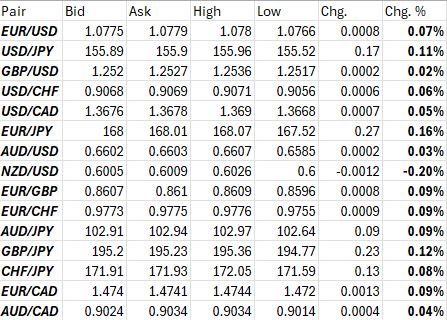

The Forex market summary for Monday, May 13, 2024, shows a mix of minor fluctuations and modest gains across several currency pairs. Here’s a breakdown of the session:

EUR/USD saw a slight increase, closing with a change of +0.07%, reflecting a small bullish sentiment. USD/JPY also saw gains, increasing by 0.11%. GBP/USD had a minimal change, showing an increase of only 0.02%. USD/CHF and USD/CAD both saw slight increases of 0.06% and 0.05% respectively. EUR/JPY was one of the stronger performers with a +0.16% change. AUD/USD and EUR/GBP experienced very slight gains. NZD/USD declined by -0.20%, marking it as one of the few pairs with a notable decrease.

Overall, the session displayed typical fluctuations with most currencies showing slight gains against their counterparts, except for the NZD/USD which recorded a notable decrease. The market behavior was generally stable with no extreme volatilities observed.

From a technical perspective, the US dollar is positioned in a quite interesting settings against the EURO , the British Pound and the Australian dollar. EUR/USD is testing its 200 day SMA in a intermediate bearish channel. For a more robust bullish setup the pair will need to make a breakout of the higher side of the channel, which is 30 pips away at the moment.

GBP/USD is also facing a multiple resistance: the 200 day SMA and the 38.2% Fibonacci retracement from its 2024 high.

AUD/USD is close to test a multiple static resistance in area 0.6665, 60 pips away from current quotes.

USD/JPY , after the BOJ bought less bonds than expected, potentially signalling the narrowing gap between US and Japanese yields, , is still trading in a close range in the most recent sessions after the volatility spikes of the latest two weeks. From an intermediate time horizon perspective, the pair will have to break above its recent highs to trigger another bullish wave while a retracement below 147.8 would likely to be considered a shift from bullish to bearish.