💱 GBP/USD Soars on Inflation Data; USD/JPY Declines Amid Stagnant U.S. Dollar

📊 US Dollar Index (DXY)

Current Level: 99.96 (-0.09%)

The currency markets are currently influenced by a mix of inflation data and central bank expectations, particularly in the U.S. and Europe. The U.S. Dollar Index (DXY) stands at approximately 99.96, reflecting a slight decline of 0.09%. Recent sentiment towards the USD has improved significantly, driven by reduced trade risks and a stronger outlook in the options market, which has bolstered the currency’s exchange rate. This positive sentiment suggests growing confidence in the U.S. economy amid ongoing global uncertainties.

In Sweden, October’s CPIF inflation unexpectedly exceeded forecasts, prompting speculation that the Riksbank may adopt a more cautious approach to potential rate cuts. This development highlights the central bank’s vigilance regarding inflationary pressures, which could support the Swedish Krona if the Riksbank maintains a tighter monetary stance.

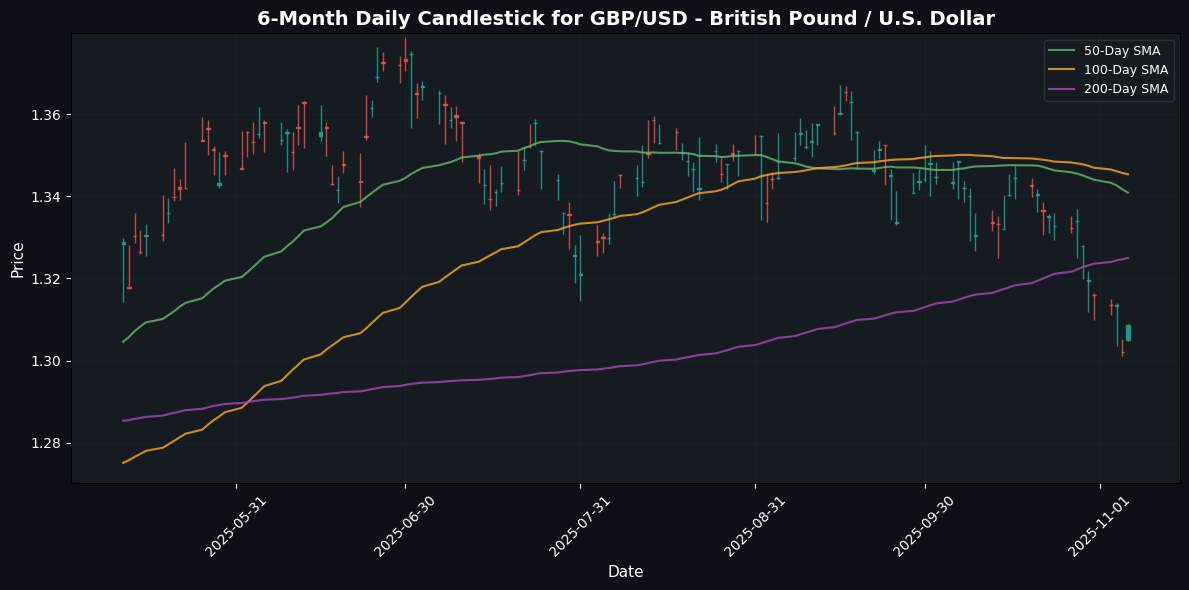

Meanwhile, the British Pound is under scrutiny as the Bank of England faces pressure, with markets pricing in a 25% chance of a rate cut in December. This uncertainty surrounding UK monetary policy is likely to weigh on the Pound’s performance in the near term.

Overall, the FX market is characterized by divergent monetary policy outlooks, with the USD gaining traction amid positive sentiment, while concerns over potential rate cuts in both Sweden and the UK create a mixed environment for their respective currencies.

📅 Today’s Economic Calendar

No significant economic events scheduled for today.

💱 Major Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

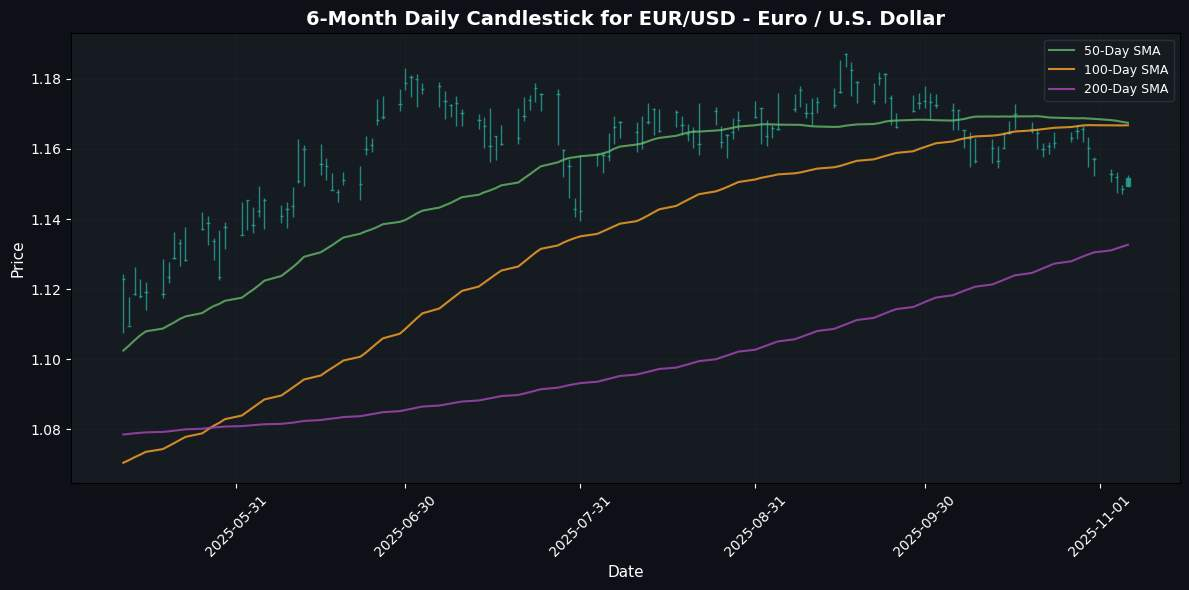

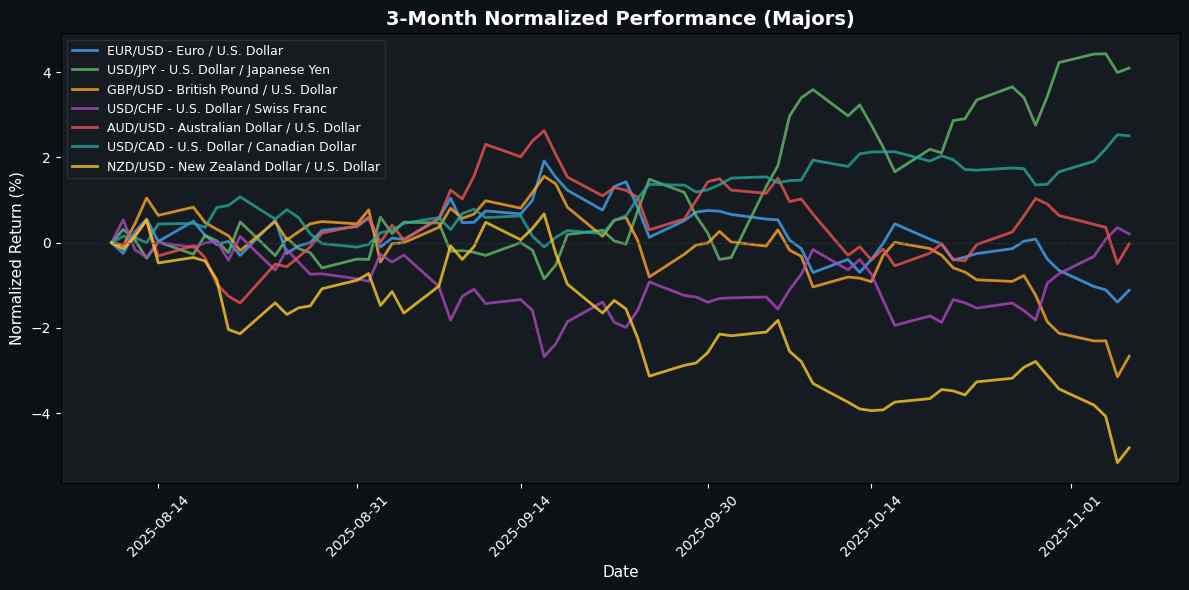

| EUR/USD – Euro / U.S. Dollar | EURUSD | 1.1518 | +0.17% | -0.73% | -1.15% | -1.93% | -2.39% | +10.10% | +3.17% | +6.86% | 1.1675 | 1.1668 | 1.1327 | 24.90 | -0.00 |

| USD/JPY – U.S. Dollar / Japanese Yen | USDJPY | 153.7090 | -0.24% | +0.65% | +0.67% | +3.33% | +7.09% | +2.57% | +6.36% | -1.99% | 149.8994 | 148.3998 | 147.8390 | 73.02 | 1.12 |

| GBP/USD – British Pound / U.S. Dollar | GBPUSD | 1.3086 | +0.26% | -0.83% | -1.91% | -2.72% | -4.13% | +3.71% | -0.80% | +2.80% | 1.3409 | 1.3454 | 1.3250 | 15.89 | -0.01 |

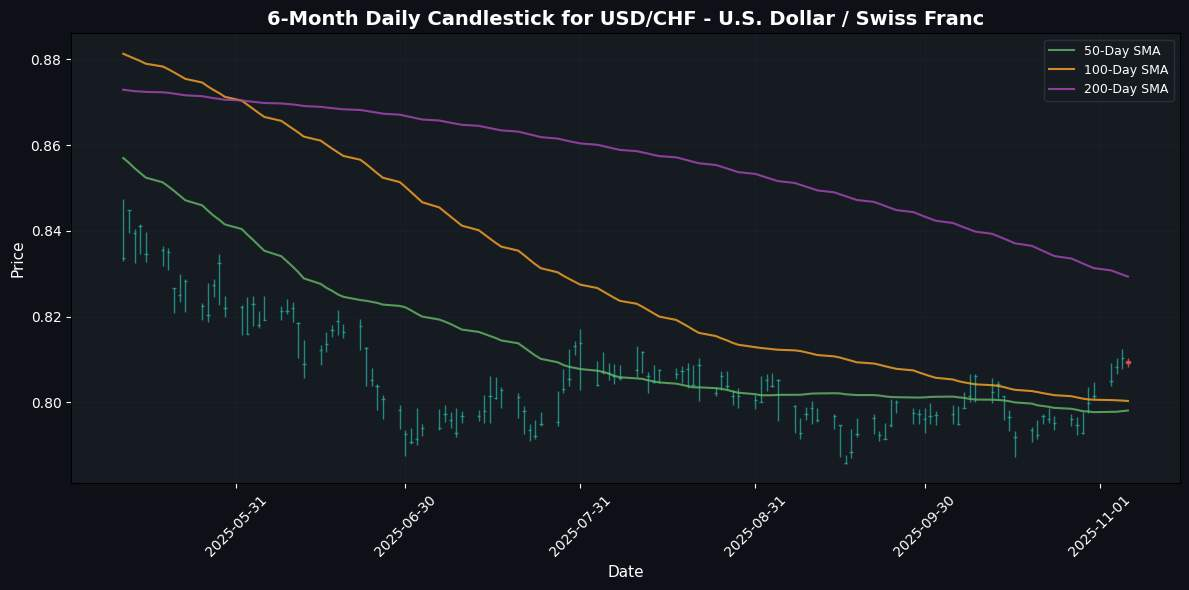

| USD/CHF – U.S. Dollar / Swiss Franc | USDCHF | 0.8091 | -0.09% | +1.17% | +1.83% | +1.82% | +2.23% | -9.83% | -4.48% | -9.71% | 0.7981 | 0.8003 | 0.8293 | 77.24 | 0.00 |

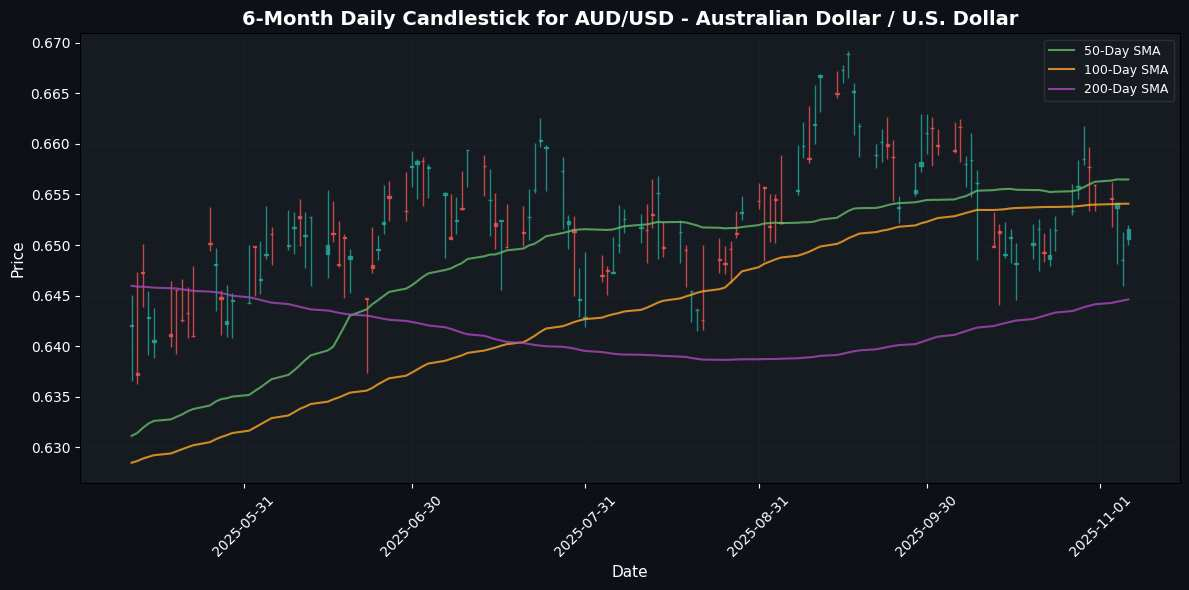

| AUD/USD – Australian Dollar / U.S. Dollar | AUDUSD | 0.6516 | +0.10% | -0.93% | -0.65% | -1.08% | -1.02% | +2.81% | -3.79% | -1.01% | 0.6565 | 0.6541 | 0.6446 | 55.88 | -0.00 |

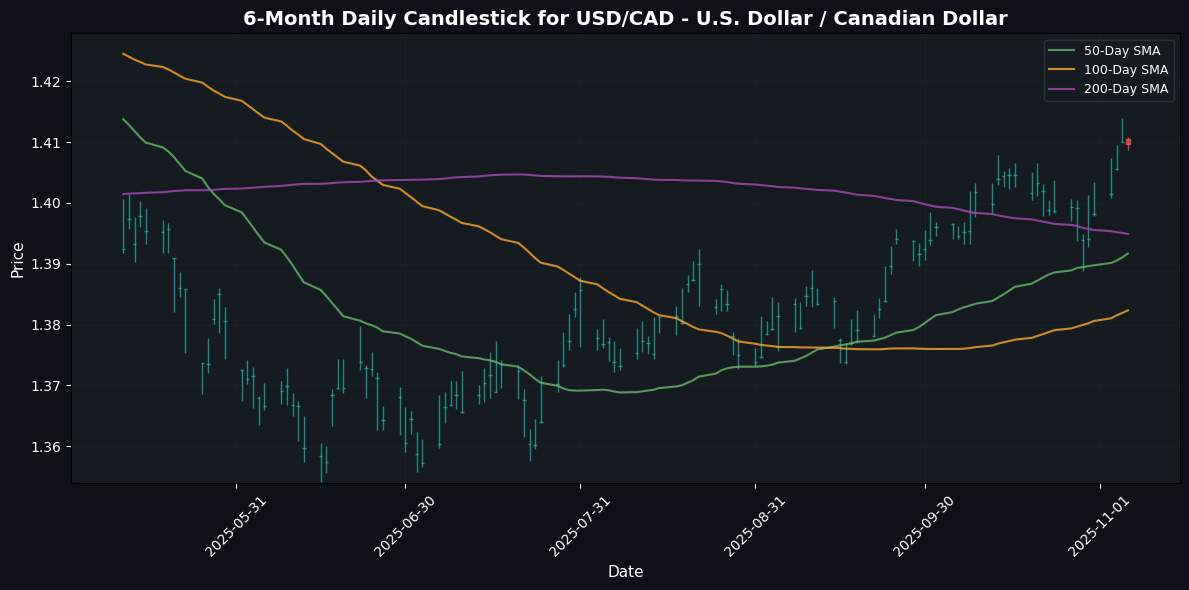

| USD/CAD – U.S. Dollar / Canadian Dollar | USDCAD | 1.4097 | -0.04% | +1.12% | +0.75% | +1.45% | +3.75% | -1.25% | +4.56% | +2.46% | 1.3917 | 1.3823 | 1.3949 | 57.95 | 0.00 |

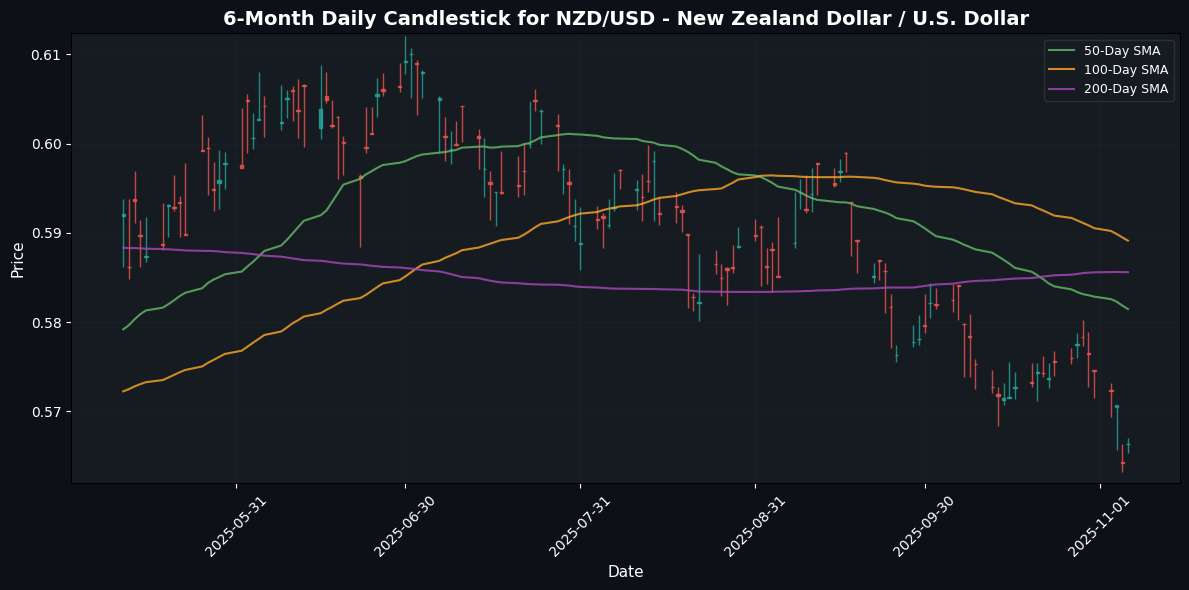

| NZD/USD – New Zealand Dollar / U.S. Dollar | NZDUSD | 0.5663 | -0.05% | -1.75% | -1.95% | -2.64% | -7.00% | -1.11% | -8.74% | -7.26% | 0.5815 | 0.5891 | 0.5856 | 36.34 | -0.00 |

In the latest trading session, the GBP/USD exhibited strength with a gain of 0.26%, signaling bullish momentum as the pair continues to find support above key psychological levels. The EUR/USD also showed resilience, rising 0.17%, indicating a potential continuation of the upward trend as buyers remain active despite economic uncertainties in the Eurozone. Conversely, the USD/JPY faced selling pressure, declining 0.24%, which suggests a bearish sentiment may be building against the U.S. Dollar amid mixed economic signals. The USD/CHF and NZD/USD also weakened slightly, reflecting a broader trend of dollar fatigue as market participants weigh geopolitical risks and the outlook for U.S. monetary policy.

🔀 Cross Currency Pairs

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| EUR/GBP | EURGBP | 0.8799 | -0.09% | +0.25% | +0.80% | +0.73% | +2.47% | +6.28% | +3.93% | +3.36% | 0.8702 | 0.8670 | 0.8543 | 76.40 | 0.00 |

| EUR/JPY | EURJPY | 176.9960 | -0.08% | -0.12% | -0.51% | +1.32% | +4.51% | +12.91% | +9.72% | +4.71% | 174.9738 | 173.1222 | 167.3833 | 58.68 | 0.66 |

| EUR/CHF | EURCHF | 0.9317 | +0.08% | +0.37% | +0.64% | -0.17% | -0.27% | -0.74% | -1.48% | -3.55% | 0.9316 | 0.9337 | 0.9376 | 63.91 | -0.00 |

| EUR/AUD | EURAUD | 1.7676 | +0.10% | +0.20% | -0.49% | -0.86% | -1.39% | +7.10% | +7.23% | +7.95% | 1.7783 | 1.7838 | 1.7564 | 19.51 | -0.00 |

| GBP/JPY | GBPJPY | 201.1340 | +0.01% | -0.18% | -1.26% | +0.52% | +2.67% | +6.38% | +5.51% | +0.76% | 200.9590 | 199.6077 | 195.8123 | 46.68 | 0.12 |

| GBP/CHF | GBPCHF | 1.0588 | +0.18% | +0.30% | -0.11% | -0.95% | -2.01% | -6.48% | -5.25% | -7.16% | 1.0700 | 1.0766 | 1.0976 | 42.91 | -0.00 |

| AUD/JPY | AUDJPY | 100.1270 | -0.17% | -0.31% | -0.01% | +2.20% | +5.99% | +5.43% | +2.31% | -3.00% | 98.3885 | 97.0509 | 95.2790 | 73.30 | 0.61 |

| AUD/NZD | AUDNZD | 1.1505 | +0.16% | +0.84% | +1.32% | +1.61% | +6.42% | +3.96% | +5.42% | +6.73% | 1.1290 | 1.1104 | 1.1009 | 85.38 | 0.01 |

| CHF/JPY | CHFJPY | 189.9500 | -0.16% | -0.49% | -1.13% | +1.49% | +4.78% | +13.76% | +11.36% | +8.57% | 187.7950 | 185.4065 | 178.5391 | 52.37 | 0.82 |

| NZD/JPY | NZDJPY | 87.0240 | -0.32% | -1.12% | -1.30% | +0.59% | -0.41% | +1.43% | -2.94% | -9.11% | 87.1229 | 87.3812 | 86.5277 | 59.63 | 0.15 |

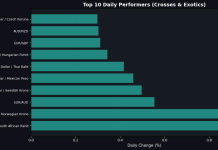

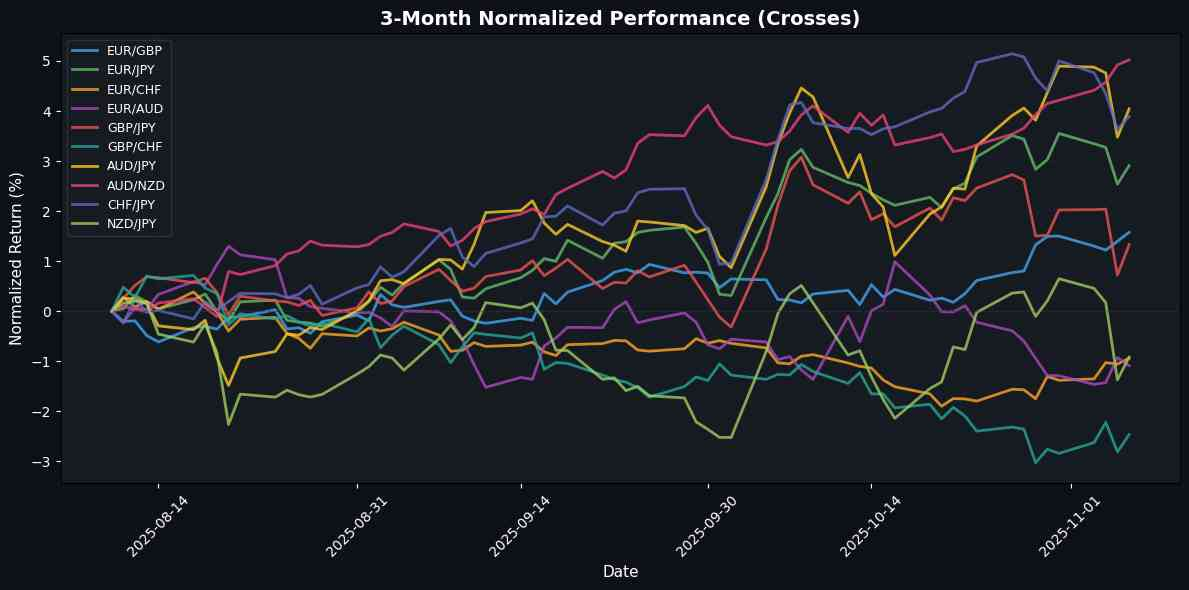

In the latest analysis of Crosses currency pairs, GBP/CHF leads the pack with a modest gain of +0.18%, suggesting a strengthening of the British pound against the Swiss franc, potentially driven by positive economic sentiment in the UK. AUD/NZD follows closely with a +0.16% gain, indicating resilience in the Australian dollar amid fluctuating commodity prices, while EUR/AUD’s +0.10% uptick reflects a slight recovery for the euro against the Australian currency. Conversely, the weakest performers are led by NZD/JPY at -0.32%, highlighting a bearish trend for the New Zealand dollar against the yen, likely influenced by Japan’s stable economic outlook; similarly, AUD/JPY and CHF/JPY show declines of -0.17% and -0.16% respectively, indicating a general risk-off sentiment affecting the Australian and Swiss currencies against the yen.

🌍 Exotic and Emerging Market Currencies

| Name | Symbol | Price | Daily (%) | 5D (%) | 1W (%) | 1M (%) | 3M (%) | 6M (%) | YTD (%) | 12M (%) | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| USD/TRY – U.S. Dollar / Turkish Lira | USDTRY | 41.9550 | -0.32% | +0.14% | -0.01% | +1.17% | +5.14% | +15.09% | +23.31% | +29.47% | 41.6168 | 41.0080 | 39.3876 | 55.22 | 0.12 |

| USD/ZAR – U.S. Dollar / South African Rand | USDZAR | 17.3690 | -0.20% | +1.20% | +0.92% | +0.24% | -1.08% | -5.41% | -1.85% | -8.03% | 17.3617 | 17.5517 | 17.9537 | 51.48 | -0.00 |

| USD/THB – U.S. Dollar / Thai Baht | USDTHB | 32.3400 | -0.28% | -0.19% | -0.86% | +0.78% | +0.06% | -3.52% | -4.80% | -12.38% | 32.2879 | 32.3779 | 32.9086 | 46.00 | 0.02 |

| USD/SEK – U.S. Dollar / Swedish Krona | USDSEK | 9.5413 | -0.12% | +1.45% | +1.76% | +1.50% | +0.34% | -10.57% | -6.57% | -9.62% | 9.4109 | 9.4946 | 9.7714 | 67.16 | 0.02 |

| USD/NOK – U.S. Dollar / Norwegian Krone | USDNOK | 10.1705 | -0.36% | +1.57% | +1.84% | +2.36% | +1.17% | -8.61% | -3.47% | -5.08% | 9.9959 | 10.0754 | 10.3421 | 62.36 | 0.04 |

| USD/DKK – U.S. Dollar / Danish Krone | USDDKK | 6.4823 | -0.16% | +0.72% | +1.13% | +2.00% | +2.52% | -9.09% | -2.99% | -6.33% | 6.3953 | 6.3978 | 6.5991 | 75.08 | 0.02 |

| USD/MXN – U.S. Dollar / Mexican Peso | USDMXN | 18.5770 | -0.06% | +0.60% | +1.02% | +0.86% | -1.00% | -9.30% | -4.12% | +1.37% | 18.4715 | 18.6020 | 19.2627 | 59.78 | 0.03 |

| USD/PLN – U.S. Dollar / Polish Zloty | USDPLN | 3.6946 | -0.14% | +1.16% | +1.71% | +1.78% | +2.34% | -6.70% | -3.63% | -7.51% | 3.6422 | 3.6453 | 3.7456 | 70.52 | 0.01 |

| USD/HUF – U.S. Dollar / Hungarian Forint | USDHUF | 335.6600 | -0.21% | +0.24% | +0.75% | +0.74% | -0.96% | -12.42% | -4.90% | -7.32% | 334.4477 | 337.9308 | 352.5535 | 58.70 | 0.39 |

| USD/CZK – U.S. Dollar / Czech Koruna | USDCZK | 21.1534 | -0.14% | +0.83% | +1.40% | +2.33% | +1.29% | -11.33% | -5.59% | -7.39% | 20.8315 | 20.9583 | 21.8560 | 80.69 | 0.08 |

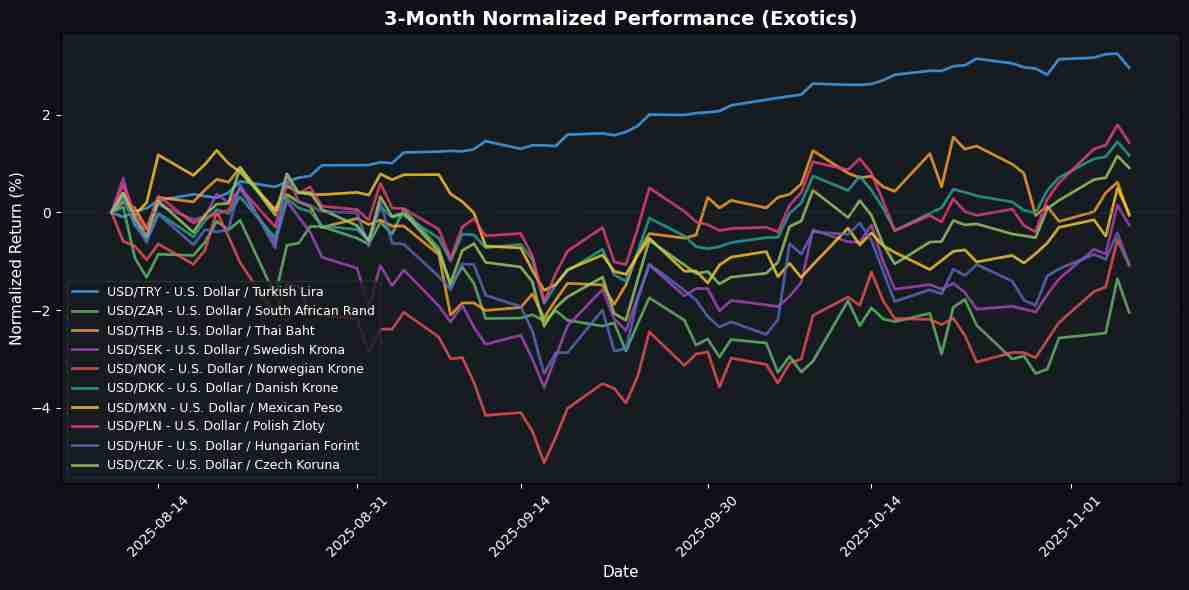

In the latest analysis of exotic currency pairs, the U.S. Dollar has shown mixed performance, with top performers like USD/MXN, USD/SEK, and USD/CZK maintaining relatively stable positions, each experiencing slight declines of -0.06%, -0.12%, and -0.14%, respectively. These modest movements suggest a period of consolidation in these pairs, potentially indicating underlying strength in the Mexican Peso, Swedish Krona, and Czech Koruna against the Dollar. Conversely, the weakest performers—USD/NOK, USD/TRY, and USD/THB—have seen sharper declines, with losses of -0.36%, -0.32%, and -0.28%. This trend could signal increased volatility or economic pressures in Norway, Turkey, and Thailand, prompting traders to watch for further developments that could impact these currencies. Overall, the market appears to be navigating through cautious sentiment, with the Dollar facing headwinds against certain exotic currencies while remaining resilient against others.

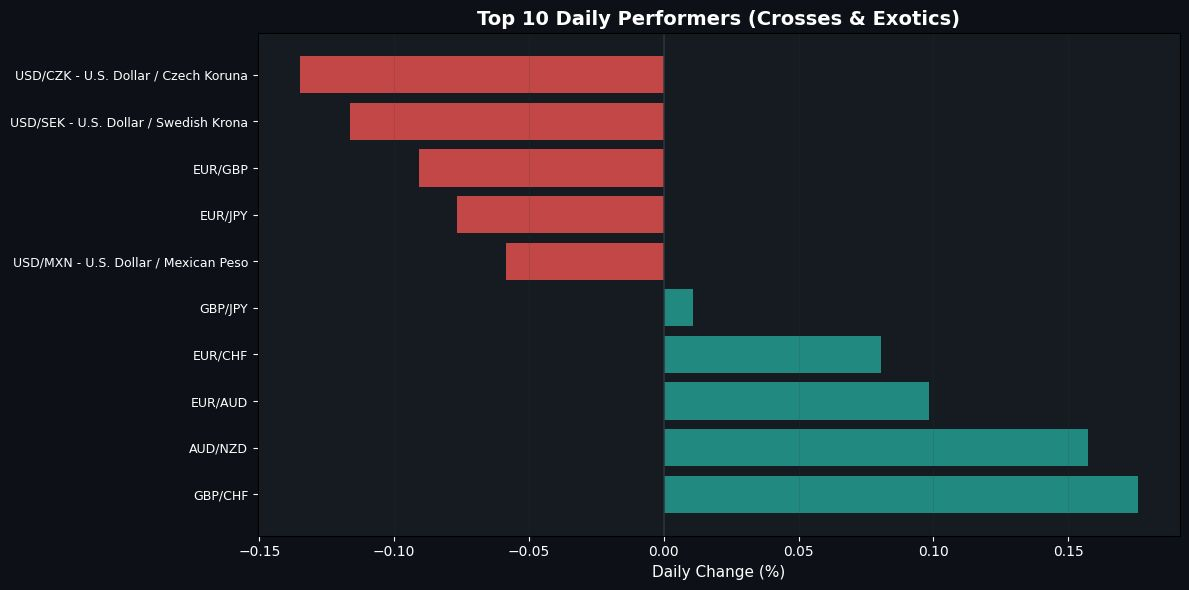

🏆 Top Daily Performers (Crosses & Exotics)

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.