When historians of finance recount the most successful investors of all time, they often point to Warren Buffett’s value discipline or George Soros’s macro brilliance. But in terms of raw returns, no one matches the astonishing record of Jim Simons, the mathematician-turned-hedge fund manager who founded Renaissance Technologies. Simons, who passed away in 2024 at the age of 86, left behind not only one of the most profitable investment firms in history, but also a legacy that bridged mathematics, technology, and philanthropy.

From Academia to Codebreaking

James Harris Simons was born in 1938 in Newton, Massachusetts. From a young age, he displayed a talent for mathematics that would define his career. He earned his bachelor’s degree from the Massachusetts Institute of Technology and a Ph.D. in mathematics from the University of California, Berkeley, by the age of 23.

His early professional life was spent in academia and government service. Simons taught at MIT and Harvard before joining the Institute for Defense Analyses (IDA), a Cold War-era research group focused on cryptography. At IDA, Simons worked on breaking codes—a skill that would later inspire his systematic approach to financial markets.

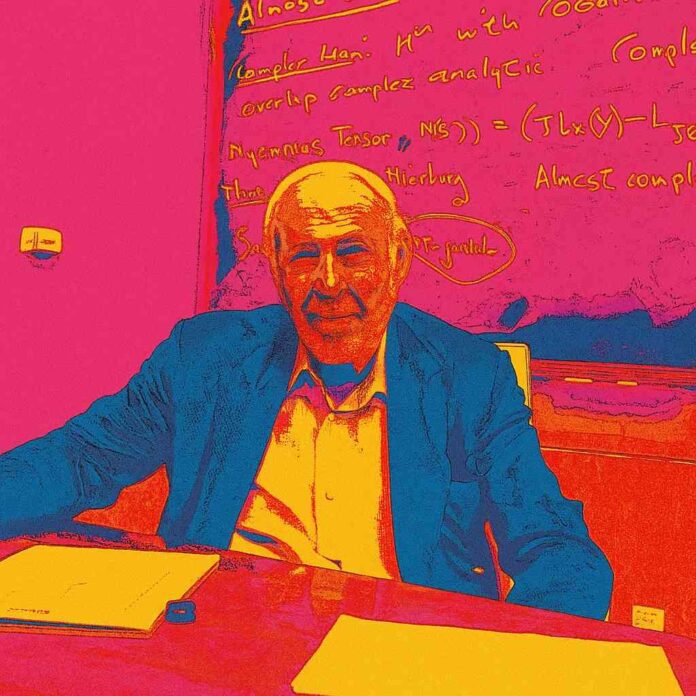

In 1968, he became chair of the mathematics department at Stony Brook University, where he made significant contributions to differential geometry. His work on the “Chern-Simons form” remains influential in theoretical physics today. By his mid-40s, Simons was already a celebrated mathematician. But he had grown restless in academia and yearned for a new challenge.

Entering the World of Finance

In 1978, Simons founded Monemetrics, a hedge fund that initially traded currencies and commodities. Unlike traditional traders who relied on gut instinct, Simons sought to apply statistical methods and algorithms. He recruited scientists—mathematicians, physicists, and computer scientists—rather than Wall Street veterans.

This unconventional team analyzed patterns in historical price data, searching for anomalies and recurring signals. The premise was simple yet radical: markets are not perfectly efficient; hidden within the noise are predictive signals that machines can detect better than humans.

By the early 1980s, Monemetrics evolved into Renaissance Technologies. Simons moved its headquarters to East Setauket, New York, away from the distractions of Manhattan, and quietly began building what would become the most secretive and successful hedge fund in history.

The Rise of the Medallion Fund

At the heart of Renaissance Technologies lies the Medallion Fund, launched in 1988. What distinguishes Medallion is not just its performance, but its consistency. For over three decades, the fund generated annualized returns of around 66% before fees and about 39% net of fees—numbers that dwarf every other hedge fund and even Buffett’s long-term record.

Medallion is notoriously exclusive. It manages about $10 billion and is open only to Renaissance employees and insiders. External investors were forced out by the early 2000s as returns were simply too lucrative to share.

The fund’s secret sauce lies in its quantitative trading algorithms, which digest mountains of data—price histories, news, satellite images, weather reports—and generate short-term signals. Trades are executed at lightning speed, and positions are often held for just days or even hours.

Unlike many quant shops, Renaissance eschewed traditional financial theory. Simons famously told his team, “We don’t care if it’s economic theory or astrology, as long as it works.” What mattered was empirical evidence. If a signal had predictive power, it went into the model. If not, it was discarded.

Building the Quant Revolution

Simons’s vision pioneered the era of quantitative finance. Renaissance became a haven for brilliant scientists, many of them Nobel-caliber mathematicians and physicists. They worked collaboratively, unlike the siloed culture of most hedge funds. Information was shared, models were constantly refined, and success was collective.

This culture produced innovations that rippled across Wall Street:

- High-frequency trading: While not the sole inventor, Renaissance helped popularize automated, short-term strategies.

- Machine learning in finance: Long before “AI” became fashionable, Renaissance was using pattern-recognition algorithms to forecast price movements.

- Data-driven investing: The firm’s reliance on data over theory inspired a generation of hedge funds and fintech startups.

Simons himself described his role modestly: “I’m just the guy who hired the smart people.” Yet it was his vision—to merge mathematics with markets—that made it possible.

Navigating Crises and Market Shifts

One of the most remarkable aspects of Renaissance’s record is its resilience across market regimes.

- Dot-com Bust (2000–2002): While tech-heavy indices collapsed, Medallion thrived by betting against overvalued stocks.

- Global Financial Crisis (2008): Many hedge funds imploded, but Medallion returned about 80% net of fees, its best year ever.

- Quant Meltdown (2007): Even during the infamous quant crash of August 2007, when statistical arbitrage models across Wall Street failed simultaneously, Medallion managed to recover quickly.

This ability to adapt underscored the robustness of Renaissance’s models and its relentless process of refinement.

Personal Wealth and Influence

By the time of his death, Jim Simons had amassed an estimated net worth of $30–35 billion, ranking him among the wealthiest hedge fund managers in history. But unlike many of his peers, Simons stepped back from day-to-day management in 2009, focusing on philanthropy and research while his lieutenants carried on Renaissance’s strategies.

Simons’s influence extended well beyond finance:

- Philanthropy – Through the Simons Foundation, he donated more than $6 billion to support mathematics, physics, life sciences, and autism research. The foundation is one of the largest private funders of basic scientific research in the U.S.

- Education – He endowed Stony Brook University with hundreds of millions, transforming it into a leading math and science institution.

- Politics – A significant donor to Democratic candidates, Simons used his fortune to support causes ranging from education reform to climate research.

Criticisms and Controversies

Despite his stellar record, Simons and Renaissance were not free from criticism.

- Opacity – The firm is notoriously secretive. Its models are black boxes even to most employees, and its strategies are tightly guarded. Critics argue this lack of transparency makes Renaissance a “black hole” in financial markets.

- Tax Disputes – In 2014, the U.S. Senate investigated Renaissance for using complex “basket options” to convert short-term trading profits into long-term gains, potentially avoiding billions in taxes. The firm ultimately paid billions in settlements.

- Concentration of Wealth – Medallion’s exclusivity meant its astronomical returns benefited only employees and insiders, fueling debates about inequality in finance.

Still, even detractors acknowledged Simons’s brilliance and Renaissance’s role in pushing finance into the age of data science.

Legacy and the Future

Jim Simons’s passing in 2024 prompted tributes from mathematicians, scientists, and investors alike. His legacy rests on two intertwined achievements:

- Revolutionizing Finance – By proving that mathematics and computation could systematically outperform markets, Simons redefined hedge funds and ushered in the quantitative era.

- Advancing Science – Through his philanthropy, he redirected his fortune into basic research, ensuring that discoveries in mathematics and physics would benefit future generations.

Renaissance Technologies continues to operate under the leadership of Peter Brown and Bob Mercer (though Mercer later stepped back amid political controversies). While no firm can guarantee Medallion’s legendary returns will continue indefinitely, the infrastructure and culture Simons built remain unparalleled.

Conclusion

Jim Simons’s story is one of transformation: from pure mathematics to Wall Street, from cryptography to hedge funds, and from personal wealth to philanthropy. He was a man who saw patterns where others saw randomness and turned that insight into one of the greatest fortunes ever made in finance.

Yet unlike many billionaires defined solely by their wealth, Simons will be remembered equally for the billions he gave away, the scientists he empowered, and the intellectual curiosity he embodied. In bridging the worlds of numbers and markets, Jim Simons not only became the most successful investor of all time, but also one of the most influential figures in the history of science and finance.