | ||

| 2025-09-17 | 14:00 | 🇺🇸 | High | FOMC Economic Projections | ||

| 2025-09-17 | 14:00 | 🇺🇸 | High | FOMC Statement | ||

| 2025-09-17 | 14:00 | 🇺🇸 | High | Fed Interest Rate Decision | 4.25% | |

| 2025-09-17 | 14:30 | 🇺🇸 | High | FOMC Press Conference | ||

| 2025-09-17 | 17:30 | 🇧🇷 | Medium | Interest Rate Decision | 15.00% | |

| 2025-09-17 | 18:45 | 🇳🇿 | Medium | GDP (QoQ) (Q2) | -0.3% | |

| 2025-09-17 | 21:30 | 🇦🇺 | Medium | Employment Change (Aug) | 21.2K | |

| 2025-09-17 | 21:30 | 🇦🇺 | Medium | Full Employment Change (Aug) | ||

| 2025-09-17 | 21:30 | 🇦🇺 | Medium | Unemployment Rate (Aug) | 4.2% |

On September 17, 2025, several key economic events are poised to impact FX markets significantly.

The UK’s Consumer Price Index (CPI) for August came in at 3.8% YoY and 0.3% MoM, matching forecasts. This stability may bolster the GBP, as it reflects consistent inflation, potentially supporting the Bank of England’s policy stance.

In the Eurozone, the ECB President Christine Lagarde is scheduled to speak at 03:30, which could influence EUR sentiment, especially ahead of the CPI data release at 05:00. The expected CPI YoY is 2.1%, with core CPI at 2.3%. Any deviation from these forecasts could lead to volatility in the EUR.

The US will release housing data at 08:30, with building permits and housing starts both forecasted at 1.370M. These indicators are crucial for gauging the housing market’s health, impacting USD. Later, the Federal Open Market Committee (FOMC) will announce its interest rate decision at 14:00, with expectations of maintaining rates at 4.25%. Market reactions will depend on the accompanying economic projections and the tone of the FOMC statement.

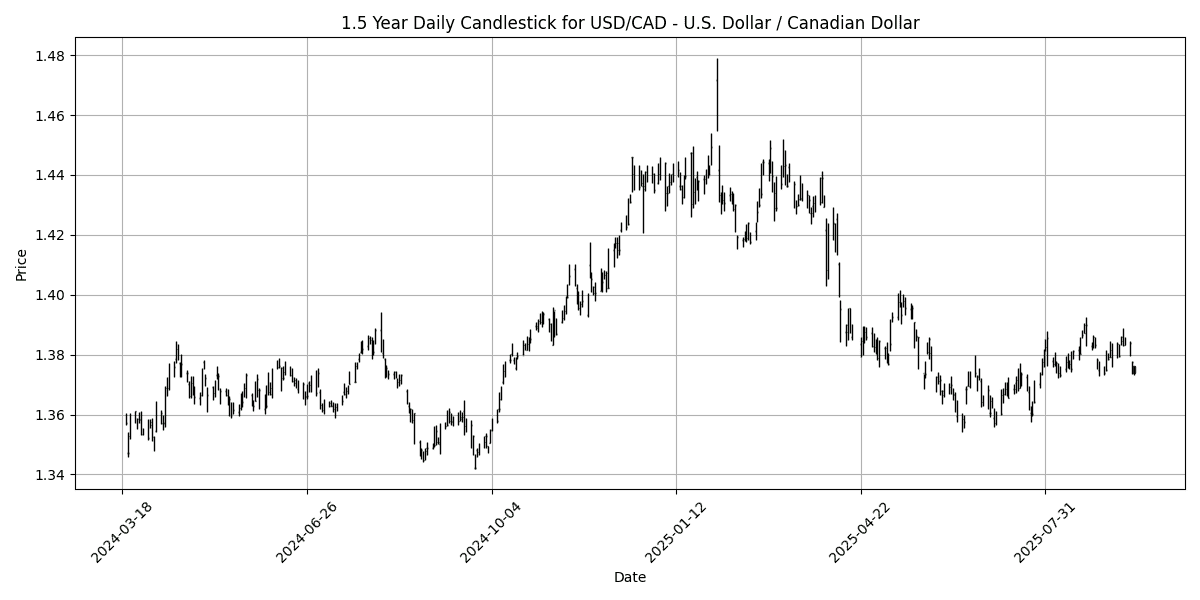

Additionally, the Bank of Canada’s interest rate decision and press conference at 09:45 will be critical for CAD, particularly as foreign securities purchases show a significant outflow of -1.32B.

Overall, these events are likely to create

## Major FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

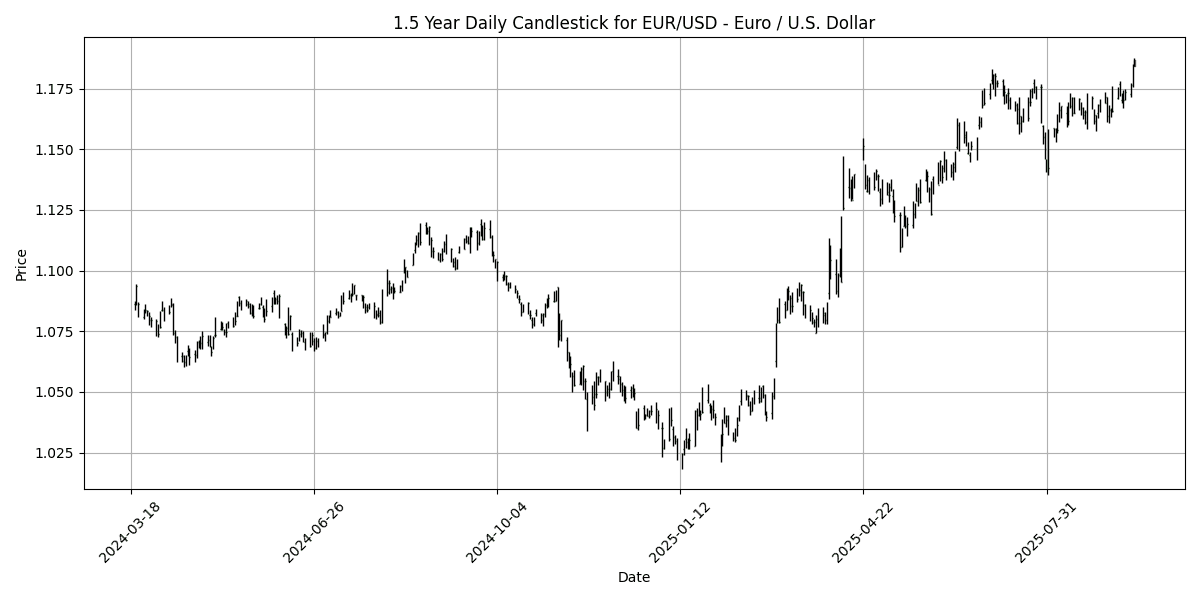

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1844 | -0.2106 | 0.9310 | 1.2070 | 1.1738 | 3.1932 | 9.0939 | 13.82 | 6.4195 | 1.1666 | 1.1556 | 1.1099 | 69.15 | 0.0033 |

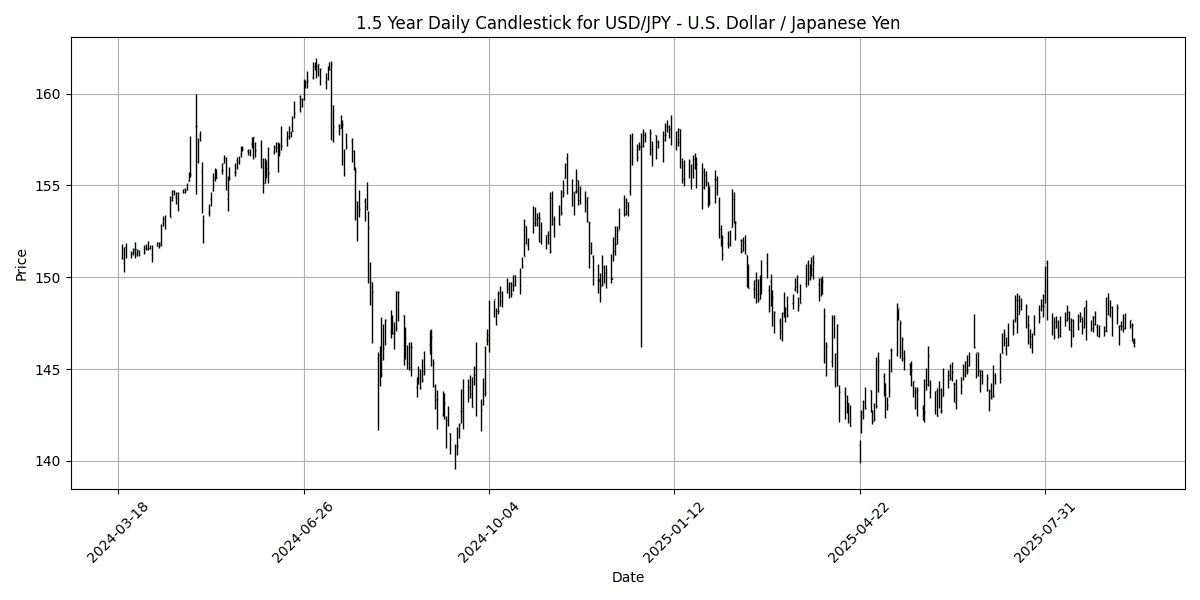

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 146.66 | 0.1174 | -0.3858 | -0.4993 | -0.4129 | 1.1735 | -1.3055 | -6.5856 | 4.1665 | 147.62 | 146.12 | 148.75 | 44.44 | -0.0507 |

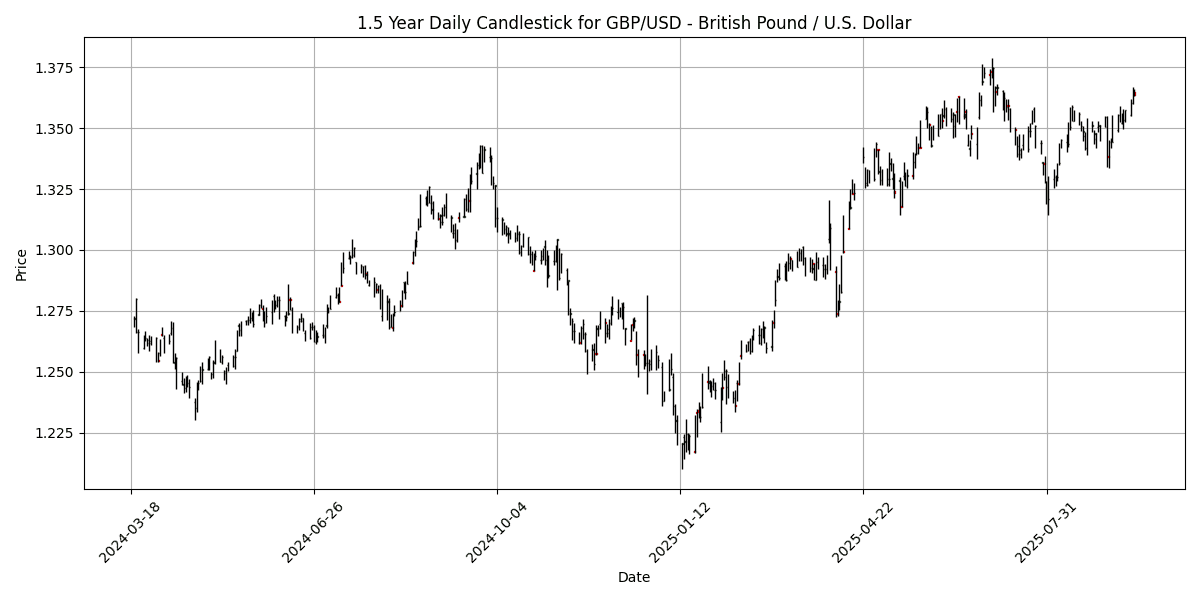

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3635 | -0.1172 | 0.4300 | 0.8424 | 0.5799 | 1.6285 | 5.1436 | 8.6532 | 3.2115 | 1.3467 | 1.3475 | 1.3090 | 61.23 | 0.0033 |

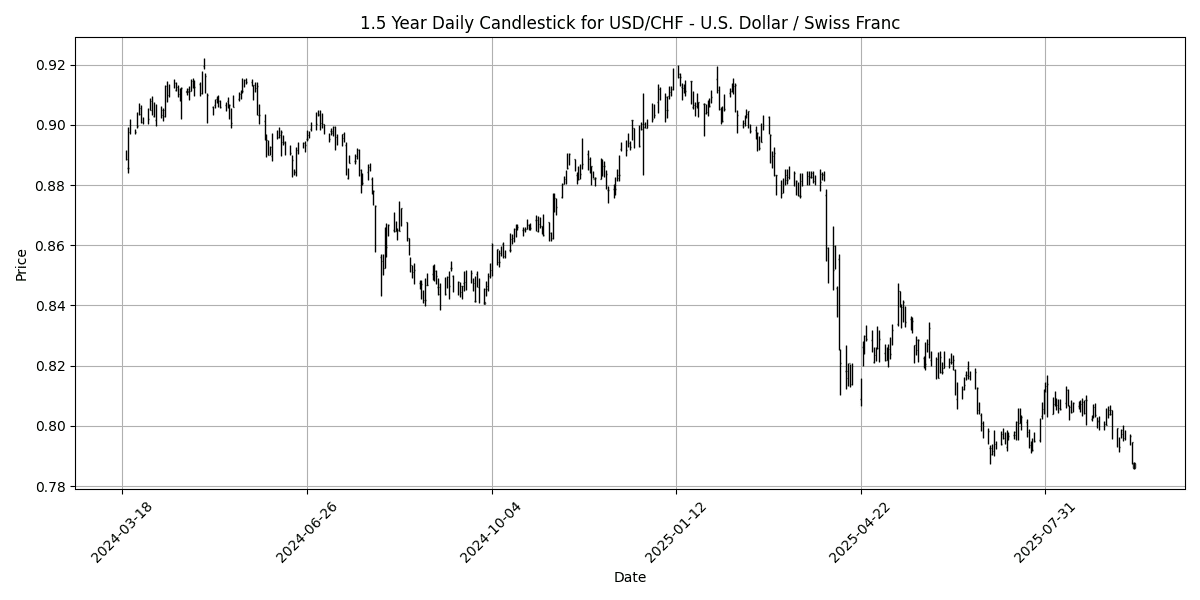

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7876 | 0.1781 | -1.0491 | -1.2166 | -2.3556 | -3.8410 | -10.6398 | -12.8028 | -6.7465 | 0.8019 | 0.8101 | 0.8481 | 32.74 | -0.0030 |

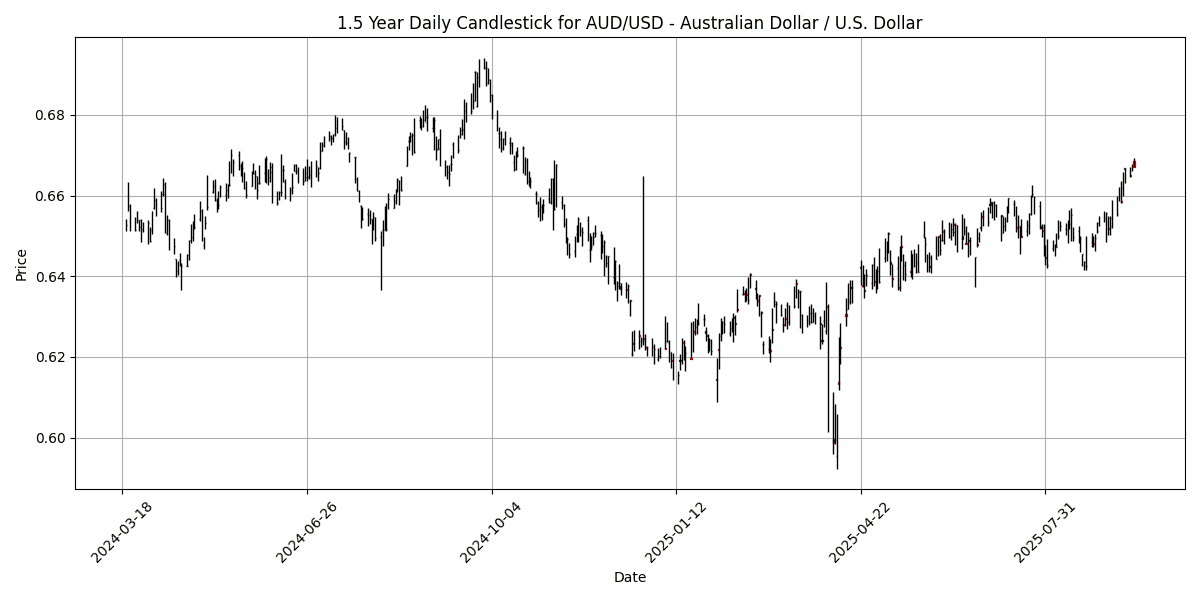

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6670 | -0.2542 | 0.0300 | 1.2954 | 2.4112 | 2.4986 | 5.8075 | 7.2347 | -1.2130 | 0.6533 | 0.6506 | 0.6394 | 72.63 | 0.0041 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3760 | 0.1456 | -0.5328 | -0.6254 | -0.3981 | 0.4673 | -3.9287 | -4.1102 | 1.2785 | 1.3768 | 1.3761 | 1.4017 | 47.03 | 0.0008 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5971 | -0.3338 | -0.1138 | 0.7594 | 0.7153 | -0.9704 | 3.6291 | 5.8742 | -3.6328 | 0.5934 | 0.5963 | 0.5837 | 65.86 | 0.0011 |

In the current forex landscape, several key pairs exhibit notable overbought and oversold conditions. The AUD/USD, with an RSI of 72.63, is approaching overbought territory, supported by a positive MACD of 0.0041, indicating bullish momentum. A potential pullback may be expected as it nears resistance levels.

Conversely, the USD/CHF is in an oversold position, evidenced by an RSI of 32.74 and a negative MACD of -0.0030. This suggests that a corrective bounce could be on the horizon, potentially offering a buying opportunity.

The EUR/USD is close to overbought conditions with an RSI of 69.15, while the GBP/USD remains stable at 61.23, indicating moderate bullish sentiment. The USD/JPY, with an RSI of 44.44, shows a neutral stance, while USD/CAD and NZD/USD display mixed signals, warranting cautious trading strategies. Overall, traders should

## Cross FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8684 | -0.0920 | 0.4790 | 0.3351 | 0.5675 | 1.5174 | 3.7304 | 4.7287 | 3.0815 | 0.8662 | 0.8575 | 0.8475 | 63.88 | 0.0003 |

| EUR/JPY | EURJPY | 173.65 | -0.0995 | 0.5140 | 0.6783 | 0.7326 | 4.3829 | 7.6418 | 6.2827 | 10.83 | 172.20 | 168.85 | 164.91 | 68.88 | 0.4327 |

| EUR/CHF | EURCHF | 0.9326 | -0.0322 | -0.1424 | -0.0643 | -1.2254 | -0.7777 | -2.5425 | -0.7767 | -0.7883 | 0.9354 | 0.9358 | 0.9390 | 47.24 | -0.0009 |

| EUR/AUD | EURAUD | 1.7758 | 0.0338 | 0.9035 | -0.0715 | -1.2144 | 0.7032 | 3.1147 | 6.1320 | 7.7346 | 1.7856 | 1.7759 | 1.7351 | 38.82 | -0.0060 |

| GBP/JPY | GBPJPY | 199.96 | 0.0005 | 0.0450 | 0.3362 | 0.1653 | 2.8284 | 3.7724 | 1.5010 | 7.5119 | 198.78 | 196.89 | 194.54 | 58.66 | 0.4230 |

| GBP/CHF | GBPCHF | 1.0739 | 0.0652 | -0.6127 | -0.3619 | -1.7753 | -2.2554 | -6.0414 | -5.2455 | -3.7474 | 1.0798 | 1.0914 | 1.1082 | 39.49 | -0.0015 |

| AUD/JPY | AUDJPY | 97.78 | -0.1307 | -0.3618 | 0.7543 | 1.9774 | 3.6728 | 4.3922 | 0.1598 | 2.8711 | 96.43 | 95.06 | 95.05 | 75.73 | 0.5686 |

| AUD/NZD | AUDNZD | 1.1169 | 0.0896 | 0.1591 | 0.5283 | 1.6972 | 3.4866 | 2.0932 | 1.2882 | 2.5027 | 1.1009 | 1.0911 | 1.0955 | 64.84 | 0.0049 |

| CHF/JPY | CHFJPY | 186.18 | -0.0666 | 0.6661 | 0.7370 | 1.9838 | 5.2189 | 10.45 | 7.1227 | 11.70 | 184.07 | 180.41 | 175.62 | 66.41 | 0.6402 |

| NZD/JPY | NZDJPY | 87.53 | -0.2109 | -0.5103 | 0.2290 | 0.2795 | 0.2072 | 2.2570 | -1.1217 | 0.3543 | 87.57 | 87.10 | 86.76 | 68.21 | 0.1272 |

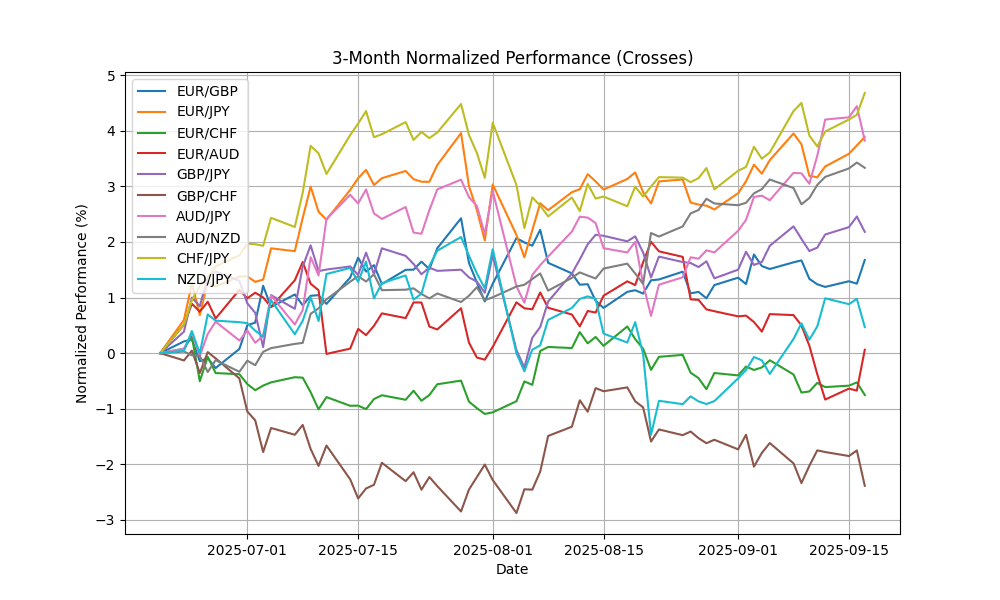

Current analysis of the FX pairs reveals notable overbought and oversold conditions. AUD/JPY, with an RSI of 75.73 and a bullish MACD, indicates overbought territory, suggesting potential profit-taking. Conversely, EUR/CHF and GBP/CHF are nearing oversold conditions, with RSIs of 47.24 and 39.49 respectively, alongside bearish MACD readings, indicating weakness and potential for a corrective rebound. EUR/GBP and GBP/JPY maintain neutral positions, while EUR/JPY is close to overbought levels. Overall, traders should exercise caution in overbought pairs and consider potential buying opportunities in oversold pairs, particularly in EUR/CHF and GBP/CHF.

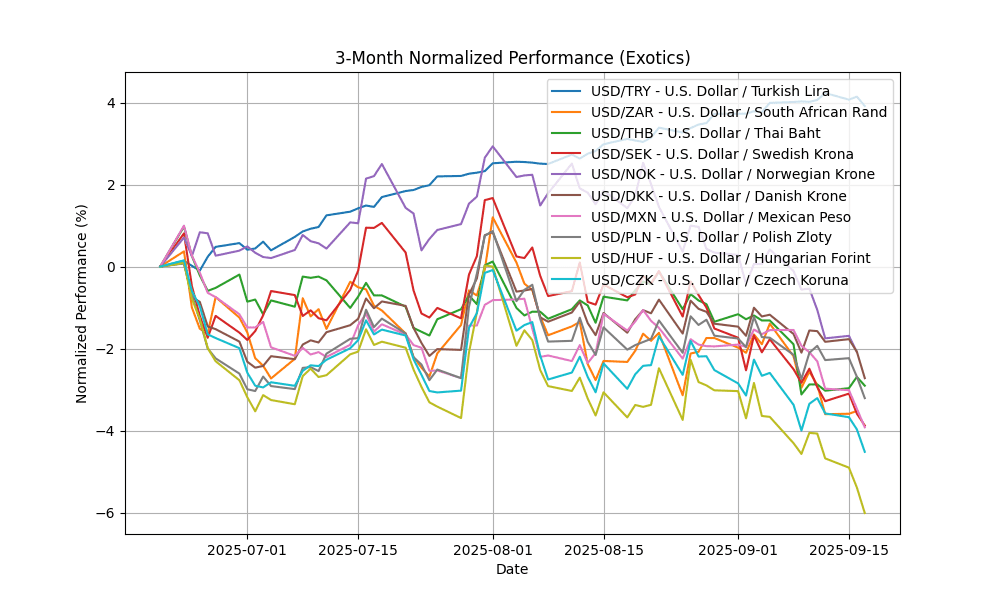

## Exotics and Emerging

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.22 | -0.0412 | -0.3043 | -0.0977 | 0.7778 | 4.2568 | 8.6203 | 16.74 | 21.30 | 40.79 | 40.01 | 38.22 | 66.54 | 0.1541 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.39 | 0.3589 | 0.2611 | -0.8093 | -1.0469 | -3.4802 | -4.1922 | -7.3169 | -1.2273 | 17.69 | 17.82 | 18.14 | 35.44 | -0.0836 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 31.75 | 0.3160 | 0.1261 | -0.0315 | -2.0968 | -2.7803 | -5.8422 | -6.9979 | -4.5113 | 32.31 | 32.53 | 33.24 | 23.14 | -0.1854 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.2507 | 0.2243 | -0.6133 | -1.4206 | -3.1516 | -4.0561 | -8.5022 | -16.0845 | -9.1064 | 9.5353 | 9.5647 | 10.06 | 27.05 | -0.0750 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 9.8036 | 0.4292 | -0.5145 | -1.7291 | -3.6290 | -1.7015 | -7.0396 | -13.4540 | -7.4285 | 10.13 | 10.15 | 10.58 | 18.93 | -0.0796 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.3035 | 0.2098 | -0.9033 | -1.1811 | -1.1264 | -3.0011 | -8.2477 | -12.0458 | -5.9829 | 6.3983 | 6.4589 | 6.7379 | 31.13 | -0.0180 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.28 | -0.0700 | -0.9537 | -1.8552 | -2.3793 | -3.8380 | -9.1889 | -11.4103 | -4.8298 | 18.66 | 18.92 | 19.62 | 18.28 | -0.0827 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.5905 | 0.3606 | -0.9504 | -1.1296 | -1.2079 | -3.4916 | -6.9810 | -12.5776 | -6.5084 | 3.6476 | 3.6827 | 3.8261 | 31.26 | -0.0114 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 328.85 | 0.2255 | -1.3973 | -2.0373 | -2.4201 | -6.3148 | -10.3712 | -16.7485 | -7.1648 | 339.51 | 345.50 | 363.66 | 23.48 | -2.4270 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.55 | 0.3458 | -0.9722 | -1.2126 | -1.5846 | -4.8444 | -10.7193 | -14.9492 | -9.0258 | 21.00 | 21.34 | 22.45 | 29.93 | -0.1060 |

In the current forex landscape, several pairs exhibit notable overbought or oversold conditions. The USD/TRY shows an RSI of 66.54, approaching overbought territory, with a positive MACD, suggesting potential bullish momentum. Conversely, the USD/ZAR, USD/THB, USD/SEK, USD/NOK, USD/DKK, USD/MXN, USD/PLN, USD/HUF, and USD/CZK are significantly oversold, with RSIs well below 30 and negative MACDs indicating bearish trends. This widespread weakness may present opportunities for reversal or further declines, particularly in the USD/THB and USD/NOK, which have the lowest RSIs. Traders should monitor these dynamics closely for potential