## Forex and Global News (Last 8 Hours)

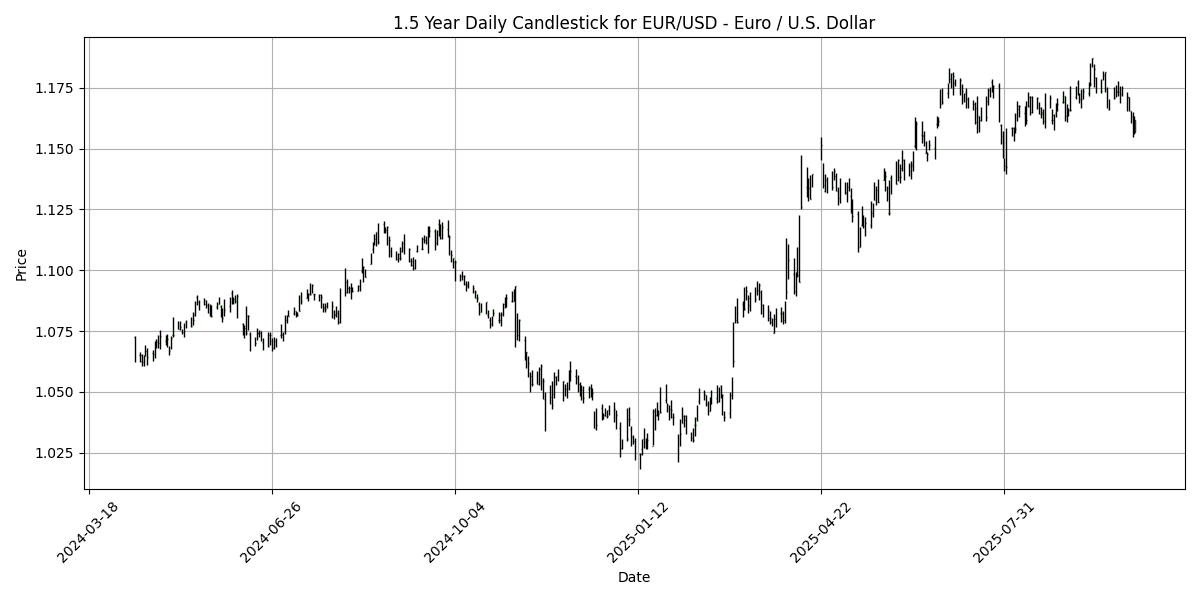

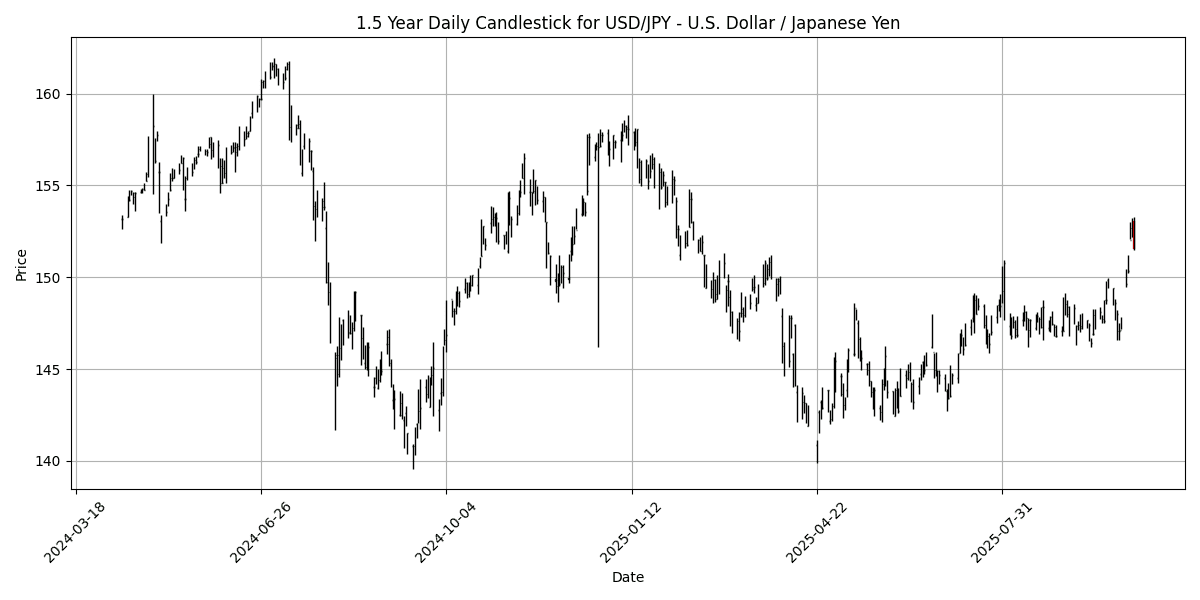

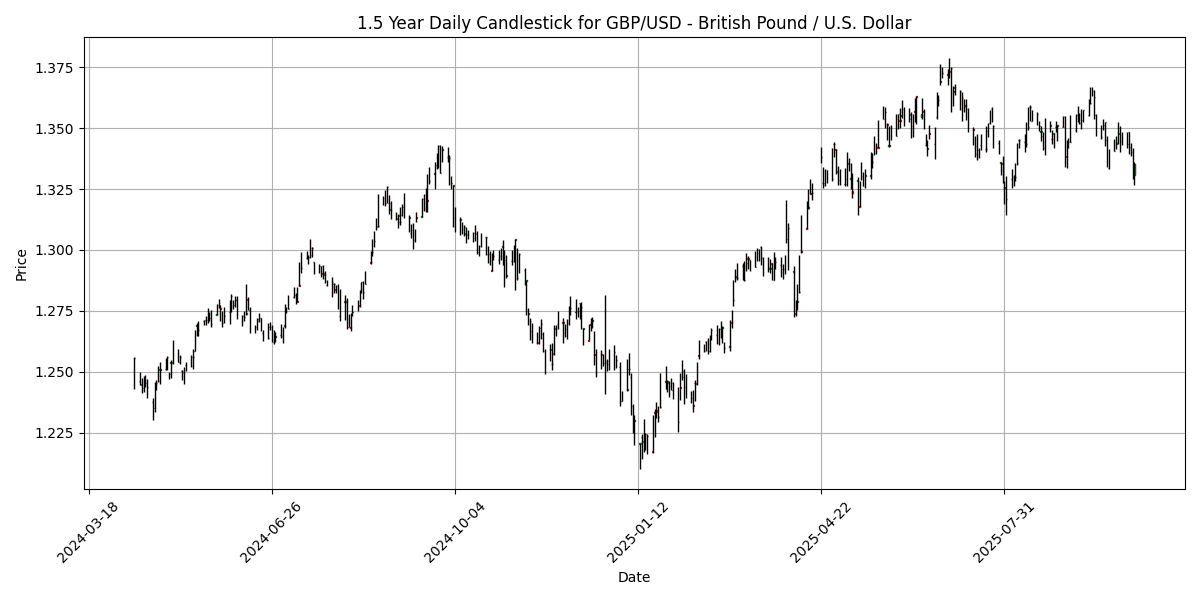

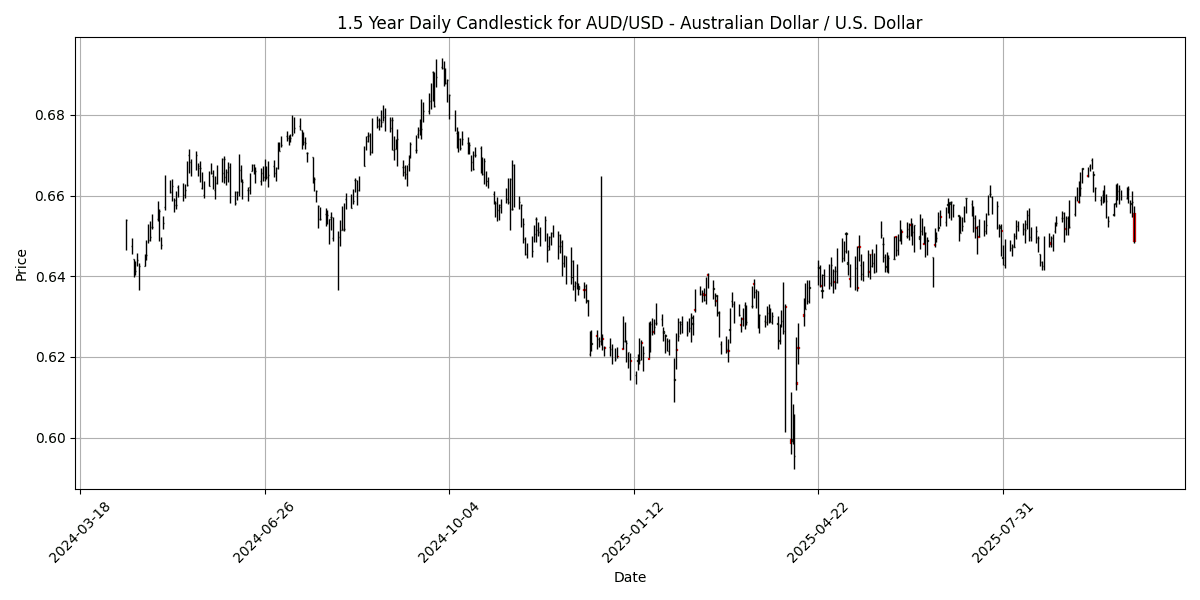

In the past eight hours, market sentiment has been significantly influenced by renewed U.S.-China trade tensions, primarily stemming from former President Trump’s threat of a “massive” tariff hike on Chinese imports. This announcement has led to a notable sell-off in global equity markets, with the Dow Jones Industrial Average dropping over 900 points. In the forex market, the Australian Dollar (AUD) has slumped to a one-month low against the U.S. Dollar (USD), reflecting heightened concerns over trade relations. The Euro (EUR) and British Pound (GBP) also faced downward pressure, with EUR/USD dipping to 1.1542 and GBP/USD testing levels below 1.3300, as risk aversion drives demand for the USD. Gold prices surged to near $4,000, indicating a flight to safety amid escalating geopolitical risks. The U.S. Dollar Index (DXY) is currently at 98.96, down 0.3494% for the day, as investors navigate through uncertainty in both political and economic landscapes.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-10 | 08:30 | 🇨🇦 | Medium | Employment Change (Sep) | 60.4K | 2.8K |

| 2025-10-10 | 08:30 | 🇨🇦 | Medium | Unemployment Rate (Sep) | 7.1% | 7.2% |

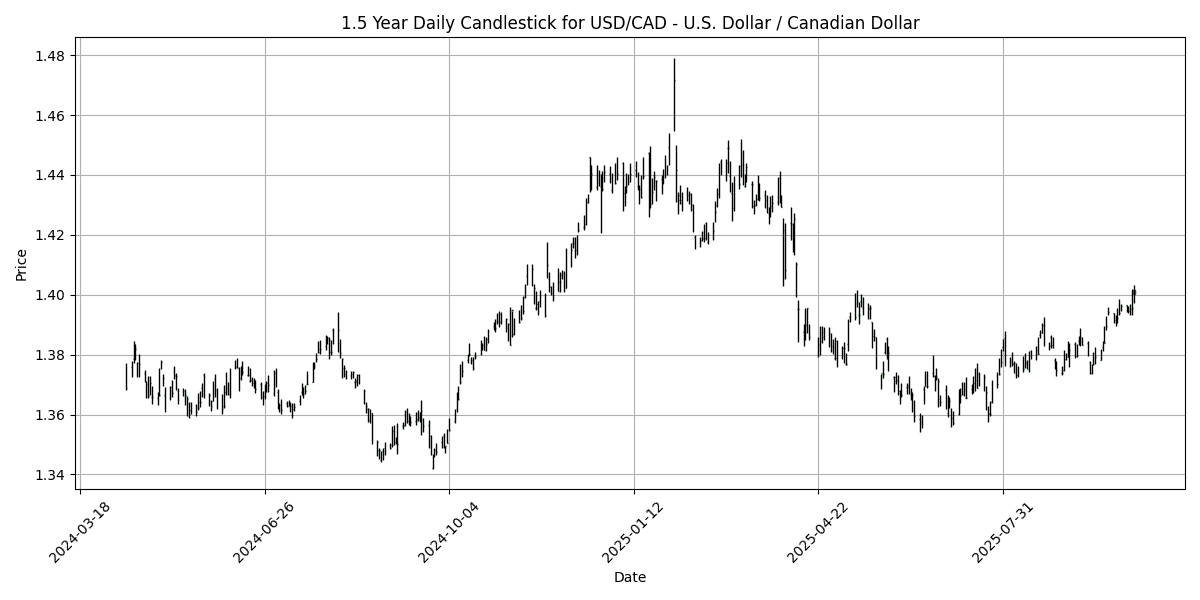

On October 10, 2025, significant economic data releases from Canada are poised to influence G7 FX markets, particularly the CAD. The Employment Change for September reported an impressive increase of 60.4K jobs, substantially exceeding the forecast of 2.8K. This robust job growth signals a strengthening labor market, which could bolster the CAD as traders reassess their outlook on the Bank of Canada’s monetary policy stance.

Additionally, the Unemployment Rate for September came in at 7.1%, slightly better than the anticipated 7.2%. This decline in unemployment further reinforces the positive narrative surrounding the Canadian economy, suggesting resilience amid global economic uncertainties.

The combination of stronger-than-expected employment figures is likely to lead to a bullish sentiment for the CAD, potentially prompting a recalibration of interest rate expectations. As a result, we may observe upward pressure on the CAD against major currencies, especially if market participants begin to price in a more aggressive monetary tightening by the Bank of Canada. Overall, these developments are expected to enhance the CAD’s appeal in the FX markets, while providing a counterbalance to any broader market volatility.

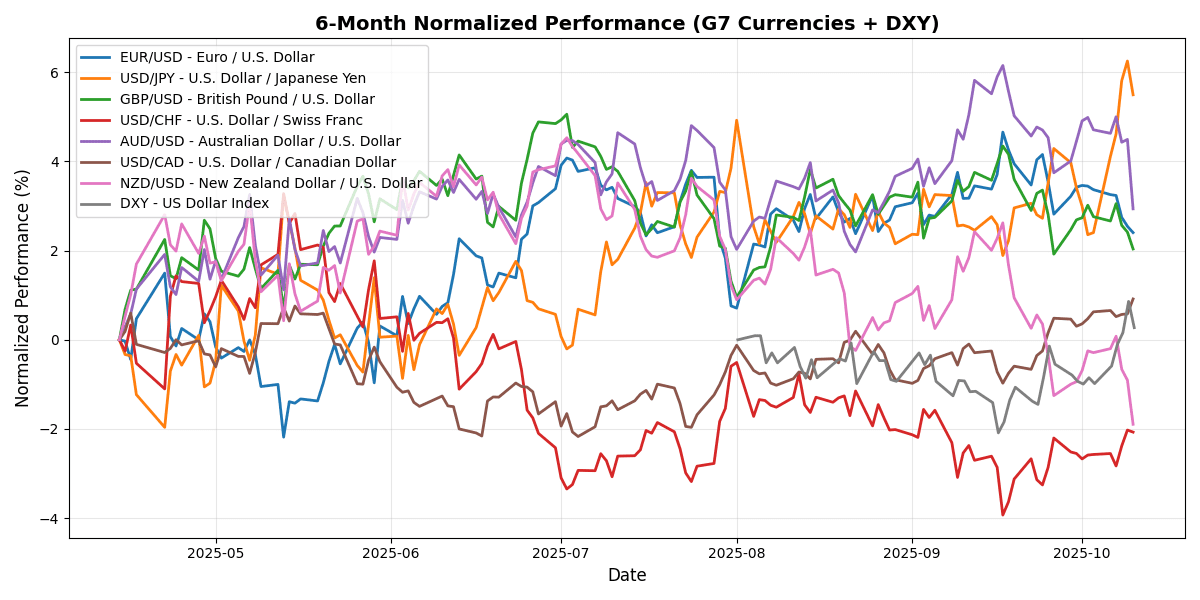

## G7 Currency Pairs Performance

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1616 | 0.4236 | -0.9306 | -0.9306 | -0.7413 | -0.7413 | 3.1814 | 11.63 | 6.1470 | 1.1693 | 1.1636 | 1.1207 | 35.65 | -0.0014 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 151.59 | -0.9358 | 3.0187 | 3.0187 | 2.8495 | 3.6257 | 5.4575 | -3.4415 | 1.6305 | 148.02 | 146.80 | 148.26 | 64.34 | 0.9703 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3352 | 0.3910 | -0.7038 | -0.7038 | -1.2506 | -1.6759 | 2.7703 | 6.3981 | 2.1708 | 1.3474 | 1.3500 | 1.3161 | 40.92 | -0.0026 |

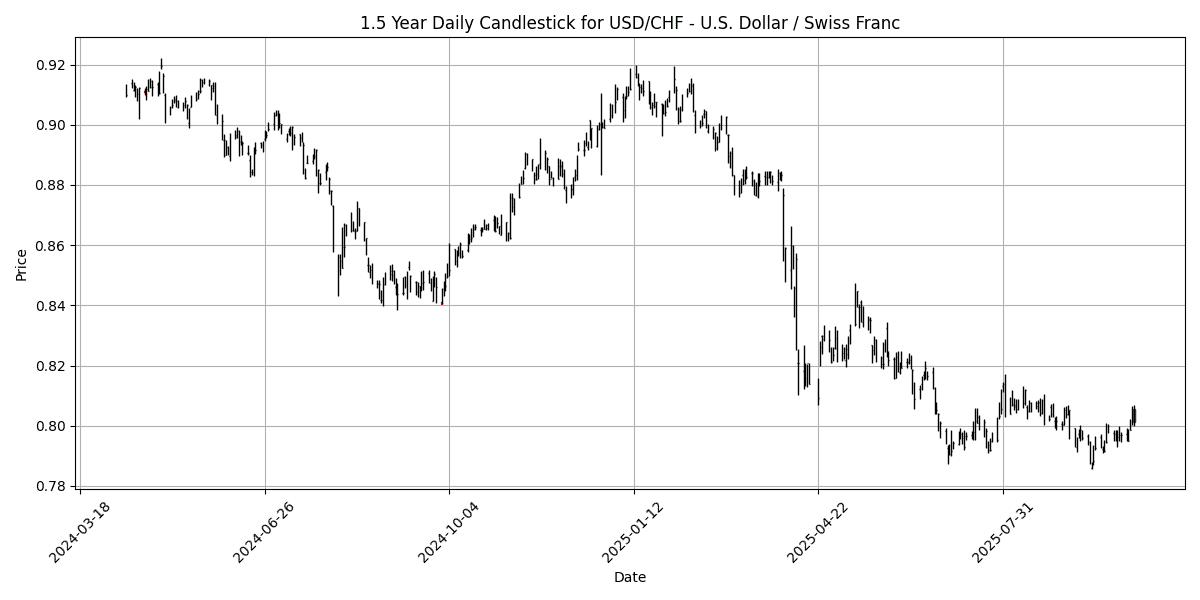

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8011 | -0.6449 | 0.5119 | 0.5119 | 0.4766 | 0.5498 | -2.3953 | -11.3082 | -6.8997 | 0.8005 | 0.8041 | 0.8398 | 58.89 | 0.0001 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6486 | -1.1280 | -1.6988 | -1.6988 | -1.4989 | -1.6379 | 4.2196 | 4.2765 | -3.4448 | 0.6552 | 0.6534 | 0.6418 | 34.84 | -0.0001 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4001 | -0.1284 | 0.2872 | 0.2872 | 1.1151 | 2.5241 | 0.3584 | -2.4307 | 2.1278 | 1.3834 | 1.3763 | 1.3984 | 85.71 | 0.0046 |

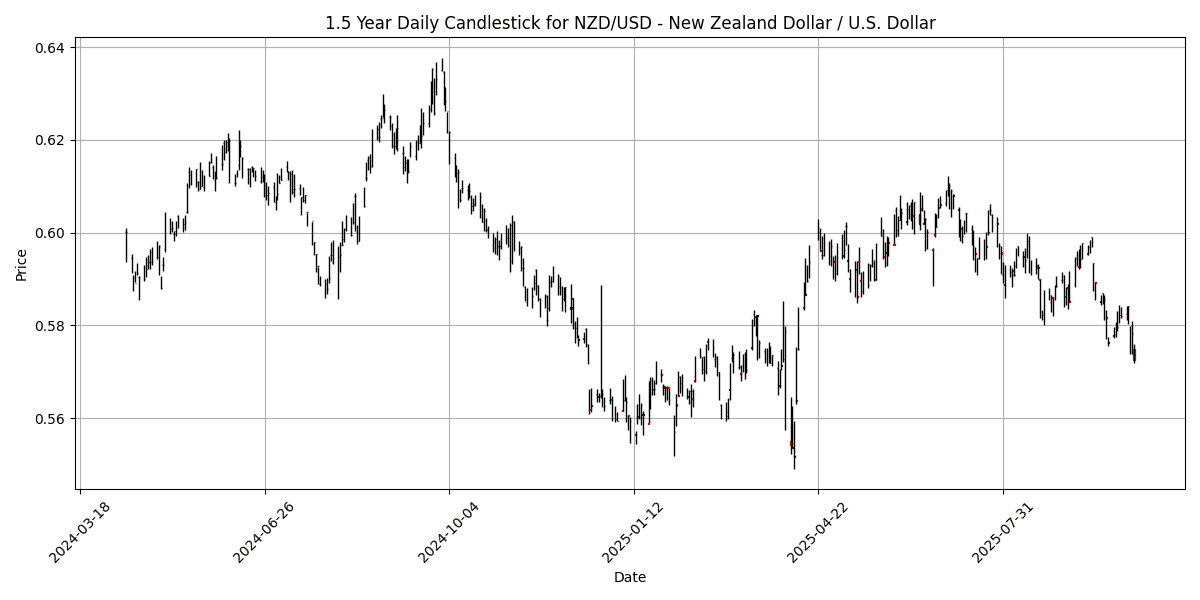

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5726 | -0.4001 | -1.6067 | -1.6067 | -3.3750 | -5.2255 | -0.3808 | 1.5300 | -5.6813 | 0.5881 | 0.5946 | 0.5846 | 30.43 | -0.0034 |

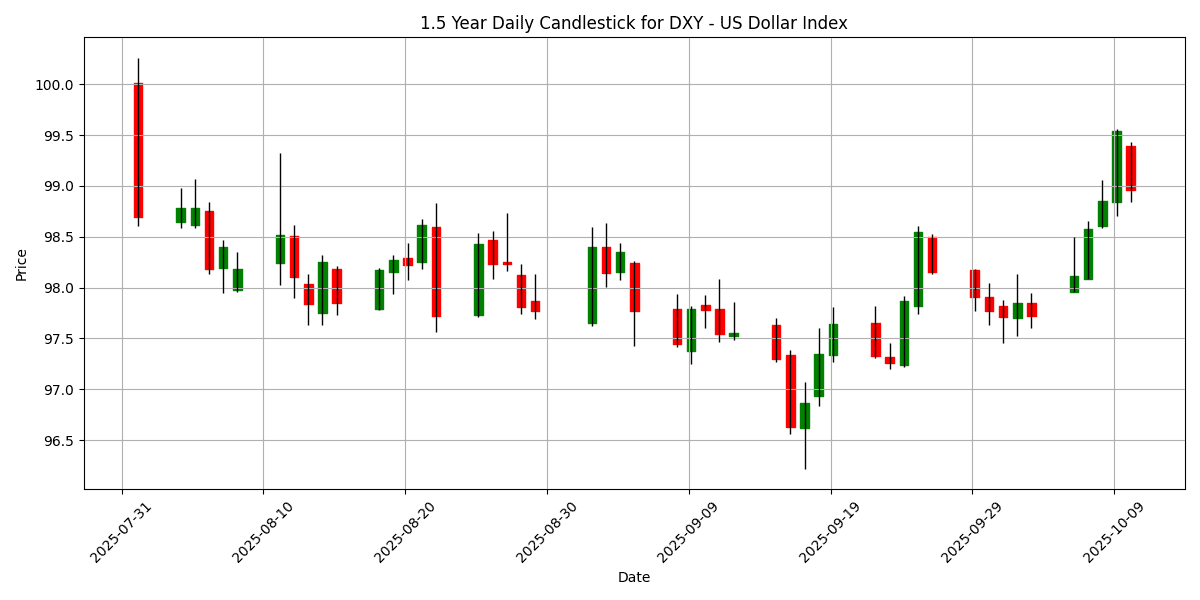

| DXY – US Dollar Index | DXY | 98.96 | -0.3494 | 1.2669 | 1.2669 | 1.2047 | N/A | N/A | N/A | N/A | 98.04 | 98.04 | 98.04 | 66.71 | 0.2684 |

## Charts

## Technical Analysis

In the current analysis of G7 currency pairs and the DXY, several key technical indicators suggest varied trading opportunities.

Starting with **EUR/USD**, the price is at 1.1616, with an RSI of 35.65, indicating a neutral to oversold condition. The MACD is slightly negative, suggesting bearish momentum, while the price remains below both the 50 and 100-day moving averages, signaling continued weakness.

In contrast, **USD/JPY** shows strength with a price of 151.5920 and an RSI of 64.34. The MACD is positive, indicating bullish momentum, and the price is comfortably above the 50, 100, and 200-day moving averages, suggesting potential for further gains.

**GBP/USD** is underperforming with a price of 1.3352, an RSI of 40.92, and a negative MACD, indicating bearish pressure. The pair remains below major moving averages, reinforcing the downside bias.

**USD/CAD** is notably overbought with an RSI of 85.71 and a positive MACD, suggesting caution for long positions. The price is well above key moving averages, indicating strong bullish momentum.

The **DXY** at 98.9580, with an RSI of 66.71 and a positive MACD, indicates a strong dollar, potentially supporting further strength in USD pairs.

Traders should watch for potential reversals in oversold pairs like EUR/USD

—

**Disclaimer:** The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.