Jabil, Inc., founded in 1966 by William E. Morean and James Golden, is headquartered in St. Petersburg, Florida. The company provides comprehensive manufacturing services and solutions through two primary segments: Electronics Manufacturing Services (EMS) and Diversified Manufacturing Services (DMS). EMS focuses on core electronics and IT-driven manufacturing, while DMS specializes in engineering solutions involving advanced material sciences and manufacturing technologies for plastic and metal parts.

Recent news surrounding Jabil Inc. (NYSE: JBL) highlights a series of financial achievements and forecasts that could significantly impact its stock performance. On September 25, 2025, multiple sources including Zacks, Reuters, and Benzinga reported that Jabil exceeded Q4 earnings and revenue estimates, with a particular boost from AI-driven demand in data centers. Despite these positive results, Jabil’s stock experienced a decline, as noted by Barrons.com and Investing.com, which could suggest investor concerns or a market adjustment.

Further, CEO commentary pointed towards strong projections for 2026, emphasizing robust AI-driven demand, which could reassure investors about the company’s growth trajectory. This outlook was echoed in CNBC TV’s coverage where Jim Cramer discussed Jabil’s prospects in his “Mad Dash” segment, potentially influencing investor sentiment.

Overall, the blend of strong financial performance and positive future outlook, juxtaposed with the immediate stock price fall, presents a complex picture for investors. The market’s reaction seems to be weighing short-term results against long-term forecasts, which could lead to volatility in Jabil’s stock in the upcoming sessions.

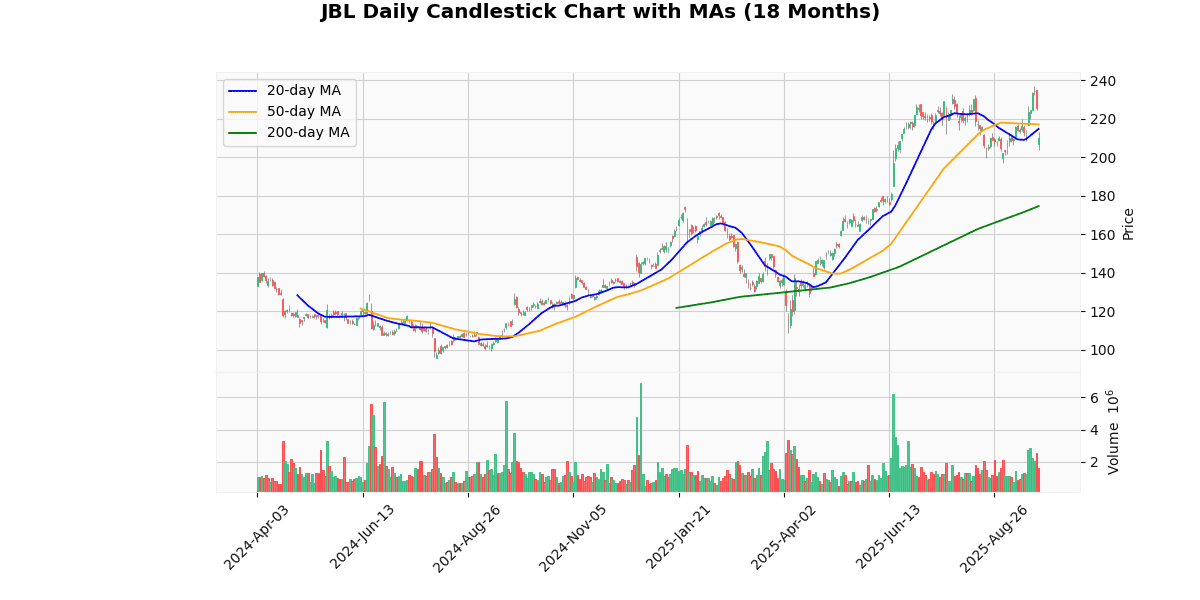

The current price of the asset is $209.735, reflecting a significant drop of 6.72% today. This downturn positions the price closer to the lower end of this week’s range, which is between $203.55 and $237.14. Despite this recent decline, the price has shown a robust increase of 93.18% from both the 52-week and YTD lows of $108.57, indicating a strong upward trajectory over the longer term.

However, the asset is currently trading below its 20-day and 50-day moving averages by 2.31% and 3.38%, respectively, suggesting a short-term bearish sentiment. Conversely, the price remains well above the 200-day moving average by 20.12%, highlighting a longer-term bullish trend.

The Relative Strength Index (RSI) at 43.9 indicates that the asset is neither overbought nor oversold, supporting a more neutral market stance in the immediate term. The MACD of 2.83 confirms some bullish momentum, although this might be weakening given the sharp price drop today. This combination of factors suggests a market in flux, with potential for both recovery and further declines, urging investors to watch for more definitive trend signals.

## Price Chart

Jabil Inc. (NYSE: JBL) reported substantial financial results for the fourth quarter and the full fiscal year 2025. For Q4, the company achieved a net revenue of $8.3 billion, marking a 19% increase from the previous year’s $6.964 billion. U.S. GAAP diluted earnings per share (EPS) rose significantly by 68% to $1.99 from $1.18. Non-GAAP core diluted EPS also saw a robust growth of 43%, reaching $3.29 compared to $2.30 in Q4 FY 2024.

For the fiscal year, Jabil posted a total revenue of $29.8 billion, a modest increase of 3.2% year-over-year. However, there was a notable decline in U.S. GAAP operating income and EPS, with the former decreasing by 40.1% to $1.2 billion and the latter by 46.9% to $5.92. Despite these decreases, non-GAAP core operating income slightly improved by 2% to $1.6 billion, and core diluted EPS grew by 14.8% to $9.75.

Looking ahead, Jabil anticipates net revenue for the upcoming quarter to be between $7.7 billion and $8.3 billion. The company projects a core operating margin of 5.6% and expects non-GAAP core diluted EPS to reach $11.00. Additionally, adjusted free cash flow is expected to exceed $1.3 billion. These projections reflect Jabil’s strong demand in sectors such as AI, capital equipment, data centers, and networking, showcasing the effectiveness of its diversified business model.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-09-25 | 2.92 | 3.29 | 12.67 |

| 1 | 2025-06-17 | 2.31 | 2.55 | 10.39 |

| 2 | 2025-03-20 | 1.83 | 1.94 | 6.18 |

| 3 | 2024-12-18 | 1.88 | 2.00 | 6.52 |

| 4 | 2024-09-26 | 2.22 | 2.30 | 3.60 |

| 5 | 2024-06-20 | 1.85 | 1.89 | 2.09 |

| 6 | 2024-03-15 | 1.66 | 1.68 | 1.39 |

| 7 | 2023-12-14 | 2.58 | 2.60 | 0.91 |

Over the past eight quarters, the company has consistently surpassed its EPS estimates, indicating a robust and stable financial performance. The trend shows a gradual increase in both the estimated and reported EPS, with the most significant increments generally observed in the third quarter of each fiscal year (September). For instance, the EPS in September 2025 was estimated at 2.92 and reported at 3.29, showing a substantial positive surprise of 12.67%.

The percentage of EPS surprise has varied, with the highest surprise occurring in the most recent quarter at 12.67% and the lowest at 0.91% in December 2023. This variability suggests that while the company consistently outperforms expectations, the extent of outperformance can fluctuate significantly.

Seasonal trends indicate stronger performance towards the end of the fiscal year, particularly in the September quarter. This pattern could be reflective of cyclical business operations or possibly strategic fiscal planning and execution. Overall, the consistent outperformance across all quarters underscores a well-managed operation and possibly conservative estimation practices by analysts.

## Dividend Payments Table

| Date | Dividend |

|---|---|

| 2025-08-15 | 0.08 |

| 2025-05-15 | 0.08 |

| 2025-02-18 | 0.08 |

| 2024-11-15 | 0.08 |

| 2024-08-15 | 0.08 |

| 2024-05-14 | 0.08 |

| 2024-02-14 | 0.08 |

| 2023-11-14 | 0.08 |

The analysis of the dividend data over the last eight recorded samples, spanning from November 2023 to August 2025, reveals a consistent dividend payout of $0.08 per share. This uniformity in dividend distribution across all observed quarters suggests a stable dividend policy maintained by the company during this period. The lack of fluctuation in the dividend amount may indicate a steady cash flow situation and a management decision to sustain shareholder returns at a predictable rate. This consistency can be favorable for investors seeking reliable income streams, as it provides a sense of financial stability and predictability in the company’s distribution strategy. However, the data also reflects a lack of growth in the dividend amount, which might be a point of consideration for growth-oriented investors. Overall, the company’s approach appears conservative, prioritizing steady returns over potentially riskier strategies that aim for higher, yet more variable, payouts.

The most recent rating changes for Outer reflect a mix of positive and negative sentiment from various financial firms, with adjustments in both target prices and overall ratings.

1. **Stifel – July 2, 2025**: Stifel resumed coverage on Outer with a “Buy” rating, setting a target price of $245. This indicates a strong bullish outlook from Stifel, suggesting that they see significant upside potential from current levels. The high target price could reflect expectations of robust growth or operational improvements by Outer.

2. **Argus – June 18, 2025**: Argus upgraded their rating on Outer from “Hold” to “Buy.” Although no specific target price was provided, this upgrade indicates a shift in Argus’s perspective, possibly due to improved financial performance or market conditions favoring Outer’s business model.

3. **Argus – March 19, 2024**: Earlier, Argus had downgraded Outer from “Buy” to “Hold.” This change likely reflected concerns about challenges that might have been impacting the company at the time, such as market saturation, competitive pressures, or operational issues, leading to a more cautious outlook.

4. **Barclays – January 17, 2024**: Barclays reiterated their “Overweight” rating but slightly lowered their target price from $153 to $151. This minor adjustment in the target price suggests a slight recalibration of expectations, possibly due to macroeconomic factors or slight shifts in company fundamentals, while still maintaining a generally positive view on the stock.

Overall, these rating changes indicate a dynamic perception of Outer’s financial health and market position, with recent trends showing a more optimistic outlook by analysts as of mid-2025.

The current price of the stock stands at $209.74, which when compared to the analyst target prices, shows a varied perspective on its future valuation. Stifel recently resumed coverage with a “Buy” rating, setting a target price of $245, indicating a potential upside of approximately 16.8% from the current price. This optimistic outlook contrasts with Barclays’ earlier assessment, where they reiterated an “Overweight” rating but slightly lowered their target from $153 to $151, well below the current market price. This discrepancy in target prices underscores differing expectations about the company’s future performance among analysts.

Additionally, the shift in ratings from Argus, from “Buy” to “Hold” in March 2024 and then upgrading back to “Buy” in June 2025, suggests a change in their outlook towards more positive growth or recovery prospects for the company. This fluctuation in ratings and target prices points to a dynamic and possibly uncertain environment surrounding the stock, influenced by varying analyst assessments and market conditions.

Disclaimer: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice, investment recommendations, or trading guidance. Markets involve risk, and past performance is not indicative of future results. You should always conduct your own research and consult with a qualified financial advisor before making any investment decisions. By acting, you accept full responsibility for your choices.