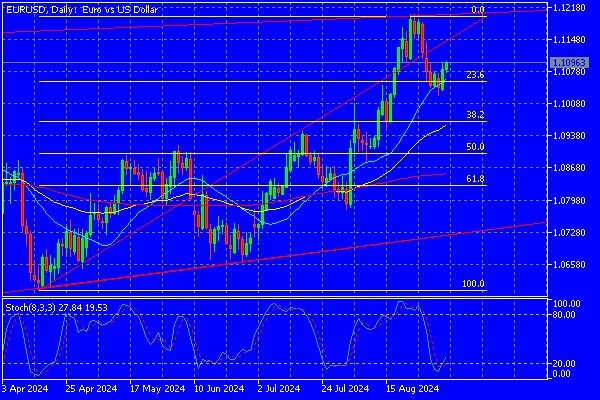

EUR/USD (Euro vs. US Dollar)

The EUR/USD is currently trading above the 200-day SMA (red line), indicating a long-term bullish trend. The price has recently retraced to the 23.6% Fibonacci level, which is acting as a support, suggesting the possibility of a continuation of the uptrend. The 21-day SMA (light blue line) is above the 55-day EMA (yellow line), reinforcing the bullish momentum. The Stochastic Oscillator is in the middle range, suggesting there’s room for further upward movement before reaching overbought conditions.

Key Support Levels:

- 1.0970 (23.6% Fibonacci retracement)

- 1.0890 (38.2% Fibonacci retracement)

Key Resistance Levels:

- 1.1145 (Recent high and upper trendline resistance)

- 1.1218 (0% Fibonacci retracement, strong resistance)

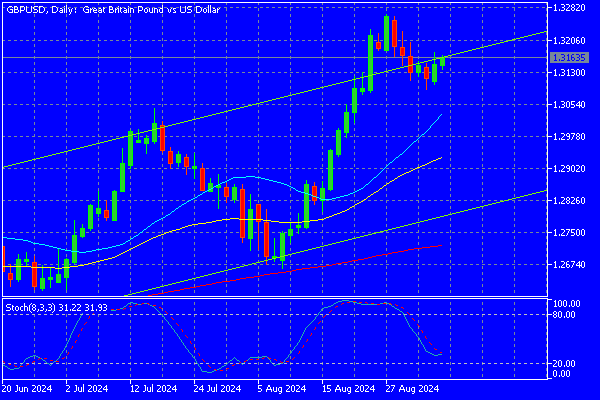

GBP/USD (British Pound vs. US Dollar)

The GBP/USD pair is showing strong bullish momentum, as it continues to trade above all key moving averages (200-day SMA, 21-day SMA, and 55-day EMA). The recent price action suggests the pair is consolidating near the upper trendline, which might act as resistance. However, as the 21-day SMA is above the 55-day EMA and the 200-day SMA, the bullish trend remains intact. The Stochastic Oscillator is in the lower half, indicating that there could be more room for upward movement.

Key Support Levels:

- 1.3050 (Near the 21-day SMA)

- 1.2950 (55-day EMA level)

Key Resistance Levels:

- 1.3210 (Recent high)

- 1.3280 (Upper trendline resistance)

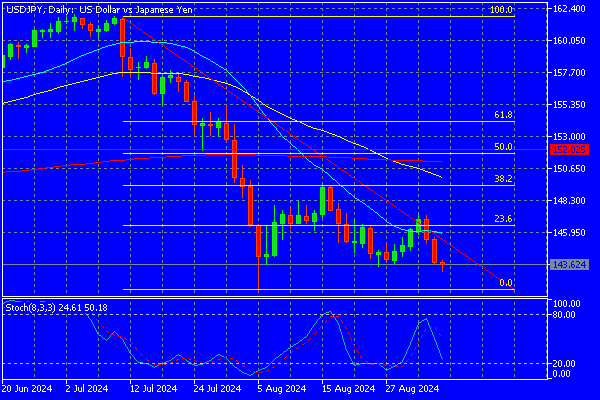

USD/JPY (US Dollar vs. Japanese Yen)

The USD/JPY pair is in a clear downtrend, as it trades below the 200-day SMA, and the 21-day SMA is also below the 55-day EMA. The pair recently touched the 23.6% Fibonacci retracement level but failed to break above it, suggesting strong resistance and the likelihood of continuing the downward trend. The Stochastic Oscillator is in the middle range, indicating a possible continuation of the bearish momentum.

Key Support Levels:

- 143.00 (Psychological level and recent low)

- 141.50 (Continuation of the downtrend support)

Key Resistance Levels:

- 145.90 (23.6% Fibonacci retracement)

- 147.00 (38.2% Fibonacci retracement)

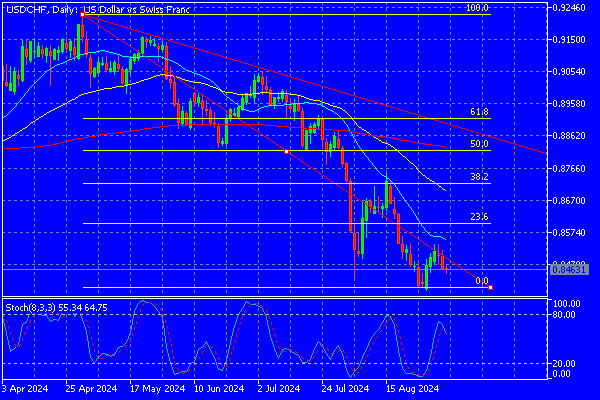

USD/CHF (US Dollar vs. Swiss Franc)

The USD/CHF is trading below the 200-day SMA, indicating a bearish trend. The pair has recently bounced off the 0% Fibonacci retracement level but is still facing resistance from the 21-day SMA and 55-day EMA, which are both above the current price. The downward sloping moving averages reinforce the bearish outlook. The Stochastic Oscillator is moving upwards but still in the lower range, indicating a possible short-term correction before resuming the downtrend.

Key Support Levels:

- 0.8740 (Recent low)

- 0.8660 (0% Fibonacci retracement level)

Key Resistance Levels:

- 0.8860 (21-day SMA level)

- 0.8950 (38.2% Fibonacci retracement)

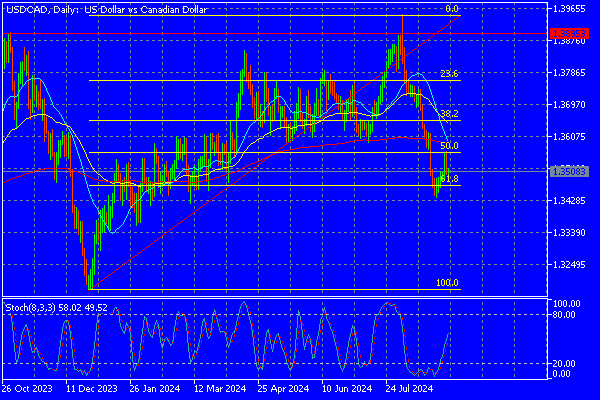

USD/CAD (US Dollar vs. Canadian Dollar)

The USD/CAD pair is in a corrective phase after a significant downtrend. The price has reached the 61.8% Fibonacci retracement level, which is providing strong support. The pair is currently trading below the 200-day SMA, and the 21-day SMA is below the 55-day EMA, suggesting that the overall trend remains bearish. However, the Stochastic Oscillator is moving upwards from oversold conditions, indicating the potential for a short-term rebound.

Key Support Levels:

- 1.3500 (61.8% Fibonacci retracement)

- 1.3425 (Recent low)

Key Resistance Levels:

- 1.3625 (50.0% Fibonacci retracement)

- 1.3700 (38.2% Fibonacci retracement)

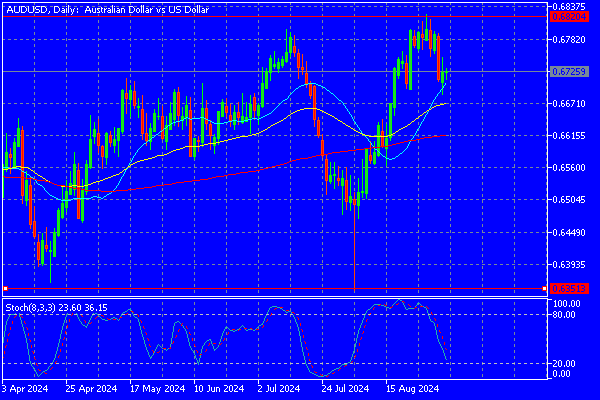

AUD/USD (Australian Dollar vs. US Dollar)

The AUD/USD pair is in a bullish phase, trading above the 200-day SMA. The price has recently pulled back but found support above the 21-day SMA. The 21-day SMA is above the 55-day EMA, suggesting continued bullish momentum. The Stochastic Oscillator is in the lower range, which may indicate a potential for upward movement as the pair continues to find support at higher levels.

Key Support Levels:

- 0.6725 (Near the 21-day SMA)

- 0.6670 (55-day EMA level)

Key Resistance Levels:

- 0.6820 (Recent high)

- 0.6880 (Upper resistance level)

This analysis provides a comprehensive outlook on the current trends and potential future movements in these major currency pairs, identifying key levels that traders should watch closely.