For the full report click here, the following is a short summary.

In the wake of a global disinflationary trend through 2022-23, the world economy has proven remarkably resilient, defying earlier forecasts of stagflation and a looming global recession. Data reveals that both employment and income levels remained robust, supported by unexpectedly high government spending and consumer demand, alongside a notable rise in labor force participation.

Despite significant rate hikes by central banks aimed at curbing inflation, the economic downturn many feared did not materialize. Analysts point to a combination of factors for this resilience, including the availability of substantial savings amassed during the pandemic, which cushioned households in major economies from the immediate impacts of policy tightening. Additionally, long-term low interest rates prior to the pandemic helped to moderate the effects of recent rate increases on mortgage and housing markets.

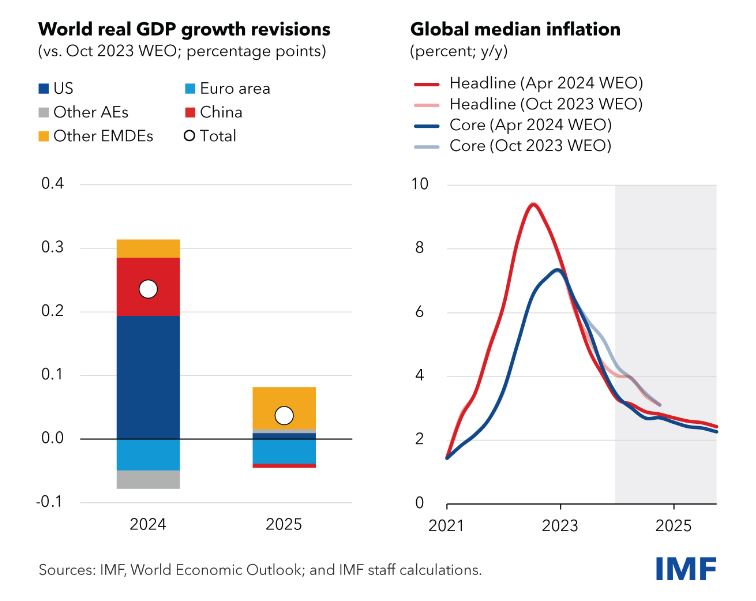

Looking ahead, global growth is projected to maintain a steady pace of 3.2% annually through 2025, slightly up from earlier predictions, according to the latest World Economic Outlook Update by the International Monetary Fund. However, this growth rate is considered low by historical standards, attributed to a mix of high borrowing costs, the withdrawal of fiscal support, and ongoing effects from the pandemic and geopolitical tensions like Russia’s invasion of Ukraine.

Inflation rates are expected to decline, with the global average falling from 6.8% in 2023 to an anticipated 4.5% by 2025. Advanced economies are likely to hit their inflation targets sooner than their emerging market counterparts.

The economic forecast isn’t without its risks—analysts caution about the potential for new price spikes triggered by ongoing geopolitical conflicts, such as those in Ukraine and the Gaza-Israel regions. These could lead to increased interest rate expectations and lower asset prices. Moreover, high government debt levels across many economies could force a turn towards austerity measures like tax hikes and spending cuts, potentially stifling economic growth and undermining public confidence.

On the upside, if fiscal policies remain more relaxed than currently projected, or if inflation decreases more rapidly due to further gains in labor force participation, economic activity could see a short-term boost. Additionally, advances in artificial intelligence and unexpected structural reforms might enhance productivity more than anticipated.

Central banks now face the delicate task of managing a “soft landing” for inflation, balancing the timing of policy easing to avoid falling short of inflation targets. As monetary authorities adopt less restrictive policies, the emphasis shifts towards fiscal consolidation to ensure debt sustainability and make room for critical investments. Tailored policy responses are essential given the varied conditions across countries, with a renewed focus on multilateral cooperation to address challenges such as geoeconomic fragmentation and climate change.

.