## Forex and Global News

Federal Reserve Chair Jerome Powell hinted at potential interest rate cuts amid ongoing uncertainty, signaling a cautious approach to monetary policy. This development has stirred market sentiment, contributing to a rally in U.S. equities, with the Dow soaring 800 points. President Trump’s threat to fire Fed Governor Lisa Cook if she does not resign adds further political tension to the Fed’s landscape.

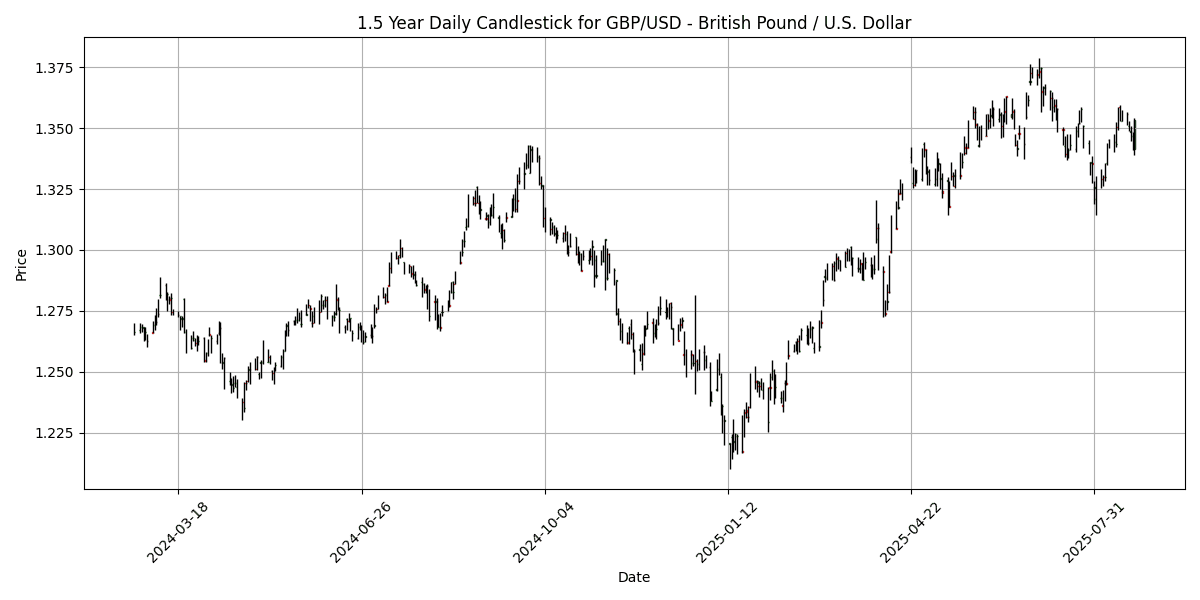

In the forex market, the British pound continues to exhibit volatility, with mixed opinions among analysts regarding its future trajectory. Meanwhile, the euro remains under pressure amid concerns over Europe’s economic performance.

Gold prices are closely monitoring Powell’s statements, with traders eyeing the 100-day SMA for support after a recent decline. Oil futures showed little change as the market remains alert to geopolitical developments, particularly regarding the Russia-Ukraine conflict.

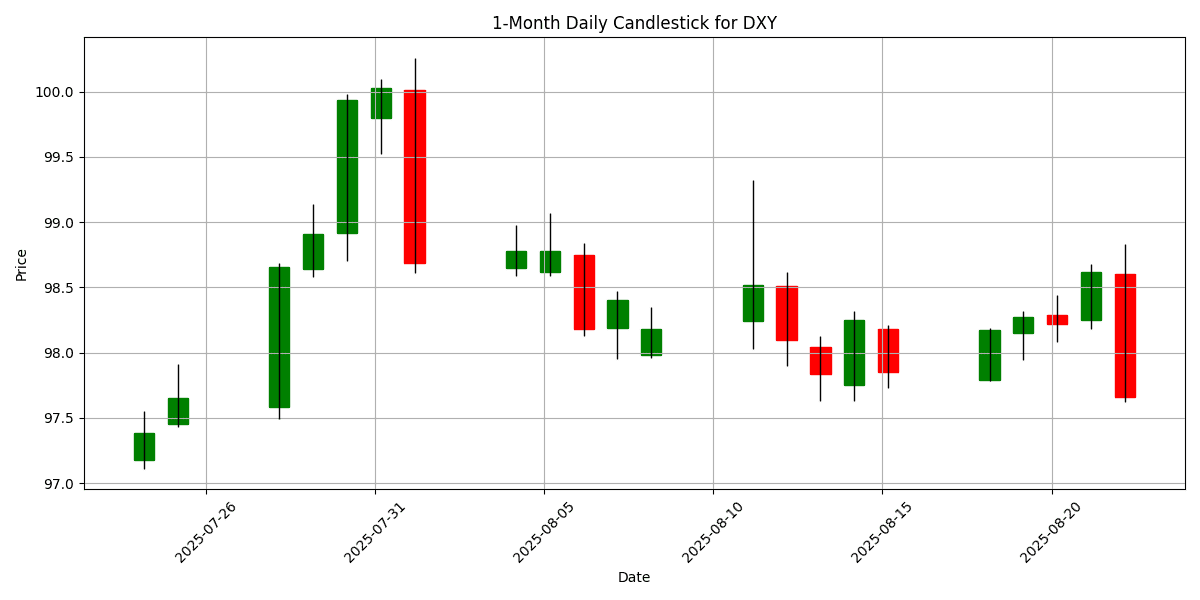

Overall, the U.S. dollar index (DXY) is trading at 97.66, reflecting a daily change of -0.9700%, as traders digest the implications of Powell’s remarks and the broader economic outlook.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-08-22 | 02:00 | 🇪🇺 | Medium | German GDP (YoY) (Q2) | 0.2% | 0.4% |

| 2025-08-22 | 02:00 | 🇪🇺 | High | German GDP (QoQ) (Q2) | -0.3% | -0.1% |

| 2025-08-22 | 08:30 | 🇨🇦 | Medium | Core Retail Sales (MoM) (Jun) | 1.9% | 0.9% |

| 2025-08-22 | 08:30 | 🇨🇦 | Medium | Retail Sales (MoM) (Jun) | 1.5% | 1.6% |

| 2025-08-22 | 08:30 | 🇨🇦 | Medium | Retail Sales (MoM) (Jun) | 1.5% | |

| 2025-08-22 | 10:00 | 🇺🇸 | High | Fed Chair Powell Speaks | ||

| 2025-08-22 | 12:00 | 🇺🇸 | High | U.S. President Trump Speaks | ||

| 2025-08-22 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Oil Rig Count | ||

| 2025-08-22 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Total Rig Count | ||

| 2025-08-22 | 15:30 | 🇬🇧 | Medium | CFTC GBP speculative net positions | ||

| 2025-08-22 | 15:30 | 🇺🇸 | Medium | CFTC Crude Oil speculative net positions | ||

| 2025-08-22 | 15:30 | 🇺🇸 | Medium | CFTC Gold speculative net positions | ||

| 2025-08-22 | 15:30 | 🇺🇸 | Medium | CFTC Nasdaq 100 speculative net positions | ||

| 2025-08-22 | 15:30 | 🇺🇸 | Medium | CFTC S&P 500 speculative net positions | ||

| 2025-08-22 | 15:30 | 🇦🇺 | Medium | CFTC AUD speculative net positions | ||

| 2025-08-22 | 15:30 | 🇧🇷 | Medium | CFTC BRL speculative net positions | ||

| 2025-08-22 | 15:30 | 🇯🇵 | Medium | CFTC JPY speculative net positions | ||

| 2025-08-22 | 15:30 | 🇪🇺 | Medium | CFTC EUR speculative net positions | ||

| 2025-08-22 | 20:00 | 🇺🇸 | Medium | Jackson Hole Symposium |

On August 22, 2025, key economic data releases and speeches are expected to influence FX markets significantly.

At 02:00 ET, Germany’s Q2 GDP figures will be released, with expectations set at 0.4% YoY and -0.1% QoQ. The actual results of 0.2% YoY and -0.3% QoQ are disappointing, suggesting a weaker economic outlook for the Eurozone, which could lead to EUR depreciation against major currencies.

Later, at 08:30 ET, Canada’s retail sales data for June is due. The core retail sales came in at 1.9%, exceeding the forecast of 0.9%, while total retail sales showed a slight miss at 1.5% against a forecast of 1.6%. This stronger-than-expected core data may bolster the CAD, providing support against the USD.

At 10:00 ET, Fed Chair Powell’s speech is anticipated, where any hints on future monetary policy could impact the USD significantly. The day culminates with the Jackson Hole Symposium at 20:00 ET, a pivotal event that may set the tone for market sentiment and currency movements. Overall, traders should monitor these events closely for potential volatility in the FX markets.

## Major FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

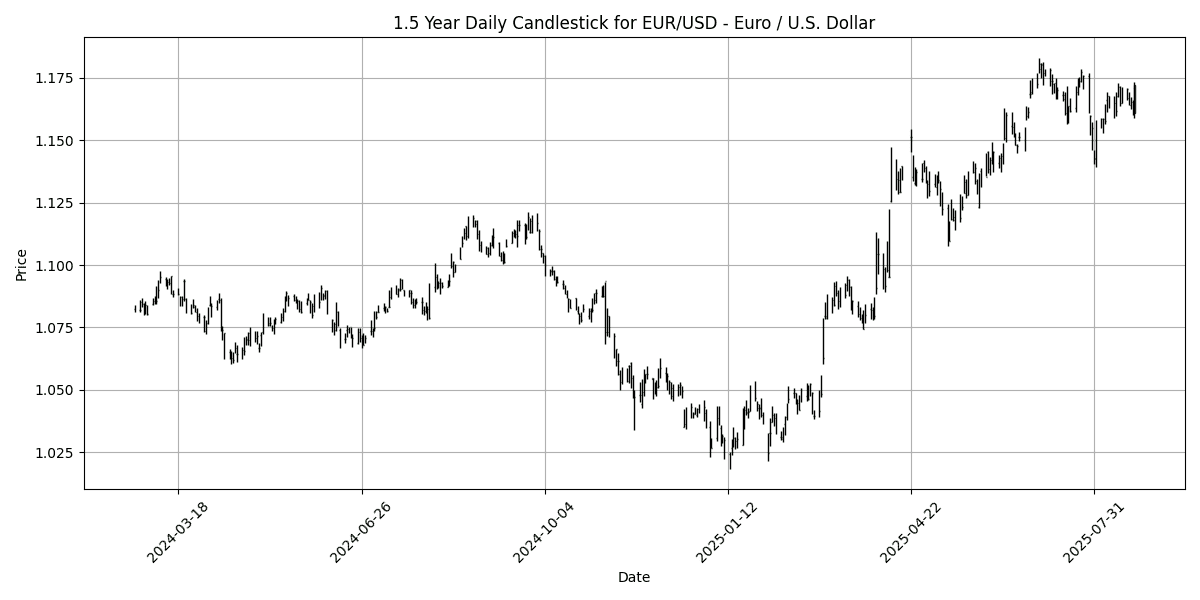

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1722 | 0.6000 | 0.6064 | 0.6064 | -0.1461 | 3.9015 | 11.63 | 12.64 | 5.0795 | 1.1652 | 1.1472 | 1.0995 | 63.06 | 0.0015 |

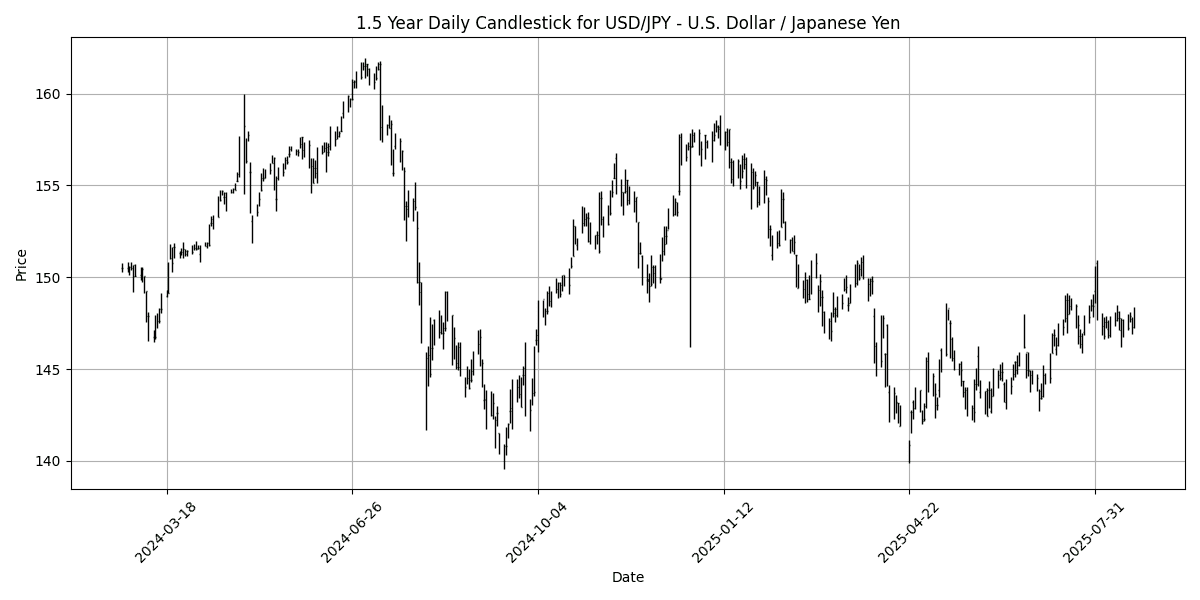

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 146.75 | -0.3900 | -0.6405 | -0.6405 | -0.0273 | 2.0068 | -1.7824 | -6.5289 | 1.1212 | 146.58 | 145.53 | 149.27 | 32.75 | 0.1968 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3533 | 0.5000 | 0.0170 | 0.0170 | 0.0847 | 0.8479 | 6.8080 | 7.8404 | 3.3569 | 1.3501 | 1.3409 | 1.3014 | 71.51 | 0.0015 |

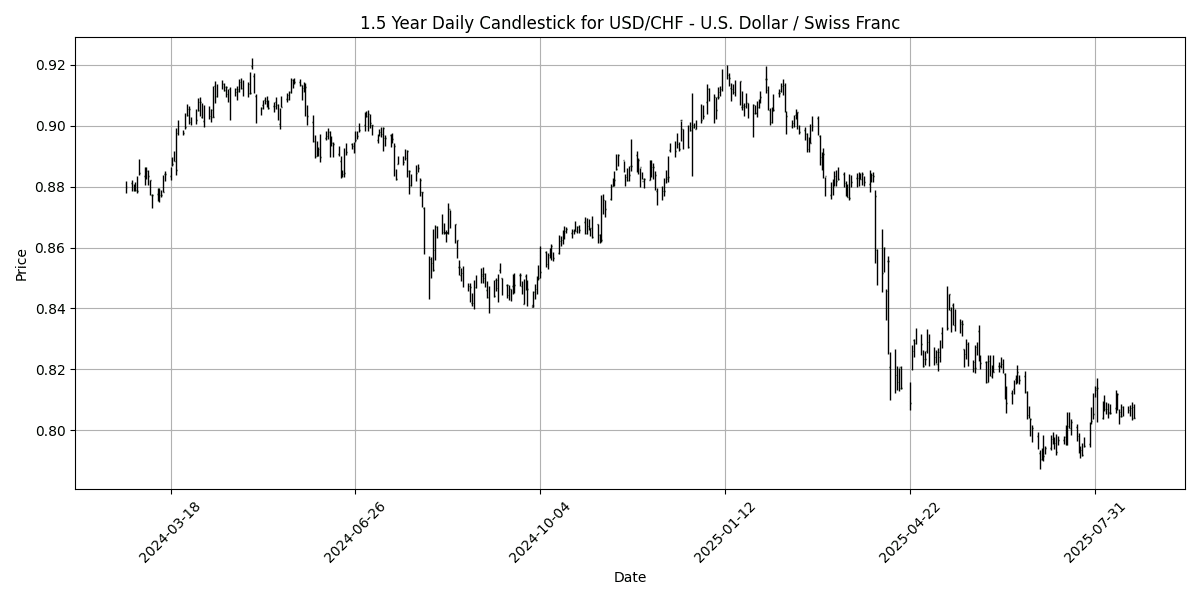

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8010 | -0.3900 | -0.8074 | -0.8074 | 0.9286 | -3.3052 | -10.8077 | -11.3193 | -5.8865 | 0.8035 | 0.8170 | 0.8561 | 36.47 | 0.0009 |

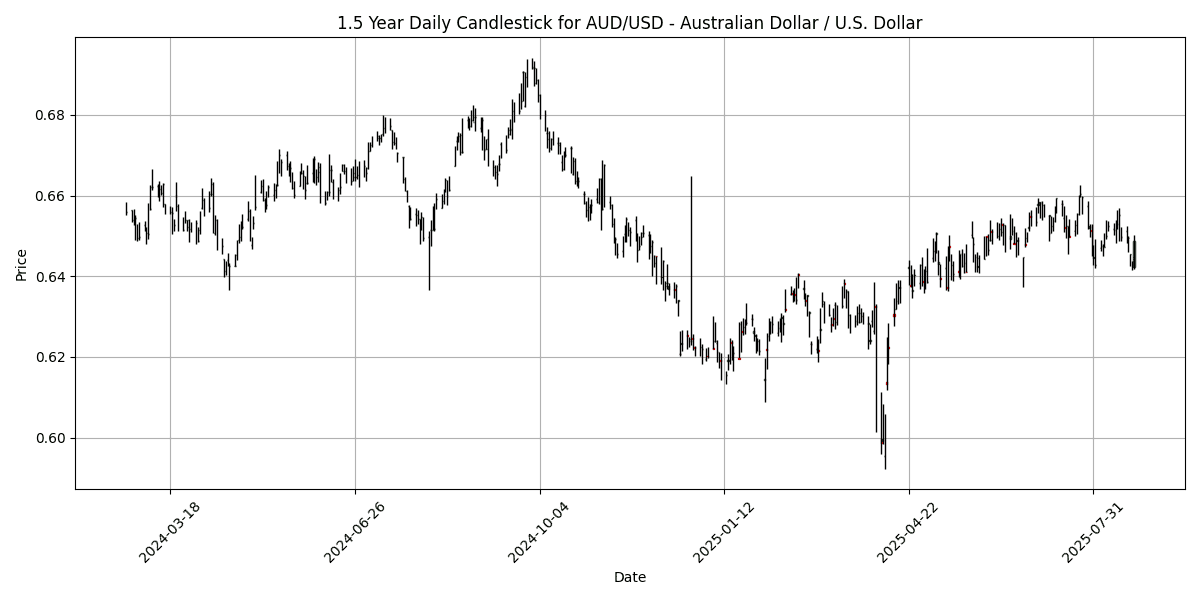

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6488 | 0.8100 | -0.1464 | -0.1464 | -1.0178 | 1.2199 | 1.3101 | 4.3087 | -3.8772 | 0.6519 | 0.6455 | 0.6387 | 53.14 | -0.0011 |

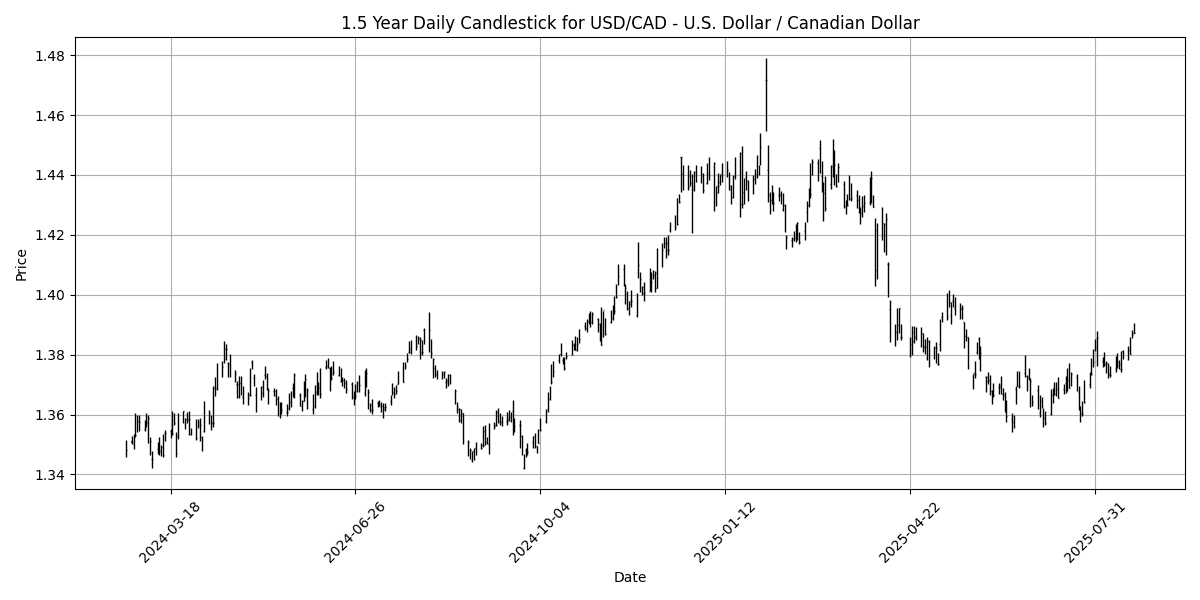

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3835 | -0.2700 | 0.1585 | 0.1585 | 1.6958 | -0.1660 | -2.4055 | -3.5875 | 1.8530 | 1.3708 | 1.3796 | 1.4037 | 52.33 | 0.0035 |

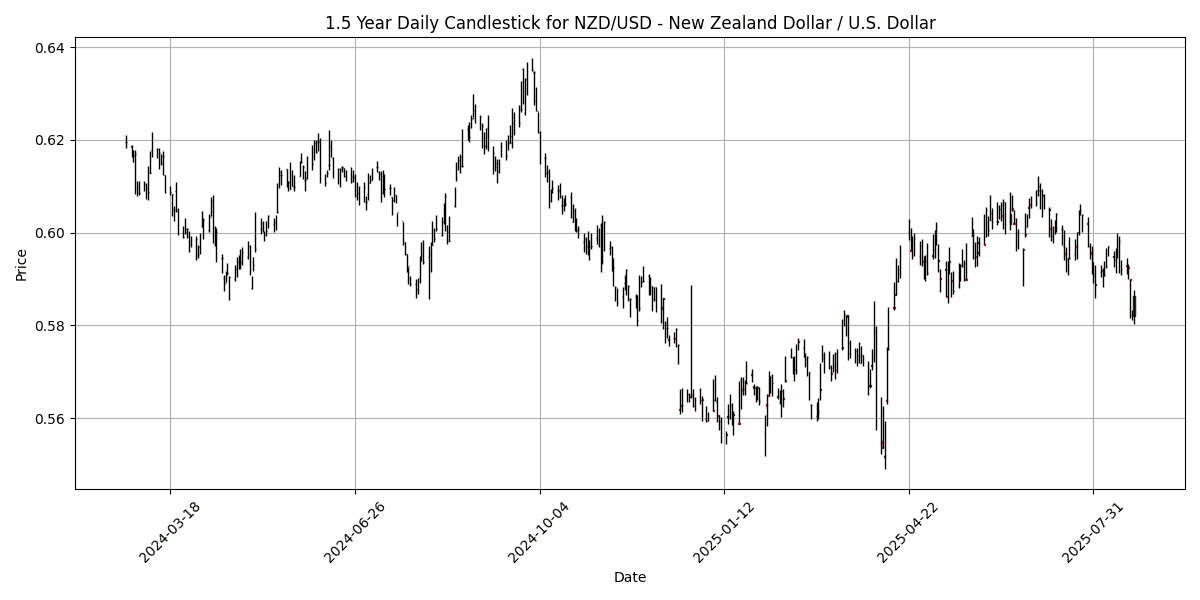

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5863 | 0.6000 | -0.9810 | -0.9810 | -2.2849 | -0.5870 | 1.7125 | 3.9592 | -4.8599 | 0.5983 | 0.5948 | 0.5835 | 42.51 | -0.0027 |

In the current analysis of key FX pairs, the GBP/USD is exhibiting overbought conditions with an RSI of 71.51, indicating potential for a price correction. The MACD remains positive, suggesting bullish momentum, but traders should be cautious of overextension. Conversely, the USD/JPY is in oversold territory with an RSI of 32.75, coupled with a positive MACD, signaling potential for a rebound. This could present a buying opportunity if momentum shifts.

The EUR/USD remains neutral with an RSI of 63.06, while the USD/CHF and NZD/USD are also in oversold conditions, indicated by RSIs of 36.47 and 42.51, respectively. Both pairs have weak MACD readings, suggesting bearish sentiment. The AUD/USD and USD/CAD are relatively stable, with RSIs of 53.14 and 52.33, indicating a lack of strong directional bias. Overall, GBP/USD and USD/JPY are the focal

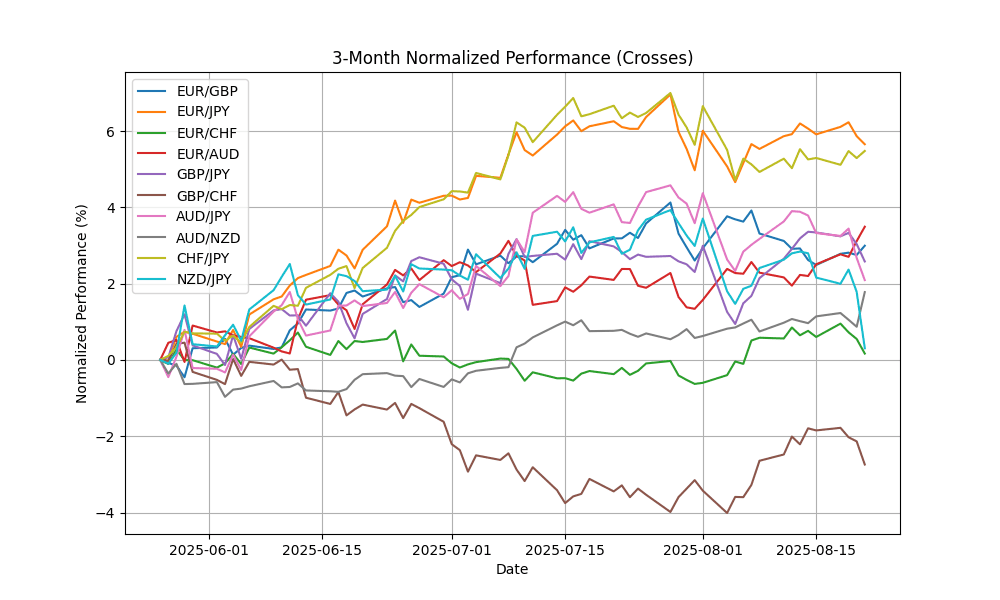

## Cross FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8659 | 0.0700 | 0.5656 | 0.5656 | -0.2580 | 3.0049 | 4.4890 | 4.4272 | 1.6350 | 0.8627 | 0.8552 | 0.8443 | 50.96 | 0.0001 |

| EUR/JPY | EURJPY | 171.96 | 0.1800 | -0.0662 | -0.0662 | -0.2025 | 5.9580 | 9.6106 | 5.2452 | 6.2244 | 170.74 | 166.81 | 163.84 | 45.91 | 0.3845 |

| EUR/CHF | EURCHF | 0.9386 | 0.1900 | -0.2444 | -0.2444 | 0.7492 | 0.4366 | -0.4655 | -0.1383 | -1.1396 | 0.9359 | 0.9360 | 0.9387 | 61.90 | 0.0019 |

| EUR/AUD | EURAUD | 1.8066 | -0.2000 | 0.7568 | 0.7568 | 0.8789 | 2.6501 | 10.16 | 7.9727 | 9.3180 | 1.7868 | 1.7762 | 1.7199 | 76.62 | 0.0049 |

| GBP/JPY | GBPJPY | 198.57 | 0.1100 | -0.6271 | -0.6271 | 0.0504 | 2.8621 | 4.9126 | 0.7965 | 4.5128 | 197.92 | 195.03 | 194.03 | 46.21 | 0.4282 |

| GBP/CHF | GBPCHF | 1.0838 | 0.1100 | -0.8009 | -0.8009 | 0.9999 | -2.5018 | -4.7477 | -4.3720 | -2.7336 | 1.0848 | 1.0946 | 1.1120 | 57.95 | 0.0021 |

| AUD/JPY | AUDJPY | 95.17 | 0.3800 | -0.8139 | -0.8139 | -1.0665 | 3.2222 | -0.4956 | -2.5086 | -2.8301 | 95.54 | 93.89 | 95.30 | 30.36 | -0.0468 |

| AUD/NZD | AUDNZD | 1.1065 | 0.2100 | 0.8375 | 0.8375 | 1.2942 | 1.8155 | -0.3728 | 0.3451 | 1.0281 | 1.0888 | 1.0850 | 1.0948 | 71.27 | 0.0026 |

| CHF/JPY | CHFJPY | 183.19 | 0.0000 | 0.1783 | 0.1783 | -0.9409 | 5.5033 | 10.13 | 5.4052 | 7.4479 | 182.41 | 178.19 | 174.53 | 38.64 | 0.0409 |

| NZD/JPY | NZDJPY | 86.00 | 0.1900 | -1.6311 | -1.6311 | -2.3282 | 1.3900 | -0.1161 | -2.8501 | -3.8203 | 87.72 | 86.53 | 87.04 | 25.33 | -0.2442 |

Currently, the EUR/AUD pair is exhibiting overbought conditions with an RSI of 76.62, suggesting potential price corrections ahead. In contrast, the AUD/JPY and NZD/JPY pairs are showing oversold conditions with RSIs of 30.36 and 25.33, respectively, indicating possible upward reversals. The MACD readings across the pairs generally reflect mixed sentiment, with several pairs like EUR/JPY and GBP/JPY maintaining bullish momentum. The moving averages indicate a strengthening trend for EUR/AUD, while the bearish pressure on AUD/JPY and NZD/JPY suggests traders should remain cautious and consider potential buying opportunities in these oversold markets.

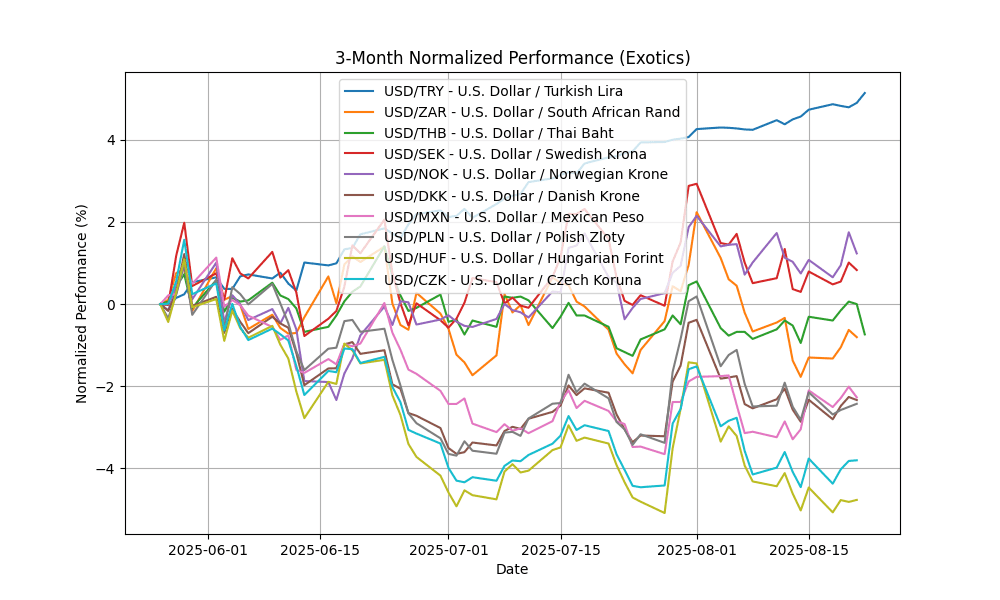

## Exotics and Emerging

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.01 | 0.2300 | 0.3883 | 0.3883 | 1.4134 | 5.0525 | 12.70 | 16.15 | 20.87 | 40.27 | 39.47 | 37.62 | 82.29 | 0.1927 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.45 | -1.2200 | -0.7192 | -0.7192 | -0.5527 | -3.0656 | -4.7224 | -6.9864 | -2.0528 | 17.77 | 18.07 | 18.17 | 24.81 | -0.0482 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.32 | -0.7400 | -0.4313 | -0.4313 | 0.4351 | -1.6134 | -3.6375 | -5.3282 | -5.7451 | 32.47 | 32.83 | 33.46 | 47.76 | -0.0028 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.5009 | -0.8800 | -0.8412 | -0.8412 | -0.1329 | -1.4200 | -10.6143 | -13.8149 | -6.6147 | 9.5742 | 9.6345 | 10.21 | 33.45 | -0.0060 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.05 | -1.7400 | -1.5869 | -1.5869 | -0.1599 | -1.4624 | -9.3732 | -11.2479 | -4.2569 | 10.14 | 10.25 | 10.68 | 42.26 | 0.0189 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.3680 | -0.5900 | -0.6000 | -0.6000 | 0.1395 | -3.6897 | -10.3456 | -11.1458 | -4.8122 | 6.4060 | 6.5124 | 6.8036 | 31.19 | -0.0056 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.60 | -0.9200 | -1.0917 | -1.0917 | -0.2571 | -3.7529 | -8.3670 | -9.8690 | -3.5334 | 18.76 | 19.19 | 19.79 | 44.77 | -0.0043 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6318 | -0.3400 | -0.6239 | -0.6239 | 0.3009 | -3.5508 | -8.3016 | -11.5720 | -5.2837 | 3.6530 | 3.7139 | 3.8693 | 29.67 | -0.0054 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 336.68 | -0.4100 | -0.7283 | -0.7283 | -0.8628 | -5.7473 | -12.0871 | -14.7663 | -4.3088 | 342.30 | 350.38 | 368.67 | 24.51 | -1.5371 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.93 | -0.3400 | -0.3784 | -0.3784 | -0.0926 | -5.1072 | -12.2186 | -13.3567 | -6.8099 | 21.13 | 21.62 | 22.75 | 31.93 | -0.0613 |

In the current analysis of key FX pairs, USD/TRY shows significant overbought conditions with an RSI of 82.29, indicating a potential reversal as momentum wanes. The positive MACD supports the bullish trend but caution is warranted. Conversely, USD/ZAR is in oversold territory with an RSI of 24.81 and a negative MACD, suggesting a potential rebound. Other pairs such as USD/SEK, USD/DKK, and USD/PLN also exhibit oversold conditions, with RSIs below 30, indicating potential buying opportunities. Monitoring MA crossovers in these pairs may provide further insights into trend reversals and entry points for traders.