Ingersoll Rand Inc., founded in 1872 and based in Davidson, NC, specializes in innovative air, fluid, energy, and medical technologies. The company operates through two segments: Industrial Technologies and Services, offering solutions like compressors and power tools, and Precision and Science Technologies, which focuses on fluid management and niche compression technologies. Ingersoll Rand is a leader in delivering efficient technological solutions across diverse industries.

Ingersoll Rand, a global industrial manufacturing company, announced its participation in an upcoming investor conference scheduled for August 21, 2025. This event, as reported by GlobeNewswire, is an opportunity for Ingersoll Rand to engage with investors, analysts, and other financial professionals. The company’s involvement in such a conference is typically aimed at discussing its financial health, future strategies, and current market position. Participation in this kind of event often signals to the market that the company is ready to be transparent about its operations and future plans, which can have a positive impact on its stock. Investors and stakeholders might look forward to updates on performance, innovations, or strategic initiatives that could influence the company’s stock value. This news could potentially lead to increased investor confidence and a positive shift in stock prices depending on the nature of the disclosures made during the conference.

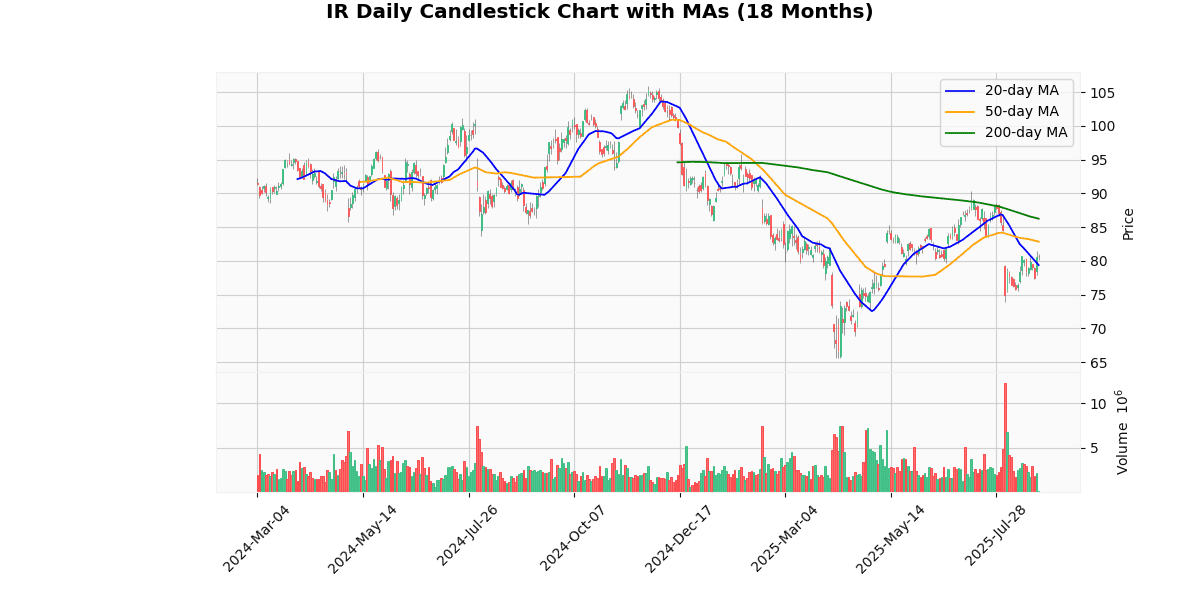

The current price of the asset is $80.68, experiencing a slight decline today by 0.16%. This price is near the upper end of this week’s trading range ($80.20 – $81.00), indicating some stability in the short term. However, the asset is significantly below its 52-week high of $105.95 by approximately 23.85%, and also down 15.77% from the year-to-date high of $95.78, suggesting a bearish trend over the longer term.

The moving averages reveal a bearish sentiment as well; the asset is trading below the 20-day, 50-day, and 200-day moving averages by 1.62%, 2.63%, and 6.46% respectively. This indicates a sustained downward pressure over time.

The Relative Strength Index (RSI) at 50.02 shows the asset is neither overbought nor oversold, suggesting a lack of strong momentum in either direction. The MACD value at -1.07 further supports this, indicating a bearish momentum as the asset is below the signal line.

Overall, the price metrics suggest a bearish outlook with the asset experiencing a gradual decline from its highs, coupled with a lack of strong buying or selling momentum in the immediate term.

## Price Chart

Ingersoll Rand Inc. (NYSE: IR) reported its financial outcomes for the second quarter of 2025 on July 31, demonstrating a record performance with strong operational execution. The company saw a significant increase in total orders, reaching $1,940 million, an 8% rise from the previous year. Total revenues also grew by 5% to $1,888 million. Despite a net loss of $115 million, or $(0.29) per share, adjusted net income stood robust at $325 million, or $0.80 per share.

Adjusted EBITDA increased by 3% to $509 million, maintaining a healthy margin of 27.0%. The company generated $246 million in operating cash flow and $210 million in free cash flow. Liquidity was strong at $3.9 billion, including $1.3 billion in cash and $2.6 billion in undrawn credit facilities.

Ingersoll Rand returned approximately $508 million to shareholders, comprising $500 million in share repurchases and $8 million in dividends. The company also invested $47 million in strategic acquisitions, including Lead Fluid and Termomeccanica Industrial Compressor S.p.A., enhancing its product offerings in fluid handling and renewable natural gas sectors.

Looking ahead, Ingersoll Rand raised its full-year 2025 guidance, expecting revenue growth of 4-6%, adjusted EBITDA between $2,100 million to $2,160 million, and adjusted EPS of $3.34 to $3.46, reflecting year-over-year increases of 4-7% and 2-5%, respectively.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-07-31 | 0.80 | 0.80 | 0.38 |

| 1 | 2025-05-01 | 0.73 | 0.72 | -1.89 |

| 2 | 2025-02-13 | 0.84 | 0.84 | -0.31 |

| 3 | 2024-10-31 | 0.81 | 0.84 | 3.26 |

| 4 | 2024-07-31 | 0.78 | 0.83 | 6.13 |

| 5 | 2024-05-02 | 0.69 | 0.78 | 12.98 |

| 6 | 2024-02-15 | 0.77 | 0.86 | 11.70 |

| 7 | 2023-11-01 | 0.69 | 0.77 | 12.02 |

Over the last eight quarters, the company’s earnings per share (EPS) have demonstrated a generally positive trend, with notable fluctuations in performance relative to estimates. Initially, in Q4 2023, the company exceeded expectations with a reported EPS of 0.77 against an estimate of 0.69, marking a surprise of 12.02%. This trend of surpassing estimates continued robustly into 2024, with Q1 and Q2 showing significant positive surprises of 11.70% and 12.98%, respectively, and reported EPS figures consistently higher than estimates.

However, the latter half of 2024 saw a slight moderation in this trend. While Q3 still outperformed expectations (6.13% surprise), by Q4, the surprise percentage reduced to 3.26%, albeit still maintaining a positive surprise.

Moving into 2025, the pattern shifted slightly. The first quarter saw a minor underperformance, where the reported EPS of 0.84 was slightly below the estimate by 0.31%. This was followed by a more noticeable underperformance in Q2, with a -1.89% surprise. By Q3 2025, the company managed to meet the EPS estimate exactly, with both estimated and reported EPS at 0.80, indicating a stabilization in earnings relative to expectations.

Overall, the data suggests a company capable of robust performance, particularly in early 2024, with a gradual approach towards stabilization in meeting EPS estimates by mid-2025. This trend indicates effective management of expectations and a potential recalibration of operational or financial strategies to align more closely with analyst forecasts.

## Dividend Payments Table

| Date | Dividend |

|---|---|

| 2025-08-14 | 0.02 |

| 2025-05-15 | 0.02 |

| 2025-03-05 | 0.02 |

| 2024-11-14 | 0.02 |

| 2024-08-15 | 0.02 |

| 2024-05-15 | 0.02 |

| 2024-03-06 | 0.02 |

| 2023-11-17 | 0.02 |

The dividend data spanning from November 2023 to August 2025 indicates a consistent dividend payment of $0.02 per share. This uniformity suggests a stable dividend policy by the company over the observed period. The regularity in the dividend payments, with distributions occurring roughly quarterly, highlights a predictable return for shareholders, which is often indicative of a company’s steady cash flow and financial stability.

The lack of variation in the dividend amount could imply that the company has maintained a steady financial performance without significant fluctuations in earnings or operational challenges that might otherwise necessitate a change in dividend payouts. This consistency might be appealing to income-focused investors looking for reliable dividend income. However, the absence of growth in the dividend amount over these eight quarters could raise questions about the company’s long-term strategy for growth and value enhancement. Investors might seek additional insights into the company’s future earnings potential and any possible plans for increasing shareholder value through higher dividends or strategic investments.

The most recent rating changes for the stock in question reflect a mix of strategic reassessments and market positioning by several notable financial firms.

1. **Melius on 2025-07-14**: Melius downgraded the stock from “Buy” to “Hold,” setting a new target price at $93. This adjustment suggests a shift in their outlook, possibly due to perceived limited upside or emerging risks that could cap the stock’s potential gains.

2. **Stifel on 2024-11-18**: Stifel also issued a downgrade, moving from “Buy” to “Hold.” This revision was accompanied by a decrease in the target price from $112 to $107. The reduction in target price alongside the downgrade indicates a reassessment of the stock’s future performance, likely driven by evolving market conditions or company-specific factors that do not support the previously higher valuation.

3. **UBS on 2024-11-13**: Contrasting the downgrades, UBS resumed coverage with a “Buy” rating, significantly raising the target price from $102 to $124. This positive outlook suggests that UBS sees substantial growth potential or undervaluation at previous levels, which could be due to new developments within the company or favorable industry trends.

4. **Morgan Stanley on 2024-09-06**: Morgan Stanley initiated coverage with an “Equal-Weight” rating and a target price of $97. This initiation at a neutral stance indicates a cautious optimism, recognizing the company’s stable fundamentals but also acknowledging potential challenges or a fair valuation at current levels.

These recent ratings and adjustments provide a nuanced view of the stock, reflecting varying degrees of confidence and expectations from the financial firms based on their latest analysis and market conditions.

The current price of the stock is $80.68, which is below the average target price suggested by recent analyst ratings. The ratings indicate varied expectations, with target prices ranging from $93 to $124. Notably, Melius downgraded the stock from “Buy” to “Hold” with a target price of $93, suggesting a potential upside but with caution. Similarly, Stifel adjusted their target from $112 to $107 while downgrading from “Buy” to “Hold,” indicating a reassessment of the stock’s growth prospects. On a more optimistic note, UBS resumed coverage with a “Buy” rating, raising their target from $102 to $124, suggesting significant potential upside. Morgan Stanley initiated coverage with an “Equal-Weight” rating and a target price of $97, aligning closer to other moderate estimates. This spread in target prices and ratings reflects a mixed but generally positive outlook, with a lean towards cautious optimism regarding the stock’s future performance.

Disclaimer: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice, investment recommendations, or trading guidance. Markets involve risk, and past performance is not indicative of future results. You should always conduct your own research and consult with a qualified financial advisor before making any investment decisions. By acting, you accept full responsibility for your choices.