During the week of August 26 to 30, 2024, the performance of major currency pairs varied. The EUR/USD pair declined by 1.26%, closing on Friday at 1.1052. The USD/JPY pair, on the other hand, experienced a positive performance, rising by 1.29% and closing at 146.2. The GBP/USD pair saw a modest decline of 0.64%, ending the week at 1.312.

The USD/CHF pair showed a small gain of 0.22%, with a closing price of 0.8498. Meanwhile, the USD/CAD pair had a slight decrease of 0.12%, closing at 1.3483. The EUR/JPY pair was relatively stable, with a minimal decrease of 0.03%, closing at 161.48.

The AUD/USD pair decreased by 0.38% over the week, ending at 0.6771, while the NZD/USD pair saw an increase of 0.3%, closing at 0.6247. Lastly, the EUR/GBP pair fell by 0.6%, with a Friday close of 0.8415.

This summary highlights the mixed performance of the Forex market during this period, with some currency pairs gaining ground while others experienced declines.

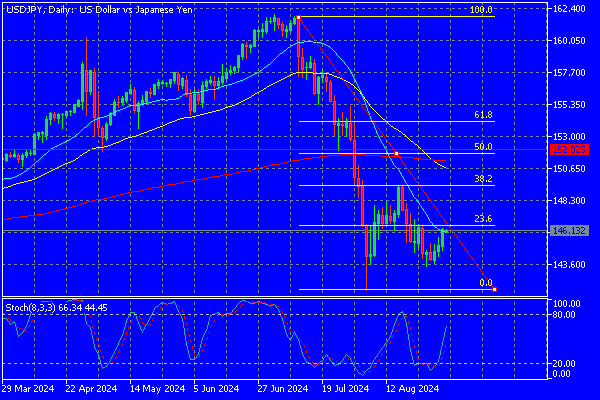

EUR/USD

Four consecutive negative sessions and 23.6% Fibonacci support of the most recent uptrend tested. More space for further retracements because the trendline which links higher lows is 300 pips circa beneath current quotes. The pair is oversold accordingly to Stochastic oscillator.

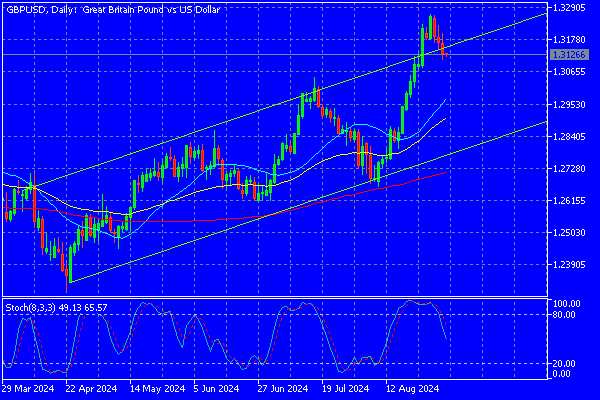

GBP/USD

This week probably there will be confirmation about the fake breakout of the higher side of the bullish channel. Is also possible a rebound which would validate the breakout and lift the pair to retest its 2024 high. Bullish framework valid till the lower side of the channel which is also close to its 200 day SMA.

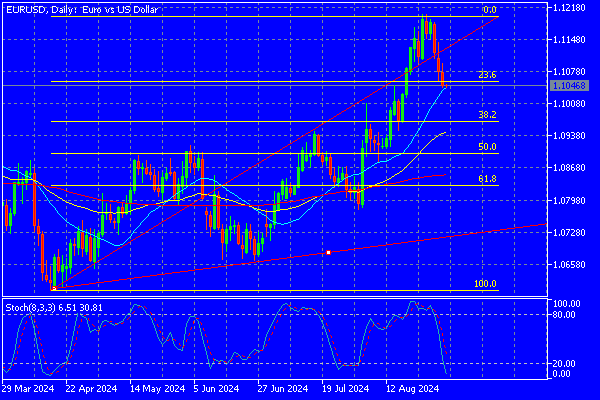

USD/JPY

The pair rebounded initially up to the 38.2% retracement of the recent bearish wave from its multiyear highs and then closed near its 23.6%. A breakout above could open the scenario of a trading range or for a larger recovering wave. A failed advance would lead to a double bottom with its recent low and beneath it selling pressure is likely to increase to 140 as a first test.