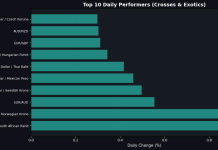

FX Market Update: NZD/JPY Tumbles 1.33%

Market Overview

The US dollar has gained momentum, reflected in the current DXY at 100.22, up 0.35%, driven by stronger-than-expected job growth in the private sector. The addition of 42,000 jobs in October, as reported by ADP, has alleviated some fears surrounding the labor market, suggesting resilience in the US economy. This positive employment data is likely to bolster expectations for continued monetary tightening by the Federal Reserve, which could further support the dollar against major currencies.

In contrast, European markets opened lower due to a sell-off in tech stocks, reflecting broader concerns over elevated valuations and economic uncertainties. As investor sentiment in Europe appears cautious, the euro may face downward pressure against the dollar. Meanwhile, the fallout from Amazon’s layoffs and McDonald’s disappointing earnings highlights challenges within the consumer sector, which could influence investor sentiment towards the US dollar and its safe-haven appeal. Overall, the market sentiment remains mixed, with a cautious outlook on equities and a more bullish stance on the dollar, particularly against currencies from regions facing economic headwinds.

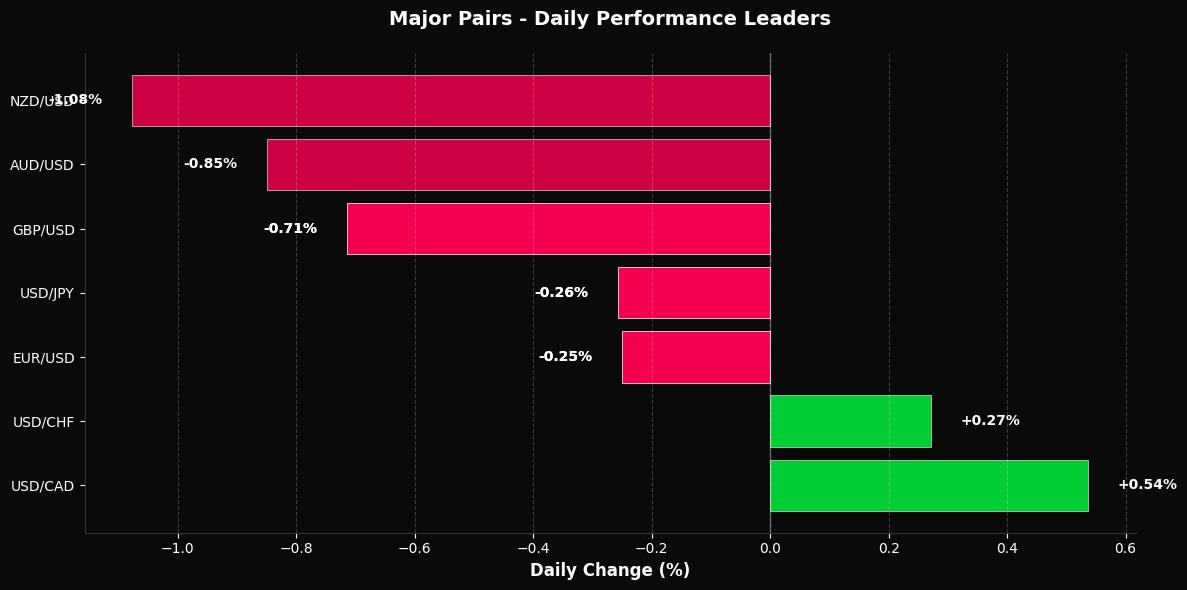

Major Pairs – Top Performers

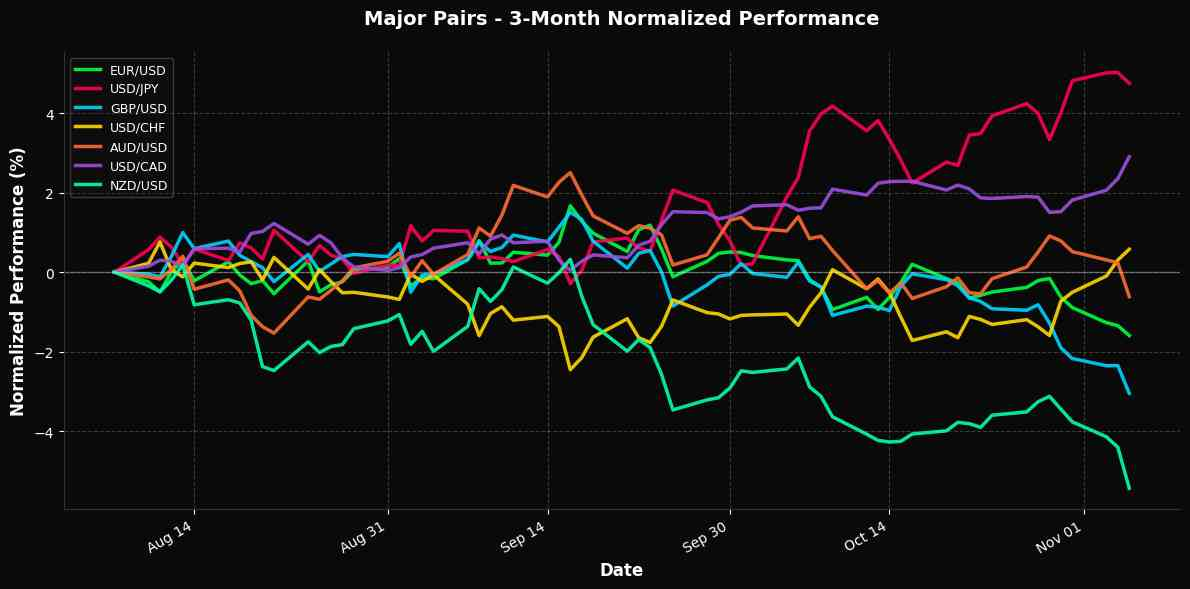

Major Pairs – Normalized Performance

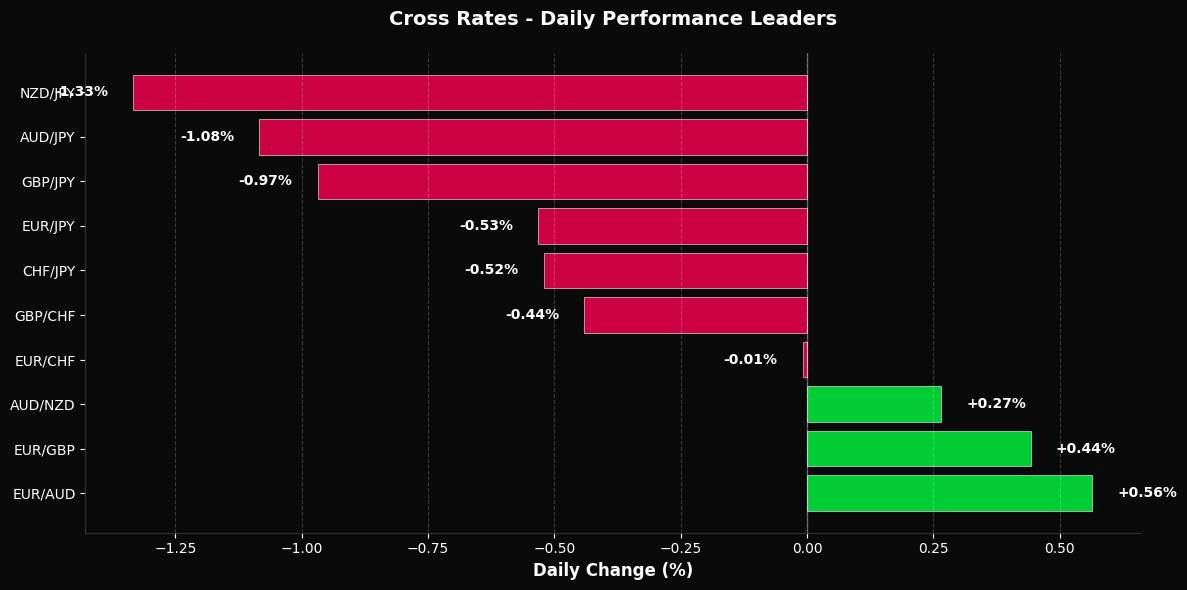

Cross Rates – Top Performers

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.