The Bank for International Settlements (BIS) has released its latest residential property price statistics for the first quarter of 2025, and the results underscore an increasingly divided global housing market. According to the statistical release (BIS, August 2025), global real house prices declined by 1.0% year-on-year. While that represents an improvement compared with the steeper –1.6% fall in late 2024, the headline figure hides a stark divergence: advanced economies (AEs) are seeing recovery and resilience, while emerging market economies (EMEs)—especially in Asia—continue to struggle under structural and financial pressures.

The BIS release is particularly timely. After a turbulent few years shaped by pandemic-era policy responses, global inflation shocks, and monetary tightening, housing has re-emerged as a key barometer of both financial stability and consumer confidence. For investors, policymakers, and lenders, the Q1 2025 data offer critical insights into where risks and opportunities lie in the housing sector.

Global Trends: A Softer Decline but No Rebound Yet

In aggregate, global real house prices fell 1.0% in Q1 2025, marking the third consecutive year of decline since the downtrend began in 2022. Nominal house prices actually rose 2.1%, but when adjusted for inflation, the real picture remains negative (BIS Statistical Release).

- Advanced economies (AEs) posted a 1.2% rise, extending the recovery trend that began in mid-2024. Europe was the main driver, with both euro area countries and non-euro European economies seeing gains of roughly 3%. Outside Europe, however, growth was almost flat (–0.1%).

- Emerging markets (EMEs) contracted by –2.6%, a slower pace than the –3.5% fall registered the quarter before. Still, Asia stood out with a sharp –4.4% drop, reflecting significant weaknesses in China and Hong Kong.

This global divergence illustrates how different regions are absorbing the effects of higher interest rates, demographic trends, and capital flows. While advanced markets show resilience, many EMEs remain hampered by tighter credit, household debt stress, and fragile consumer sentiment.

Regional Highlights

Europe: Southern Strength, Northern Stability

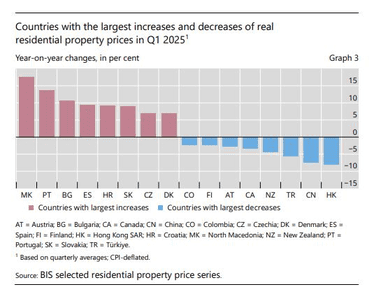

Europe is clearly leading the rebound. The BIS data show that North Macedonia (+18%), Portugal (+14%), and Bulgaria (+11%) were among the best performers worldwide in Q1 2025. Within the euro area, Spain (+9%), Italy (+3%), and Germany (+2%) all registered gains. Even France (0%), after years of decline, finally stabilized (BIS release, p.5).

These gains reflect the combination of easing inflation, stabilizing mortgage markets, and resilient household demand in Europe. Moreover, supply shortages in southern Europe—particularly Portugal and Spain—are amplifying price pressures even amid high financing costs.

North America: A Tale of Two Markets

The United States posted flat real house prices (0%), reflecting a delicate balance between affordability pressures and still-strong demand. Mortgage rates remain elevated, yet household balance sheets and employment conditions have provided a cushion. By contrast, Canada (–3%) continues to struggle. Its high household debt ratios and exposure to rate hikes have weighed heavily on property values.

Asia: China and Hong Kong in the Red

Asia remains the weak link. China (–7%) and Hong Kong SAR (–8%) recorded some of the steepest global declines, reflecting a continued property-sector downturn, unresolved developer debt issues, and weak buyer sentiment. Türkiye (–6%) also posted a significant decline, following a volatile cycle marked by inflation and financial instability.

By contrast, some resilience was seen elsewhere in Asia. India (–1%) and Korea (–2%) showed stabilization compared to earlier steep drops, while the Philippines (+5%) stood out with strong growth, supported by remittances and robust domestic demand.

Latin America and Eastern Europe: Bright Spots

In Latin America, real house prices increased 1.9% on average. Mexico led with a +4% rise, followed by modest gains in Brazil. In Central and Eastern Europe, growth of 2.5% was reported, with North Macedonia (+18%) and Czechia (+7%) leading the charge.

Longer-Term Context

Looking beyond short-term volatility, the BIS highlights how real housing prices have evolved since the Global Financial Crisis (2007–09). Globally, they have risen by 21%, with 34% growth in AEs and 11% in EMEs.

- The United States has seen a +50% increase since 2010, underpinned by tight housing supply and resilient household formation.

- Turkey more than doubled its real house prices since 2010, though recent declines now challenge that trajectory.

- Italy (–27%) and South Africa (–12%) remain below their 2010 levels, highlighting structural stagnation.

The long-term data show that while housing remains a key driver of wealth and consumption, market paths remain region-specific and shaped by policy, supply constraints, and demographics.

Policy and Market Implications

1. Monetary Policy Divergence

Central banks in advanced economies may take comfort from stable or rising property prices, suggesting households are absorbing higher rates. In EMEs, however, continued declines risk compounding financial stress, potentially forcing more accommodative policy responses.

2. Financial Stability Risks

China and Hong Kong’s steep housing contractions highlight the risks of contagion through banking systems, as real estate often forms the backbone of collateral and household wealth. Prolonged downturns could tighten credit further and depress economic activity.

3. Investor Strategies

For global investors, the BIS data point to selective opportunity. Southern and Eastern Europe’s resilience makes it an attractive area for capital allocation, while caution remains warranted across Asia, particularly in China and Hong Kong.

4. Long-Term Housing Challenges

Persistent supply shortages continue to drive gains in many advanced economies, while weaker demographic trends and oversupply weigh on EMEs. Policymakers must balance affordability with financial stability, ensuring housing markets don’t exacerbate inequality or systemic risks.

The Q1 2025 BIS housing release (full report here) confirms a critical global divergence. Advanced economies, led by Europe, are staging a cautious recovery, while many emerging markets remain in decline, particularly in Asia.

For policymakers, the challenge is to avoid complacency: rising housing prices in advanced economies risk fueling inequality and affordability crises, while continued stress in Asia threatens broader financial stability. For investors, the lesson is to remain nimble—opportunities exist in recovering European markets, but exposure to vulnerable EMEs requires vigilance.

The health of the housing sector remains central to global financial stability. As the BIS data show, its trajectory is anything but uniform.

References

- Bank for International Settlements (2025). Statistical release: BIS residential property price statistics in Q1 2025. Published 28 August 2025. Available at: https://www.bis.org/statistics/pp_residential_2508.pdf

- BIS Data Portal: Residential property prices – overview