## Forex and Global News

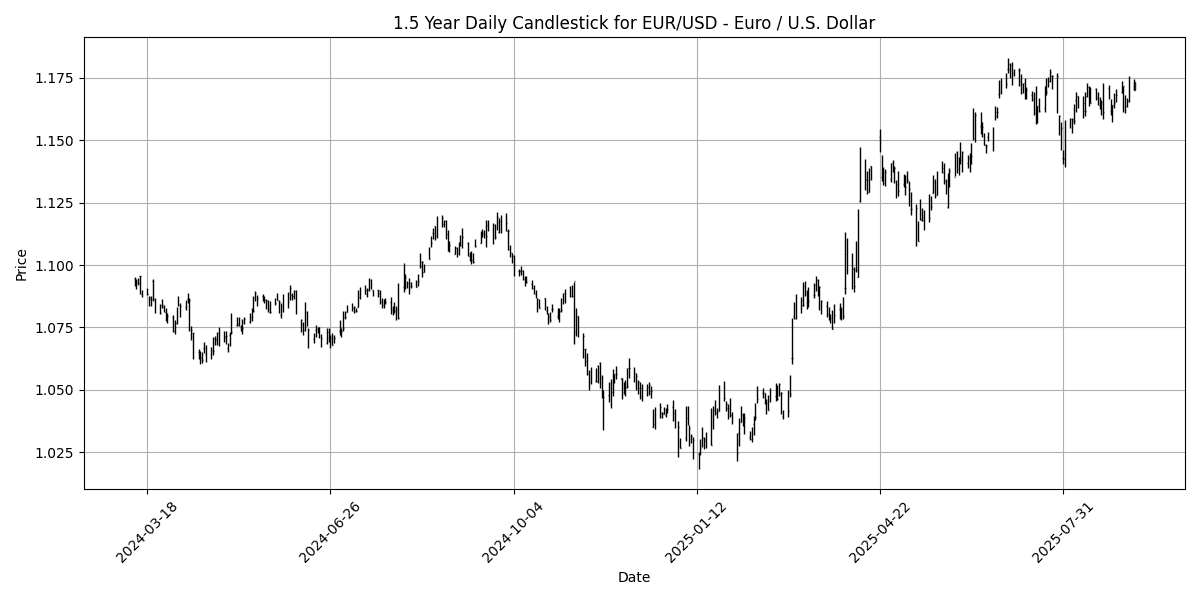

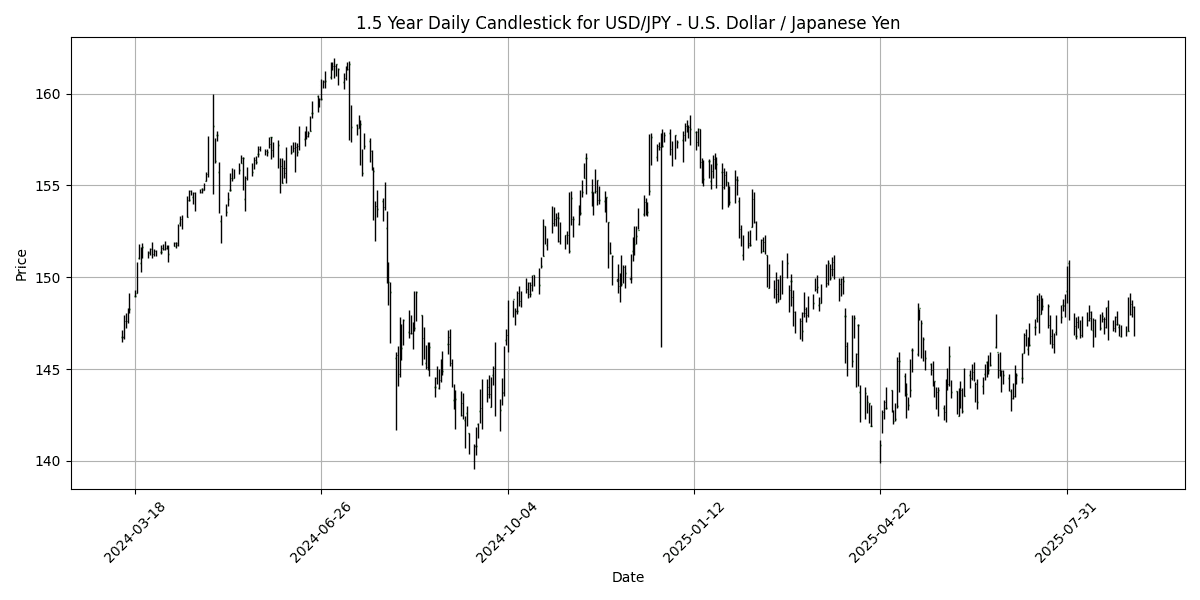

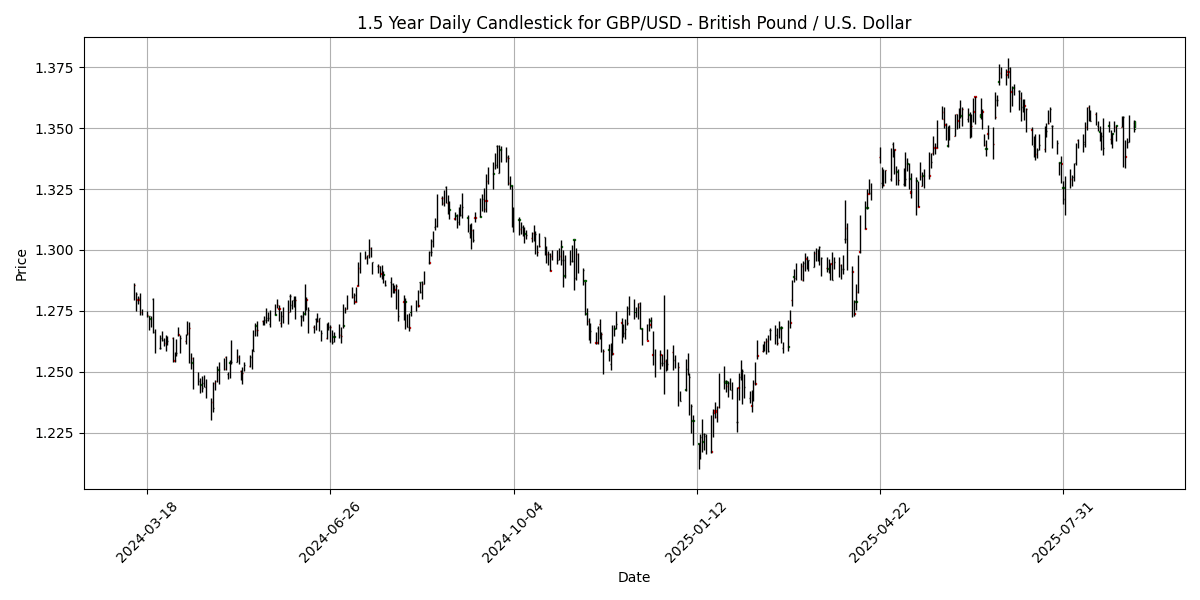

In the forex market, key currencies are experiencing mixed sentiment as traders prepare for a week packed with crucial economic data. The USD/JPY pair opened higher following the resignation of Japan’s Prime Minister Shigeru Ishiba, reflecting bearish sentiment towards the yen. Meanwhile, GBP/USD remains in a consolidation phase above 1.3500 after a recent uptick, maintaining a bullish outlook. The euro is also holding steady, with EUR/USD trading comfortably above 1.1700, though caution prevails ahead of a confidence vote in France that could impact market dynamics.

Geopolitical tensions are also at play, notably after a shooting attack in Jerusalem, which may contribute to risk aversion in the markets. Additionally, China’s exports to the U.S. plunged 33% in August, signaling potential economic strain that could affect global trade and currencies.

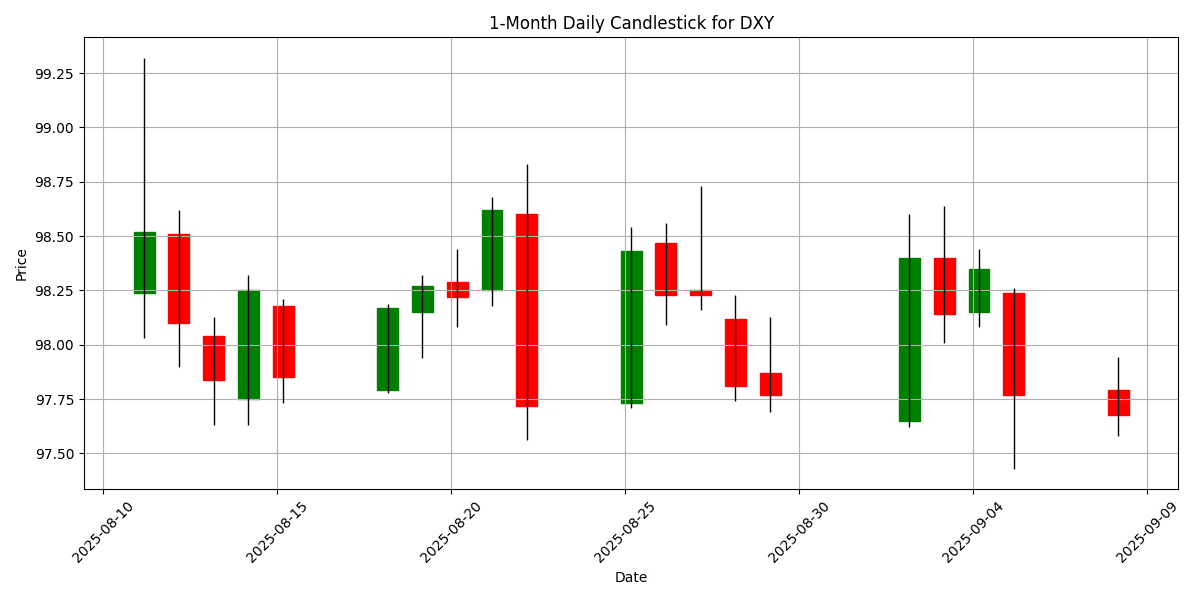

As investors await key inflation data and central bank decisions, the DXY is trading at 97.68, down 0.1921% on the day, reflecting a cautious market sentiment amid these developments.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-09-08 | 02:00 | 🇪🇺 | Medium | German Industrial Production (MoM) (Jul) | 1.3% | 1.1% |

| 2025-09-08 | 02:00 | 🇪🇺 | Medium | German Trade Balance (Jul) | 14.7B | 15.7B |

| 2025-09-08 | 15:00 | 🇺🇸 | Medium | Consumer Credit (Jul) | 10.40B | |

| 2025-09-08 | 19:01 | 🇬🇧 | Medium | BRC Retail Sales Monitor (YoY) (Aug) | 2.0% | |

| 2025-09-08 | 21:30 | 🇦🇺 | Medium | NAB Business Confidence (Aug) |

On September 8, 2025, several key economic indicators are set to impact foreign exchange (FX) markets, particularly involving the euro (EUR), US dollar (USD), and British pound (GBP).

At 02:00 ET, the release of German Industrial Production for July showed a stronger-than-expected growth of 1.3%, surpassing the forecast of 1.1%. This positive surprise may bolster the euro, as it indicates resilience in the German economy, a crucial driver for the Eurozone.

Conversely, the German Trade Balance for July reported at €14.7 billion, falling short of the anticipated €15.7 billion. This discrepancy could temper the euro’s gains, as a weaker trade balance may signal challenges in external demand.

Later in the day, at 15:00 ET, the Consumer Credit data for the USD will be released, with expectations set at $10.40 billion. A significant deviation from this forecast could influence USD volatility, particularly if consumer borrowing trends indicate shifts in economic sentiment.

At 19:01 ET, the BRC Retail Sales Monitor for GBP is anticipated to show a year-over-year growth of 2.0%. A miss here could weigh on the pound as concerns about consumer spending persist.

Finally, the NAB Business Confidence for AUD at 21:30 ET remains under wraps, but any surprises could affect the Australian dollar’s trajectory. Overall, today’s releases suggest a cautious outlook for the euro and pound, while the USD

## Major FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1734 | 0.1964 | 0.8420 | 0.3609 | 0.4912 | 2.6772 | 7.5116 | 12.76 | 5.6060 | 1.1669 | 1.1531 | 1.1057 | 56.06 | 0.0013 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 147.76 | -0.4514 | -0.5318 | 0.4494 | 0.6272 | 2.2264 | -0.1918 | -5.8836 | 3.0441 | 147.18 | 145.73 | 148.88 | 57.05 | 0.1668 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3530 | 0.2965 | 1.0948 | 0.1937 | 0.5834 | -0.1973 | 4.5206 | 7.8165 | 2.6751 | 1.3481 | 1.3460 | 1.3060 | 51.65 | 0.0005 |

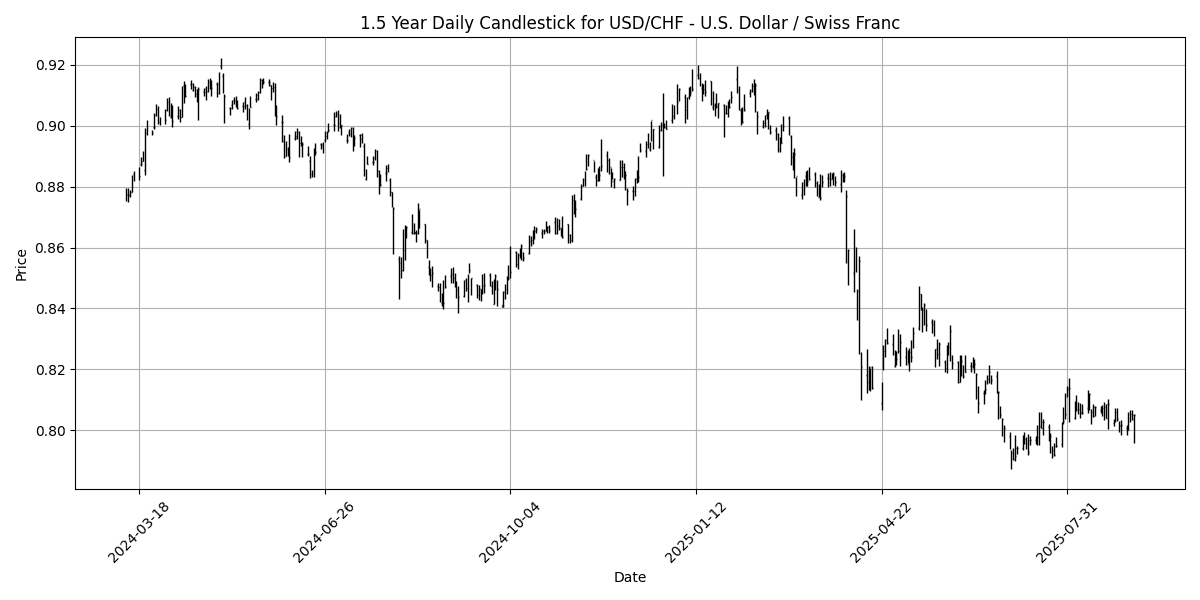

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7953 | -0.5004 | -1.2405 | -0.6670 | -1.2896 | -3.1539 | -9.9769 | -11.9503 | -5.7489 | 0.8017 | 0.8123 | 0.8516 | 47.83 | -0.0004 |

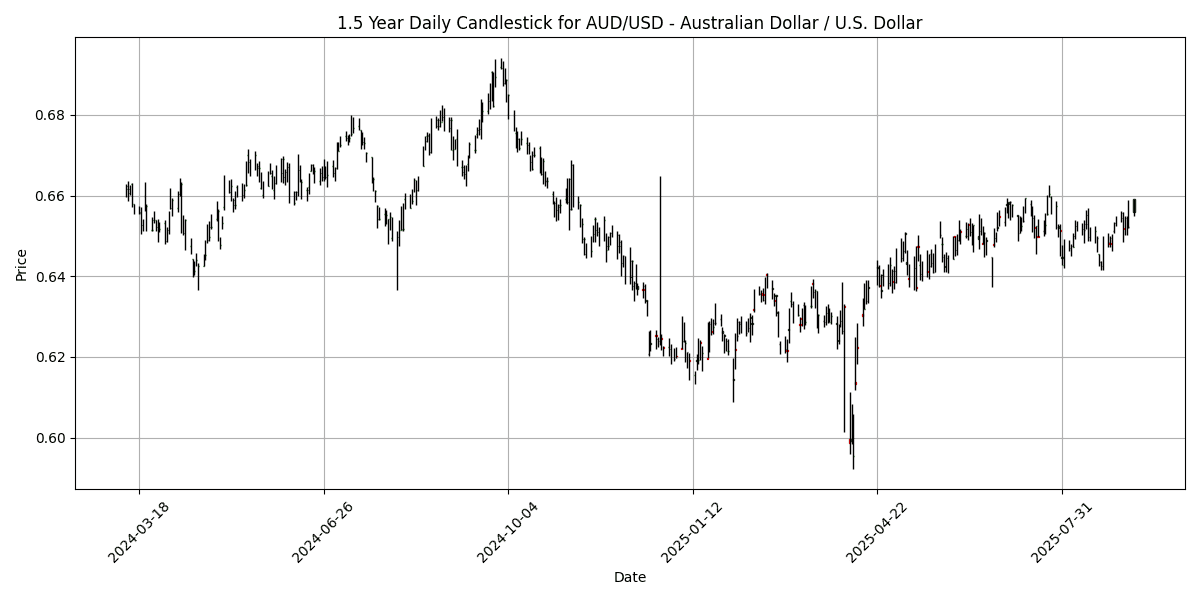

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6591 | 0.6106 | 1.1153 | 0.7244 | 1.0005 | 1.1184 | 4.6974 | 5.9646 | -2.2180 | 0.6523 | 0.6490 | 0.6388 | 63.22 | 0.0012 |

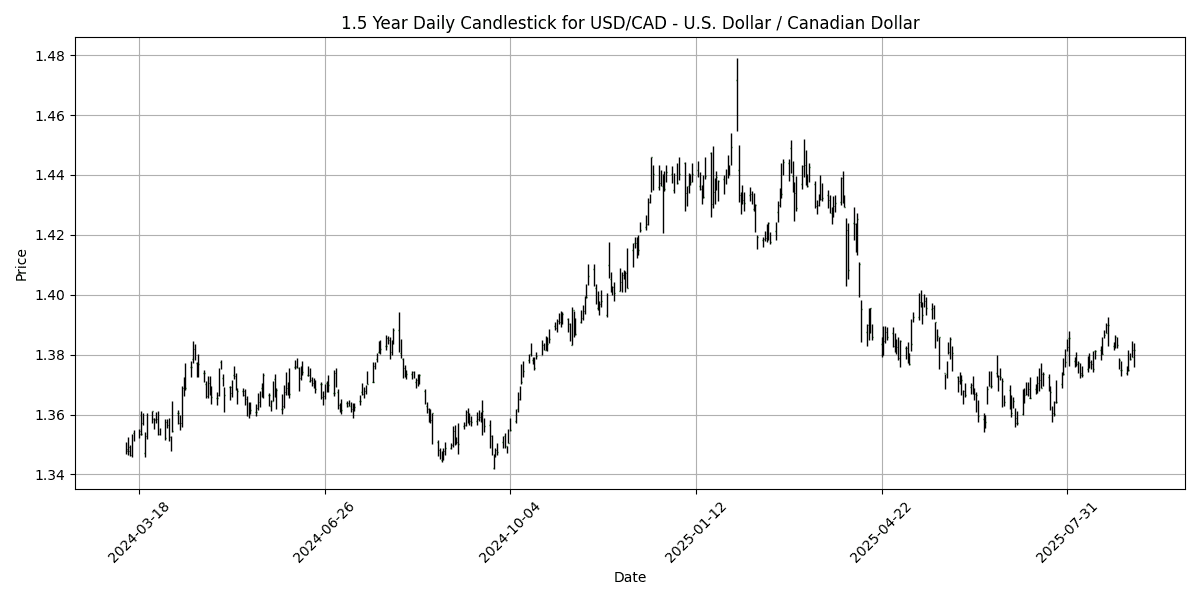

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3802 | -0.2890 | 0.1270 | 0.4629 | 0.5061 | 0.7526 | -4.3680 | -3.8175 | 2.2363 | 1.3737 | 1.3763 | 1.4026 | 50.00 | 0.0010 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5934 | 0.7984 | 1.2334 | 0.6294 | -0.6049 | -1.9317 | 3.8848 | 5.2181 | -4.6655 | 0.5949 | 0.5964 | 0.5835 | 51.30 | -0.0017 |

Currently, the analysis of key FX pairs indicates a generally balanced market with no extreme overbought or oversold conditions. The EUR/USD pair shows a neutral RSI of 56.06, with the MACD slightly bullish at 0.0013, suggesting potential upward momentum but not yet overextended. Similarly, USD/JPY’s RSI at 57.05 and positive MACD indicate a stable bullish sentiment, though it remains below overbought territory.

In contrast, the GBP/USD is also neutral with an RSI of 51.65, while USD/CHF is slightly bearish with an RSI of 47.83 and a negative MACD, indicating potential weakness. The AUD/USD pair, with an RSI of 63.22, is approaching overbought territory but is not yet extreme. USD/CAD and NZD/USD are firmly in neutral zones, with RSIs of 50.00 and 51.30, respectively. Overall, the market appears to be consolidating,

## Cross FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8671 | -0.0922 | -0.2462 | 0.1640 | -0.0991 | 2.8710 | 2.8503 | 4.5719 | 2.8466 | 0.8653 | 0.8565 | 0.8461 | 58.96 | 0.0005 |

| EUR/JPY | EURJPY | 173.34 | -0.2314 | 0.3032 | 0.8037 | 1.1035 | 4.9496 | 7.2894 | 6.0929 | 8.8005 | 171.73 | 167.98 | 164.33 | 55.93 | 0.3107 |

| EUR/CHF | EURCHF | 0.9329 | -0.2886 | -0.4184 | -0.3205 | -0.8302 | -0.5850 | -3.2402 | -0.7448 | -0.4949 | 0.9355 | 0.9360 | 0.9388 | 37.36 | 0.0002 |

| EUR/AUD | EURAUD | 1.7804 | -0.4195 | -0.2381 | -0.3387 | -0.4913 | 1.5578 | 2.7014 | 6.4069 | 8.0110 | 1.7892 | 1.7767 | 1.7293 | 39.49 | -0.0006 |

| GBP/JPY | GBPJPY | 199.90 | -0.1389 | 0.5543 | 0.6389 | 1.2101 | 2.0211 | 4.3162 | 1.4711 | 5.7970 | 198.44 | 196.09 | 194.19 | 48.60 | 0.2355 |

| GBP/CHF | GBPCHF | 1.0759 | -0.1948 | -0.1605 | -0.4764 | -0.7198 | -3.3524 | -5.9133 | -5.0690 | -3.2334 | 1.0810 | 1.0929 | 1.1099 | 33.66 | -0.0005 |

| AUD/JPY | AUDJPY | 97.36 | 0.1986 | 0.5505 | 1.1501 | 1.6104 | 3.3503 | 4.4738 | -0.2735 | 0.7357 | 95.97 | 94.53 | 95.05 | 62.06 | 0.2074 |

| AUD/NZD | AUDNZD | 1.1106 | -0.1798 | -0.1187 | 0.0883 | 1.6090 | 3.1083 | 0.7778 | 0.7169 | 2.5570 | 1.0956 | 1.0877 | 1.0950 | 79.15 | 0.0053 |

| CHF/JPY | CHFJPY | 185.79 | 0.0544 | 0.7231 | 1.1445 | 1.9541 | 5.5727 | 10.89 | 6.9006 | 9.3558 | 183.54 | 179.43 | 175.03 | 67.89 | 0.2970 |

| NZD/JPY | NZDJPY | 87.66 | 0.3871 | 0.6869 | 1.0758 | 0.0194 | 0.2459 | 3.6857 | -0.9783 | -1.7727 | 87.57 | 86.88 | 86.79 | 43.72 | -0.2336 |

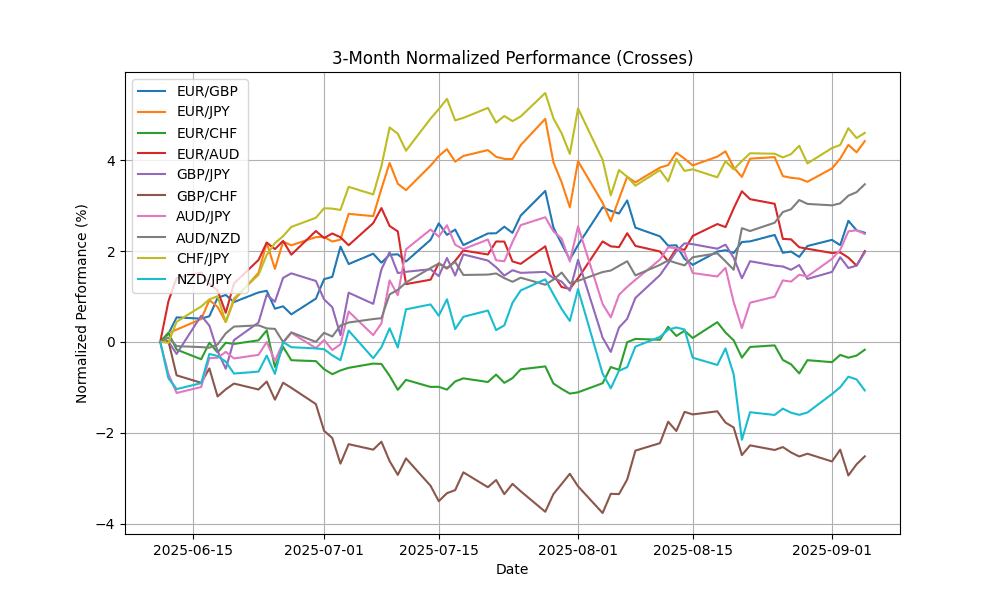

Current analysis reveals notable overbought and oversold conditions across key FX pairs. AUD/NZD stands out with an RSI of 79.15, indicating a potential reversal from overbought territory, despite a bullish MACD. Conversely, EUR/CHF and GBP/CHF exhibit oversold conditions, with RSIs of 37.36 and 33.66, respectively, alongside bearish MACD readings, suggesting potential buying opportunities. The EUR/JPY and CHF/JPY pairs remain stable with moderate RSI values, indicating no immediate overbought or oversold pressures. Overall, traders should monitor AUD/NZD for possible corrections and consider EUR/CHF and GBP/CHF for potential rebounds.

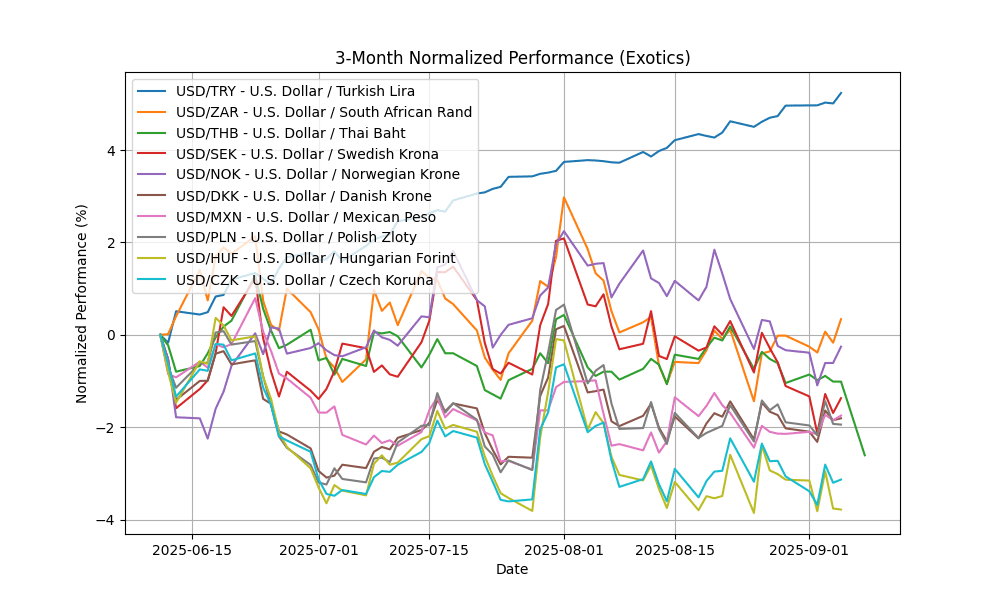

## Exotics and Emerging

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.25 | -0.0114 | 0.2007 | 0.2586 | 1.4581 | 4.9611 | 12.71 | 16.83 | 21.37 | 40.57 | 39.78 | 37.95 | 83.72 | 0.1868 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.55 | -0.3073 | -0.8307 | -0.5057 | -0.8122 | -0.8979 | -3.5466 | -6.4775 | -0.8096 | 17.72 | 17.91 | 18.17 | 58.46 | -0.0191 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 31.75 | -0.8742 | -1.7332 | -1.7636 | -1.6541 | -2.6939 | -5.8143 | -6.9979 | -5.4525 | 32.40 | 32.64 | 33.33 | 25.00 | -0.0875 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.3783 | -0.0671 | -0.8840 | -0.8294 | -1.8445 | -1.9767 | -6.3033 | -14.9270 | -8.4992 | 9.5639 | 9.5895 | 10.13 | 42.37 | -0.0415 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 9.9701 | -0.5377 | -0.6564 | -0.8788 | -2.3431 | -0.8897 | -6.4503 | -11.9842 | -6.1886 | 10.15 | 10.19 | 10.62 | 41.83 | -0.0397 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.3642 | -0.1929 | -0.7890 | -0.3234 | -0.4464 | -2.5140 | -6.8713 | -11.1989 | -5.2107 | 6.3958 | 6.4749 | 6.7668 | 55.00 | -0.0041 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.67 | -0.3054 | -0.2947 | 0.0806 | 0.3523 | -1.9136 | -7.8775 | -9.4934 | -6.0754 | 18.69 | 19.01 | 19.69 | 50.20 | -0.0096 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6239 | -0.2258 | -1.0957 | -0.5649 | -0.4888 | -2.9856 | -5.6460 | -11.7643 | -5.9472 | 3.6455 | 3.6933 | 3.8442 | 53.13 | -0.0025 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 335.54 | 0.0596 | -1.2970 | -1.0936 | -1.2185 | -4.5405 | -8.5505 | -15.0549 | -5.1552 | 340.46 | 347.39 | 366.01 | 50.09 | -0.9968 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.78 | -0.1499 | -1.2073 | -0.6180 | -0.7154 | -4.1309 | -9.1903 | -13.9971 | -7.7254 | 21.04 | 21.44 | 22.58 | 53.37 | -0.0401 |

In the current analysis of key FX pairs, USD/TRY is significantly overbought with an RSI of 83.72, indicating potential exhaustion in bullish momentum, despite a positive MACD and MA crossovers suggesting strength. Conversely, USD/THB is deeply oversold, reflected by an RSI of 25.00 and a negative MACD, indicating potential reversal opportunities. Other pairs, such as USD/ZAR, USD/SEK, and USD/NOK, show neutral conditions with RSIs below 70 and above 30, suggesting limited immediate trading signals. Traders should approach USD/TRY cautiously and consider potential long positions in USD/THB as it may offer a rebound opportunity.