## Forex and Global News (Last 8 Hours)

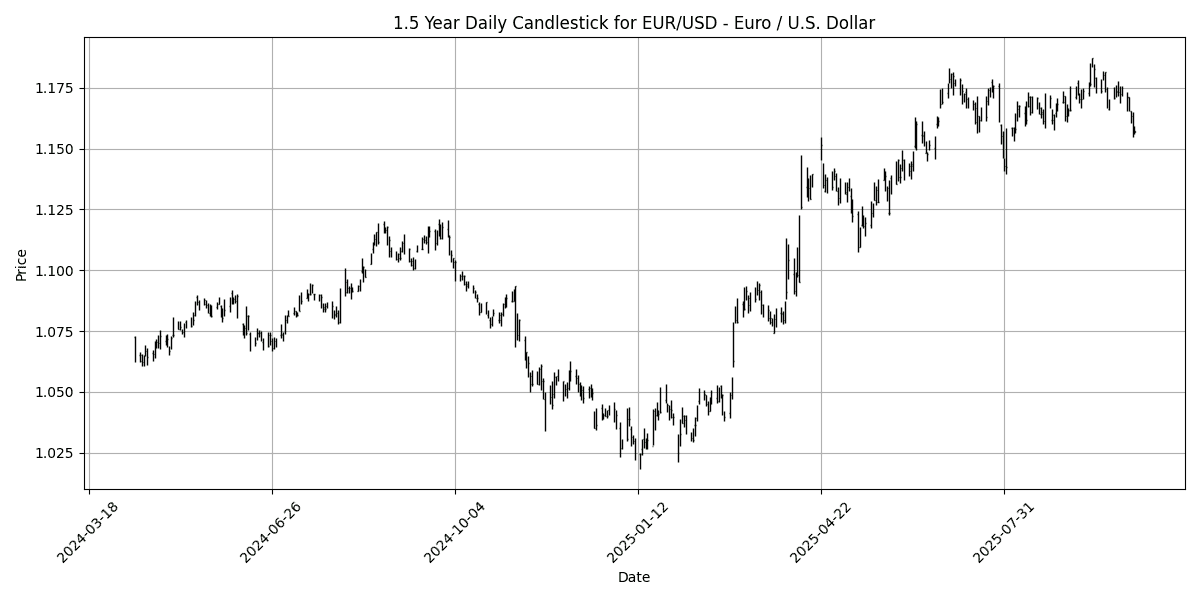

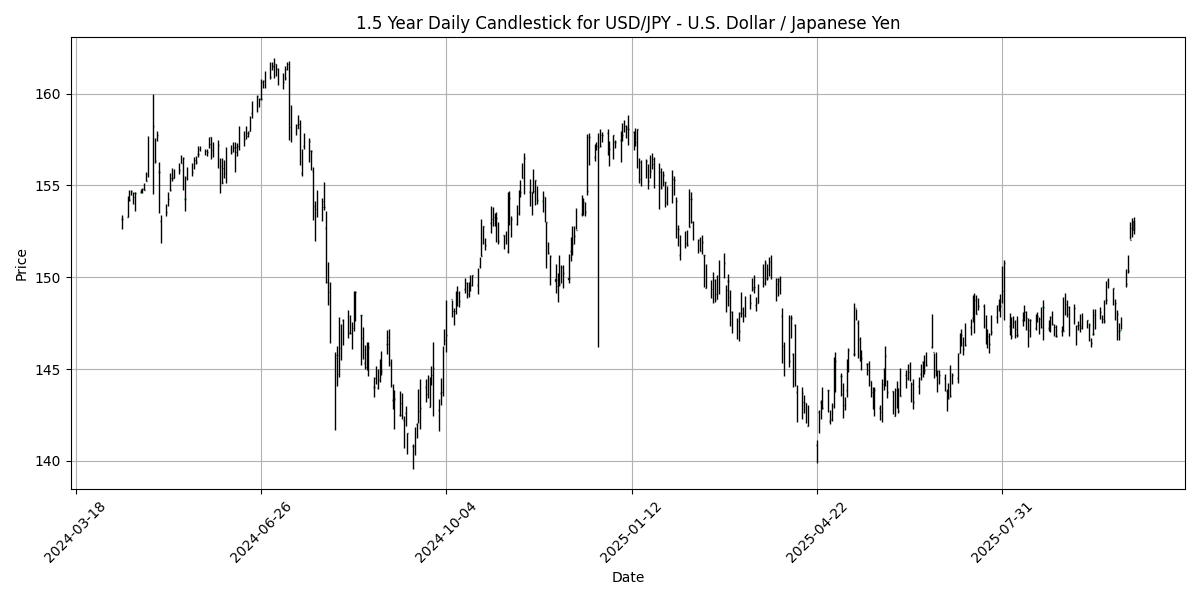

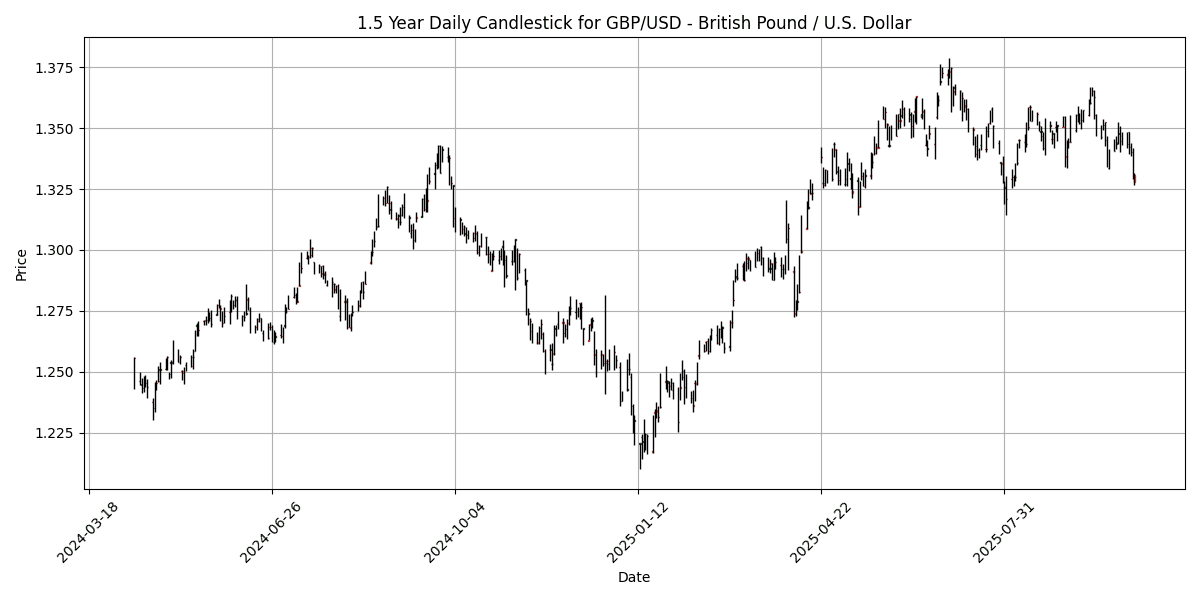

In the latest forex developments, the US Dollar (USD) remains firm, influencing key currency pairs amid mixed economic signals. Fed Governor Waller’s cautious stance on potential rate cuts has contributed to a steady USD, while the Pound Sterling (GBP) struggles to regain footing after dipping to a two-month low around 1.3280. The Euro (EUR) also faces challenges, with EUR/USD failing to show significant recovery after a four-day decline.

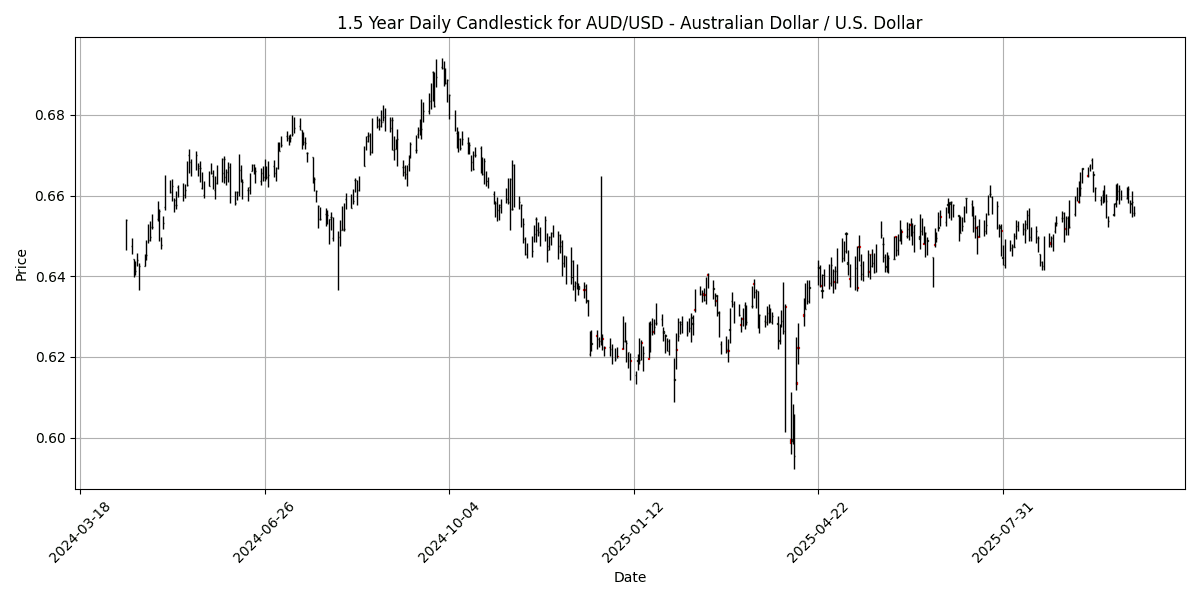

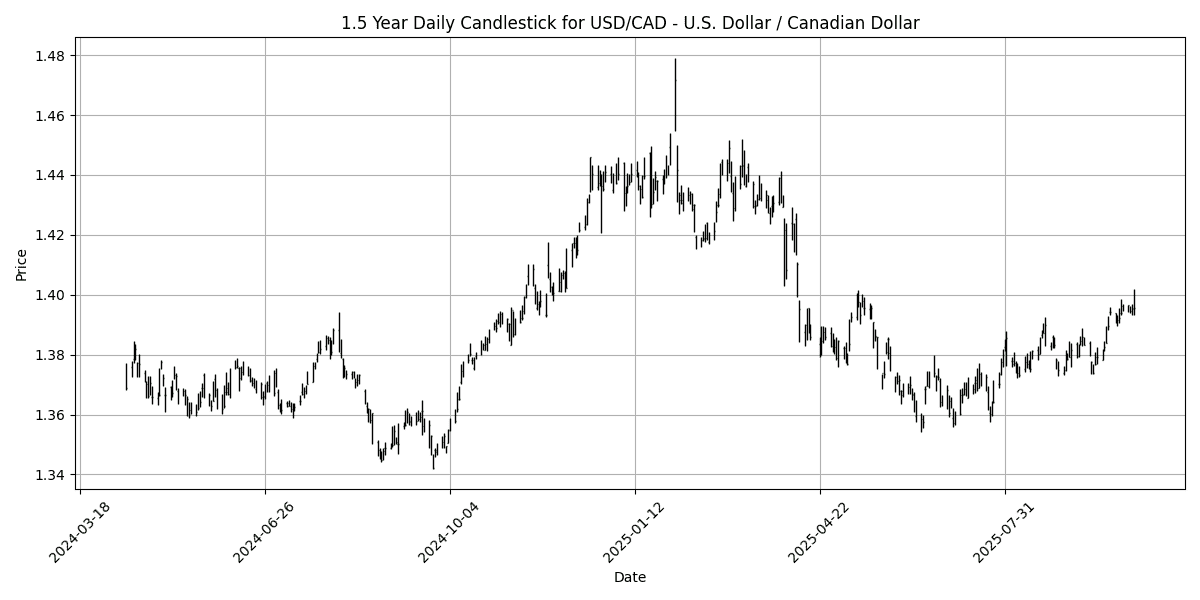

The Australian Dollar (AUD) has ticked lower against the USD, trading near 0.6550 as market sentiment shifts. Meanwhile, the USD/CAD pair has reached a six-month high, buoyed by a breakout above the 200-day Simple Moving Average ahead of Canadian jobs data.

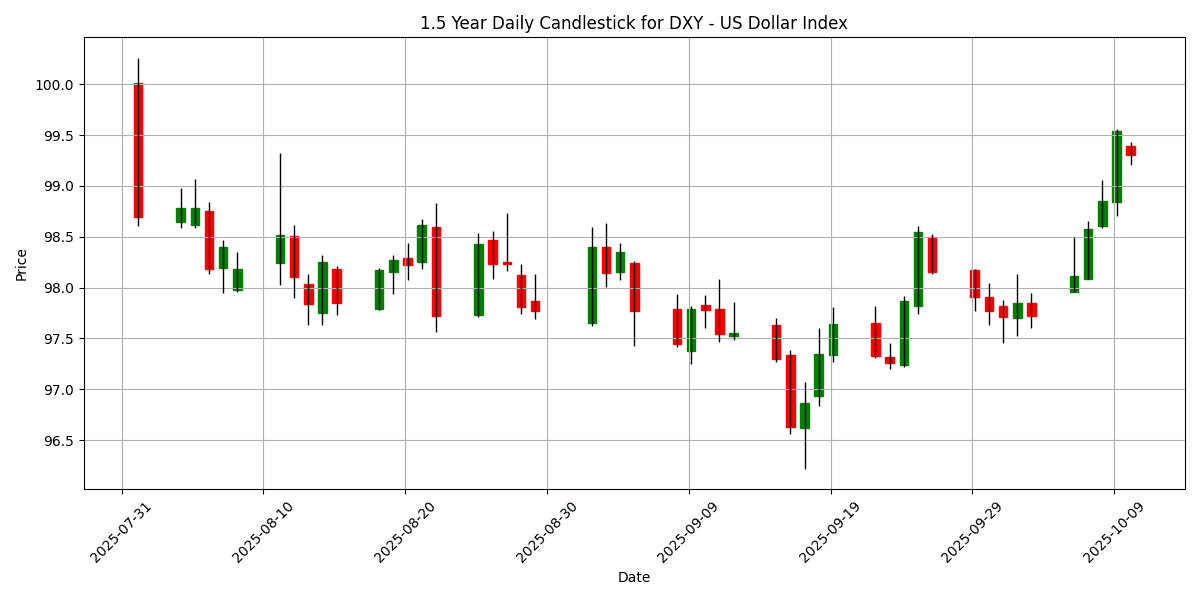

Geopolitical tensions continue to impact market sentiment, particularly following China’s retaliatory measures against US port fees. The US Dollar Index (DXY) is currently at 99.30, reflecting a daily change of -0.0040%. As traders await the Michigan Consumer Sentiment Index, the overall market sentiment remains cautious, balancing economic indicators with geopolitical developments.

## Economic Calendar Events Today

All times are in US Eastern Time (New York).

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-10 | 08:30 | 🇨🇦 | Medium | Employment Change (Sep) | 60.4K | 2.8K |

| 2025-10-10 | 08:30 | 🇨🇦 | Medium | Unemployment Rate (Sep) | 7.1% | 7.2% |

On October 10, 2025, Canadian economic data released at 08:30 ET revealed a significant increase in employment, with the Employment Change for September reported at 60.4K, vastly exceeding the forecast of 2.8K. This robust job growth suggests a strengthening labor market, potentially bolstering consumer spending and overall economic activity in Canada. The surprise in employment figures is likely to support the Canadian dollar (CAD) as traders reassess the Bank of Canada’s monetary policy stance, potentially leaning towards a more hawkish outlook.

Additionally, the Unemployment Rate for September came in at 7.1%, slightly better than the anticipated 7.2%. This decline in unemployment further reinforces the positive employment narrative and may enhance market confidence in the CAD.

In the context of G7 FX markets, the stronger-than-expected Canadian employment data is anticipated to lead to a bullish sentiment for the CAD against other currencies, particularly the USD and JPY. Traders may adjust positions in anticipation of potential rate hikes by the Bank of Canada, impacting CAD’s performance in the broader currency markets. Overall, the data reflects a resilient Canadian economy, with implications for currency valuation and interest rate expectations.

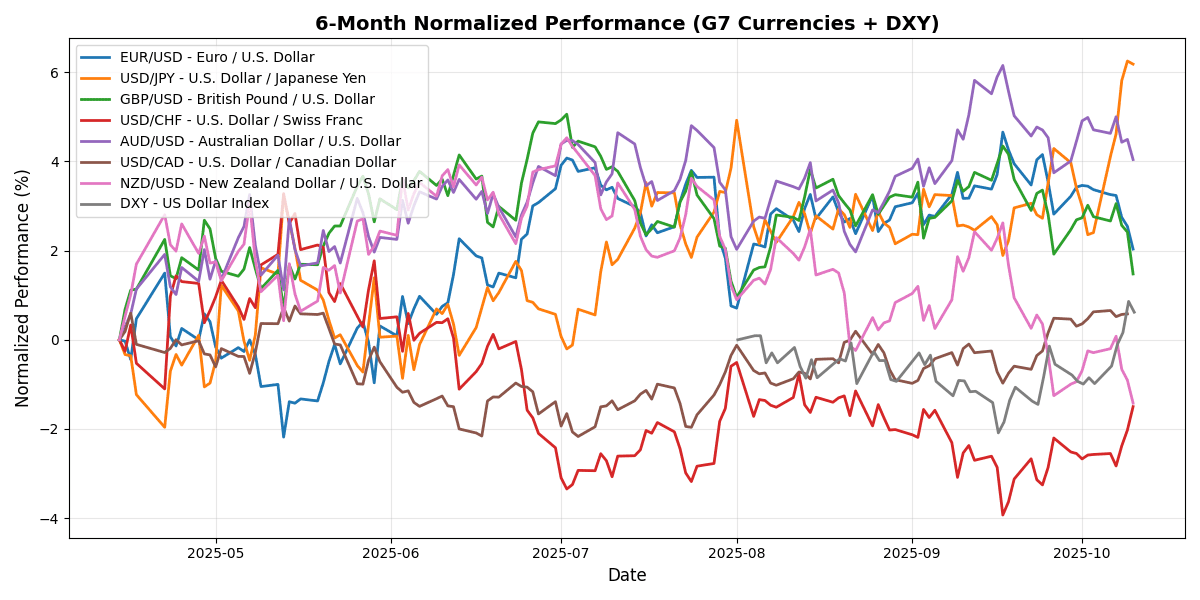

## G7 Currency Pairs Performance

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1574 | 0.0605 | -1.2888 | -1.2888 | -1.1002 | -1.1002 | 2.8084 | 11.22 | 5.7632 | 1.1692 | 1.1636 | 1.1207 | 32.45 | -0.0018 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 152.58 | -0.2902 | 3.6901 | 3.6901 | 3.5199 | 4.3011 | 6.1448 | -2.8122 | 2.2928 | 148.04 | 146.81 | 148.26 | 70.01 | 1.0491 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3278 | -0.1654 | -1.2542 | -1.2542 | -1.7979 | -2.2208 | 2.2008 | 5.8084 | 1.6046 | 1.3472 | 1.3500 | 1.3161 | 36.60 | -0.0032 |

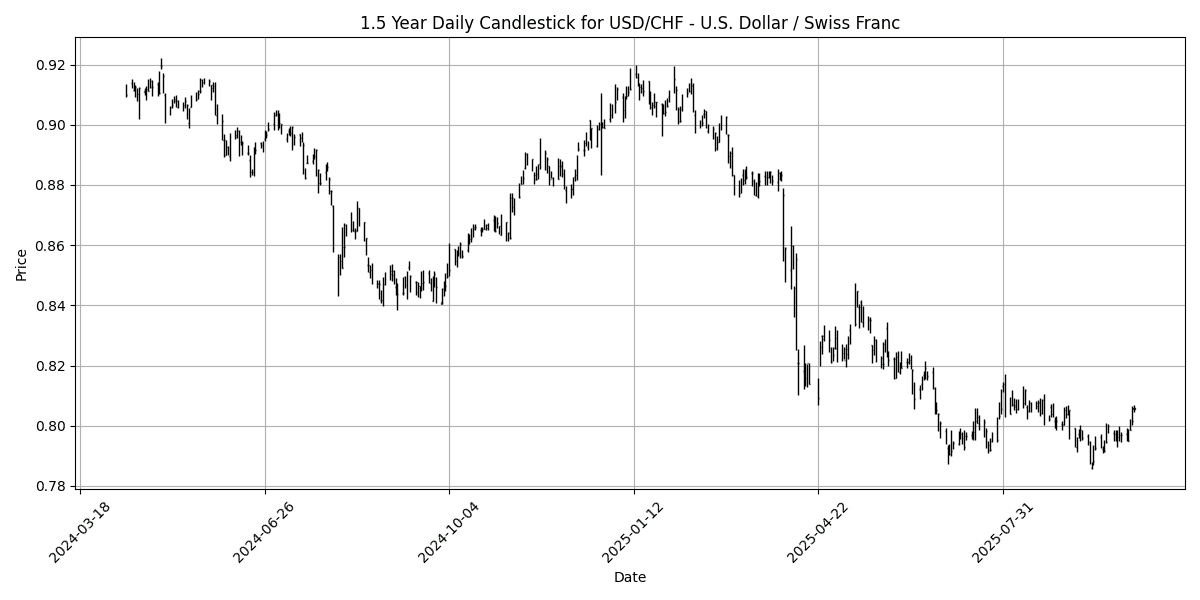

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8058 | -0.0620 | 1.1016 | 1.1016 | 1.0661 | 1.1397 | -1.8227 | -10.7878 | -6.3535 | 0.8006 | 0.8042 | 0.8398 | 65.22 | 0.0004 |

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6556 | -0.0610 | -0.6379 | -0.6379 | -0.4359 | -0.5763 | 5.3444 | 5.4019 | -2.4027 | 0.6554 | 0.6535 | 0.6418 | 43.84 | 0.0004 |

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.3984 | -0.2497 | 0.1655 | 0.1655 | 0.9923 | 2.3996 | 0.2365 | -2.5492 | 2.0038 | 1.3831 | 1.3761 | 1.3985 | 80.15 | 0.0043 |

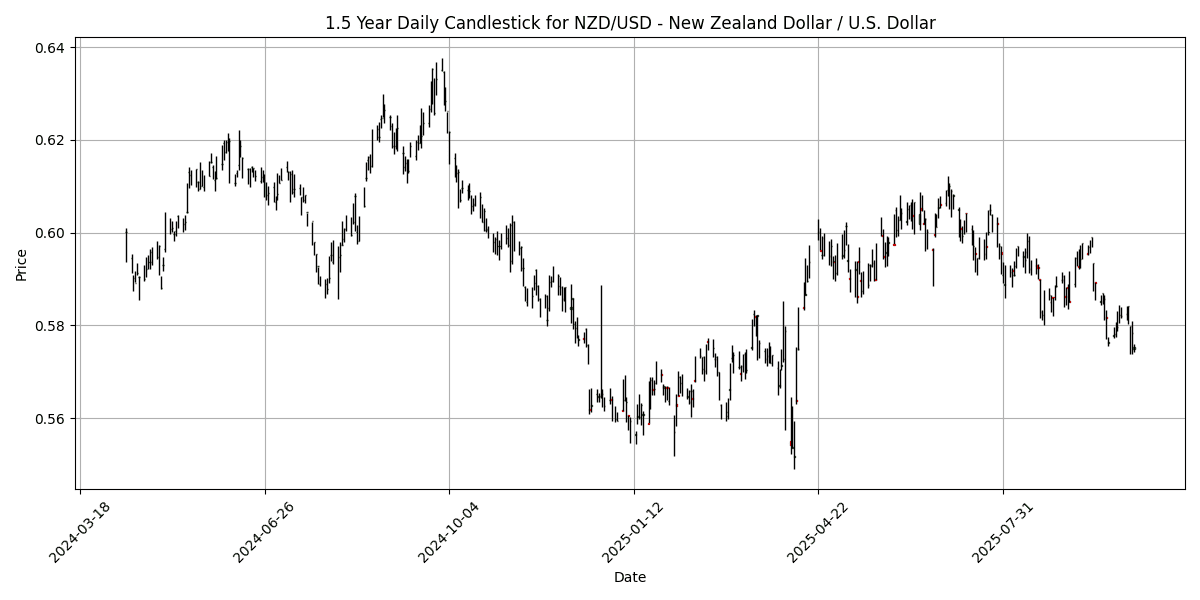

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5753 | 0.0696 | -1.1428 | -1.1428 | -2.9193 | -4.7786 | 0.0890 | 2.0087 | -5.2366 | 0.5882 | 0.5946 | 0.5846 | 33.30 | -0.0032 |

| DXY – US Dollar Index | DXY | 99.30 | -0.0040 | 1.6179 | 1.6179 | 1.5555 | N/A | N/A | N/A | N/A | 98.04 | 98.04 | 98.04 | 71.76 | 0.2957 |

## Charts

## Technical Analysis

In the current technical landscape of G7 currency pairs, several key signals emerge from the analysis of RSI, MACD, and moving averages.

Starting with EUR/USD, the RSI at 32.45 indicates an oversold condition, which may present a potential buying opportunity if bullish momentum develops. The MACD is slightly negative, suggesting a bearish trend, while both the 50 and 100-day moving averages are above the current price, reinforcing resistance levels.

In contrast, USD/JPY shows an RSI of 70.01, nearing overbought territory, coupled with a positive MACD of 1.0491, indicating strong bullish momentum. Traders may consider profit-taking or short positions as the price approaches resistance levels defined by the moving averages.

GBP/USD remains in bearish territory with an RSI of 36.60 and a negative MACD, suggesting further downside potential.

USD/CAD stands out with an RSI of 80.15 and a bullish MACD, indicating potential for a pullback or reversal as it approaches overbought conditions.

Finally, the DXY at 99.3010, with an RSI of 71.76, suggests that the US dollar is overbought, which could lead to a correction, impacting all dollar pairs.

Overall, traders should remain cautious, focusing on potential reversals in oversold pairs while being mindful of overbought conditions in others.

—

**Disclaimer:** The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.