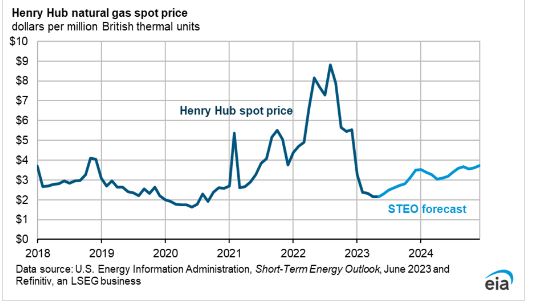

The US Energy Information administration has released the last June 6th its short term energy outlook, . The report is very interesting since it partially explains the depressed prices of Natural Gas in US. In April, the United States achieved a monthly record in dry natural gas production, reaching 104 billion cubic feet per day (Bcf/d), surpassing the previous month’s production of 102 Bcf/d. This production milestone was accomplished despite natural gas prices averaging below $2.50 per million British thermal units (MMBtu) at the Henry Hub, a benchmark in the U.S., during March and April. These prices were approximately $4.00/MMBtu lower than the annual average in 2022.

Despite lower natural gas prices, the United States achieved a new monthly production record, with notable growth in the Haynesville region and the Permian Basin.

According to forecasts, dry natural gas production in the United States is expected to remain near record levels for the remainder of the forecast period, with an average of around 103 billion cubic feet per day (Bcf/d) during the second half of 2023 and 2024. This steady production level is a result of reduced drilling specifically for natural gas, which is a response to the decline in natural gas prices this year. However, this reduction is being offset by increasing associated natural gas production in the Permian Basin. The revised outlook for natural gas production reflects higher expected crude oil prices in the current forecast, even though natural gas prices are expected to be lower.

Regarding natural gas prices, it is anticipated that the U.S. benchmark Henry Hub natural gas spot price will increase during the summer months. It is projected to average slightly over $2.60 per million British thermal units (MMBtu) in the third quarter of 2023, up from an average of $2.15/MMBtu in May. The primary drivers of this price increase are the rising use of natural gas in the electric power sector and a slower growth rate in production, leading to storage injections that are below the five-year average. The forecast predicts that the Henry Hub spot price will average around $3.40/MMBtu in 2024, which is nearly 30% higher than in 2023.

EIA.gov expects that despite the anticipated increase in natural gas prices during the summer months due to narrower inventory surplus compared to the five-year average, it is expected that prices will remain significantly lower than last year’s prices, which averaged around $8.00/MMBtu in the third quarter of 2022.

If the EIA is expecting a price of $ 3.4 for the next year, in our analysis the Fibonacci retracement from the 2022 highs is offering a more bullish upside potential since the 23.6% resistance is at 3.85$. Clearly before the static resistance at 3$ must be won and in case of false breakout or bearish market sentiment 2$ level might be retested again.