Welcome to Marketsfn global markets update, where in 2 min you will have exposure to the most relevant facts and event of markets and asset classes around the globe.

The European session began with mixed performances across various markets. The FTSE 100 opened lower, declining by 0.36%, which could be due to local UK economic concerns. In contrast, both the CAC 40 and DAX showed strength, with the CAC 40 rising by 0.50% and the DAX up 0.25%. Leading the European markets, the IBEX 35 posted a solid gain of 0.86%.

Asian markets have shown positive momentum, with most major indices posting gains. The S&P/ASX 200 rose by 0.30% to close at 8,011.90, reflecting a modest upward move. Japan’s Nikkei 225 edged up by 0.06%, closing at 36,182.50, marking a slight increase amid cautious sentiment. The Hang Seng index gained 0.22%, closing at 17,234.09, indicating a moderate recovery in Hong Kong stocks. India’s Nifty 50 saw a more substantial rise, advancing 0.66% to close at 25,102.10, signaling positive sentiment in the Indian market. Finally, the FTSE China 50 increased by 0.51%, closing at 11,476.23, reflecting optimism in Chinese equities.

Markets are trying to assess the Federal Reserve’s next move on monetary policy following recent data, with a rate cut at the central bank’s meeting on September 17-18 now almost certain. However, uncertainty persists regarding whether the cut will be 25 or 50 basis points. More clarity may emerge on Wednesday when the latest U.S. consumer price index, a key inflation indicator, is released.

Turning to the U.S. markets from the previous day, there was a strong performance across the board. The Dow surged by 1.20%, the NASDAQ gained 1.16%, and the S&P 500 increased by 1.47%. These gains were likely fueled by a combination of positive macroeconomic data and corporate earnings that exceeded market expectations. The Russell 2000 also moved higher, though more modestly, with an increase of 0.28%, indicating that smaller companies performed well, albeit not as strongly as their larger peers.

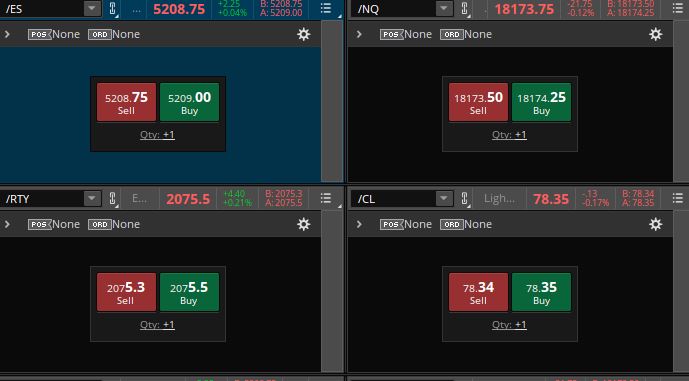

In the futures market, crude oil slipped by 0.25% and natural gas fell by 0.41%, signaling some weakness in the energy sector. This downturn may be a result of concerns about global demand. Meanwhile, U.S. index futures are showing slight gains for the Dow and S&P 500, while Nasdaq 100 futures are down 0.11%, suggesting mixed expectations for technology stocks.

In the currency and bond markets, the EUR/USD remained flat, reflecting a stable outlook for the Euro against the Dollar, while the USD/JPY rose by 0.32%, indicating a stronger U.S. dollar against the yen, possibly tied to expectations around U.S. interest rates. Bitcoin (BTC/USD) experienced a notable increase, climbing by 1.30%.U.S. Treasury yields saw a slight decline, reflecting a degree of caution among investors. The 10-year Treasury yield fell by 0.35%, signaling a potential flight to safety or a recalibration of expectations concerning future interest.

On the economic front, significant indicators were released earlier from China, including a robust increase in exports, which rose 8.7% YoY, while imports dropped by 0.5% YoY. These figures may have influenced global market sentiment, particularly in commodities and industrial metals. In Europe, inflation data from the Eurozone, as measured by the Harmonized Index of Consumer Prices (HICP), showed little deviation from expectations. This suggests that inflationary pressures remain in line with forecasts, potentially easing concerns about aggressive monetary tightening in the region.

In conclusion, European markets are showing a mixed performance, while U.S. markets had a strong close the previous day. The release of economic data from China and Europe, combined with developments in U.S. futures and forex movements, will be critical factors to monitor as the day