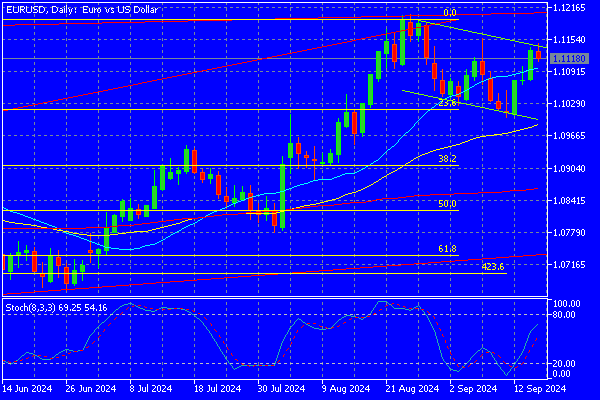

After the 2024 multiple top made last month EUR/USD started to develop lower highs and lower lows. This could be considered a retracement input albeit the pair is still only 100 pips below its 2024 high. At the moment the rate is trading at 1.1119, down by 0.12%

The framework for EUR/USD is thus mixed if we consider both bullish and bearish factors and the reason is because we need to distinguish between tactical versus strategical views.

From a tactical perspective EUR/USD could be on a way to developing some weakness but strategically its bullish framework is still intact.

Monitor both sides of the channel to be part of the price action and stay tuned for catalysts. The next one is the FOMC rate decision of tomorrow. Intraday volatility could be the enemy of tactical traders because of possible bad execution on a short term view thus timing is essential.