Intraday Performance

In today’s forex market, the EUR/USD pair is up by 0.24%, currently trading at 1.1070, showing strength as it reached a high of 1.1086. Similarly, the GBP/USD is also performing well, up by 0.25% at 1.3147, following a strong session with a high of 1.3165. On the other hand, the USD/JPY has seen a significant drop of 0.75%, trading at 144.38, indicating weakness in the dollar against the yen. The commodity currencies like the AUD/USD and NZD/USD are showing positive momentum, with gains of 0.37% and 0.31%, respectively. The AUD/USD is trading at 0.6736, while the NZD/USD is at 0.6206. In the commodities market, crude oil (WTI) is down by 0.65%, trading at $69.88 per barrel, reflecting some selling pressure, while gold is up by 0.29%, trading at $2530.20 per ounce, indicating a flight to safety.

Price Action Analysis

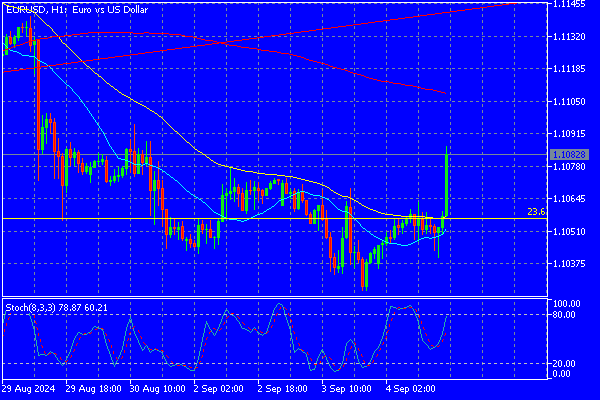

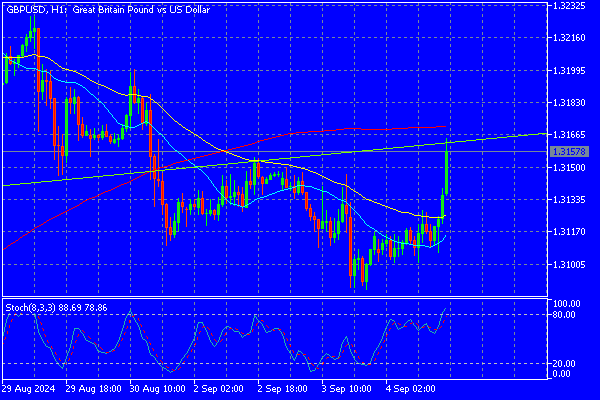

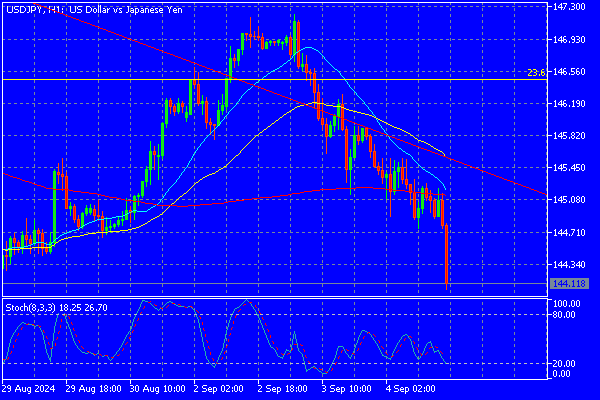

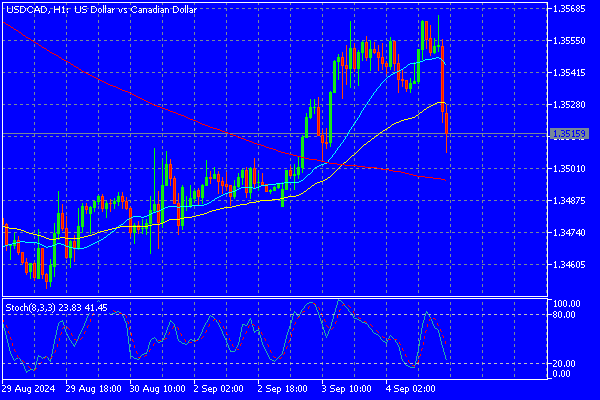

Looking at the one-hour charts:

EUR/USD: The pair is in a strong uptrend, breaking above 1.1070 with a significant bullish candle. The current price action suggests potential for further gains if it can maintain above the 1.1070 level.

GBP/USD: The British pound is also showing strength, breaking out above the 1.3147 level with consistent buying pressure. The upward trend looks strong, and the pair might test higher resistance levels around 1.3165.

USD/JPY: The pair has been under significant selling pressure, declining sharply to 144.38. The bearish momentum suggests that it might continue to slide, with the next support level around 144.00.

USD/CAD: The Canadian dollar is gaining against the U.S. dollar, with the pair dropping to 1.3523. The chart indicates a bearish trend, with the pair likely to test lower levels if it breaks below 1.3520.

AUD/USD: The Australian dollar is in recovery mode, with the pair rebounding to 0.6736. The price action shows potential for further gains if the pair can hold above 0.6730.

NZD/USD: The Kiwi is also on the rise, trading at 0.6206. The pair is in an uptrend and could see more upside if it maintains the current momentum.

USD/CHF: The Swiss franc is gaining ground, with the pair trading lower at 0.8491. The price action is bearish, suggesting that the pair could test lower support levels around 0.8480.

EUR/GBP: The pair is relatively flat, trading around 0.8420. The lack of momentum indicates a potential consolidation phase before the next move.

GBP/JPY: The pair has dropped to 189.77, continuing its downward trend. The bearish sentiment could lead to further declines, with the next target around 189.50.

Geopolitical and Macro Events

Today’s forex movements are heavily influenced by several geopolitical and macroeconomic factors: U.S. Treasury Yields: Falling U.S. Treasury yields continue to weigh on the USD, especially against safe-haven currencies like the JPY and CHF. The market is closely watching the upcoming economic data releases in the U.S., particularly related to inflation and job markets, which could impact the Fed’s future monetary policy decisions.

Global Energy Prices: The decline in crude oil prices is reflecting concerns over global demand, particularly with China’s economic slowdown. This has also impacted commodity-linked currencies like the CAD and AUD.