Forex Update: Cautious Sentiment Post-CPI, USD/CAD Gains 0.24%

📰 Forex and Global Market News

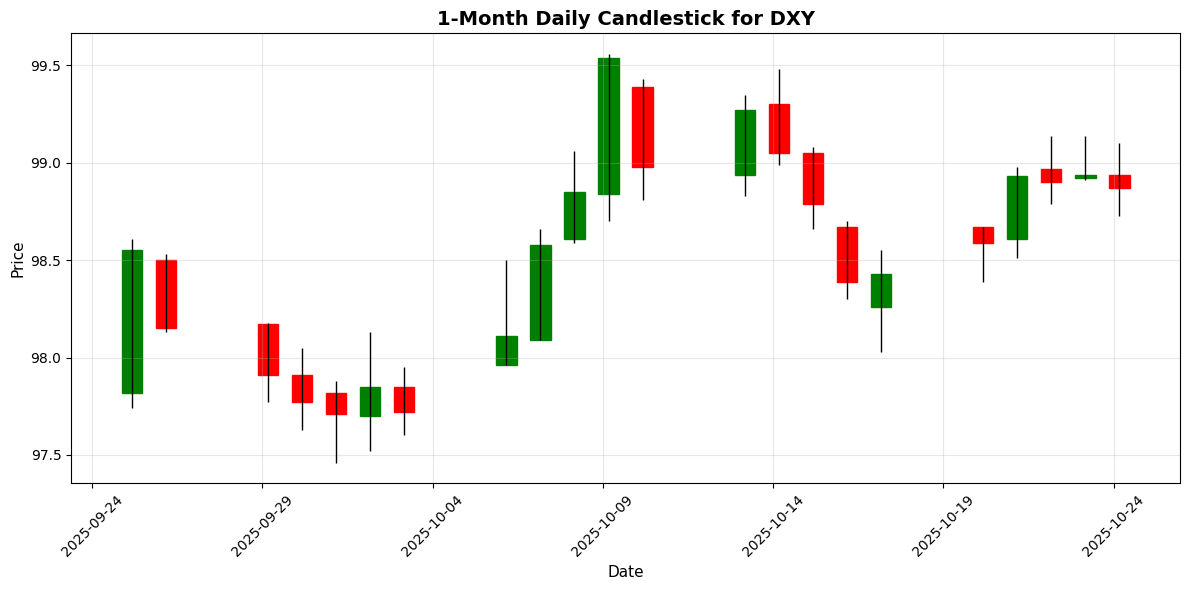

Today’s forex market reflects a cautious sentiment following the release of the U.S. Consumer Price Index (CPI) data, which showed inflation at 3.0% for September, slightly below expectations of 3.1%. This lower-than-anticipated inflation rate has contributed to a modest decline in the U.S. Dollar Index (DXY), currently at 98.87 (-0.1404%), as traders reassess the Federal Reserve’s potential monetary policy trajectory.

The Euro (EUR) has shown resilience against the Swiss Franc (CHF), stabilizing around 0.9243 after positive Eurozone PMI data, indicating improved business activity. Meanwhile, the GBP remains under pressure amid ongoing geopolitical tensions and economic uncertainties. The Australian Dollar (AUD) and Canadian Dollar (CAD) are also impacted by fluctuating commodity prices, particularly oil, as discussions between the U.S. and India regarding Russian crude imports continue.

Geopolitical events, including President Trump’s termination of trade negotiations with Canada, further complicate the market landscape. Gold prices have remained elevated, reflecting ongoing concerns over global trade and economic stability, with XAU/USD consolidating near $4,100. As traders await further developments, including U.S.-China trade talks, the forex market is poised for potential volatility in the coming days.

📅 Economic Calendar Events Today

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Core Retail Sales (MoM) (Sep) | 0.6% | |

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Core Retail Sales (YoY) (Sep) | 2.3% | 0.7% |

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Retail Sales (YoY) (Sep) | 1.5% | 0.6% |

| 2025-10-24 | 02:00 | 🇬🇧 | Medium | Retail Sales (MoM) (Sep) | 0.5% | -0.2% |

| 2025-10-24 | 03:15 | 🇪🇺 | Medium | HCOB France Manufacturing PMI (Oct) | 48.3 | 48.2 |

| 2025-10-24 | 03:15 | 🇪🇺 | Medium | HCOB France Services PMI (Oct) | 47.1 | 48.7 |

| 2025-10-24 | 03:30 | 🇪🇺 | Medium | HCOB Germany Manufacturing PMI (Oct) | 49.6 | 49.5 |

| 2025-10-24 | 03:30 | 🇪🇺 | Medium | HCOB Germany Services PMI (Oct) | 54.5 | 51.1 |

| 2025-10-24 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Manufacturing PMI (Oct) | 50.0 | 49.8 |

| 2025-10-24 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Composite PMI (Oct) | 52.2 | 51.0 |

| 2025-10-24 | 04:00 | 🇪🇺 | Medium | HCOB Eurozone Services PMI (Oct) | 52.6 | 51.2 |

| 2025-10-24 | 04:30 | 🇬🇧 | Medium | S&P Global Composite PMI (Oct) | 51.1 | 50.6 |

| 2025-10-24 | 04:30 | 🇬🇧 | Medium | S&P Global Manufacturing PMI (Oct) | 49.6 | 46.6 |

| 2025-10-24 | 04:30 | 🇬🇧 | Medium | S&P Global Services PMI (Oct) | 51.1 | 51.0 |

| 2025-10-24 | 05:15 | 🇬🇧 | Medium | BoE Deputy Governor Woods Speaks | ||

| 2025-10-24 | 06:30 | 🇷🇺 | Medium | Interest Rate Decision (Oct) | 16.50% | 17.00% |

| 2025-10-24 | 08:00 | 🇷🇺 | Medium | CBR Press Conference | ||

| 2025-10-24 | 08:30 | 🇺🇸 | Medium | Core CPI (YoY) (Sep) | 3.0% | 3.1% |

| 2025-10-24 | 08:30 | 🇺🇸 | High | Core CPI (MoM) (Sep) | 0.2% | 0.3% |

| 2025-10-24 | 08:30 | 🇺🇸 | High | CPI (YoY) (Sep) | 3.0% | 3.1% |

| 2025-10-24 | 08:30 | 🇺🇸 | High | CPI (MoM) (Sep) | 0.3% | 0.4% |

| 2025-10-24 | 08:30 | 🇨🇦 | Medium | New Housing Price Index (MoM) (Sep) | -0.2% | 0.2% |

| 2025-10-24 | 08:45 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-24 | 09:45 | 🇺🇸 | High | S&P Global Manufacturing PMI (Oct) | 51.9 | |

| 2025-10-24 | 09:45 | 🇺🇸 | Medium | S&P Global Composite PMI (Oct) | ||

| 2025-10-24 | 09:45 | 🇺🇸 | High | S&P Global Services PMI (Oct) | 53.5 | |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan 1-Year Inflation Expectations (Oct) | 4.6% | |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan 5-Year Inflation Expectations (Oct) | 3.7% | |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan Consumer Expectations (Oct) | 51.2 | |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | Michigan Consumer Sentiment (Oct) | 55.0 | |

| 2025-10-24 | 10:00 | 🇺🇸 | High | New Home Sales (Sep) | 710K | |

| 2025-10-24 | 10:00 | 🇺🇸 | Medium | New Home Sales (MoM) (Sep) | ||

| 2025-10-24 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Oil Rig Count | ||

| 2025-10-24 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Total Rig Count |

**Overview:**

Today’s economic calendar features several high-impact events, particularly from the UK, Eurozone, and the US, which are crucial for forex traders. Key releases include retail sales data from the UK, PMI figures from the Eurozone, and inflation metrics from the US.

**Key Releases:**

1. **UK Retail Sales (Sep)**: Core Retail Sales (MoM) rose 0.6% (forecast not available), while YoY surged to 2.3% against a forecast of 0.7%. Retail Sales (MoM) increased by 0.5% vs. a forecast of -0.2%, and YoY rose to 1.5% vs. 0.6%.

2. **Eurozone PMIs (Oct)**: HCOB Eurozone Manufacturing PMI came in at 50.0 (forecast 49.8), while Services PMI exceeded expectations at 52.6 (forecast 51.2).

3. **US CPI (Sep)**: Core CPI YoY at 3.0% vs. 3.1% forecast, and MoM at 0.2% vs. 0.3%. Overall CPI YoY also matched at 3.0% vs. 3.1% forecast.

**FX Impact:**

The GBP is likely to strengthen against the USD and EUR due to stronger-than-expected retail sales data. The EUR may see mixed reactions given the PMI results, while the USD could experience volatility based on the CPI data, potentially affecting pairs like EUR/USD and GBP/USD. Traders should remain alert for further market reactions following these releases.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1636 | +0.1291 | -0.5436 | -0.5436 | -1.5106 | -1.0219 | +2.3223 | +11.82 | +7.9355 | 1.1690 | 1.1661 | 1.1273 | 42.12 | -0.0023 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 152.86 | +0.1855 | +1.8272 | +1.8272 | +3.5566 | +3.9849 | +6.9877 | -2.6319 | +0.0615 | 148.88 | 147.61 | 147.95 | 66.36 | 0.9621 |

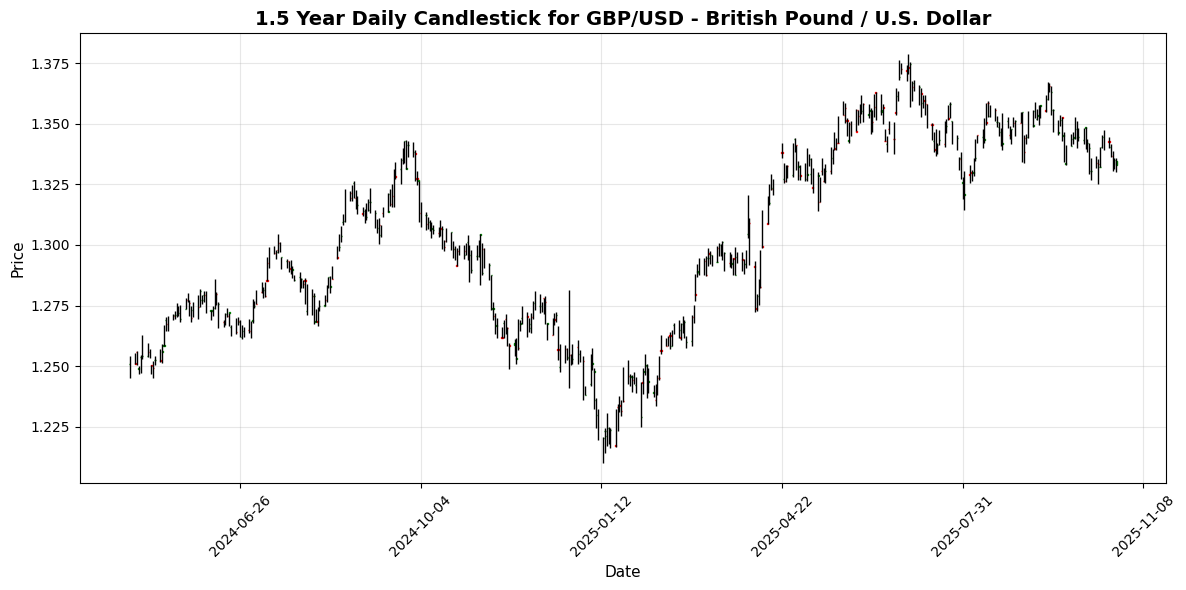

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3347 | +0.1501 | -0.7330 | -0.7330 | -1.3123 | -1.2068 | +0.1559 | +6.3582 | +3.3552 | 1.3464 | 1.3485 | 1.3211 | 41.32 | -0.0029 |

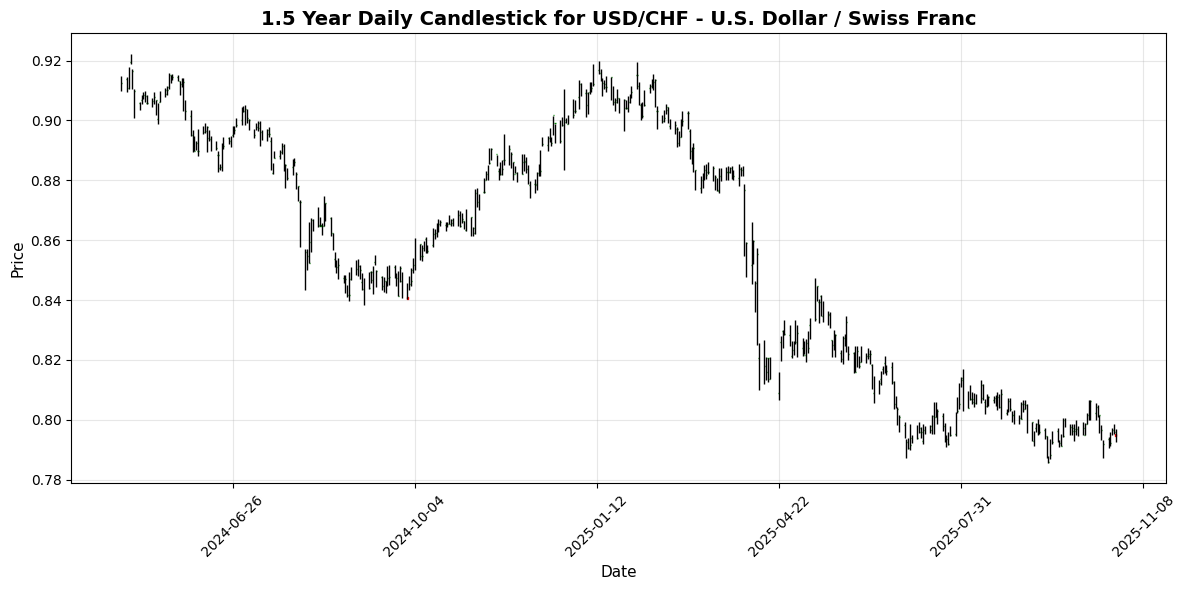

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7948 | -0.0377 | +0.3751 | +0.3751 | +0.4258 | -0.0088 | -4.0954 | -12.01 | -8.3001 | 0.7987 | 0.8017 | 0.8341 | 47.04 | -0.0008 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6517 | 0.0000 | +0.5338 | +0.5338 | -1.2246 | -1.2153 | +1.7727 | +4.7749 | -1.7932 | 0.6553 | 0.6538 | 0.6433 | 37.78 | -0.0022 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4021 | +0.2359 | -0.1780 | -0.1780 | +1.3144 | +2.7887 | +1.1762 | -2.2913 | +1.3320 | 1.3882 | 1.3788 | 1.3967 | 55.47 | 0.0046 |

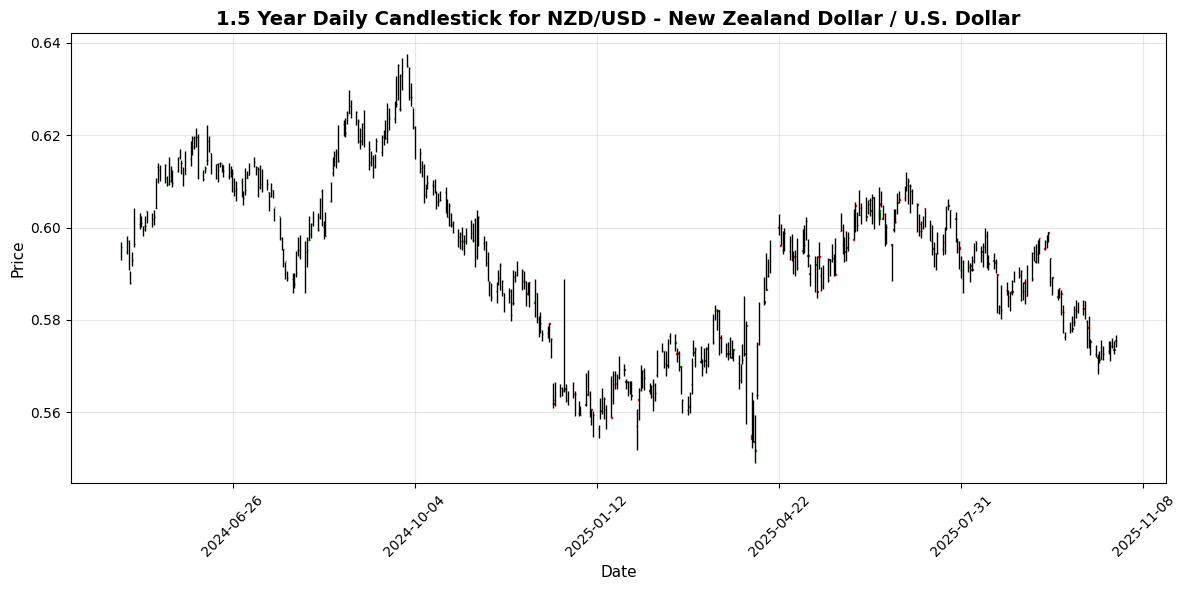

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5757 | +0.0348 | +0.5235 | +0.5235 | -1.7073 | -4.6399 | -3.8575 | +2.0797 | -4.1488 | 0.5840 | 0.5919 | 0.5852 | 32.94 | -0.0033 |

**Overview:**

The Majors FX group exhibits a generally mixed trend, with the U.S. Dollar showing strength against several currencies. However, some pairs indicate potential for reversal or consolidation, particularly in the context of RSI and MACD readings.

**Key Pairs:**

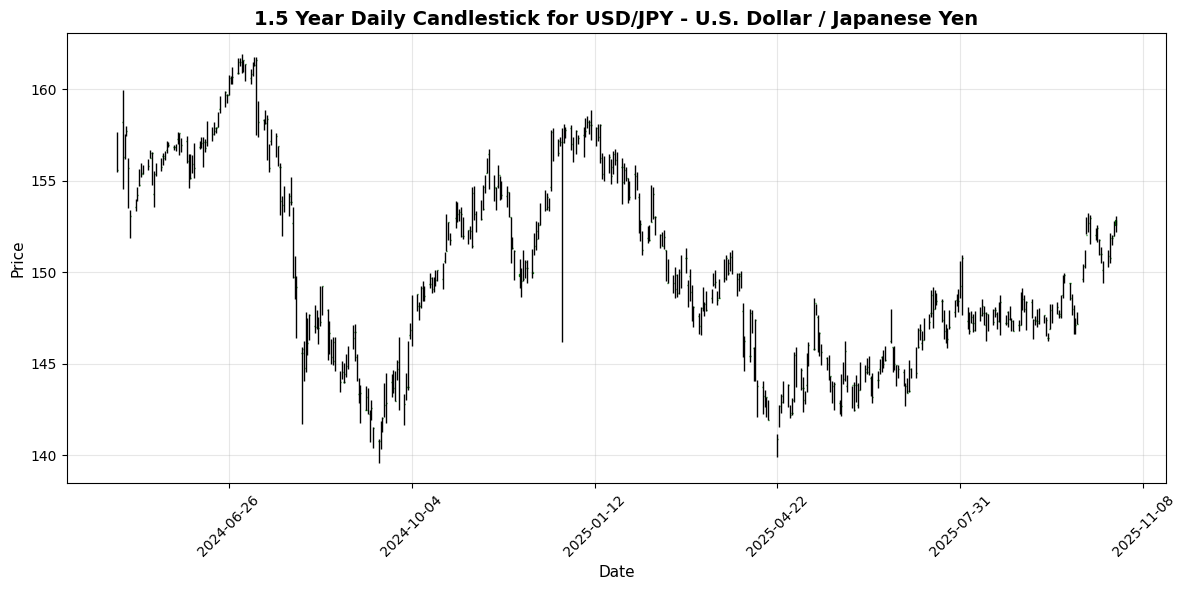

1. **USD/JPY:** Currently priced at 152.8630, it shows bullish momentum with a MACD of 0.9621 and an RSI of 66.36, approaching overbought territory. This suggests potential for a pullback if the RSI exceeds 70.

2. **USD/CAD:** Priced at 1.4021, it demonstrates moderate bullish momentum with a MACD of 0.0046 and an RSI of 55.47. This pair remains in a neutral-bullish zone, indicating potential for further upside if it breaks resistance around 1.4050.

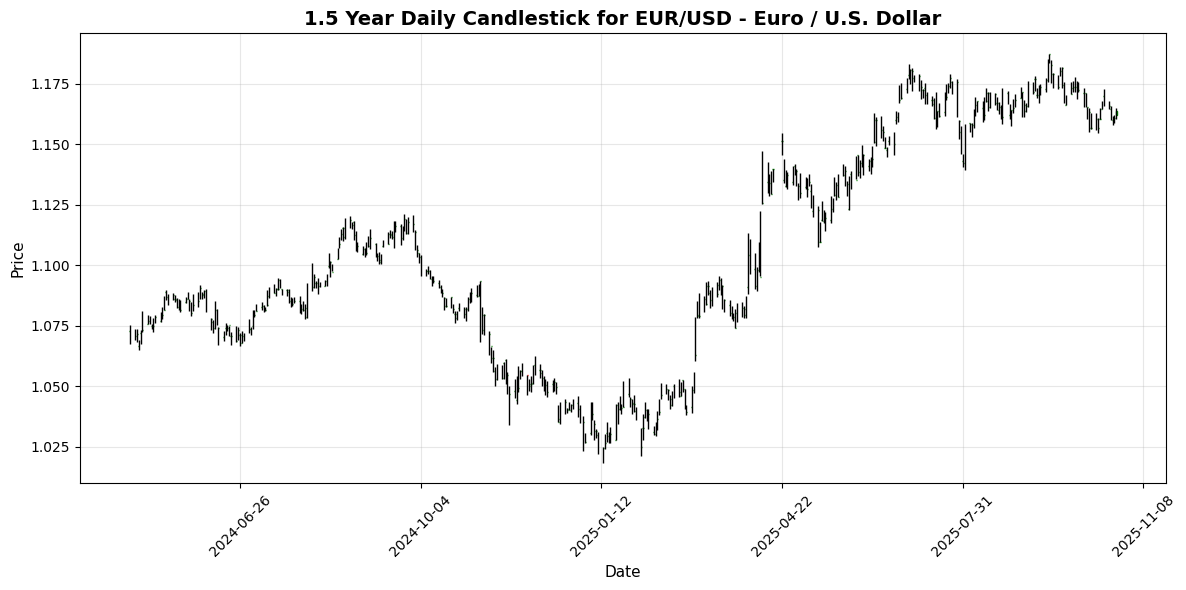

3. **EUR/USD:** At 1.1636, this pair is under bearish pressure with an RSI of 42.12 and a negative MACD of -0.0023. It suggests a lack of buying interest, with potential support near 1.1600.

**Trading Implications:**

For USD/JPY, watch for potential resistance around 153.00,

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8718 | +0.0115 | +0.1931 | +0.1931 | -0.2049 | +0.1839 | +2.1740 | +5.1387 | +4.4359 | 0.8680 | 0.8644 | 0.8528 | 43.69 | -0.0000 |

| EUR/JPY | EURJPY | 177.74 | +0.2651 | +1.2014 | +1.2014 | +1.9257 | +2.8540 | +9.4034 | +8.7853 | +7.9266 | 174.01 | 172.11 | 166.68 | 67.87 | 0.7696 |

| EUR/CHF | EURCHF | 0.9243 | +0.0650 | -0.2213 | -0.2213 | -1.1412 | -1.0820 | -1.9154 | -1.6597 | -1.0597 | 0.9335 | 0.9346 | 0.9383 | 21.09 | -0.0028 |

| EUR/AUD | EURAUD | 1.7856 | +0.1346 | -1.0567 | -1.0567 | -0.2731 | +0.1863 | +0.5145 | +6.7177 | +9.9027 | 1.7839 | 1.7836 | 1.7516 | 54.71 | 0.0024 |

| GBP/JPY | GBPJPY | 203.87 | +0.2651 | +1.0072 | +1.0072 | +2.1357 | +2.6608 | +7.0796 | +3.4883 | +3.3446 | 200.42 | 199.03 | 195.36 | 63.22 | 0.8450 |

| GBP/CHF | GBPCHF | 1.0600 | +0.0472 | -0.4302 | -0.4302 | -0.9494 | -1.2833 | -4.0151 | -6.4720 | -5.2929 | 1.0752 | 1.0809 | 1.1003 | 31.35 | -0.0034 |

| AUD/JPY | AUDJPY | 99.53 | +0.1388 | +2.2876 | +2.2876 | +2.2025 | +2.6642 | +8.8493 | +1.9575 | -1.7967 | 97.47 | 96.43 | 95.14 | 58.51 | 0.2323 |

| AUD/NZD | AUDNZD | 1.1321 | -0.0177 | +0.0194 | +0.0194 | +0.5016 | +3.6285 | +5.9205 | +2.6666 | +2.4803 | 1.1220 | 1.1046 | 1.0993 | 50.32 | 0.0027 |

| CHF/JPY | CHFJPY | 192.29 | +0.2158 | +1.4363 | +1.4363 | +3.1062 | +3.9891 | +11.55 | +10.64 | +9.1065 | 186.38 | 184.12 | 177.66 | 83.15 | 1.3945 |

| NZD/JPY | NZDJPY | 87.90 | +0.1675 | +2.2722 | +2.2722 | +1.6995 | -0.9264 | +2.7696 | -0.7004 | -4.1772 | 86.91 | 87.33 | 86.54 | 56.85 | 0.0516 |

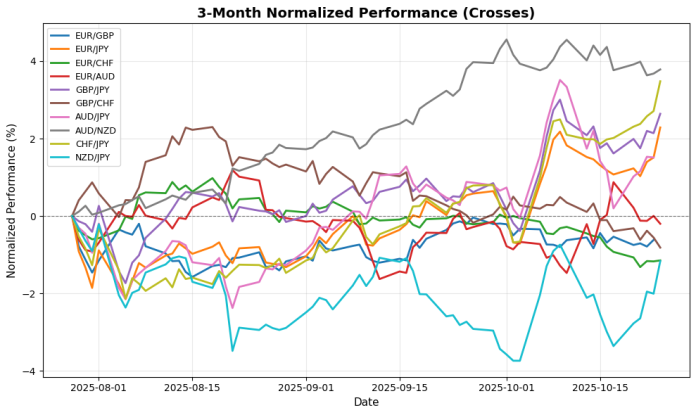

**Overview:** The Crosses FX group shows a mixed trend, with several pairs exhibiting bullish momentum while others remain neutral to bearish. Overall, the market sentiment indicates cautious optimism, particularly in pairs with positive MACD readings.

**Key Pairs:**

1. **CHF/JPY**: Price at 192.2890, RSI at 83.15 (overbought), and MACD at 1.3945 indicate strong bullish momentum. Watch for potential pullbacks as it approaches resistance.

2. **EUR/JPY**: Price at 177.7400, RSI at 67.87 (neutral-bullish), and MACD at 0.7696 suggest bullish momentum, with support around 177.00.

3. **GBP/JPY**: Price at 203.8710, RSI at 63.22 (neutral-bullish), and MACD at 0.8450 indicate a strong upward trend, with potential resistance near 204.50.

**Trading Implications:** Monitor for support

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.91 | -0.2240 | +0.0434 | +0.0434 | +1.1970 | +3.4007 | +9.1097 | +18.72 | +22.31 | 41.43 | 40.77 | 39.10 | 80.29 | 0.1608 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.27 | -0.2328 | -0.3828 | -0.3828 | +0.2380 | -1.9531 | -7.8947 | -7.9713 | -2.8527 | 17.42 | 17.60 | 18.00 | 50.47 | -0.0185 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.67 | -0.4267 | +0.5231 | +0.5231 | +2.4780 | +1.2082 | -2.1563 | -4.3030 | -3.2802 | 32.29 | 32.38 | 32.98 | 58.43 | 0.1437 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.3766 | +0.0075 | -0.4145 | -0.4145 | +0.4504 | -1.5753 | -2.5018 | -14.94 | -11.49 | 9.4313 | 9.5029 | 9.8430 | 49.11 | -0.0009 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 9.9907 | +0.2499 | -0.6721 | -0.6721 | +1.1148 | -1.2722 | -4.1089 | -11.80 | -9.0614 | 10.01 | 10.07 | 10.40 | 52.89 | 0.0150 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4231 | -0.0793 | +0.6219 | +0.6219 | +1.6769 | +1.1607 | -2.1706 | -10.38 | -7.1643 | 6.3866 | 6.4011 | 6.6321 | 59.42 | 0.0138 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.38 | -0.0636 | -0.2756 | -0.2756 | +0.1799 | -0.8579 | -6.2270 | -10.92 | -7.3262 | 18.51 | 18.65 | 19.36 | 46.52 | -0.0181 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6462 | +0.1841 | +0.4825 | +0.4825 | +1.1827 | +0.8240 | -2.8631 | -11.22 | -9.5158 | 3.6388 | 3.6493 | 3.7642 | 54.37 | 0.0028 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 334.76 | -0.2545 | +0.5050 | +0.5050 | +1.5055 | -0.9392 | -6.2174 | -15.25 | -10.42 | 335.20 | 339.40 | 355.58 | 58.41 | 0.0996 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.90 | -0.0469 | +0.7815 | +0.7815 | +1.9728 | +0.2177 | -4.6744 | -13.47 | -10.69 | 20.83 | 21.01 | 22.00 | 59.84 | 0.0282 |

**Overview:**

The Exotic FX group shows mixed signals today, with a general bearish undertone as most pairs are experiencing slight declines. However, the USD/TRY stands out with significant overbought conditions.

**Key Pairs:**

1. **USD/TRY:** Currently at 41.9145, this pair is in overbought territory with an RSI of 80.29 and a positive MACD of 0.1608, indicating strong bullish momentum.

2. **USD/ZAR:** Trading at 17.2691, it has a neutral RSI of 50.47 and a negative MACD of -0.0185, suggesting a lack of momentum.

3. **USD/HUF:** Priced at 334.7560, it has an RSI of 58.41 and a positive MACD of 0.0996, indicating potential bullish momentum.

**Trading Implications:**

For USD/TRY, watch for resistance around 42.00; a pullback could occur if momentum

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.