## Forex and Global News

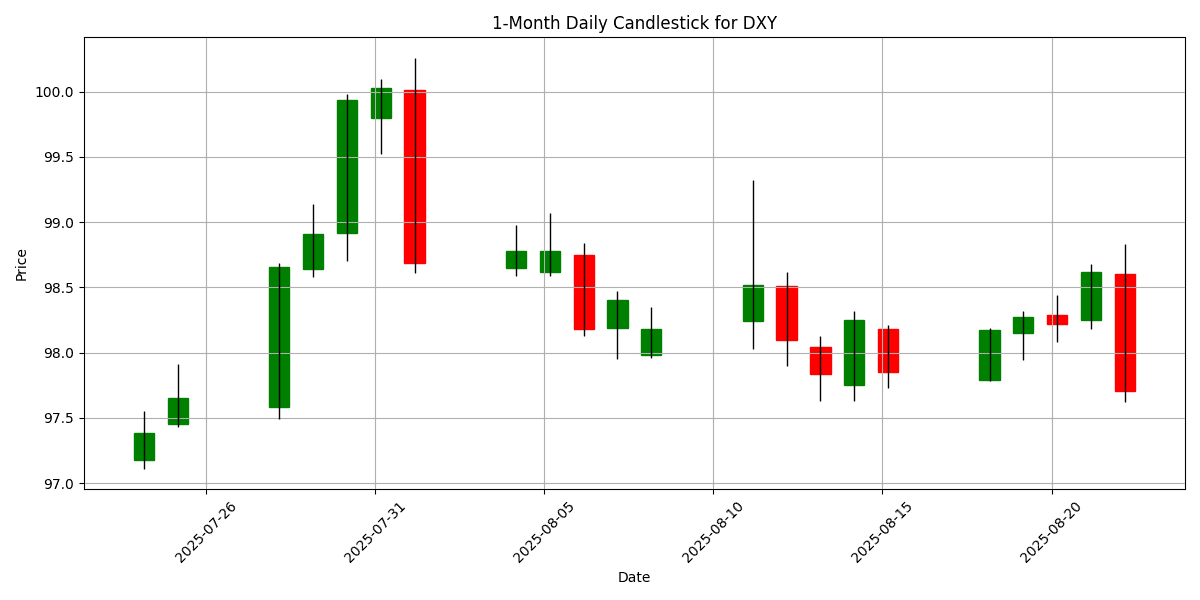

Federal Reserve Chair Jerome Powell’s recent comments hinting at potential interest rate cuts have stirred market sentiment, leading to a rally in U.S. equities. Powell emphasized a cautious approach amid ongoing economic uncertainty, suggesting that conditions “may warrant” easing monetary policy in the near future. This has bolstered the U.S. dollar, although the DXY index currently stands at 97.70, reflecting a daily decline of -1.0943%.

In related news, President Trump threatened to dismiss Fed Governor Lisa Cook if she does not resign, adding to the political tension surrounding the Fed. Meanwhile, Canada has announced the removal of several retaliatory tariffs on U.S. goods, signaling a positive shift in trade relations, although the 25% tariffs on autos, steel, and aluminum remain in place.

In commodities, gold prices are under pressure as traders await further clarity from Powell’s upcoming speeches. The overall market sentiment remains cautious as geopolitical tensions, particularly in the Middle East, continue to influence global economic stability.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-08-22 | 02:00 | 🇪🇺 | Medium | German GDP (YoY) (Q2) | 0.2% | 0.4% |

| 2025-08-22 | 02:00 | 🇪🇺 | High | German GDP (QoQ) (Q2) | -0.3% | -0.1% |

| 2025-08-22 | 08:30 | 🇨🇦 | Medium | Core Retail Sales (MoM) (Jun) | 1.9% | 0.9% |

| 2025-08-22 | 08:30 | 🇨🇦 | Medium | Retail Sales (MoM) (Jun) | 1.5% | 1.6% |

| 2025-08-22 | 08:30 | 🇨🇦 | Medium | Retail Sales (MoM) (Jun) | 1.5% | |

| 2025-08-22 | 10:00 | 🇺🇸 | High | Fed Chair Powell Speaks | ||

| 2025-08-22 | 12:00 | 🇺🇸 | High | U.S. President Trump Speaks | ||

| 2025-08-22 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Oil Rig Count | 411 | |

| 2025-08-22 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Total Rig Count | 538 | |

| 2025-08-22 | 15:30 | 🇬🇧 | Medium | CFTC GBP speculative net positions | ||

| 2025-08-22 | 15:30 | 🇺🇸 | Medium | CFTC Crude Oil speculative net positions | ||

| 2025-08-22 | 15:30 | 🇺🇸 | Medium | CFTC Gold speculative net positions | ||

| 2025-08-22 | 15:30 | 🇺🇸 | Medium | CFTC Nasdaq 100 speculative net positions | ||

| 2025-08-22 | 15:30 | 🇺🇸 | Medium | CFTC S&P 500 speculative net positions | ||

| 2025-08-22 | 15:30 | 🇦🇺 | Medium | CFTC AUD speculative net positions | ||

| 2025-08-22 | 15:30 | 🇧🇷 | Medium | CFTC BRL speculative net positions | ||

| 2025-08-22 | 15:30 | 🇯🇵 | Medium | CFTC JPY speculative net positions | ||

| 2025-08-22 | 15:30 | 🇪🇺 | Medium | CFTC EUR speculative net positions | ||

| 2025-08-22 | 20:00 | 🇺🇸 | Medium | Jackson Hole Symposium |

On August 22, 2025, several key economic events are poised to influence the foreign exchange (FX) markets, particularly focusing on the Euro (EUR) and Canadian Dollar (CAD).

At 02:00 ET, Germany’s Q2 GDP data revealed a disappointing 0.2% year-over-year growth, falling short of the 0.4% forecast, while the quarter-over-quarter figure showed a contraction of -0.3%, against expectations of -0.1%. This underperformance may exert downward pressure on the EUR, reflecting concerns about the Eurozone’s economic resilience.

Later, at 08:30 ET, Canadian retail sales data exceeded expectations, with core retail sales rising by 1.9% in June, compared to a forecast of 0.9%. However, overall retail sales came in slightly below expectations at 1.5% versus 1.6%. The stronger core figure may lend support to the CAD, as it suggests robust consumer spending.

Additionally, Fed Chair Powell’s speech at 10:00 ET and President Trump’s address at 12:00 ET could introduce volatility in the USD, particularly if they signal shifts in monetary policy or economic outlook. The Jackson Hole Symposium at 20:00 ET is also anticipated to provide critical insights into future Fed actions, impacting market sentiment across multiple currencies.

## Major FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

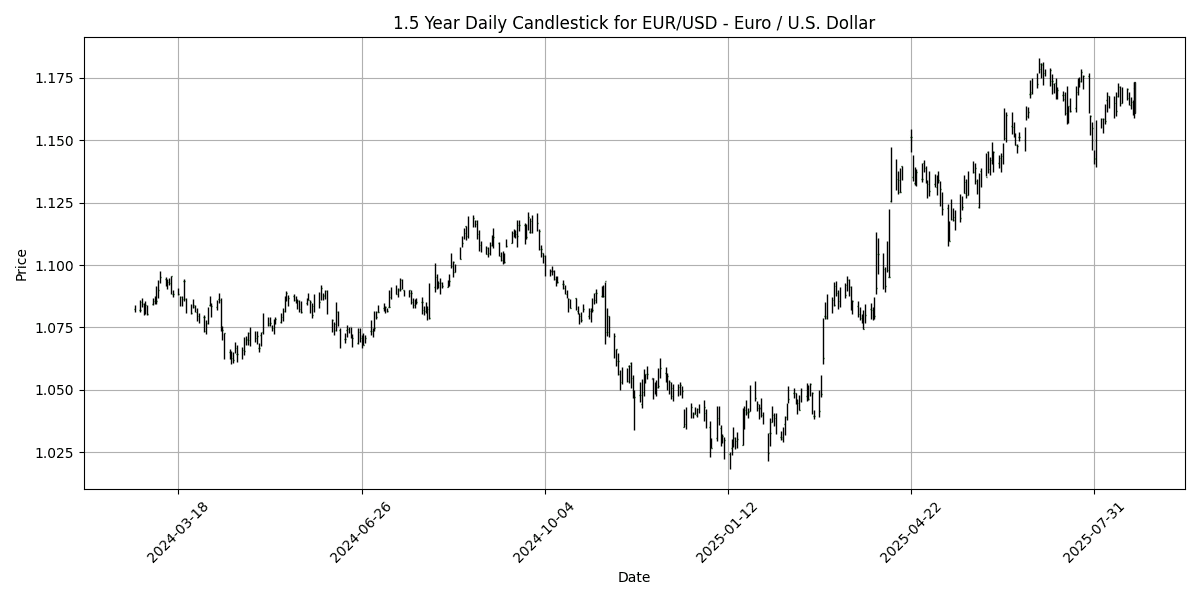

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1734 | 0.9985 | 0.7094 | 0.7094 | -0.0439 | 4.0078 | 11.75 | 12.76 | 5.1871 | 1.1652 | 1.1472 | 1.0995 | 63.92 | 0.0016 |

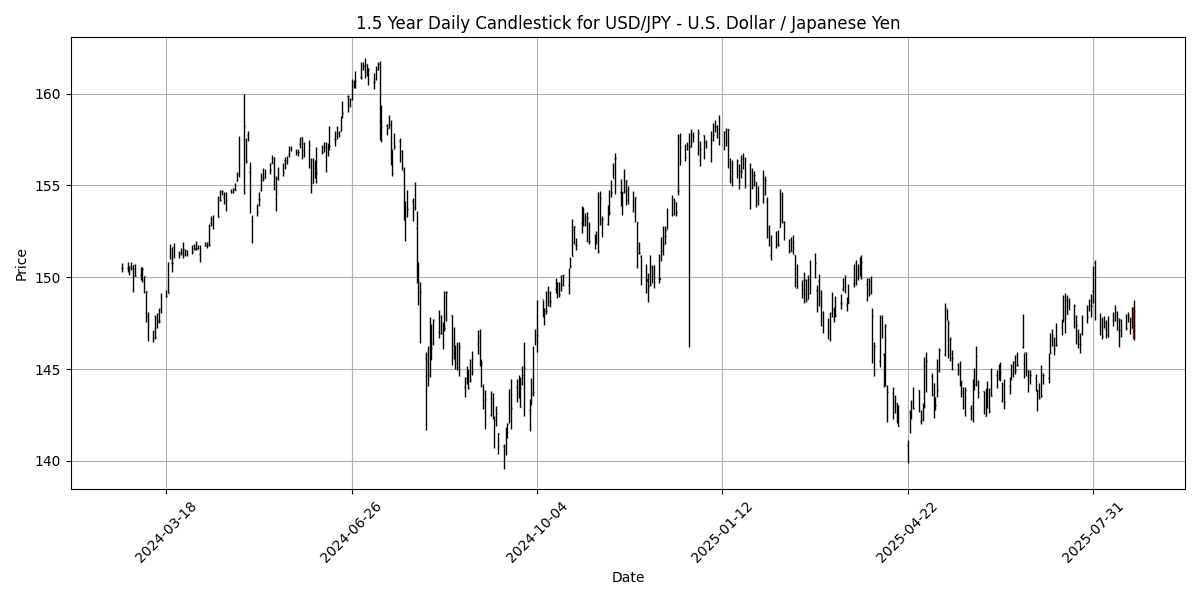

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 146.68 | -1.1131 | -0.6866 | -0.6866 | -0.0736 | 1.9596 | -1.8279 | -6.5722 | 1.0743 | 146.65 | 145.50 | 149.24 | 45.39 | 0.1094 |

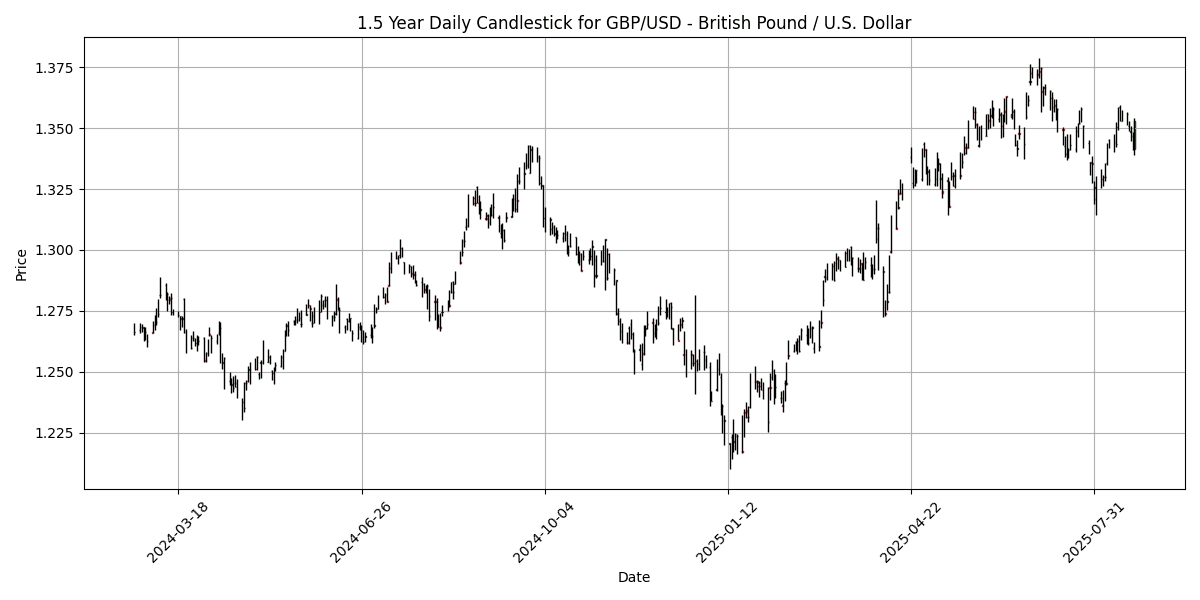

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3531 | 0.8497 | 0.0022 | 0.0022 | 0.0699 | 0.8330 | 6.7922 | 7.8245 | 3.3417 | 1.3501 | 1.3409 | 1.3014 | 71.39 | 0.0015 |

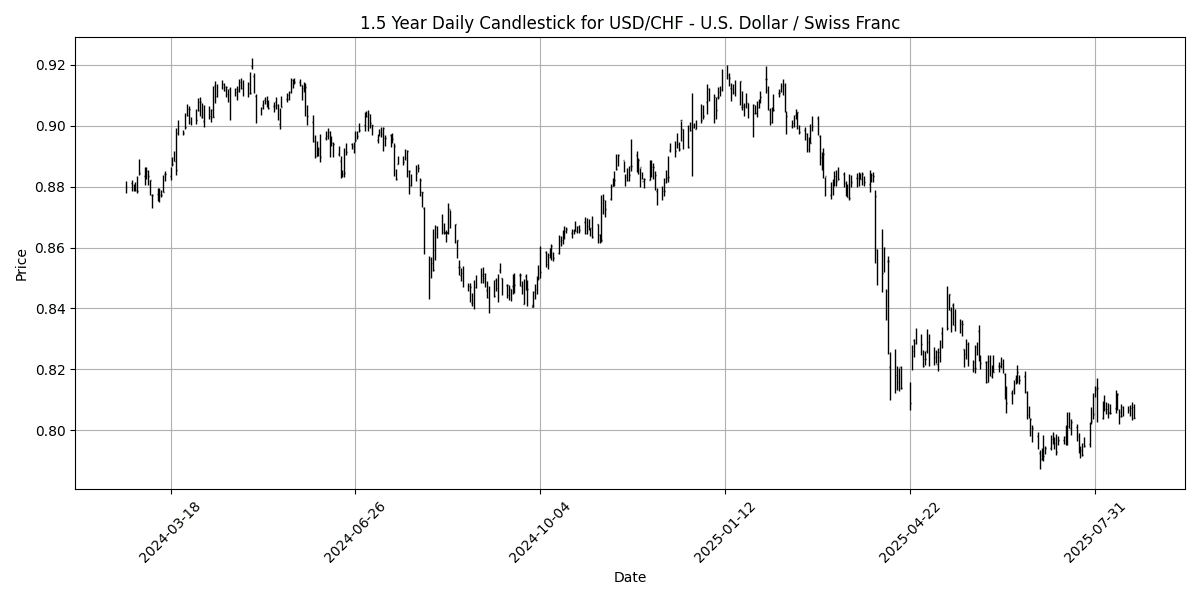

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8008 | -0.9524 | -0.8322 | -0.8322 | 0.9034 | -3.3294 | -10.8300 | -11.3414 | -5.9100 | 0.8035 | 0.8170 | 0.8561 | 36.47 | 0.0009 |

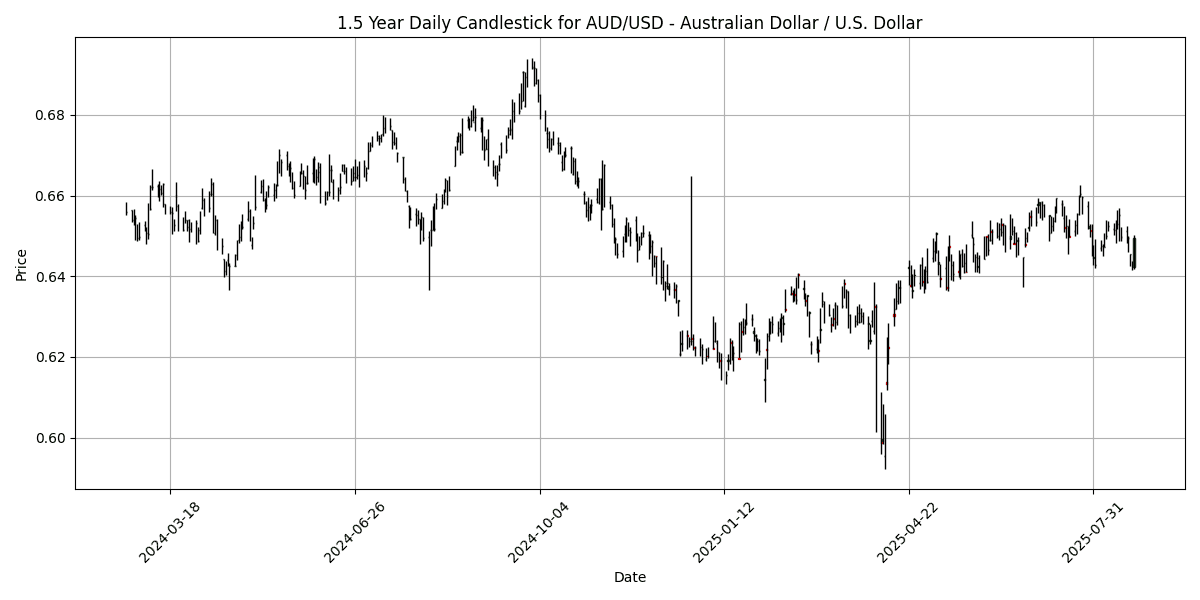

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6494 | 1.0739 | -0.0541 | -0.0541 | -0.9262 | 1.3135 | 1.4038 | 4.4051 | -3.7883 | 0.6519 | 0.6455 | 0.6387 | 54.03 | -0.0011 |

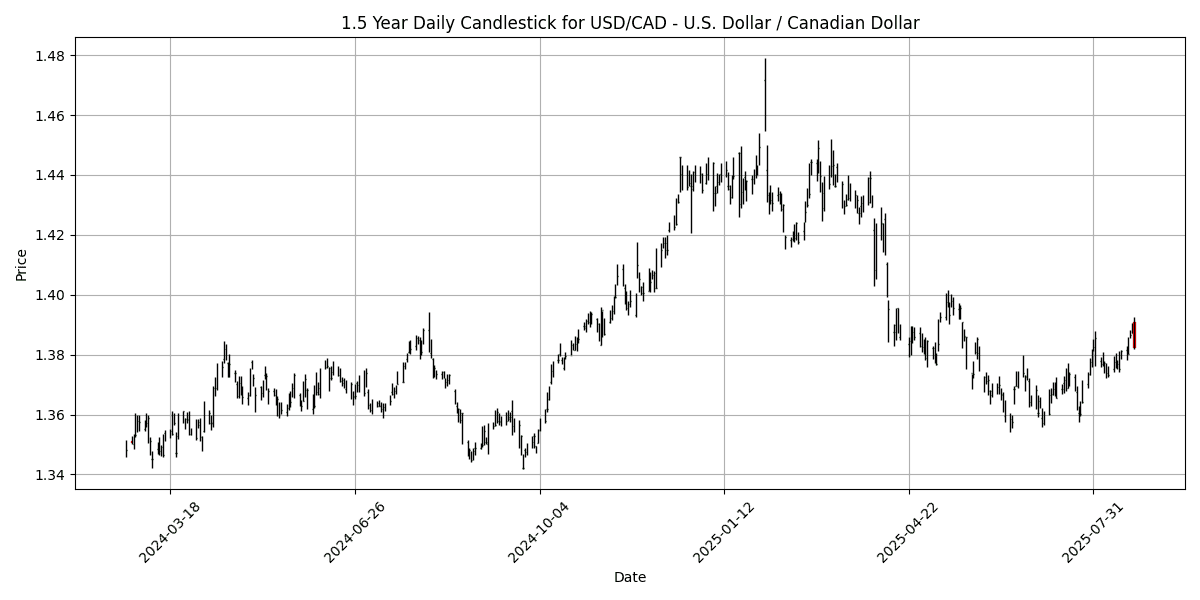

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3824 | -0.5825 | 0.0789 | 0.0789 | 1.6149 | -0.2453 | -2.4831 | -3.6642 | 1.7720 | 1.3713 | 1.3791 | 1.4036 | 57.54 | 0.0034 |

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5872 | 0.8415 | -0.8290 | -0.8290 | -2.1349 | -0.4344 | 1.8686 | 4.1188 | -4.7139 | 0.5983 | 0.5948 | 0.5835 | 43.97 | -0.0027 |

In the current forex landscape, GBP/USD is notably in overbought territory with an RSI of 71.39, suggesting potential price corrections ahead. The MACD remains positive, indicating bullish momentum, yet caution is warranted given the elevated RSI. Conversely, EUR/USD appears stable with an RSI of 63.92, indicating room for upward movement without immediate overbought concerns, supported by a positive MACD.

USD/CHF is in an oversold condition with an RSI of 36.47 and a negative MACD, which may present a buying opportunity if momentum shifts. Similarly, NZD/USD shows weakness with an RSI of 43.97 and a negative MACD, indicating bearish sentiment.

USD/JPY remains neutral at an RSI of 45.39, while AUD/USD and USD/CAD show moderate conditions, suggesting a wait-and-see approach. Overall, traders should monitor GBP/USD closely for potential reversals and consider entry points in USD/CHF as it approaches oversold levels.

## Cross FX Group

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8669 | 0.1618 | 0.6817 | 0.6817 | -0.1428 | 3.1238 | 4.6096 | 4.5478 | 1.7524 | 0.8627 | 0.8552 | 0.8443 | 50.96 | 0.0001 |

| EUR/JPY | EURJPY | 172.06 | -0.1115 | -0.0040 | -0.0040 | -0.1404 | 6.0239 | 9.6788 | 5.3107 | 6.2905 | 170.74 | 166.81 | 163.84 | 45.91 | 0.3845 |

| EUR/CHF | EURCHF | 0.9393 | 0.0533 | -0.1701 | -0.1701 | 0.8244 | 0.5115 | -0.3913 | -0.0638 | -1.0659 | 0.9359 | 0.9360 | 0.9387 | 61.90 | 0.0019 |

| EUR/AUD | EURAUD | 1.8066 | -0.0609 | 0.7568 | 0.7568 | 0.8789 | 2.6501 | 10.16 | 7.9727 | 9.3180 | 1.7868 | 1.7762 | 1.7199 | 76.62 | 0.0049 |

| GBP/JPY | GBPJPY | 198.45 | -0.2754 | -0.6841 | -0.6841 | -0.0071 | 2.8030 | 4.8523 | 0.7386 | 4.4528 | 197.92 | 195.03 | 194.03 | 46.21 | 0.4282 |

| GBP/CHF | GBPCHF | 1.0834 | -0.1198 | -0.8375 | -0.8375 | 0.9627 | -2.5378 | -4.7828 | -4.4073 | -2.7695 | 1.0848 | 1.0946 | 1.1120 | 57.95 | 0.0021 |

| AUD/JPY | AUDJPY | 95.23 | -0.0556 | -0.7576 | -0.7576 | -1.0104 | 3.2808 | -0.4391 | -2.4533 | -2.7750 | 95.54 | 93.89 | 95.30 | 30.36 | -0.0468 |

| AUD/NZD | AUDNZD | 1.1058 | 0.2175 | 0.7737 | 0.7737 | 1.2301 | 1.7511 | -0.4358 | 0.2816 | 0.9642 | 1.0888 | 1.0850 | 1.0948 | 71.27 | 0.0026 |

| CHF/JPY | CHFJPY | 183.17 | -0.1434 | 0.1657 | 0.1657 | -0.9534 | 5.4901 | 10.12 | 5.3920 | 7.4344 | 182.41 | 178.19 | 174.53 | 38.64 | 0.0409 |

| NZD/JPY | NZDJPY | 86.10 | -0.2653 | -1.5156 | -1.5156 | -2.2135 | 1.5090 | 0.0012 | -2.7360 | -3.7073 | 87.72 | 86.53 | 87.04 | 25.33 | -0.2442 |

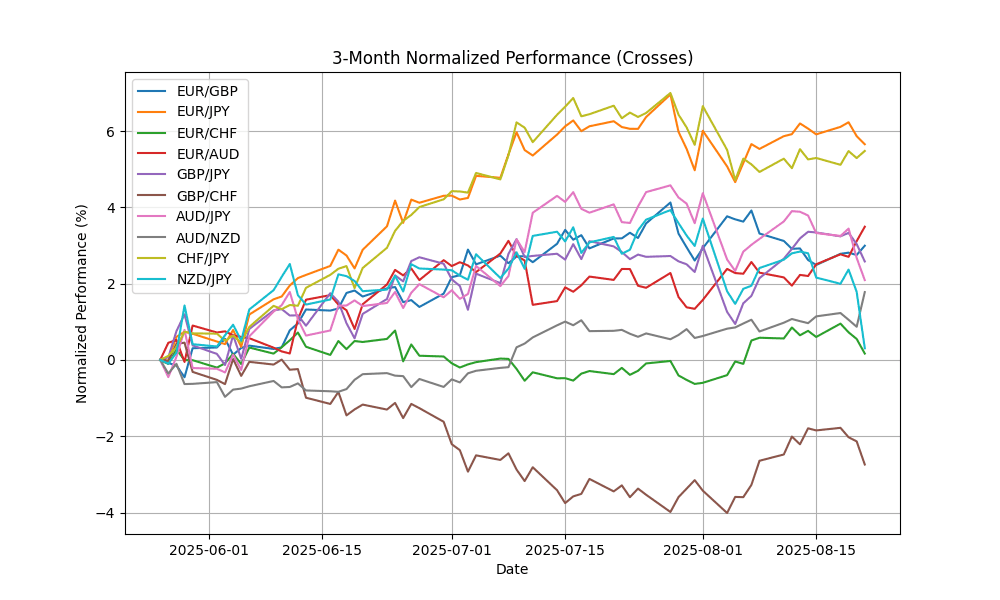

In the current analysis of key FX pairs, EUR/AUD is notably overbought with an RSI of 76.62, indicating potential reversal risks, despite a positive MACD suggesting bullish momentum. Conversely, AUD/JPY and NZD/JPY are in oversold territory with RSIs of 30.36 and 25.33, respectively, combined with negative MACD readings, signaling potential buying opportunities. EUR/CHF and GBP/CHF exhibit neutral to slightly bullish conditions, while the remaining pairs, including EUR/GBP and EUR/JPY, reflect stability with RSIs around 50. This divergence in conditions highlights potential trading strategies, particularly focusing on AUD/JPY and NZD/JPY for recovery plays.

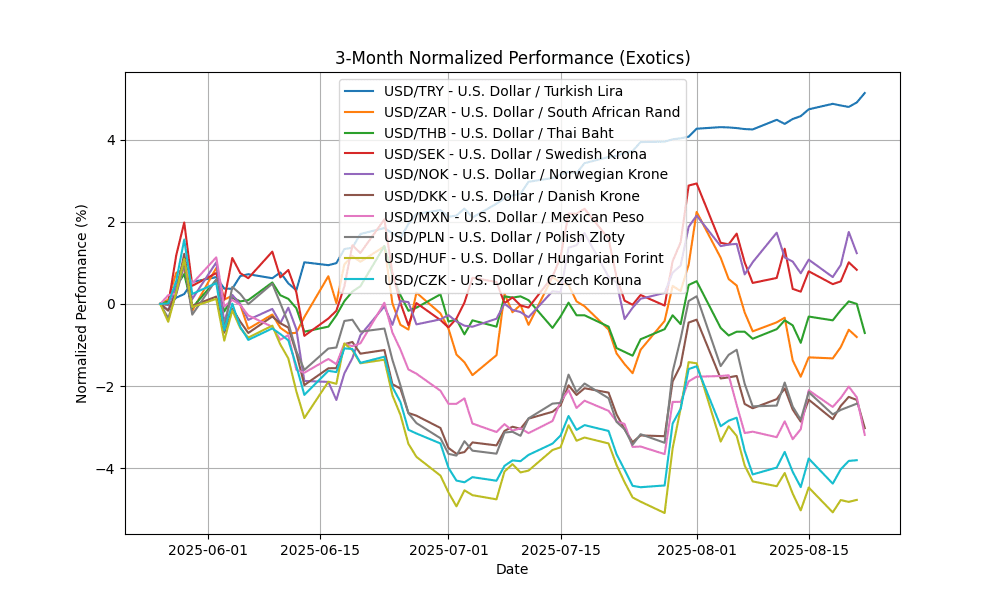

## Exotics and Emerging

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.00 | -0.0044 | 0.3787 | 0.3787 | 1.4038 | 5.0425 | 12.69 | 16.13 | 20.86 | 40.27 | 39.47 | 37.62 | 82.15 | 0.1924 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.45 | -1.4684 | -0.7590 | -0.7590 | -0.5926 | -3.1045 | -4.7606 | -7.0238 | -2.0921 | 17.77 | 18.07 | 18.17 | 24.81 | -0.0482 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.33 | -0.9498 | -0.4005 | -0.4005 | 0.4661 | -1.5829 | -3.6076 | -5.2989 | -5.7160 | 32.47 | 32.83 | 33.46 | 48.20 | -0.0020 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.4843 | -1.3501 | -1.0145 | -1.0145 | -0.3074 | -1.5923 | -10.7704 | -13.9655 | -6.7779 | 9.5742 | 9.6345 | 10.21 | 33.45 | -0.0060 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.05 | -1.2591 | -1.6623 | -1.6623 | -0.2364 | -1.5378 | -9.4426 | -11.3159 | -4.3303 | 10.14 | 10.25 | 10.68 | 42.26 | 0.0189 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.3611 | -1.0269 | -0.7077 | -0.7077 | 0.0310 | -3.7940 | -10.4427 | -11.2421 | -4.9153 | 6.4046 | 6.5069 | 6.8005 | 36.42 | -0.0086 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.60 | -0.7709 | -1.0715 | -1.0715 | -0.2367 | -3.7332 | -8.3483 | -9.8506 | -3.5136 | 18.76 | 19.17 | 19.78 | 37.38 | -0.0147 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6307 | -0.8439 | -0.6540 | -0.6540 | 0.2705 | -3.5800 | -8.3293 | -11.5988 | -5.3124 | 3.6530 | 3.7139 | 3.8693 | 29.67 | -0.0054 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 336.84 | -1.2304 | -0.6799 | -0.6799 | -0.8145 | -5.7014 | -12.0443 | -14.7248 | -4.2622 | 342.30 | 350.38 | 368.67 | 24.51 | -1.5371 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.91 | -1.0995 | -0.4588 | -0.4588 | -0.1733 | -5.1838 | -12.2895 | -13.4267 | -6.8851 | 21.13 | 21.62 | 22.75 | 31.93 | -0.0613 |

In the current forex landscape, USD/TRY is notably overbought with an RSI of 82.15, indicating a potential price correction may be imminent. The positive MACD supports this bullish momentum, but caution is warranted due to extreme RSI levels. Conversely, USD/ZAR is in oversold territory with an RSI of 24.81 and a negative MACD, suggesting potential for a rebound. Other pairs such as USD/SEK and USD/PLN are also showing oversold conditions, with RSIs below 35, which may present buying opportunities. Monitoring MA crossovers will be essential for confirming trend reversals in these pairs.