Forex Update: Central Bank Speeches Ignite Market, NZD/USD Declines 0.59%

📰 Forex and Global Market News

**Market Overview:**

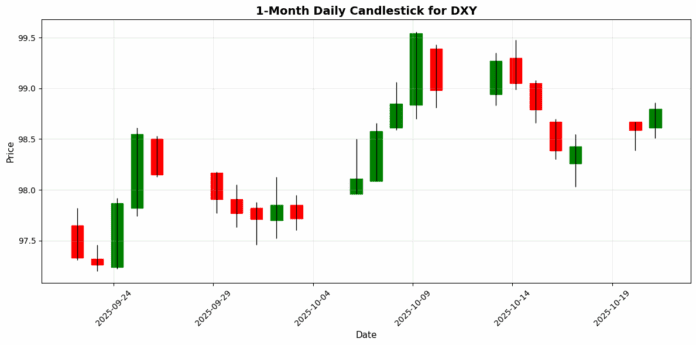

Today’s forex market reflects a mixed sentiment, driven primarily by central bank expectations and geopolitical developments. The US Dollar Index (DXY) stands at 98.80, up 0.0881%, as the greenback gains traction against major currencies amid easing Sino-US trade tensions.

**Key Currency Movements:**

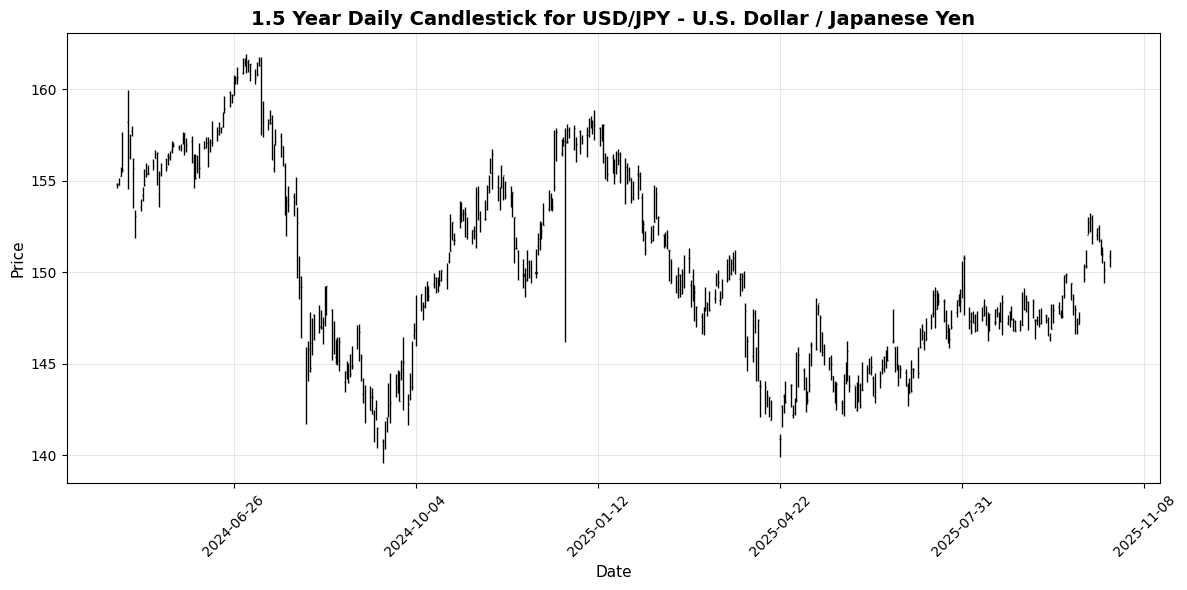

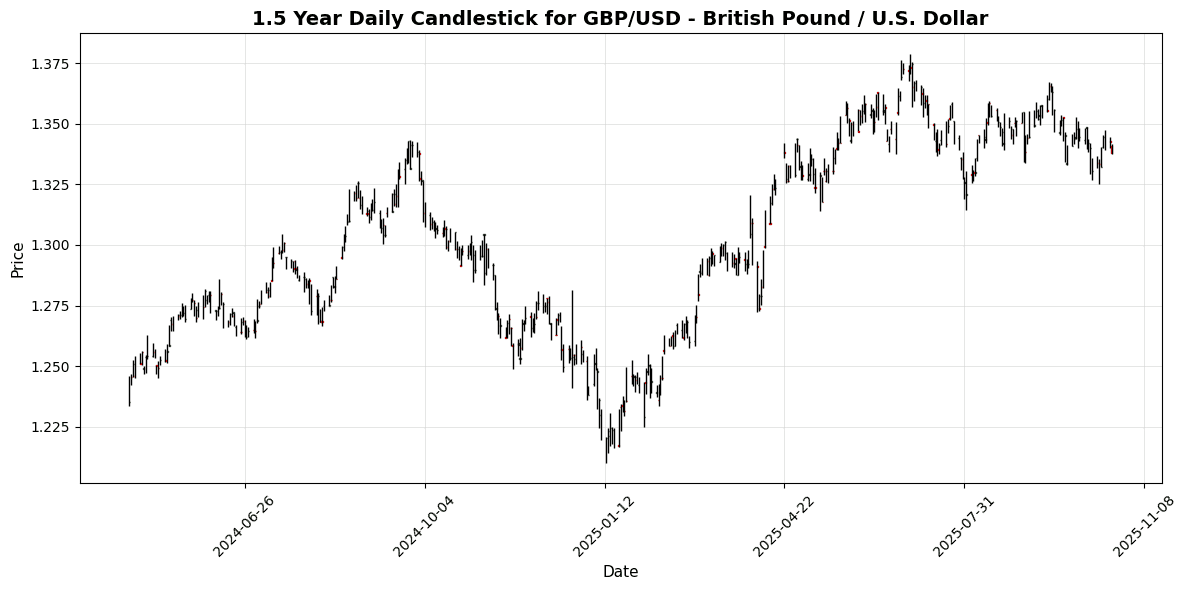

The Euro (EUR) remains stable, while the British Pound (GBP) continues to weaken against the USD, sliding to around 1.3370. This decline is attributed to the anticipation of a potential trade deal between the US and China, which has bolstered the USD’s appeal. The Japanese Yen (JPY) is under pressure following the announcement of Japan’s new cabinet, signaling continuity in policy. Meanwhile, the Australian Dollar (AUD) has seen a boost from a significant $8.5 billion minerals deal with the US, positively impacting critical metals stocks.

**Economic Data and Central Bank Insights:**

Investors are awaiting Canada’s CPI data, expected to show rising inflation, which may influence the Bank of Canada’s (BoC) future rate decisions. In the commodities space, gold prices have dipped below $4,300 amid a stronger USD, reflecting a lack of follow-through selling despite ongoing market uncertainty.

**Closing:**

Overall, the forex market is navigating through a complex landscape of economic indicators and geopolitical events, with the DXY maintaining its upward momentum as traders assess the implications for future monetary policy.

📅 Economic Calendar Events Today

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-21 | 00:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-21 | 03:00 | 🇪🇺 | Medium | ECB’s Lane Speaks | ||

| 2025-10-21 | 06:30 | 🇬🇧 | Medium | BoE Gov Bailey Speaks | ||

| 2025-10-21 | 07:00 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-10-21 | 07:30 | 🇺🇸 | Medium | Business Inventories (MoM) (Aug) | 0.1% | |

| 2025-10-21 | 07:30 | 🇺🇸 | Medium | Retail Inventories Ex Auto (Aug) | 0.3% | |

| 2025-10-21 | 07:30 | 🇺🇸 | Medium | US Leading Index (MoM) (Sep) | 0.1% | |

| 2025-10-21 | 08:30 | 🇨🇦 | Medium | Core CPI (MoM) (Sep) | ||

| 2025-10-21 | 08:30 | 🇨🇦 | Medium | Core CPI (YoY) (Sep) | ||

| 2025-10-21 | 08:30 | 🇨🇦 | Medium | CPI (MoM) (Sep) | -0.1% | |

| 2025-10-21 | 09:00 | 🇺🇸 | Medium | Fed Waller Speaks | ||

| 2025-10-21 | 13:00 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-10-21 | 15:30 | 🇺🇸 | Medium | Fed Waller Speaks | ||

| 2025-10-21 | 16:30 | 🇺🇸 | Medium | API Weekly Crude Oil Stock | ||

| 2025-10-21 | 17:00 | 🇺🇸 | Medium | TIC Net Long-Term Transactions (Aug) | ||

| 2025-10-21 | 18:00 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-21 | 19:50 | 🇯🇵 | Medium | Adjusted Trade Balance | -0.11T | |

| 2025-10-21 | 19:50 | 🇯🇵 | Medium | Exports (YoY) (Sep) | 4.6% | |

| 2025-10-21 | 19:50 | 🇯🇵 | Medium | Trade Balance (Sep) | 22.0B |

**Overview:**

Today’s economic calendar features several key events that could significantly impact forex markets, particularly speeches from central bank officials and critical inflation data from Canada. Traders should focus on the implications of these releases, as they may influence currency pairs.

**Key Releases:**

1. **CPI (MoM) (Sep) – CAD:** Forecasted at -0.1%. A lower-than-expected CPI could weaken the CAD, indicating potential easing by the Bank of Canada.

2. **Retail Inventories Ex Auto (Aug) – USD:** Forecasted at 0.3%. A miss here could signal weaker consumer demand, impacting USD negatively.

3. **Business Inventories (MoM) (Aug) – USD:** Expected at 0.1%. A lower actual figure may suggest economic slowdown, further pressuring the USD.

4. **Adjusted Trade Balance (Sep) – JPY:** Forecasted at -0.11T. A significant deviation could affect JPY’s strength, particularly against the USD.

**FX Impact:**

The CAD may face downward pressure if CPI data disappoints, impacting CAD pairs like USD/CAD. The USD may react negatively to weaker inventory data, affecting pairs such as EUR/USD and GBP/USD. The JPY could see volatility based on trade balance results, influencing pairs like USD/JPY. Overall, traders should remain vigilant for potential market movements following these releases.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

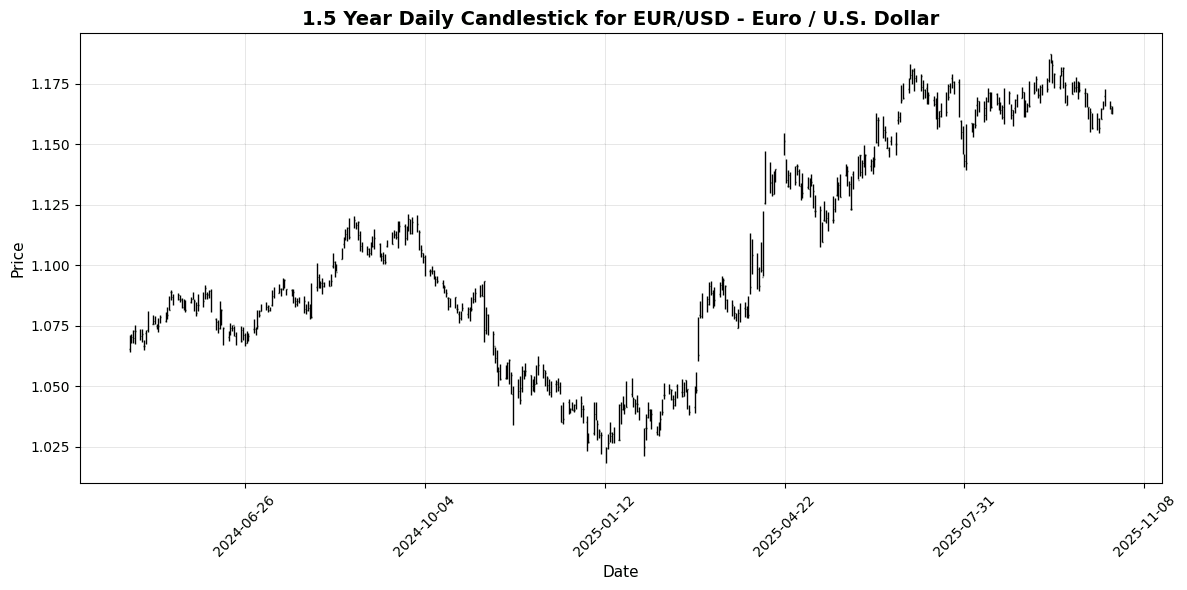

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1627 | -0.1717 | -0.1659 | +0.5201 | -1.3914 | -0.9554 | +2.6455 | +11.73 | +6.9777 | 1.1693 | 1.1655 | 1.1253 | 37.77 | -0.0022 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 151.16 | +0.2866 | +0.1212 | -0.8377 | +2.1697 | +2.9785 | +5.5396 | -3.7186 | +1.0408 | 148.54 | 147.26 | 148.07 | 59.79 | 0.9210 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3381 | -0.1716 | -0.1751 | +0.3629 | -1.2910 | -1.0395 | +0.8780 | +6.6292 | +2.5158 | 1.3474 | 1.3491 | 1.3194 | 44.28 | -0.0027 |

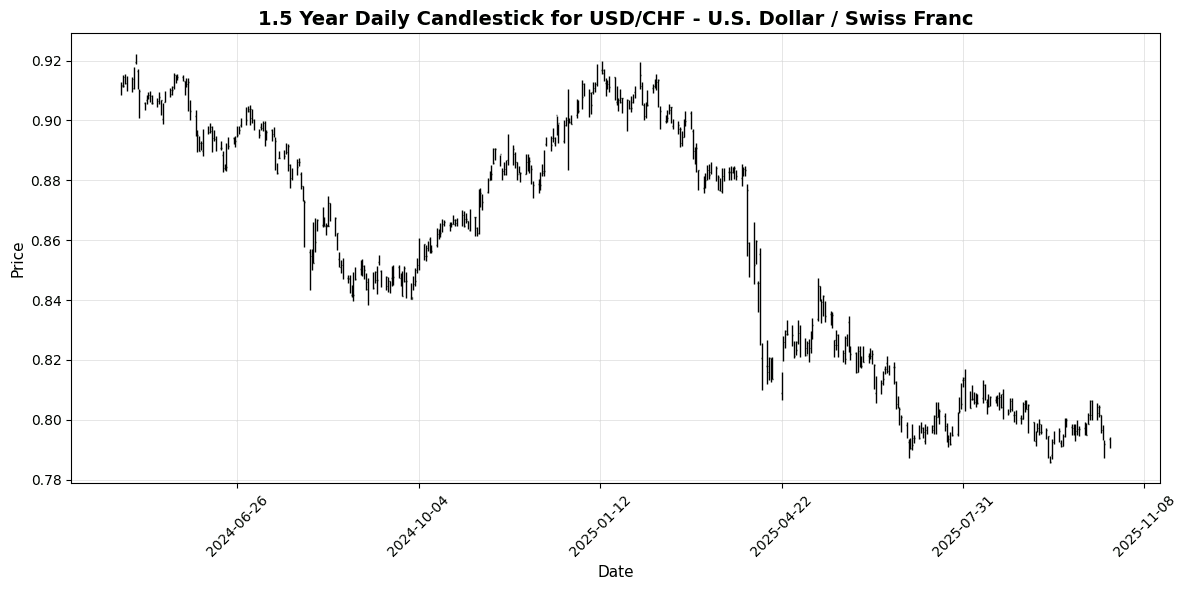

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7931 | +0.0883 | -0.4331 | -1.3913 | +0.0745 | -0.0668 | -4.4228 | -12.19 | -8.3047 | 0.7997 | 0.8026 | 0.8365 | 44.93 | -0.0003 |

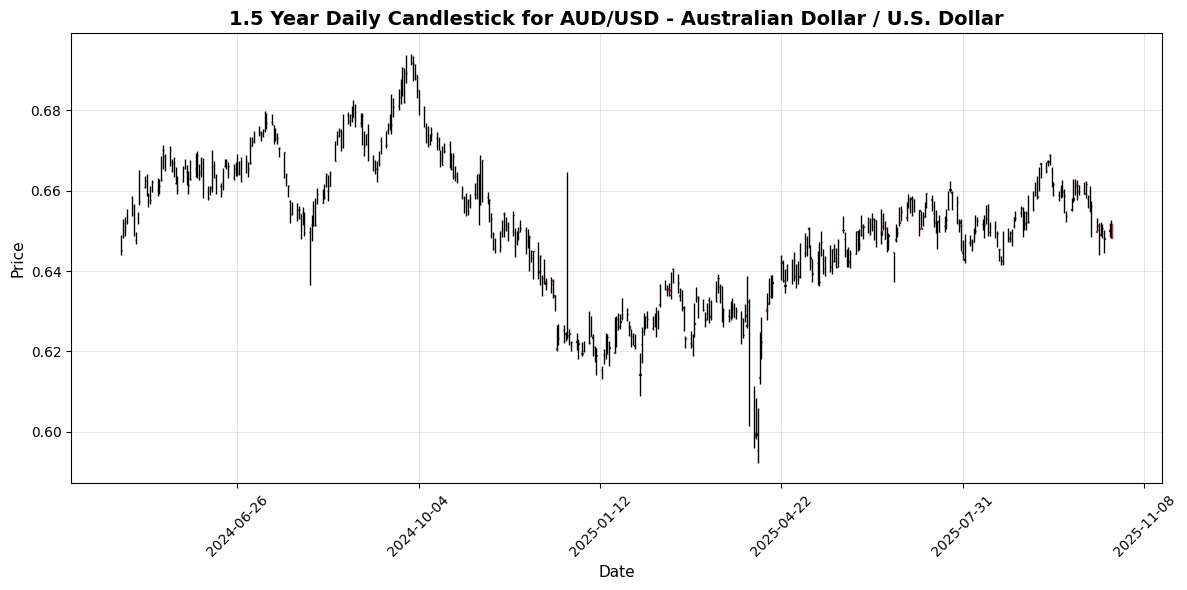

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6481 | -0.5677 | -0.4149 | -0.4699 | -2.0687 | -1.1246 | +1.8178 | +4.1961 | -3.5109 | 0.6554 | 0.6537 | 0.6428 | 27.86 | -0.0024 |

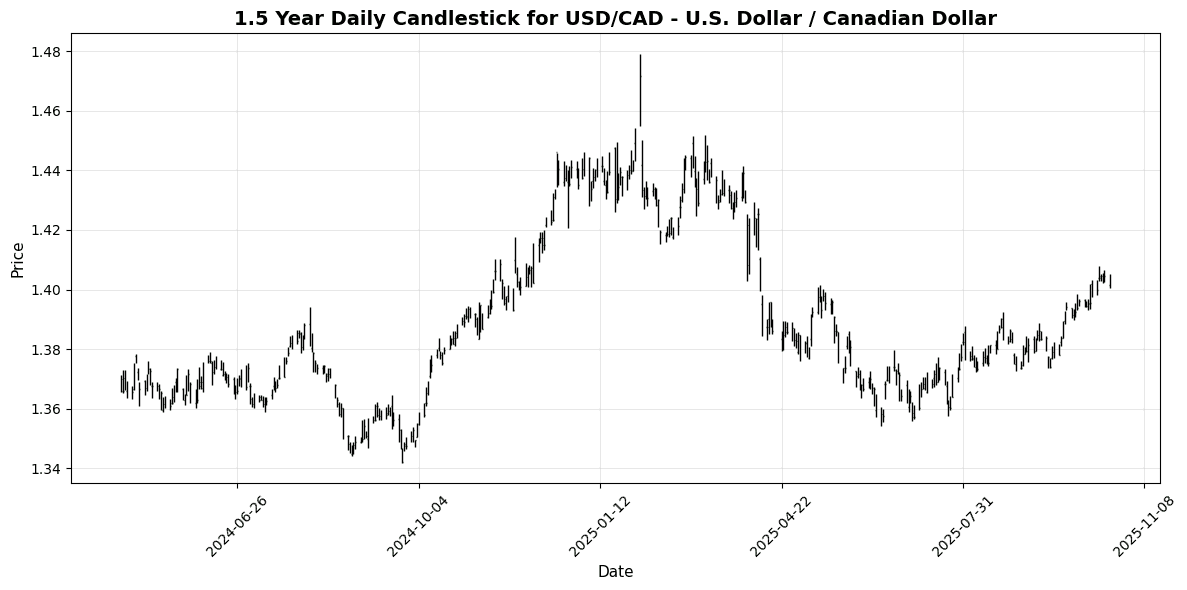

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4064 | +0.2638 | +0.1281 | +0.1781 | +1.9736 | +3.3791 | +1.3687 | -1.9917 | +1.9160 | 1.3867 | 1.3778 | 1.3973 | 70.90 | 0.0055 |

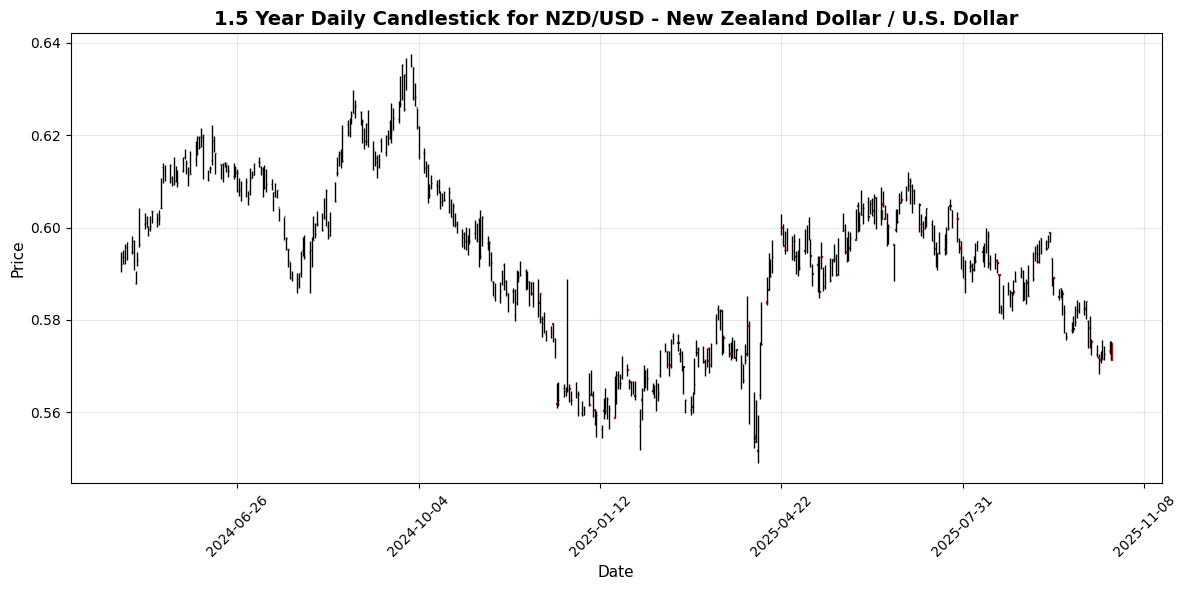

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5714 | -0.5915 | -0.0370 | -0.0610 | -3.0094 | -4.7682 | -4.0054 | +1.3172 | -5.9687 | 0.5852 | 0.5928 | 0.5850 | 30.54 | -0.0043 |

**Overview:**

The Majors FX group exhibits mixed signals today, with a general bearish sentiment in the Euro and commodity currencies, while the USD shows strength against the JPY and CAD. The overall trend suggests a cautious approach, especially in pairs with bearish momentum.

**Key Pairs:**

1. **EUR/USD:** Currently priced at 1.1627, the pair is experiencing bearish pressure with an RSI of 37.77 (neutral-bearish) and a negative MACD (-0.0022), indicating a lack of bullish momentum.

2. **USD/CAD:** Priced at 1.4064, this pair is showing strength with an RSI of 70.90 (overbought) and a positive MACD (0.0055), suggesting bullish momentum and potential for further gains.

3. **AUD/USD:** Trading at 0.6481, this pair is under significant selling pressure with an RSI of 27.86 (oversold) and a negative MACD (-0.0024), indicating a potential reversal point.

**Trading Implications:**

For EUR/USD, watch for support around 1.1600; resistance is seen at 1.1700. In USD/CAD, the overbought condition may lead

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8686 | 0.0000 | -0.0219 | +0.1268 | -0.1207 | +0.0530 | +1.7203 | +4.7528 | +4.3188 | 0.8677 | 0.8636 | 0.8523 | 38.86 | 0.0001 |

| EUR/JPY | EURJPY | 175.68 | +0.1117 | -0.0796 | -0.3585 | +0.7149 | +1.9582 | +8.2988 | +7.5239 | +8.0536 | 173.67 | 171.59 | 166.39 | 58.80 | 0.7582 |

| EUR/CHF | EURCHF | 0.9218 | -0.0759 | -0.6285 | -0.9009 | -1.3326 | -1.0541 | -1.9278 | -1.9257 | -1.9393 | 0.9350 | 0.9351 | 0.9386 | 15.00 | -0.0021 |

| EUR/AUD | EURAUD | 1.7938 | +0.4086 | +0.2392 | +0.9937 | +0.7006 | +0.1642 | +0.8070 | +7.2077 | +10.82 | 1.7839 | 1.7825 | 1.7491 | 54.80 | 0.0025 |

| GBP/JPY | GBPJPY | 202.24 | +0.1074 | -0.0618 | -0.4867 | +0.8412 | +1.8980 | +6.4574 | +2.6579 | +3.5764 | 200.14 | 198.67 | 195.16 | 60.94 | 0.8395 |

| GBP/CHF | GBPCHF | 1.0612 | -0.0847 | -0.6023 | -1.0287 | -1.2120 | -1.1062 | -3.5851 | -6.3661 | -5.9962 | 1.0775 | 1.0828 | 1.1015 | 38.67 | -0.0026 |

| AUD/JPY | AUDJPY | 97.94 | -0.2810 | -0.3054 | -1.3219 | +0.0347 | +1.8087 | +7.4504 | +0.3247 | -2.4832 | 97.38 | 96.31 | 95.13 | 50.54 | 0.2225 |

| AUD/NZD | AUDNZD | 1.1343 | +0.0353 | -0.3636 | -0.3986 | +1.0602 | +3.8391 | +6.0816 | +2.8662 | +2.6659 | 1.1192 | 1.1024 | 1.0988 | 44.90 | 0.0046 |

| CHF/JPY | CHFJPY | 190.57 | +0.1993 | +0.5678 | +0.5620 | +2.0857 | +3.0508 | +10.43 | +9.6527 | +10.19 | 185.73 | 183.47 | 177.29 | 69.46 | 1.2299 |

| NZD/JPY | NZDJPY | 86.34 | -0.3002 | +0.0695 | -0.9147 | -0.9181 | -1.9432 | +1.3012 | -2.4671 | -5.0061 | 86.96 | 87.30 | 86.56 | 54.91 | -0.1064 |

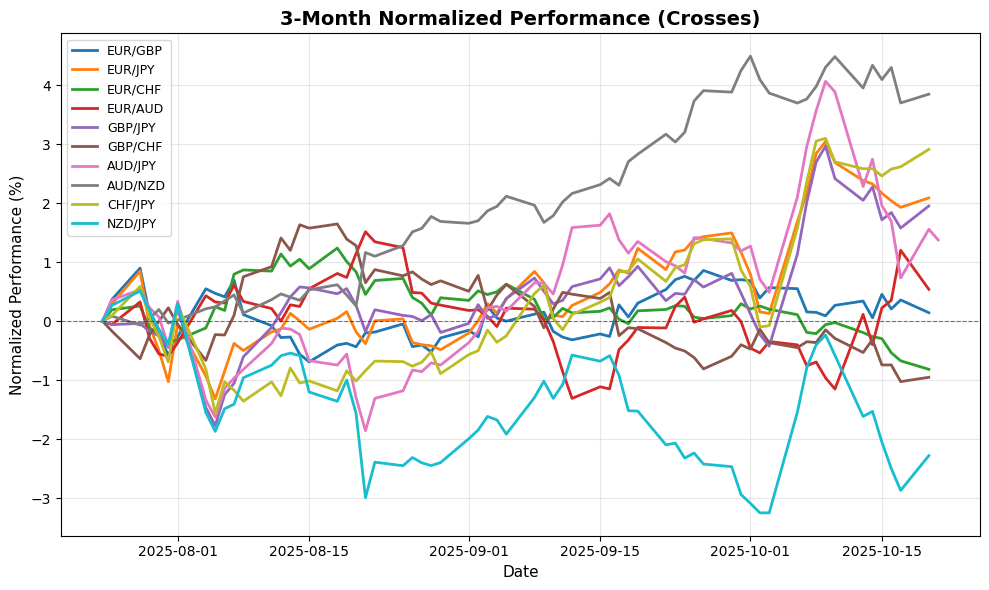

**Overview:** The Crosses FX group exhibits a mixed trend, with some pairs showing bullish momentum while others are leaning bearish. The overall sentiment is cautious, as several pairs are near neutral RSI levels.

**Key Pairs:**

1. **CHF/JPY:** Currently at 190.5720, it has an RSI of 69.46, indicating it is approaching overbought territory. The MACD at 1.2299 suggests strong bullish momentum.

2. **EUR/CHF:** Priced at 0.9218, this pair is in a bearish position with an RSI of 15.00, indicating oversold conditions, and a negative MACD of -0.0021, pointing to bearish momentum.

3. **GBP/JPY:** At 202.2350, it has an RSI of 60.94, indicating bullish sentiment, supported by a positive MACD of 0.8395.

**Trading Implications:** Watch for potential resistance at 191.00 for CHF/JPY and support around

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.88 | -0.0942 | +0.0784 | +0.1715 | +1.1759 | +3.5861 | +9.3988 | +18.63 | +22.20 | 41.36 | 40.69 | 39.00 | 86.35 | 0.1652 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.33 | +0.5735 | -0.0997 | +0.0431 | -0.0723 | -1.2712 | -7.1364 | -7.6584 | -1.4301 | 17.45 | 17.62 | 18.02 | 56.54 | -0.0285 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.75 | +0.7382 | +0.6763 | +0.4909 | +2.6968 | +1.7713 | -2.3845 | -4.0687 | -1.0275 | 32.27 | 32.38 | 33.02 | 70.15 | 0.1379 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.4240 | +0.0871 | -0.4841 | -0.8787 | +0.8592 | -0.9412 | -2.7260 | -14.51 | -10.43 | 9.4403 | 9.5084 | 9.8700 | 50.89 | 0.0098 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.08 | +0.3635 | -0.1851 | -0.0883 | +2.1099 | +0.0745 | -4.1697 | -11.04 | -7.7070 | 10.02 | 10.07 | 10.42 | 57.71 | 0.0276 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4257 | +0.2105 | +0.2030 | -0.4513 | +1.5001 | +1.0468 | -2.5094 | -10.34 | -6.3446 | 6.3843 | 6.4051 | 6.6487 | 59.46 | 0.0125 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.47 | +0.4175 | +0.0970 | +0.0796 | +0.5925 | -0.9168 | -5.8672 | -10.47 | -7.0240 | 18.53 | 18.68 | 19.40 | 50.35 | -0.0215 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6509 | +0.4264 | +0.0030 | -0.8613 | +1.0361 | +0.8284 | -3.4792 | -11.11 | -7.8003 | 3.6391 | 3.6529 | 3.7743 | 51.63 | 0.0052 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 335.00 | +0.3030 | -0.0468 | -1.0395 | +1.6670 | -1.3568 | -7.0461 | -15.19 | -9.0561 | 335.45 | 339.95 | 356.59 | 51.87 | 0.1813 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.92 | +0.3949 | +0.4706 | -0.4312 | +1.5680 | -0.1332 | -5.1415 | -13.39 | -9.8695 | 20.84 | 21.04 | 22.07 | 56.65 | 0.0212 |

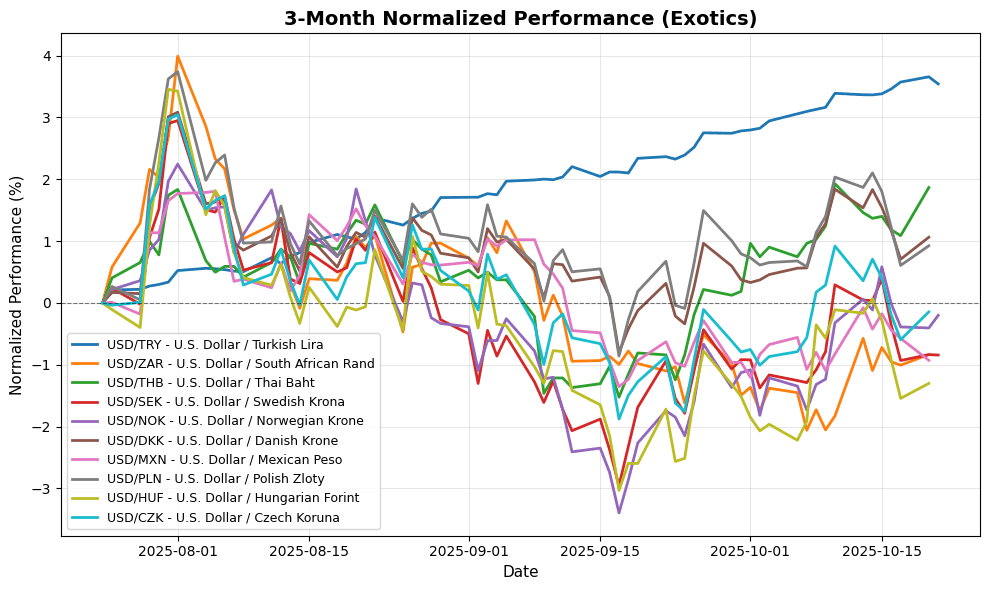

**Overview:**

The Exotic FX group shows mixed signals, with a general bullish trend in some pairs while others remain neutral. Notably, USD/TRY is significantly overbought, indicating potential for a correction.

**Key Pairs:**

1. **USD/TRY:** Price at 41.8840, RSI at 86.35 suggests extreme overbought conditions. MACD at 0.1652 indicates bullish momentum, but a pullback is likely due to overextension.

2. **USD/THB:** Price at 32.7500, RSI at 70.15 signals a near-overbought condition. MACD at 0.1379 shows bullish momentum, but caution is warranted as it approaches overbought territory.

3. **USD/ZAR:** Price at 17.3278, RSI at 56.54 is neutral-bullish. MACD at -0.0285 indicates bearish momentum, suggesting potential weakness.

**Trading Implications:**

For USD/TRY,

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.