# JPMorgan Chase & Co. (JPM) Research Update

# JPMorgan Chase & Co.: Navigating the Financial Landscape

JPMorgan Chase & Co. is a renowned financial holding company offering a wide array of financial and investment banking services. With a focus on investment banking, consumer and small business financial services, commercial banking, financial transaction processing, and asset management, the company has established itself as a key player in the financial sector. Founded in 1799 and headquartered in New York, NY, JPMorgan Chase & Co. operates through segments like Consumer and Community Banking (CCB), Commercial and Investment Bank (CIB), Asset and Wealth Management (AWM), and Corporate.

## Recent News:

In recent news, JPMorgan Chase & Co. has been making headlines due to its second-quarter earnings report. The company beat sales targets, with earnings topping estimates and lifting interest income forecasts. Despite a 17% fall in profit, JPMorgan Chase managed to surpass Wall Street expectations, showcasing the resilience of the economy and Wall Street. CEO Jamie Dimon highlighted both strengths and risks in the current economic environment, emphasizing the importance of Fed independence. The stock witnessed a rise in share prices post-earnings, with analysts viewing JPMorgan Chase & Co. as a buy opportunity.

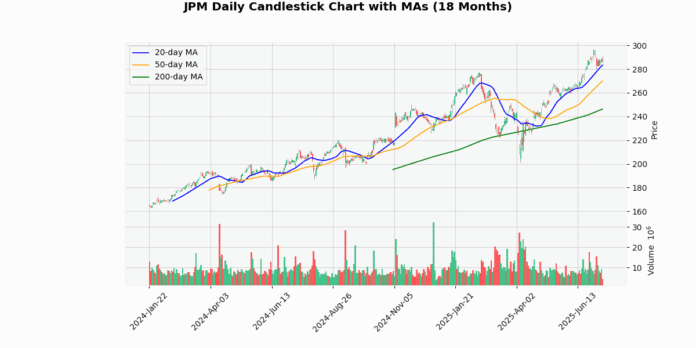

## Price Trend:

As of the latest data, JPMorgan Chase & Co.’s current price stands at $286.94. The stock’s price is slightly below the week high of $291.91, with a 1.7% difference. In terms of moving averages, the stock is 1.23% above the 20-day MA, 6.31% above the 50-day MA, and 16.55% above the 200-day MA. The 52-week high shows a 3.19% difference, while the 52-week low is 53.68% higher. The Relative Strength Index (RSI) is at 59.94, indicating a neutral position, and the Moving Average Convergence Divergence (MACD) stands at 5.84, signaling a bullish trend.

## Q10 Summary:

The Q2 2025 earnings report for JPMorgan Chase & Co. was released on July 15, 2025. The company reported net income of $15.0 billion, with total revenue at $44.9 billion. Notable figures include a 10% decrease in total revenue year-over-year and a 17% decline in net income compared to Q2 2024. JPMorgan Chase & Co. declared a common dividend of $3.9 billion and executed a share repurchase of $7.1 billion. The CEO highlighted strong financial results, enhanced capital management, and a cautious outlook due to various economic factors.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-07-15 | 4.48 | 5.24 | 16.96 |

| 2025-04-11 | nan | 4.61 | 4.91 | 6.42 |

| 2025-01-15 | nan | 4.11 | 4.81 | 17.08 |

| 2024-10-11 | nan | 4.01 | 4.37 | 9.02 |

| 2024-07-12 | nan | 4.19 | 4.26 | 1.75 |

## Earnings Trend:

Over the last eight quarters, JPMorgan Chase & Co. has shown consistency in its earnings performance. Despite a 17% decrease in net income in Q2 2025 compared to the previous year, the company has managed to beat sales targets and lift interest income forecasts. The EPS trends indicate a robust performance, with a focus on managing expenses and credit costs effectively.

## Dividend Payments Table

| Date | Dividend |

|---|---|

| 2025-07-03 | 1.4 |

| 2025-04-04 | 1.4 |

| 2025-01-06 | 1.25 |

| 2024-10-04 | 1.25 |

| 2024-07-05 | 1.15 |

| 2024-04-04 | 1.15 |

| 2024-01-04 | 1.05 |

| 2023-10-05 | 1.05 |

## Dividend Summary:

JPMorgan Chase & Co. has demonstrated a pattern of maintaining and even increasing dividends over the last eight samples. The recent dividend declared of $1.40 per share reflects the company’s commitment to rewarding shareholders and maintaining a stable dividend policy.

## Ratings:

In recent rating changes, Keefe Bruyette upgraded JPMorgan Chase & Co. from Market Perform to Outperform with a target price of $327. Conversely, HSBC Securities downgraded the stock from Hold to Reduce with a target price of $259. Robert W. Baird also downgraded the rating from Neutral to Underperform with a target price of $235. TD Cowen initiated coverage with a Buy rating and a target price of $305.