## Forex and Global News (Last 8 Hours)

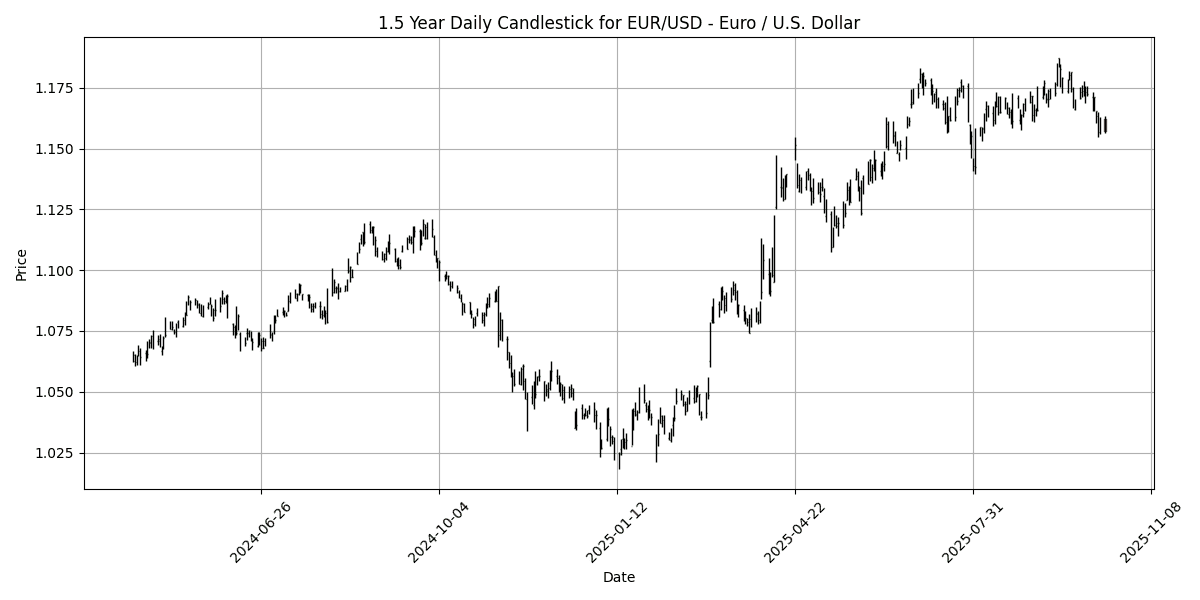

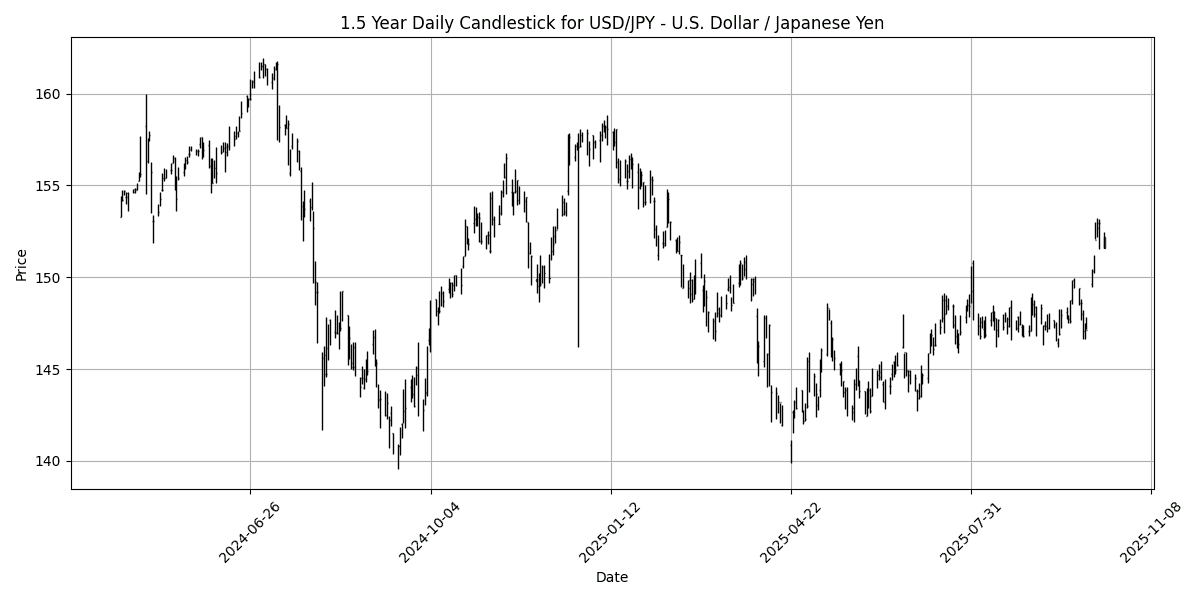

In the latest forex news, market sentiment is heavily influenced by rising US-China trade tensions, particularly regarding rare earth minerals, which has led to a surge in safe-haven assets like gold, now trading at record highs around $4,085. The US Dollar (USD) remains strong, with the USD/JPY pair climbing to 152.30 as easing trade tensions support bullish momentum. In contrast, the EUR/USD pair faces downward pressure, trading around 1.1570 amid a risk-averse environment, while the euro struggles to maintain gains near key resistance levels.

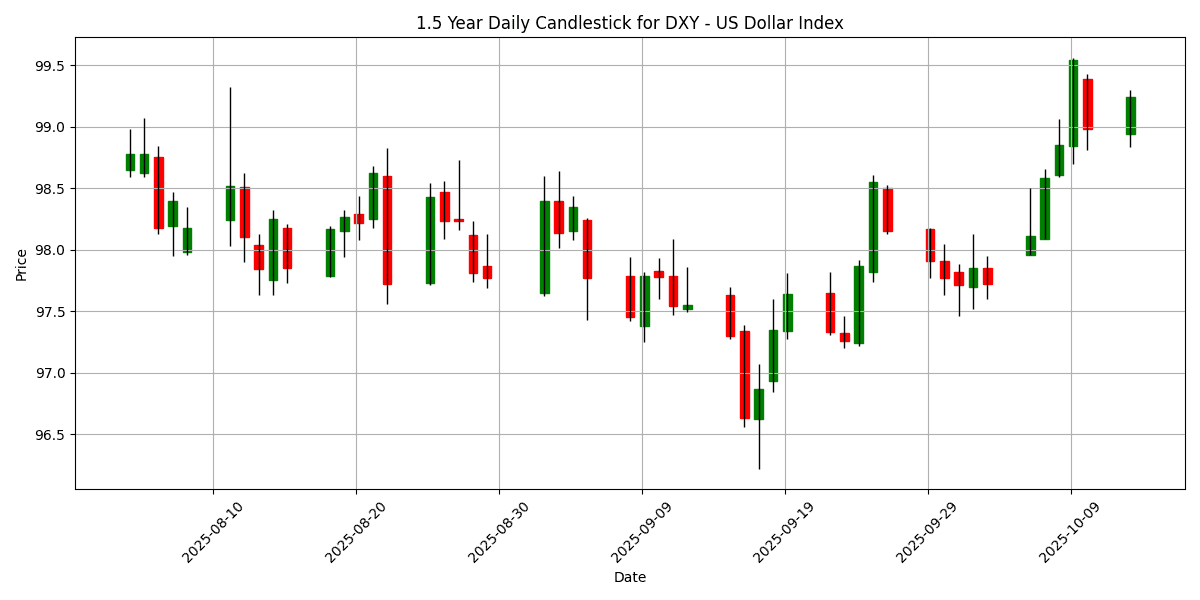

The US Dollar Index (DXY) is currently at 99.25, reflecting a daily change of 0.3316%, indicating a modest strengthening of the dollar against a basket of currencies. Analysts note that the USD/CNH is expected to trade within a range of 7.1280 to 7.1500, while the Brazilian Real (BRL) shows mild pressure against the dollar. Overall, the forex market is navigating through volatile conditions driven by geopolitical developments and trade-related uncertainties.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-13 | 09:00 | 🇪🇺 | Medium | German Buba Vice President Buch Speaks | ||

| 2025-10-13 | 13:30 | 🇪🇺 | Medium | German Buba Balz Speaks | ||

| 2025-10-13 | 20:30 | 🇦🇺 | Medium | RBA Meeting Minutes | ||

| 2025-10-13 | 20:30 | 🇦🇺 | Medium | NAB Business Confidence (Sep) |

On October 13, 2025, several key economic events are poised to influence G7 FX markets, particularly the EUR and AUD.

At 09:00 ET, the German Bundesbank Vice President, Claudia Buch, is scheduled to speak. Market participants will be attentive to her remarks, especially regarding monetary policy direction and economic outlook, which could impact the EUR. A dovish tone may weaken the euro, while hawkish comments could support it.

Following this, at 13:30 ET, another Bundesbank official, Joachim Balz, will deliver remarks. Similar to Buch’s speech, Balz’s insights will be scrutinized for indications on the ECB’s stance, particularly in light of inflationary pressures within the Eurozone.

Later, at 20:30 ET, the Reserve Bank of Australia (RBA) will release its Meeting Minutes, providing crucial insights into the central bank’s recent policy decisions. Traders will look for any shifts in the RBA’s outlook that might affect the AUD.

Simultaneously, the NAB Business Confidence index for September will be released, which could further inform expectations regarding the Australian economy’s performance and impact AUD trading sentiment. Overall, these events could lead to increased volatility in the EUR and AUD, with potential spillover effects on other G7 currencies.

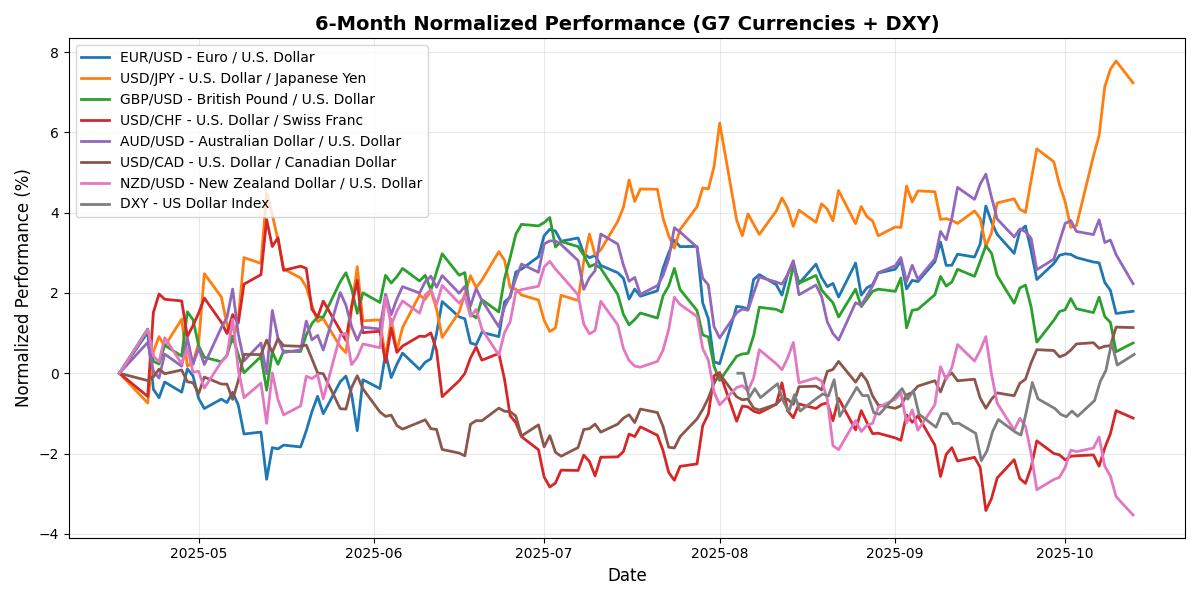

## G7 Currency Pairs Performance

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1573 | -0.2843 | -0.7002 | -1.1909 | -1.3784 | -0.7997 | 2.4824 | 11.21 | 5.8455 | 1.1692 | 1.1638 | 1.1213 | 22.41 | -0.0026 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 152.20 | 0.1784 | 0.0960 | 1.7319 | 3.3778 | 2.9805 | 6.2969 | -3.0561 | 2.3490 | 148.14 | 146.90 | 148.24 | 68.93 | 1.1636 |

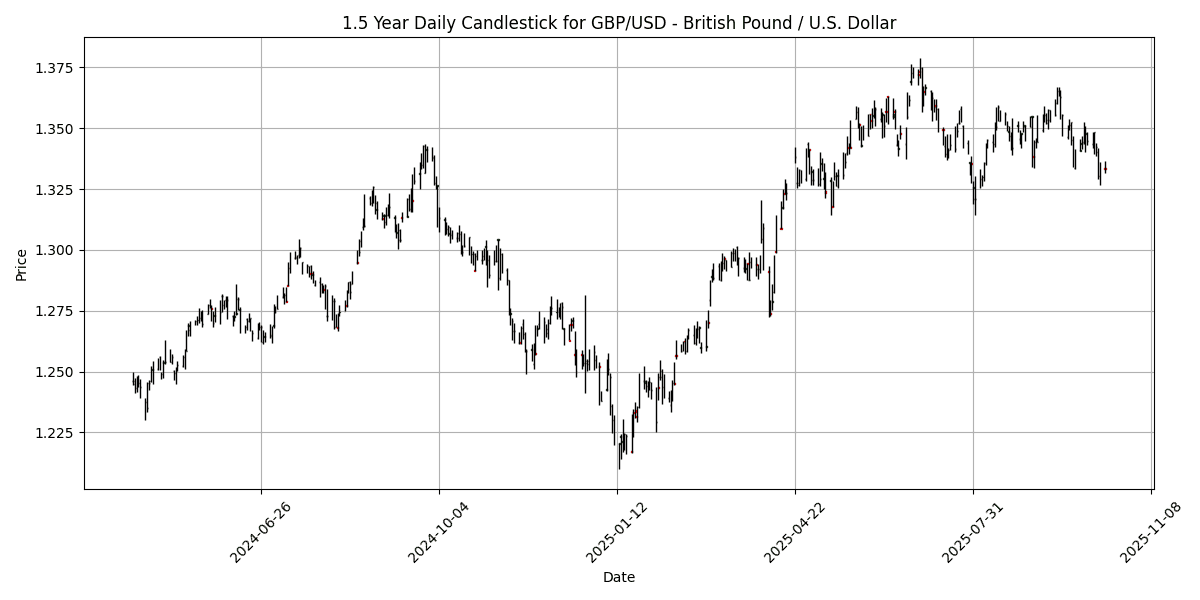

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3334 | -0.0675 | -0.6484 | -0.7430 | -1.7871 | -0.7004 | 0.7784 | 6.2546 | 2.0811 | 1.3474 | 1.3498 | 1.3165 | 36.00 | -0.0036 |

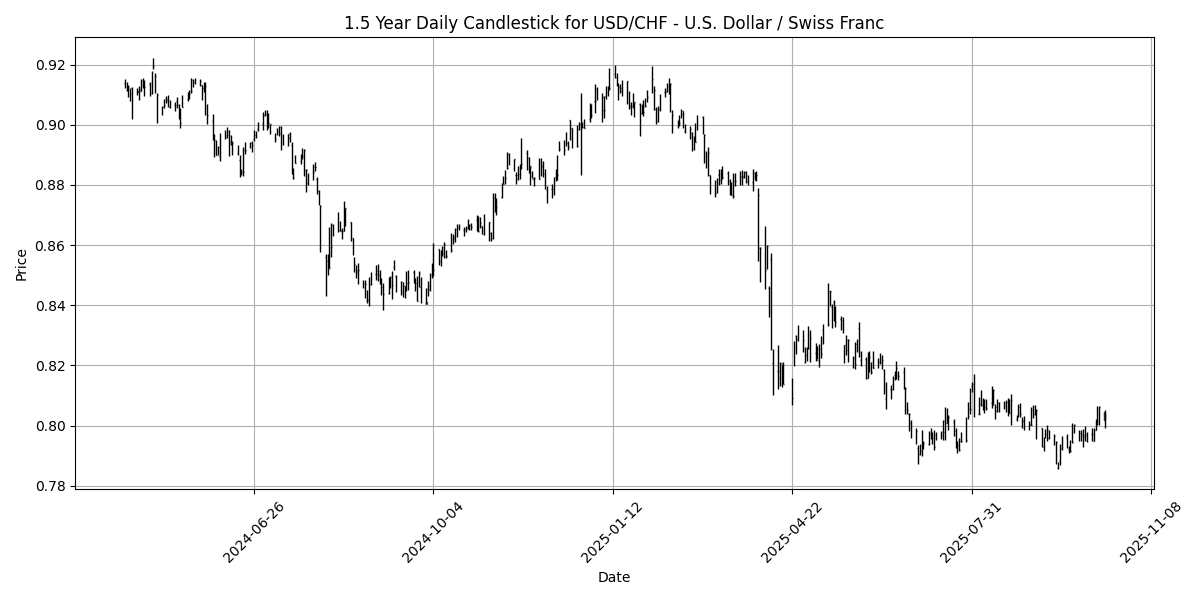

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8047 | 0.2991 | 0.7651 | 0.9421 | 1.0993 | 0.8560 | -1.9579 | -10.9096 | -6.0534 | 0.8007 | 0.8040 | 0.8393 | 70.83 | 0.0009 |

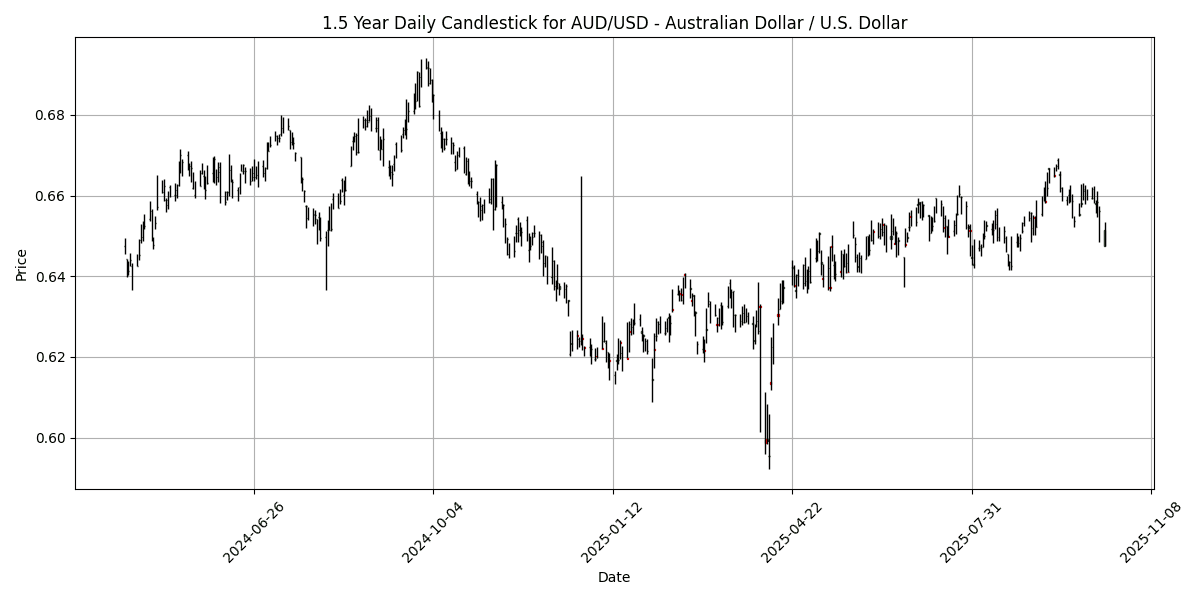

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6515 | 0.2616 | -0.9955 | -1.1846 | -2.2945 | -0.4541 | 2.7943 | 4.7428 | -3.3526 | 0.6555 | 0.6535 | 0.6420 | 35.42 | -0.0002 |

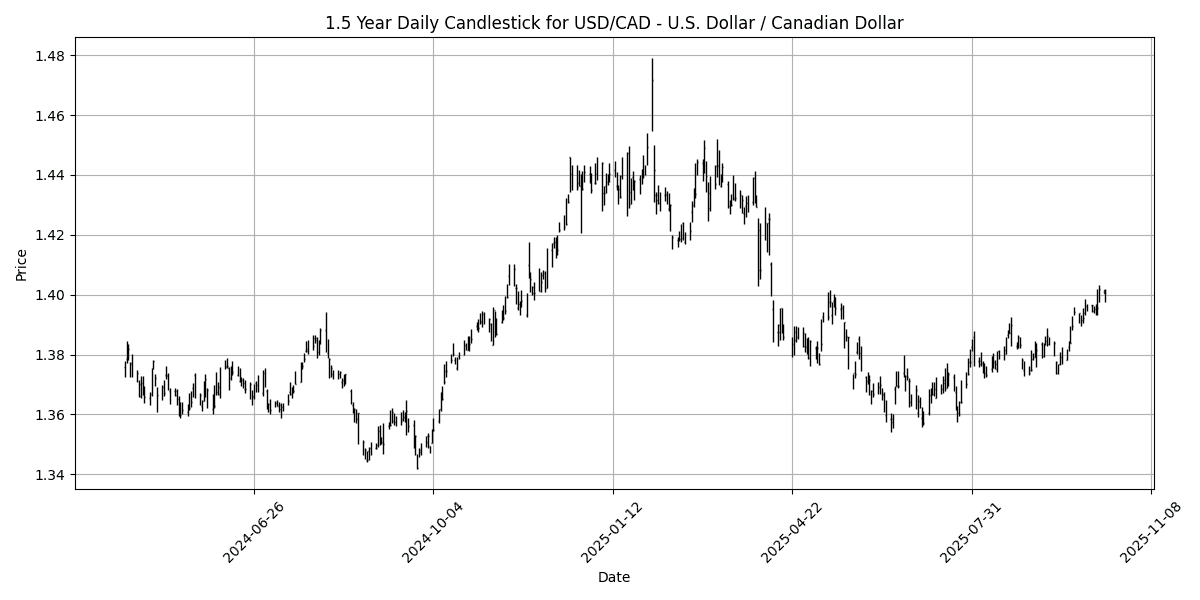

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4017 | 0.1500 | 0.4601 | 0.3724 | 1.3250 | 2.2788 | 0.4299 | -2.3192 | 1.9737 | 1.3839 | 1.3766 | 1.3982 | 83.99 | 0.0050 |

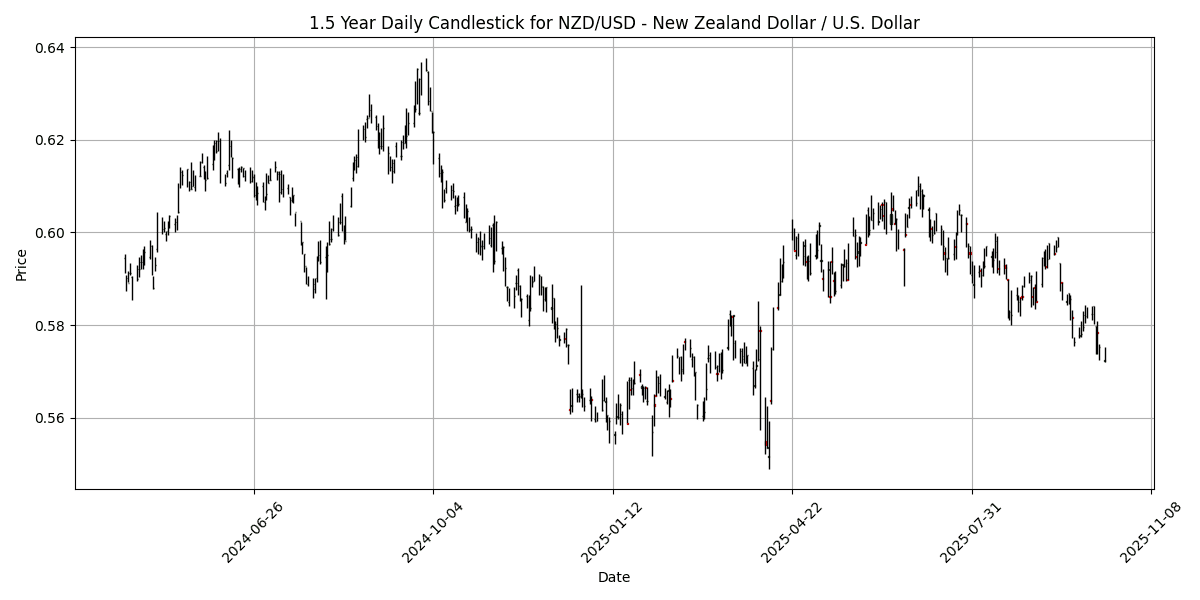

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5726 | -0.1047 | -1.2368 | -1.6943 | -4.2123 | -4.1176 | -2.8750 | 1.5300 | -6.0696 | 0.5878 | 0.5943 | 0.5847 | 26.41 | -0.0037 |

| DXY – US Dollar Index | DXY | 99.25 | 0.3316 | 0.3996 | 1.1569 | 1.7376 | N/A | N/A | N/A | N/A | 98.05 | 98.05 | 98.05 | 69.67 | 0.3153 |

## Charts

## Technical Analysis

In the current forex landscape, several G7 currency pairs exhibit notable technical signals that warrant attention.

Starting with the EUR/USD, the RSI at 22.41 indicates an oversold condition, suggesting potential for a corrective bounce. However, the MACD remains negative, reinforcing bearish momentum. The price is well below the MA50 and MA100, indicating a strong downtrend.

In contrast, the USD/JPY is approaching overbought territory with an RSI of 68.93. The positive MACD at 1.1636 supports bullish sentiment, but caution is advised as the RSI nears the 70 threshold. The price is above the MA50 and MA100, confirming upward momentum.

The USD/CHF shows an RSI of 70.83, indicating overbought conditions, while the MACD is slightly positive. Traders may look for a short-term pullback, especially as the price is near key resistance levels.

The USD/CAD, with an RSI of 83.99, is significantly overbought. This extreme reading, combined with a positive MACD, suggests a potential reversal or consolidation phase ahead.

The DXY, at 99.2450 with an RSI of 69.67, indicates strong bullish momentum but is approaching overbought territory. Traders should monitor these signals closely for potential trading opportunities and risk management strategies.

—

**Disclaimer:** The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.