Forex Update: UK Inflation Data Looms, GBP/USD Declines 0.32% Amid Tensions

📰 Forex and Global Market News

**Market Overview:**

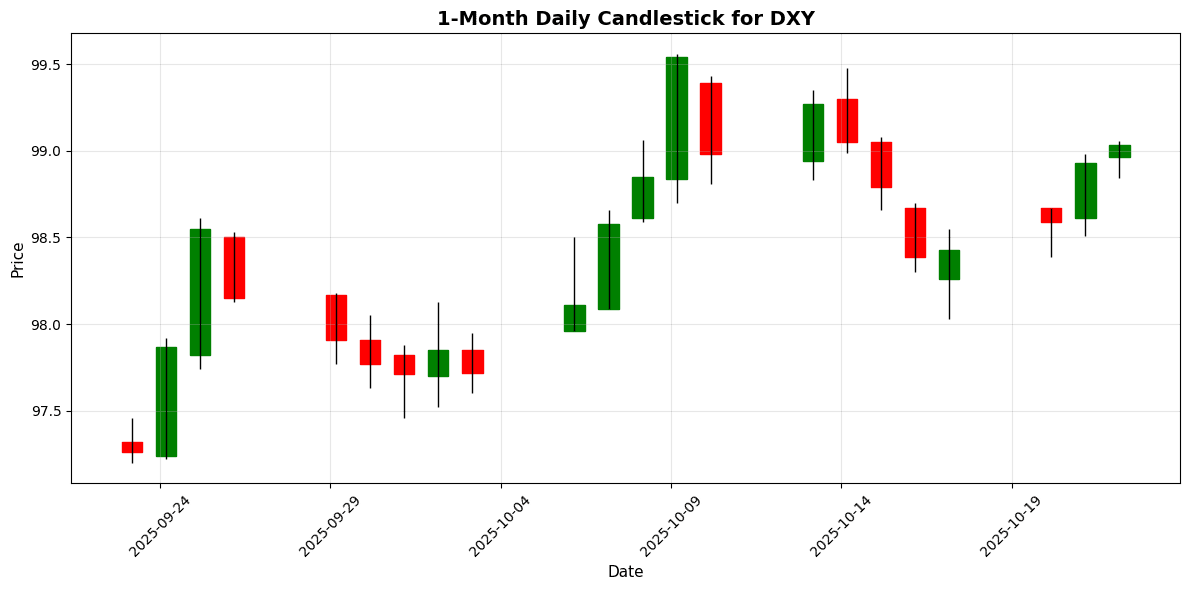

Today’s forex market exhibited mixed movements amid geopolitical tensions and upcoming economic data releases. The U.S. Dollar Index (DXY) is currently at 99.04, reflecting a modest increase of 0.1345%. Market participants are keenly awaiting the September CPI report, which is expected to influence central bank policies.

**Key Currency Movements:**

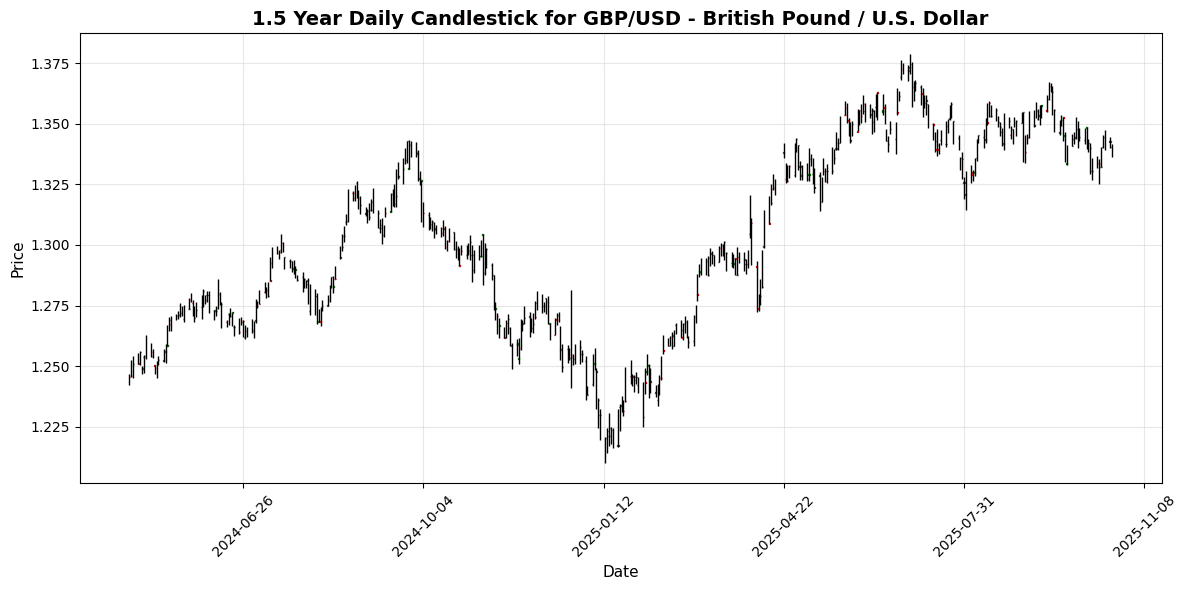

The Australian Dollar (AUD) gained traction, rising slightly above 0.6500, driven by a risk-on sentiment. In contrast, the Euro (EUR) is testing support at 1.160, with analysts expressing uncertainty about further dollar strength without fresh data. The New Zealand Dollar (NZD) rebounded above 0.5750, recovering from earlier losses as the dollar rally falters. The British Pound (GBP) remains under pressure as the Bank of England weighs potential rate cuts following stagnant inflation at 3.8%.

**Central Bank Insights:**

Japan’s Prime Minister Sanae Takaichi hinted at increasing defense spending targets, which could impact fiscal policy and the Yen (JPY).

**Geopolitical Events:**

Tensions in the Middle East and trade negotiations between India and the U.S. are contributing to market uncertainty.

**Commodity Impact:**

Gold prices are attempting a recovery above $4,100 after a recent sell-off, as investors await updates on U.S.-China trade relations.

Overall, the forex market remains cautious ahead of critical economic indicators and geopolitical developments

📅 Economic Calendar Events Today

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-22 | 02:00 | 🇬🇧 | Medium | CPI (MoM) (Sep) | 0.0% | |

| 2025-10-22 | 02:00 | 🇬🇧 | High | CPI (YoY) (Sep) | 3.8% | 4.0% |

| 2025-10-22 | 02:00 | 🇬🇧 | Medium | CPIH (YoY) | 4.1% | |

| 2025-10-22 | 02:00 | 🇬🇧 | Medium | PPI Input (MoM) (Sep) | -0.1% | 0.3% |

| 2025-10-22 | 07:00 | 🇪🇺 | Medium | ECB’s De Guindos Speaks | ||

| 2025-10-22 | 08:25 | 🇪🇺 | Medium | ECB President Lagarde Speaks | ||

| 2025-10-22 | 10:30 | 🇺🇸 | High | Crude Oil Inventories | 2.200M | |

| 2025-10-22 | 10:30 | 🇺🇸 | Medium | Cushing Crude Oil Inventories | ||

| 2025-10-22 | 11:00 | 🇪🇺 | Medium | German Buba Vice President Buch Speaks | ||

| 2025-10-22 | 13:00 | 🇺🇸 | Medium | 20-Year Bond Auction | ||

| 2025-10-22 | 16:00 | 🇬🇧 | Medium | BoE Deputy Governor Woods Speaks | ||

| 2025-10-22 | 16:00 | 🇺🇸 | Medium | Fed Vice Chair for Supervision Barr Speaks |

**Overview:**

Today’s economic calendar features several key events that are crucial for forex traders, particularly focusing on UK inflation data and central bank speeches. The most significant releases are from the GBP, with potential implications for the currency pairs involving the British Pound.

**Key Releases:**

1. **CPI (MoM) (Sep) – GBP**: Actual: 0.0%, Forecast: N/A

2. **CPI (YoY) (Sep) – GBP**: Actual: 3.8%, Forecast: 4.0% (surprise to the downside)

3. **CPIH (YoY) – GBP**: Actual: 4.1%, Forecast: N/A

4. **PPI Input (MoM) (Sep) – GBP**: Actual: -0.1%, Forecast: 0.3% (another downside surprise)

The CPI YoY figure falling below expectations may signal easing inflation pressures, which could influence the Bank of England’s monetary policy outlook.

**FX Impact:**

The GBP is likely to experience volatility following these releases, particularly against the USD and EUR. A weaker inflation reading may lead to a bearish sentiment towards GBP, potentially impacting pairs like GBP/USD and EUR/GBP. Traders should monitor the reactions closely, especially in light of upcoming speeches from ECB and BoE officials, which could further shape market expectations regarding interest rates and economic outlook.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

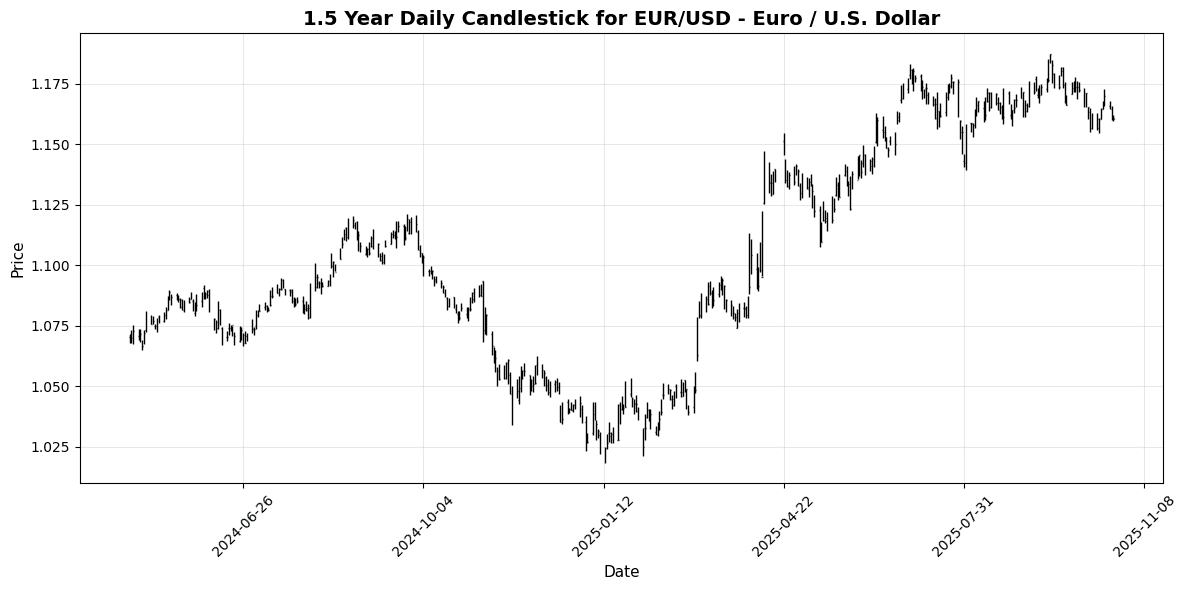

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1604 | 0.0000 | -0.8171 | +0.0149 | -1.1328 | -1.4461 | +2.0409 | +11.51 | +7.2674 | 1.1692 | 1.1657 | 1.1260 | 36.06 | -0.0023 |

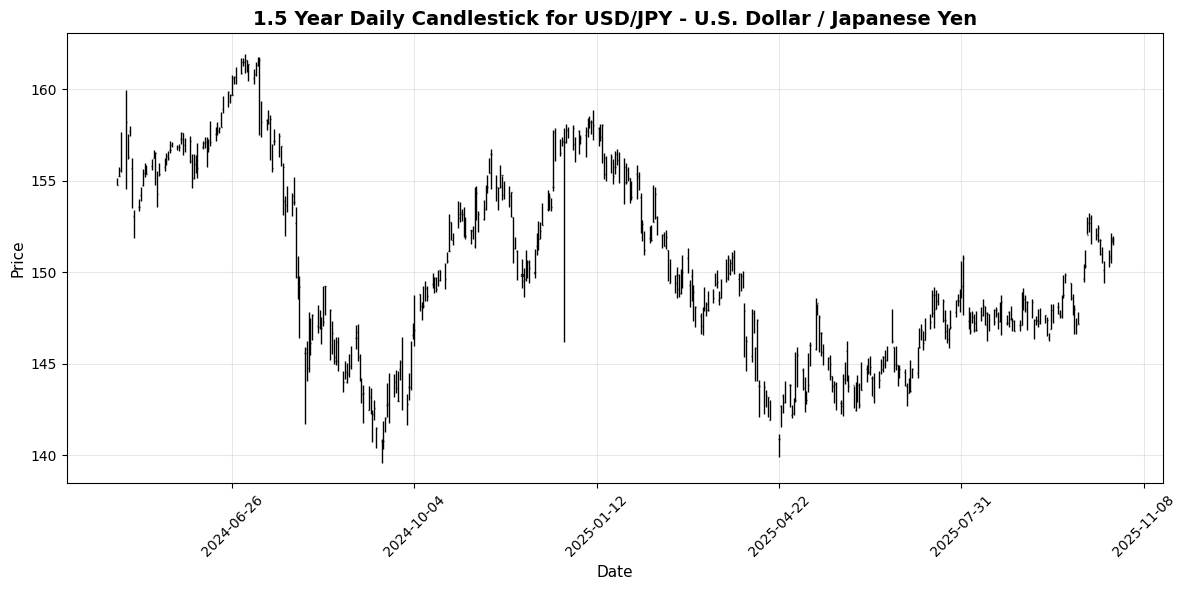

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 151.65 | -0.1843 | +1.0199 | -0.0527 | +2.4012 | +3.6228 | +6.1395 | -3.4039 | +0.6945 | 148.67 | 147.42 | 148.00 | 70.27 | 0.8555 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3325 | -0.3217 | -0.8966 | +0.0254 | -1.0379 | -1.8747 | -0.0092 | +6.1829 | +2.6345 | 1.3475 | 1.3491 | 1.3194 | 46.36 | -0.0025 |

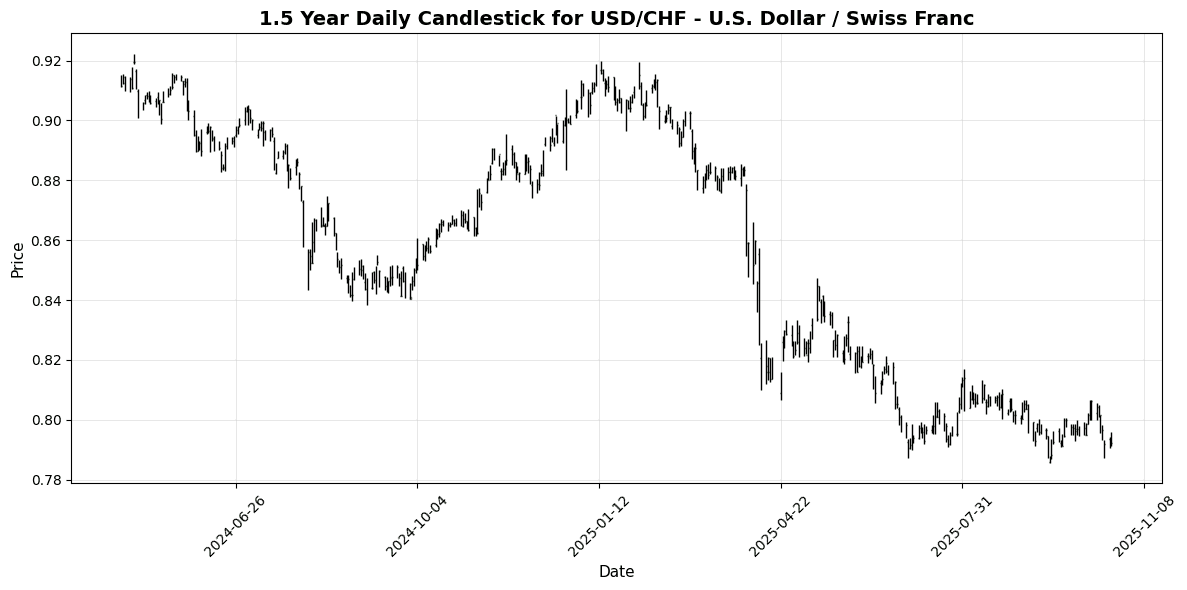

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.7959 | -0.0753 | +0.5140 | -0.7024 | -0.0414 | +0.4865 | -3.9626 | -11.88 | -8.0320 | 0.7993 | 0.8024 | 0.8359 | 44.69 | -0.0007 |

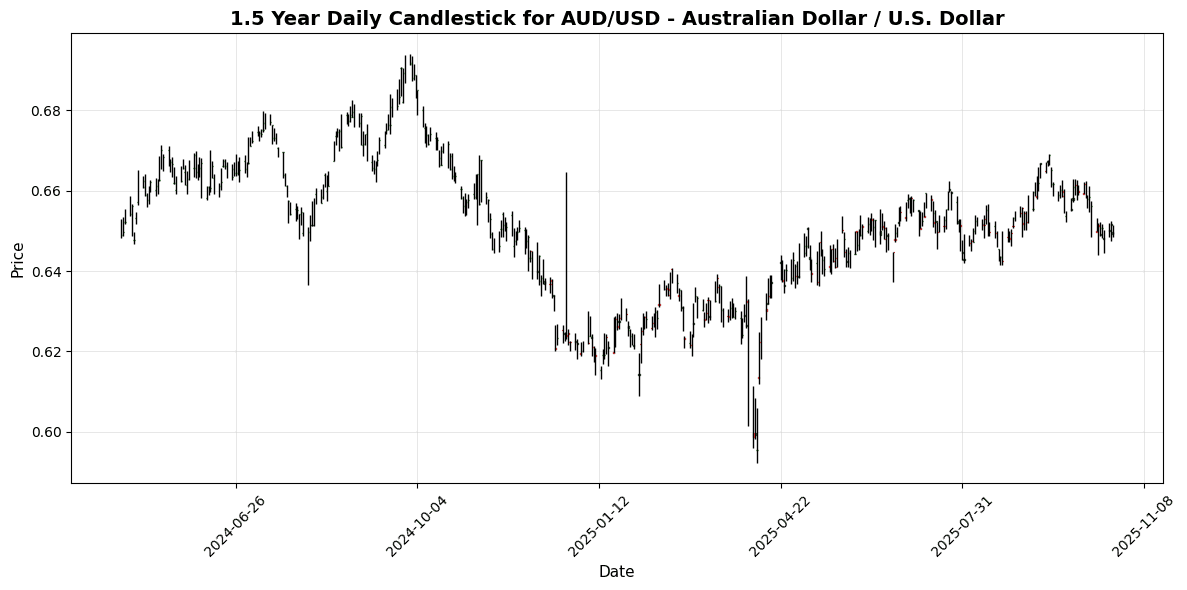

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6499 | +0.0924 | +0.2561 | +0.1186 | -1.3705 | -1.5899 | +1.4916 | +4.4855 | -2.3161 | 0.6554 | 0.6538 | 0.6430 | 30.47 | -0.0022 |

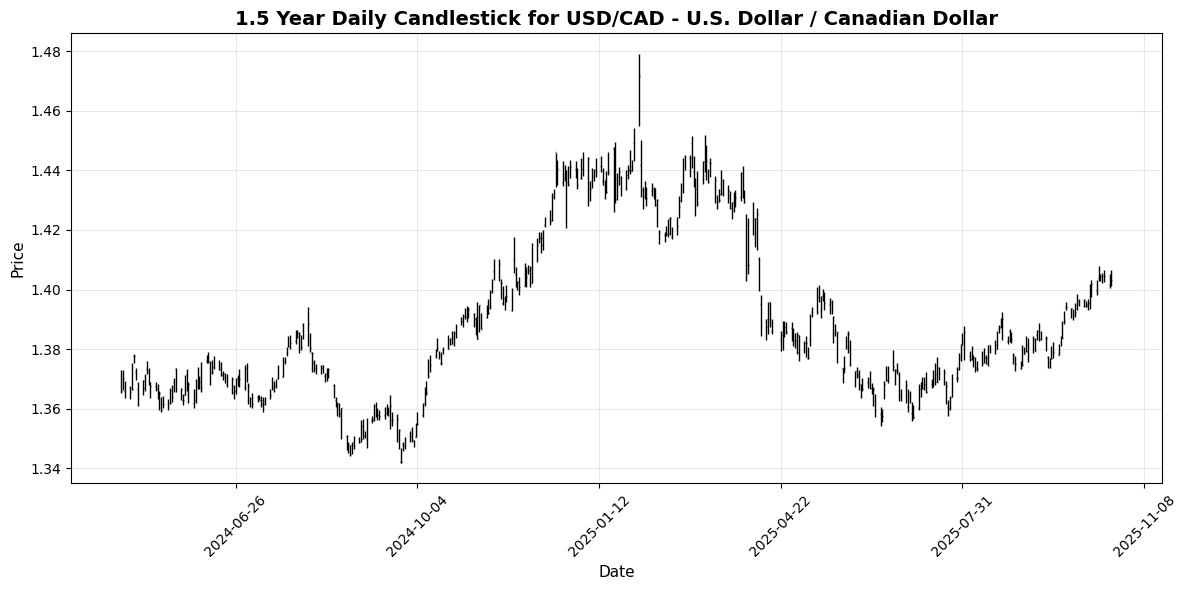

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4007 | -0.0999 | -0.2777 | -0.2706 | +1.6326 | +2.9813 | +1.0752 | -2.3889 | +1.2542 | 1.3873 | 1.3781 | 1.3971 | 72.05 | 0.0053 |

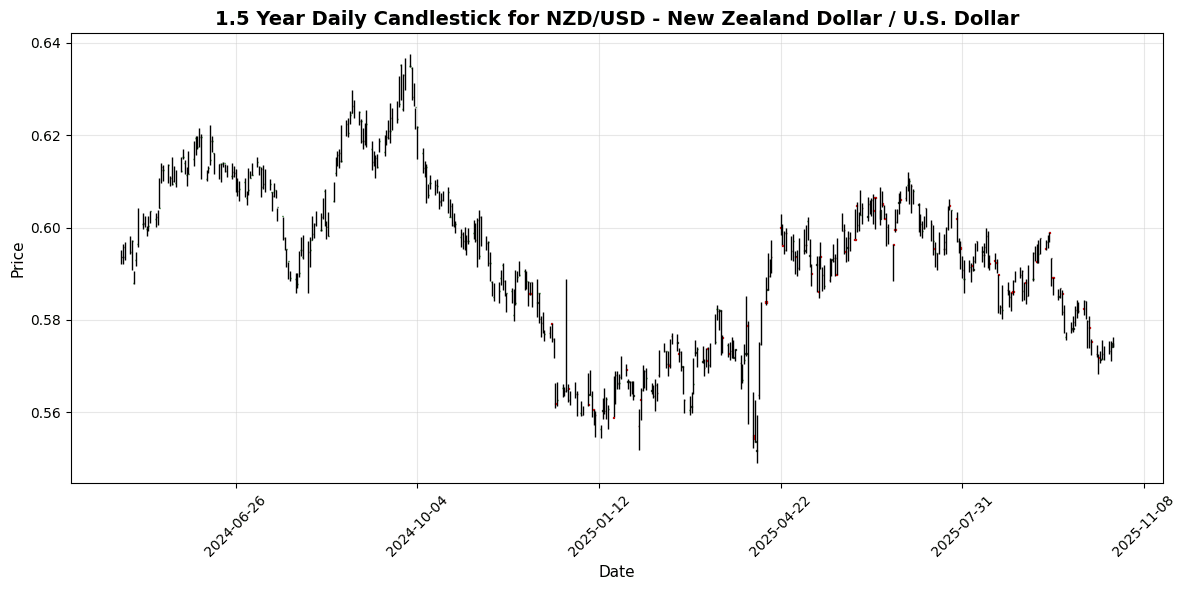

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5750 | +0.1219 | +0.4013 | +0.6124 | -1.7313 | -4.9243 | -3.9744 | +1.9555 | -4.5373 | 0.5848 | 0.5925 | 0.5851 | 30.61 | -0.0038 |

**Overview:**

The Majors FX group exhibits mixed signals today, with a general bearish sentiment prevailing in several pairs. Notably, the USD/JPY shows strength, while the AUD/USD and NZD/USD are under pressure, indicating potential downside risks.

**Key Pairs:**

1. **USD/JPY**: Currently priced at 151.6510, the pair’s RSI at 70.27 suggests it is in overbought territory, indicating potential for a price correction. The positive MACD at 0.8555 confirms bullish momentum, but traders should watch for a possible reversal.

2. **EUR/USD**: Priced at 1.1604, this pair shows bearish conditions with an RSI of 36.06, indicating oversold conditions. The negative MACD at -0.0023 reinforces the bearish outlook, suggesting further downside potential.

3. **USD/CAD**: At 1.4007, the pair is also in overbought territory with an RSI of 72.05. The positive MACD at 0.0053 indicates bullish momentum, but caution is warranted as it approaches resistance levels.

**Trading Implications:**

Support for EUR/USD is around 1.1500, while resistance for USD/JPY is

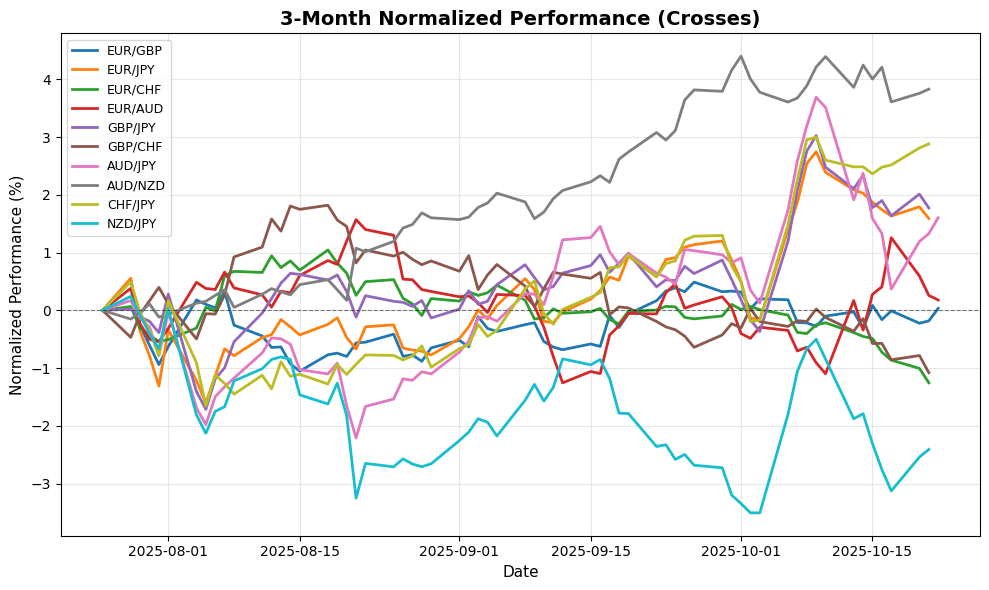

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8705 | +0.3227 | +0.0437 | -0.0505 | -0.1319 | +0.4049 | +2.0217 | +4.9820 | +4.4943 | 0.8679 | 0.8641 | 0.8527 | 50.19 | 0.0001 |

| EUR/JPY | EURJPY | 175.91 | -0.1878 | +0.1583 | -0.0761 | +1.2059 | +2.0922 | +8.2757 | +7.6641 | +8.0118 | 173.74 | 171.71 | 166.46 | 60.80 | 0.6865 |

| EUR/CHF | EURCHF | 0.9232 | -0.0866 | -0.3400 | -0.7162 | -1.2050 | -1.0079 | -2.0322 | -1.7768 | -1.3738 | 0.9346 | 0.9350 | 0.9385 | 13.63 | -0.0025 |

| EUR/AUD | EURAUD | 1.7855 | -0.0783 | -1.0622 | -0.0968 | +0.2431 | +0.1290 | +0.5089 | +6.7117 | +9.8357 | 1.7840 | 1.7830 | 1.7503 | 55.94 | 0.0024 |

| GBP/JPY | GBPJPY | 202.06 | -0.5140 | +0.1090 | -0.0287 | +1.3366 | +1.6900 | +6.1274 | +2.5680 | +3.3633 | 200.20 | 198.76 | 195.20 | 61.95 | 0.7765 |

| GBP/CHF | GBPCHF | 1.0605 | -0.4038 | -0.3832 | -0.6660 | -1.0451 | -1.4020 | -3.9698 | -6.4278 | -5.6125 | 1.0769 | 1.0824 | 1.1012 | 35.42 | -0.0029 |

| AUD/JPY | AUDJPY | 98.50 | -0.1186 | +1.2281 | +0.0102 | +0.9500 | +1.9700 | +7.7218 | +0.9014 | -1.6718 | 97.42 | 96.37 | 95.14 | 56.77 | 0.2334 |

| AUD/NZD | AUDNZD | 1.1299 | -0.0531 | -0.1749 | -0.5545 | +0.3383 | +3.5181 | +5.7147 | +2.4671 | +2.2988 | 1.1199 | 1.1030 | 1.0989 | 42.41 | 0.0043 |

| CHF/JPY | CHFJPY | 190.51 | -0.1059 | +0.4994 | +0.6510 | +2.4369 | +3.1299 | +10.52 | +9.6187 | +9.5381 | 185.89 | 183.63 | 177.37 | 73.75 | 1.2363 |

| NZD/JPY | NZDJPY | 87.17 | -0.0585 | +1.4194 | +0.5699 | +0.6198 | -1.4872 | +1.9127 | -1.5284 | -3.8877 | 86.93 | 87.30 | 86.55 | 57.01 | -0.1123 |

**Overview:**

The Crosses FX group shows mixed signals, with a general bearish sentiment prevailing as several pairs exhibit negative daily changes. However, some pairs display bullish momentum, indicating potential trading opportunities.

**Key Pairs:**

1. **CHF/JPY:** Price at 190.5130, RSI at 73.75 indicates overbought conditions, while a positive MACD of 1.2363 suggests strong bullish momentum. Watch for potential resistance near 191.00.

2. **EUR/JPY:** Currently at 175.9080, with an RSI of 60.80 and a MACD of 0.6865, indicating bullish momentum. Support is likely around 175.50.

3. **GBP/JPY:** Priced at 202.0580, RSI at 61.95 and a MACD of 0.7765 suggest a bullish outlook, with potential resistance at 203.00.

**Trading Implications:**

Monitor support levels for EUR/JPY and GBP/JPY,

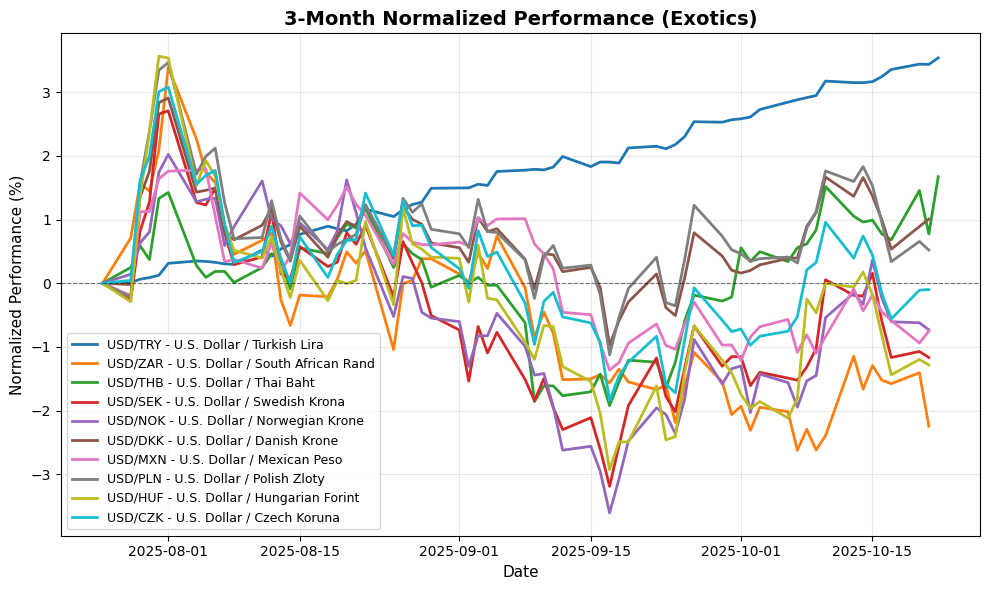

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.97 | +0.0317 | +0.1766 | +0.3613 | +1.3582 | +3.7556 | +9.2550 | +18.88 | +22.56 | 41.38 | 40.71 | 39.03 | 97.08 | 0.1694 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.47 | +0.4717 | +0.7501 | +0.4604 | +0.8452 | -0.2638 | -6.8472 | -6.9246 | -0.7625 | 17.44 | 17.61 | 18.01 | 47.28 | -0.0342 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.82 | +0.0610 | +0.9846 | +0.6749 | +2.9486 | +2.0840 | -1.7071 | -3.8636 | -2.0591 | 32.28 | 32.38 | 33.00 | 64.05 | 0.1416 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.4419 | +0.2112 | +0.2790 | -1.0433 | +0.2845 | -0.6546 | -1.8228 | -14.35 | -10.57 | 9.4401 | 9.5083 | 9.8699 | 49.89 | 0.0091 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.04 | -0.1800 | -0.1909 | -1.1549 | +1.1865 | -0.5779 | -3.6444 | -11.38 | -8.3062 | 10.02 | 10.07 | 10.42 | 55.05 | 0.0251 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4392 | +0.0373 | +0.8741 | +0.0438 | +1.2660 | +1.5871 | -1.9253 | -10.15 | -6.6100 | 6.3841 | 6.4041 | 6.6446 | 61.46 | 0.0121 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.42 | -0.0976 | -0.0814 | -0.4813 | -0.0266 | -0.6549 | -6.0444 | -10.74 | -7.7427 | 18.52 | 18.67 | 19.39 | 55.39 | -0.0216 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6567 | +0.1451 | +0.7719 | -0.4088 | +0.7050 | +1.3840 | -2.5834 | -10.97 | -8.4150 | 3.6385 | 3.6522 | 3.7718 | 50.72 | 0.0037 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 335.91 | +0.1789 | +0.8515 | -0.4218 | +1.0310 | -0.7044 | -5.8941 | -14.96 | -9.4509 | 335.31 | 339.77 | 356.25 | 54.33 | 0.0607 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 20.94 | +0.0067 | +0.9556 | -0.0496 | +1.2333 | +0.3551 | -4.5098 | -13.32 | -10.29 | 20.83 | 21.03 | 22.05 | 56.37 | 0.0192 |

**Overview:** The Exotic FX group exhibits mixed signals, with a general bullish sentiment primarily driven by USD/TRY, while other pairs show varying degrees of momentum.

**Key Pairs:**

1. **USD/TRY:** Currently at 41.9703, this pair is significantly overbought with an RSI of 97.08, indicating potential for a price correction. The MACD is positive at 0.1694, suggesting bullish momentum, but caution is warranted due to extreme RSI levels.

2. **USD/ZAR:** Trading at 17.4655, this pair has an RSI of 47.28, indicating a neutral-bearish stance. The MACD is negative at -0.0342, reflecting bearish momentum, suggesting potential for further downside.

3. **USD/THB:** Priced at 32.8200, it has an RSI of 64.05, indicating a neutral-bullish outlook. With a positive MACD of 0.1416, this pair shows some bullish

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.