Forex Update: Geopolitical Tensions Rise, AUD/USD Climbs 0.25%

📰 Forex and Global Market News

**Market Overview:**

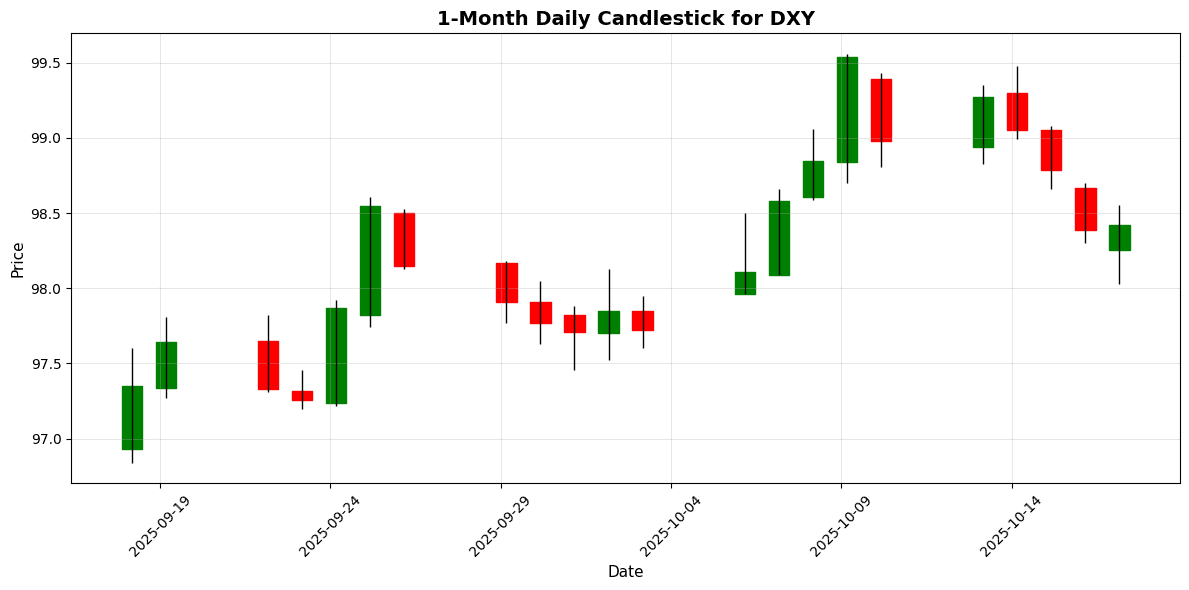

Today’s forex market exhibited notable movements, primarily driven by geopolitical tensions and central bank commentary. The US Dollar Index (DXY) rose to 98.42, up 0.25%, as traders reacted to a mixed bag of economic indicators and political developments.

**Key News Items:**

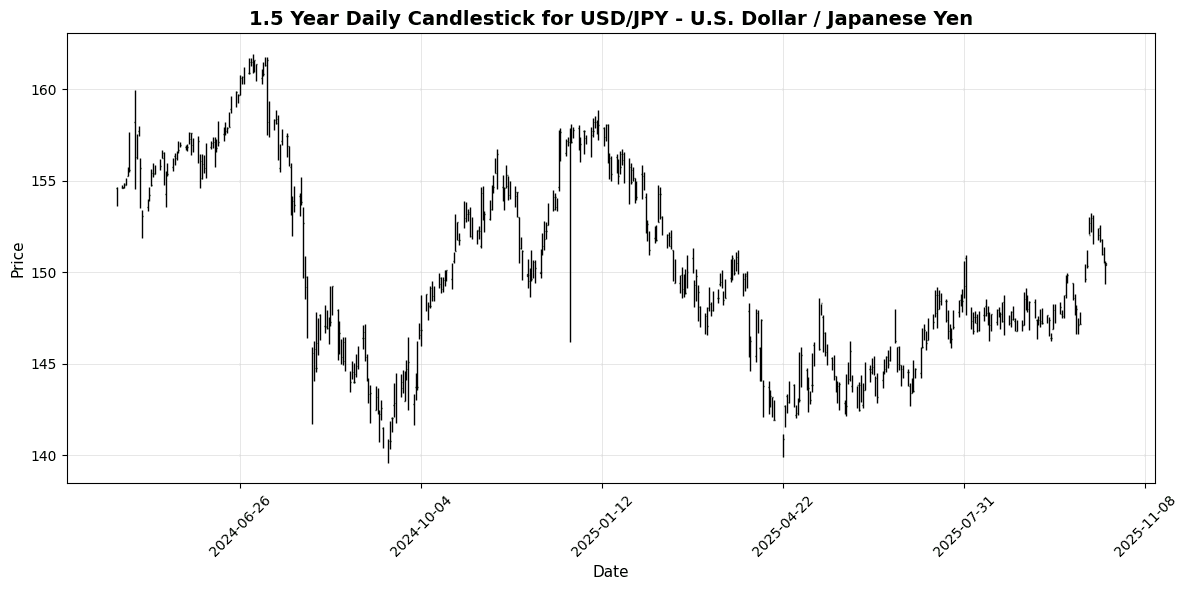

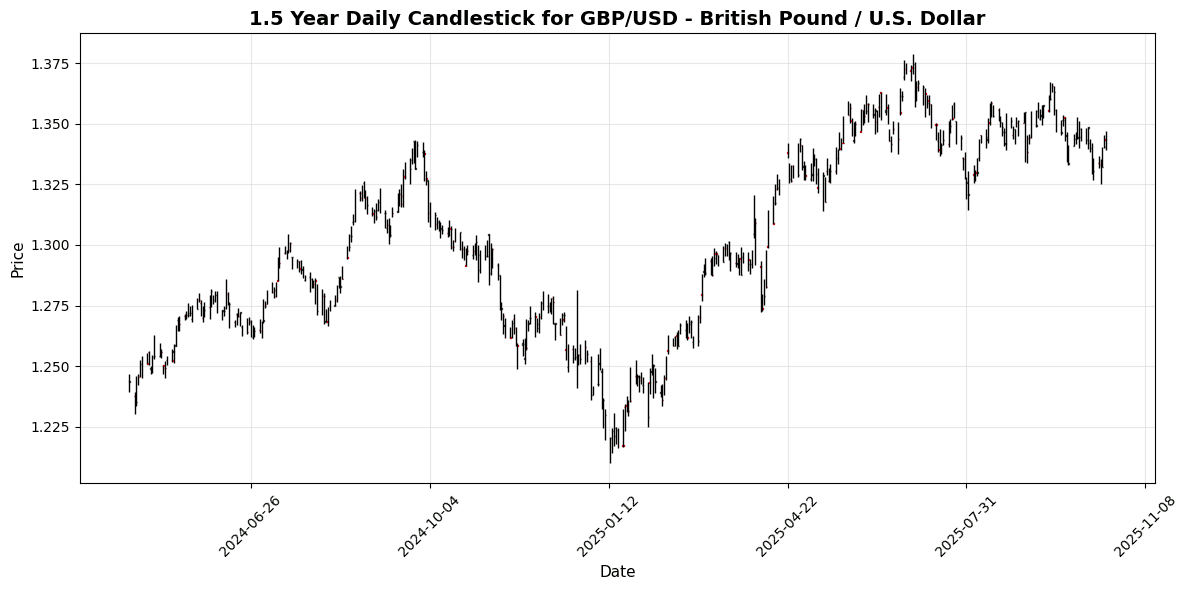

The USD strengthened against the JPY, with the USD/JPY pair rebounding after a dip to two-week lows, bolstered by President Trump’s softer stance on China, which increased demand for the dollar. Meanwhile, the GBP gained ground against the USD, with the pair approaching 1.3500 as buyers returned to the market. The EUR/GBP remained stable around 0.8700, supported by political stability in France despite ongoing fiscal challenges in the UK.

Central bank discussions also influenced sentiment; BoE member Megan Greene indicated that while the rate-cutting cycle is not over, it should not be a quarterly occurrence. This comes as the market anticipates upcoming US CPI data and the potential impact of US-China trade talks.

Geopolitical tensions persist, particularly regarding the Russia-Ukraine conflict, which continues to weigh on market sentiment. Commodity prices saw fluctuations, with oil prices reacting to these geopolitical uncertainties, while gold remained a safe haven amid the volatility.

**Closing:**

Overall, the forex market remains sensitive to geopolitical developments and economic data, with the DXY reflecting a cautious optimism amid mixed signals.

📅 Economic Calendar Events Today

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-17 | 02:45 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-10-17 | 02:45 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-17 | 05:00 | 🇪🇺 | Medium | Core CPI (YoY) (Sep) | 2.4% | 2.3% |

| 2025-10-17 | 05:00 | 🇪🇺 | Medium | CPI (MoM) (Sep) | 0.1% | 0.1% |

| 2025-10-17 | 05:00 | 🇪🇺 | High | CPI (YoY) (Sep) | 2.2% | 2.2% |

| 2025-10-17 | 05:35 | 🇬🇧 | Medium | BoE MPC Member Pill Speaks | ||

| 2025-10-17 | 08:30 | 🇨🇦 | Medium | Foreign Securities Purchases (Aug) | 25.92B | 11.61B |

| 2025-10-17 | 08:45 | 🇪🇺 | Medium | German Buba Mauderer Speaks | ||

| 2025-10-17 | 08:45 | 🇪🇺 | Medium | German Buba President Nagel Speaks | ||

| 2025-10-17 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Oil Rig Count | 418 | 417 |

| 2025-10-17 | 13:00 | 🇺🇸 | Medium | U.S. Baker Hughes Total Rig Count | 548 | |

| 2025-10-17 | 16:00 | 🇺🇸 | Medium | TIC Net Long-Term Transactions (Aug) |

**Overview:**

Today’s economic calendar features several key events that could significantly impact forex markets, particularly focusing on inflation data from the Eurozone and foreign securities purchases from Canada. With a total of 10 events scheduled, traders should pay close attention to the high-impact releases.

**Key Releases:**

1. **Eurozone Inflation Data (CPI YoY, Sep)**: Actual: 2.2%, Forecast: 2.2% – In line with expectations, indicating stable inflation.

2. **Core CPI (YoY, Sep)**: Actual: 2.4%, Forecast: 2.3% – A positive surprise, suggesting underlying inflation pressures are stronger than anticipated.

3. **CPI (MoM, Sep)**: Actual: 0.1%, Forecast: 0.1% – Confirmed expectations, showing minimal month-over-month inflation changes.

4. **Canada Foreign Securities Purchases (Aug)**: Actual: 25.92B, Forecast: 11.61B – A significant positive surprise indicating strong foreign interest in Canadian assets.

**FX Impact:**

The Euro (EUR) is likely to experience volatility due to the mixed inflation data, particularly the stronger core CPI, which may support the EUR against other currencies. The Canadian Dollar (CAD) could strengthen significantly due to the robust foreign securities purchases, impacting pairs like CAD/USD and CAD/JPY. Overall, traders should watch for potential movements in EUR/USD and CAD/USD as market expectations adjust.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

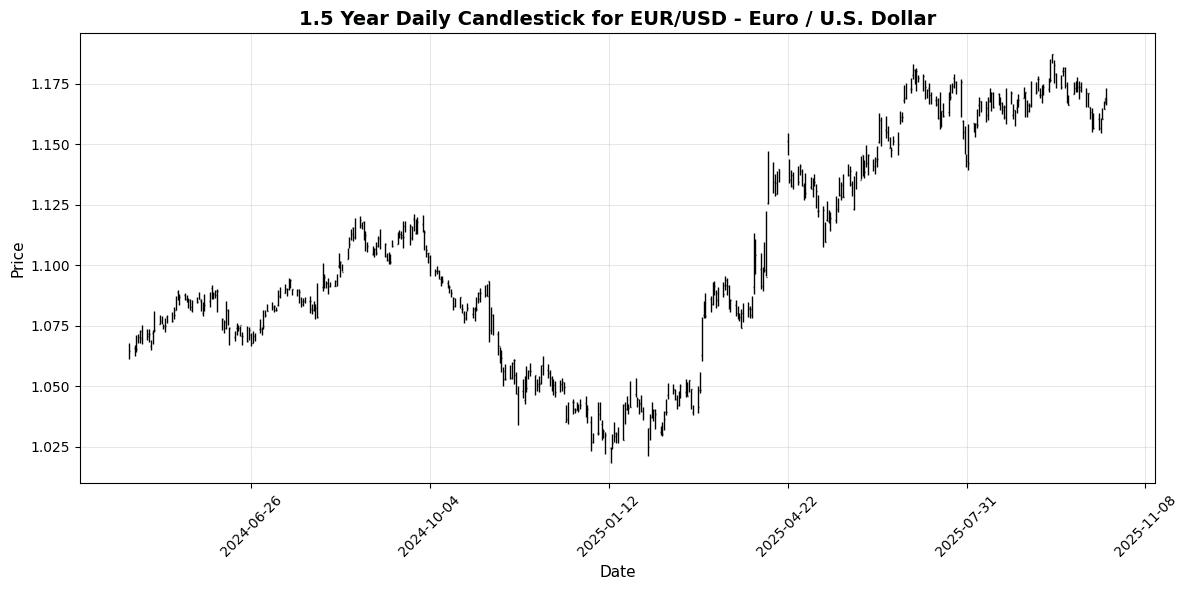

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1671 | -0.2223 | +0.9040 | +0.9040 | -1.6882 | +0.4780 | +2.4060 | +12.15 | +7.4432 | 1.1692 | 1.1649 | 1.1239 | 45.05 | -0.0025 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 150.49 | +0.1584 | -1.6180 | -1.6180 | +2.7846 | +1.3797 | +6.0326 | -4.1434 | +0.6111 | 148.48 | 147.19 | 148.11 | 54.71 | 1.0138 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3434 | -0.0298 | +0.9699 | +0.9699 | -1.6107 | +0.0108 | +1.5113 | +7.0515 | +3.4163 | 1.3475 | 1.3493 | 1.3183 | 52.50 | -0.0032 |

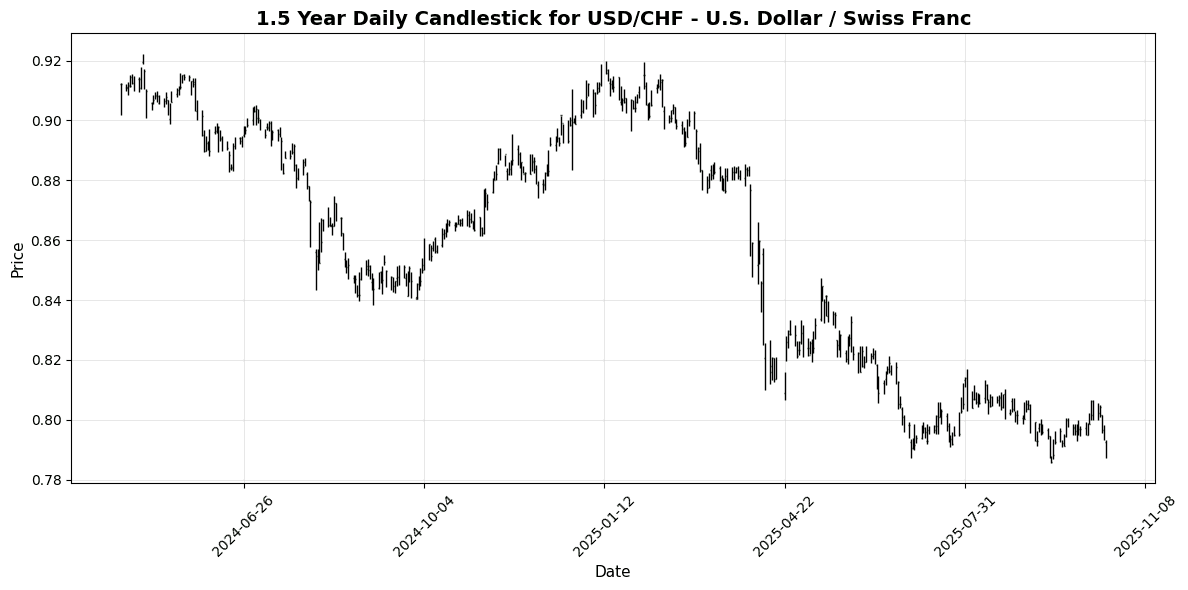

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7925 | +0.0252 | -1.6957 | -1.6957 | +0.8385 | -1.2928 | -2.6114 | -12.26 | -8.4133 | 0.8000 | 0.8029 | 0.8371 | 42.55 | 0.0001 |

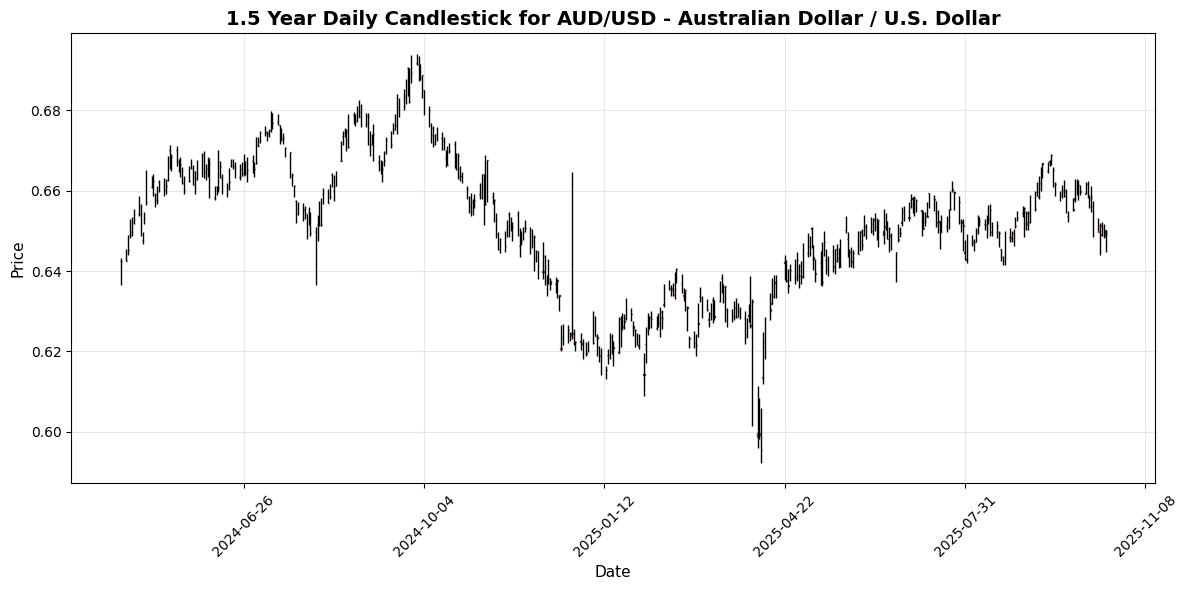

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6503 | +0.2466 | -0.8884 | -0.8884 | -2.7807 | +0.0740 | +2.0399 | +4.5498 | -2.4290 | 0.6555 | 0.6537 | 0.6426 | 41.13 | -0.0018 |

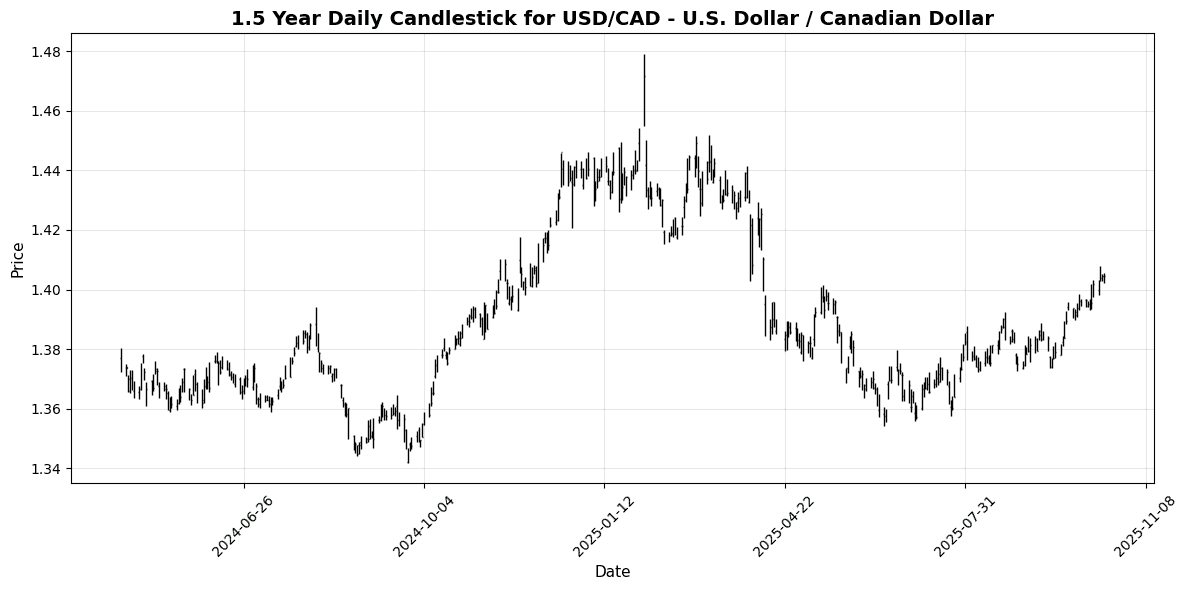

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4014 | -0.2349 | -0.0342 | -0.0342 | +2.0031 | +2.0246 | +1.1133 | -2.3401 | +1.8830 | 1.3856 | 1.3773 | 1.3976 | 72.51 | 0.0057 |

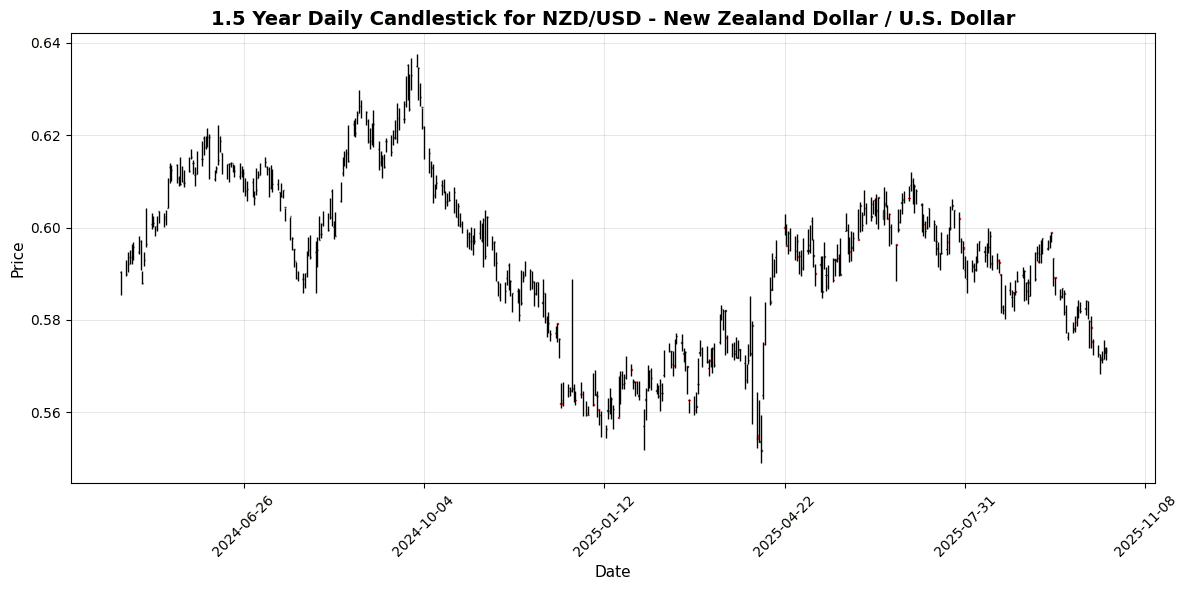

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5739 | +0.2095 | -0.2418 | -0.2418 | -4.1807 | -3.4540 | -3.3087 | +1.7605 | -5.2767 | 0.5861 | 0.5933 | 0.5849 | 40.95 | -0.0043 |

**Overview:**

The Majors FX group exhibits a mixed trend today, with the U.S. Dollar showing slight strength against several currencies. However, the presence of overbought conditions in some pairs suggests potential for a reversal.

**Key Pairs:**

1. **USD/CAD:** Currently at 1.4014, this pair is in overbought territory with an RSI of 72.51 and a positive MACD of 0.0057, indicating strong bullish momentum. Traders should watch for potential resistance around 1.4050.

2. **EUR/USD:** Priced at 1.1671, this pair is neutral-bearish with an RSI of 45.05 and a negative MACD of -0.0025. A break below support at 1.1650 could signal further downside.

3. **USD/JPY:** At 150.4900, this pair shows a neutral-bullish stance with an RSI of 54.71 and a robust MACD of 1.0138, suggesting continued upward momentum. Key support is at 150.2500.

**Trading Implications:**

Traders should monitor USD/CAD for potential profit-taking due to overbought conditions. EUR/USD may present short opportunities if

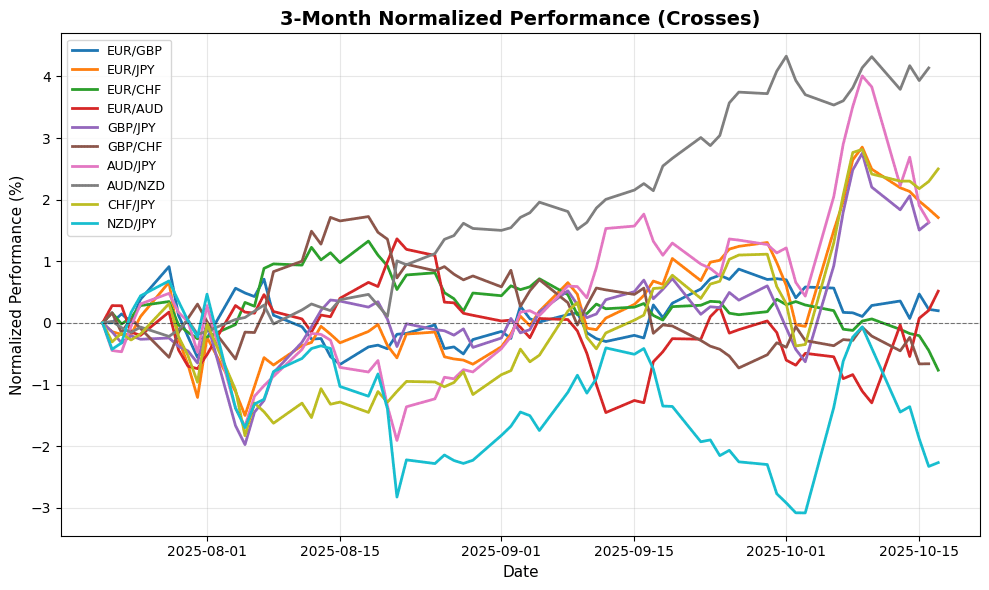

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8686 | -0.1953 | -0.0840 | -0.0840 | -0.0932 | +0.4510 | +0.8710 | +4.7528 | +3.9207 | 0.8676 | 0.8633 | 0.8522 | 38.35 | 0.0002 |

| EUR/JPY | EURJPY | 175.58 | -0.0763 | -0.7653 | -0.7653 | +1.0253 | +1.8380 | +8.5763 | +7.4645 | +8.1030 | 173.59 | 171.46 | 166.33 | 53.73 | 0.7992 |

| EUR/CHF | EURCHF | 0.9246 | -0.1943 | -0.8355 | -0.8355 | -0.8918 | -0.8525 | -0.3019 | -1.6278 | -1.6111 | 0.9353 | 0.9352 | 0.9387 | 24.05 | -0.0019 |

| EUR/AUD | EURAUD | 1.7951 | -0.3663 | +1.8369 | +1.8369 | +1.1535 | +0.4302 | +0.3421 | +7.2854 | +10.18 | 1.7836 | 1.7821 | 1.7484 | 55.16 | 0.0011 |

| GBP/JPY | GBPJPY | 202.13 | +0.1169 | -0.6752 | -0.6752 | +1.1166 | +1.3793 | +7.6454 | +2.6046 | +4.0491 | 199.97 | 198.51 | 195.10 | 59.44 | 0.9470 |

| GBP/CHF | GBPCHF | 1.0645 | 0.0000 | -0.7422 | -0.7422 | -0.7875 | -1.2889 | -1.1496 | -6.0749 | -5.2987 | 1.0783 | 1.0837 | 1.1021 | 51.37 | -0.0021 |

| AUD/JPY | AUDJPY | 97.81 | +0.3694 | -2.5410 | -2.5410 | -0.1317 | +1.4049 | +8.1938 | +0.1864 | -1.8820 | 97.28 | 96.15 | 95.13 | 51.88 | 0.5048 |

| AUD/NZD | AUDNZD | 1.1328 | +0.0442 | -0.6699 | -0.6699 | +1.4454 | +3.6309 | +5.5614 | +2.7301 | +2.9847 | 1.1176 | 1.1013 | 1.0985 | 55.49 | 0.0059 |

| CHF/JPY | CHFJPY | 189.87 | +0.1276 | +0.0812 | +0.0812 | +1.9299 | +2.7147 | +8.9133 | +9.2511 | +9.8861 | 185.59 | 183.32 | 177.21 | 62.28 | 1.2415 |

| NZD/JPY | NZDJPY | 86.33 | +0.3440 | -1.8653 | -1.8653 | -1.5317 | -2.1323 | +2.5332 | -2.4728 | -4.7075 | 87.00 | 87.29 | 86.57 | 50.25 | -0.0546 |

**Overview:** The Crosses FX group exhibits a mixed trend, with some pairs showing bullish momentum while others remain under bearish pressure. Overall, the market sentiment leans slightly bearish, particularly for pairs with low RSI values.

**Key Pairs:**

1. **EUR/CHF:** Currently at 0.9246, it shows a significant bearish signal with an RSI of 24.05, indicating oversold conditions. The MACD is negative (-0.0019), confirming bearish momentum.

2. **GBP/JPY:** Priced at 202.1300, this pair is in a bullish phase with an RSI of 59.44 and a positive MACD (0.9470), suggesting potential upward movement.

3. **CHF/JPY:** At 189.8740, it shows strong bullish momentum with an RSI of 62.28 and a MACD of 1.2415, indicating a robust upward trend.

**Trading Implications:** Watch for resistance at 0.9300 for EUR/CHF,

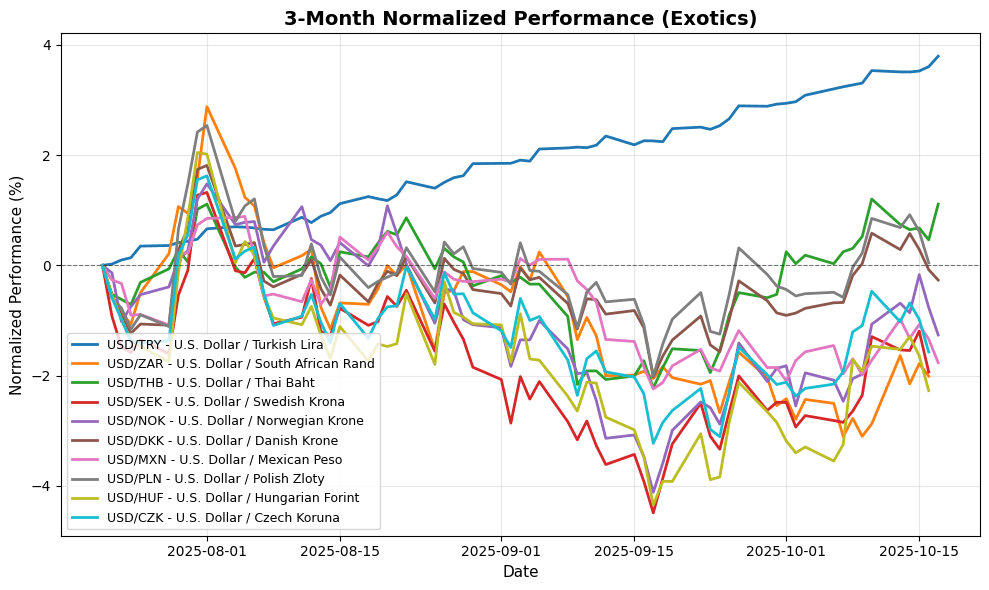

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.93 | +0.2532 | +0.2528 | +0.2528 | +1.5031 | +3.9473 | +9.9226 | +18.76 | +22.72 | 41.31 | 40.63 | 38.94 | 97.37 | 0.1707 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.35 | +0.2010 | +0.9288 | +0.9288 | +0.0792 | -2.5301 | -7.6088 | -7.5332 | -1.5998 | 17.46 | 17.63 | 18.03 | 46.21 | -0.0417 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.74 | +0.7385 | -0.0915 | -0.0915 | +3.4112 | +0.8315 | -1.0278 | -4.0980 | -1.3172 | 32.26 | 32.38 | 33.03 | 71.32 | 0.1454 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.4205 | +0.0053 | -1.1689 | -1.1689 | +2.1409 | -3.1431 | -3.4009 | -14.54 | -10.33 | 9.4501 | 9.5121 | 9.8957 | 50.79 | 0.0212 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.05 | -0.1392 | -0.1968 | -0.1968 | +2.9778 | -2.2923 | -4.9129 | -11.32 | -7.9473 | 10.03 | 10.07 | 10.43 | 57.18 | 0.0268 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4006 | +0.2333 | -0.8460 | -0.8460 | +1.7933 | -0.3753 | -2.3110 | -10.69 | -6.8387 | 6.3846 | 6.4069 | 6.6530 | 55.90 | 0.0149 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.38 | -0.2583 | -0.0208 | -0.0208 | +0.5130 | -1.9892 | -7.7112 | -10.92 | -7.6342 | 18.53 | 18.69 | 19.41 | 51.04 | -0.0218 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6330 | +0.0716 | -1.2817 | -1.2817 | +1.5996 | -0.8041 | -3.1812 | -11.54 | -8.1404 | 3.6394 | 3.6551 | 3.7793 | 46.37 | 0.0093 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 333.55 | +0.1258 | -1.2947 | -1.2947 | +1.6797 | -2.8879 | -6.7011 | -15.56 | -9.6797 | 335.69 | 340.38 | 357.27 | 48.62 | 0.5364 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.81 | +0.3147 | -1.1497 | -1.1497 | +1.6685 | -1.7577 | -5.0718 | -13.84 | -10.51 | 20.84 | 21.06 | 22.11 | 49.05 | 0.0360 |

**Overview:** The Exotics FX group shows a mixed trend, with notable bullish momentum in USD/TRY and USD/THB, while USD/ZAR remains neutral-bearish.

**Key Pairs:**

1. **USD/TRY:** Currently at 41.9282, this pair is significantly overbought with an RSI of 97.37, indicating potential for a correction. The positive MACD of 0.1707 suggests bullish momentum but caution is warranted due to extreme RSI levels.

2. **USD/THB:** Priced at 32.7400, it has an RSI of 71.32, also in overbought territory, with a positive MACD of 0.1454, indicating sustained bullish momentum. Watch for potential resistance around 33.00.

3. **USD/ZAR:** Trading at 17.3513, this pair has an RSI of 46.21 and a negative MACD of -0.0417, indicating bearish momentum. A break below 17

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.