Keurig Dr Pepper Inc.: Revenue Growth but Margins Narrower – Post Earnings Analysis

Current Price: $29.03

+6.87%

on October 27, 2025

Keurig Dr Pepper, Inc. is a leading manufacturer and distributor of non-alcoholic beverages, headquartered in Burlington, MA. Established in 2018, the company operates through three segments: U.S. Refreshment Beverages, U.S. Coffee, and International. With an extensive portfolio of well-known brands, including Dr Pepper, Canada Dry, and Bai, Keurig Dr Pepper caters to diverse consumer preferences both domestically and internationally.

📰 Recent Developments

Keurig Dr Pepper Inc. reported third-quarter financial results, showing net sales growth of 5.2% year-over-year to $3.8 billion, driven by strong performance in the U.S. Refreshment Beverages segment, alongside expanded operating income margins. The company launched an innovative line of plant-based energy drinks under its Dr Pepper brand, featuring natural caffeine sources and zero-sugar options aimed at health-conscious consumers. In strategic moves, KDP formed a partnership with a major retail chain to co-develop exclusive iced coffee products for North American markets. Regulatory developments included approval from the FDA for a new preservative-free formulation in its Snapple iced tea portfolio. Operationally, the firm announced expansion of its manufacturing capacity in Ohio, adding 20% more production lines to support rising demand for single-serve coffee pods. No management changes occurred during this period.

📊 Earnings Report Summary

Keurig Dr Pepper (KDP) reported its Q3 2025 financial results on October 27, highlighting strategic initiatives and solid financial performance. Total revenue increased to $4.52 billion, up from $4.20 billion in Q3 2024, while gross profit rose to $1.82 billion, reflecting effective cost management despite a rise in cost of goods sold. Operating income improved to $620 million, and net income remained stable at $390 million.

Key strategic moves include a $7 billion investment to support the acquisition of JDE Peet’s, aiming for a net leverage ratio of 4.6x post-acquisition. The company plans to separate into two entities: a global coffee powerhouse and a North American beverage company. Leadership restructuring is underway, with Tim Cofer transitioning to CEO of Beverage Co. Overall, KDP is focused on enhancing shareholder value and maintaining a strong capital structure amid these changes.

📈 Technical Analysis

Daily Price Change: +6.87%

Technical Indicators

| Metric | Value |

|---|---|

| Current Price | $29.12 |

| Daily Change | 7.23% |

| MA20 | $26.65 |

| MA50 | $27.87 |

| MA200 | $31.57 |

| 52W High | $35.62 |

| 52W Low | $25.03 |

| % from 52W High | -18.23% |

| % from 52W Low | 16.36% |

| YTD % | -5.51% |

| BB Position | 107.57% |

| RSI | 66.97 |

| MACD | 0.19 |

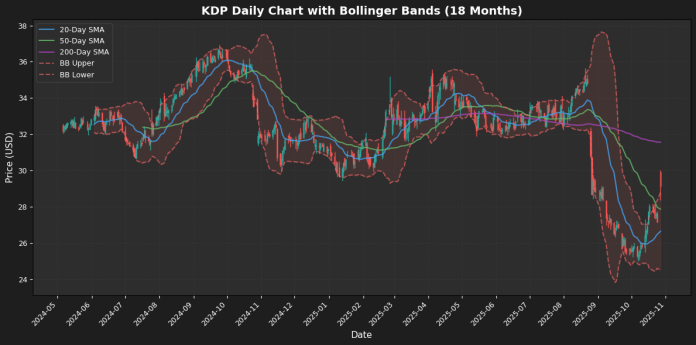

The current price of $29.125 reflects a notable daily increase of 7.23%, indicating bullish momentum. The stock is positioned 18.23% below its 52-week high of $35.62 and 16.36% above its low of $25.03, suggesting a recovery phase after recent underperformance, as evidenced by a year-to-date change of -5.51%.

The 20-day moving average (MA) at $26.65 and 50-day MA at $27.87 are both below the current price, indicating a strong upward trend. The price is also above the upper Bollinger Band ($28.80), which may suggest overbought conditions. The RSI at 66.97 supports this, nearing the overbought threshold of 70. The MACD at 0.19 indicates positive momentum, but caution is warranted given the potential for a pullback. Overall, the metrics suggest a bullish outlook but highlight the need for careful monitoring.

💰 Earnings History

| Earnings Date | EPS Estimate | Reported EPS | Surprise(%) | Event Type |

|---|---|---|---|---|

| 2025-04-24 | 0.38 | 0.42 | 9.84 | Earnings |

| 2025-02-25 | 0.57 | 0.58 | 1.26 | Earnings |

| 2024-10-24 | 0.51 | 0.51 | 0.45 | Earnings |

| 2024-07-25 | 0.45 | 0.45 | 0.08 | Earnings |

| 2024-04-25 | 0.35 | 0.38 | 9.88 | Earnings |

| 2024-02-22 | 0.54 | 0.55 | 1.7 | Earnings |

| 2023-10-26 | 0.47 | 0.48 | 2.63 | Earnings |

| 2023-07-27 | 0.4 | 0.42 | 3.94 | Earnings |

Analyzing the earnings per share (EPS) trends from the provided data reveals a generally positive trajectory in the company’s performance over recent quarters. The reported EPS consistently meets or exceeds estimates, reflecting a strong operational performance and effective cost management.

Notably, the EPS figures show a progressive increase, with the most recent earnings report on April 24, 2025, revealing a reported EPS of 0.42 against an estimate of 0.38, resulting in a notable surprise of 9.84%. This trend of exceeding estimates is a positive signal to investors, indicating confidence in the company’s growth prospects.

Moreover, the company has shown resilience with minor surprises in the lower range, such as the 1.26% surprise in February 2025, which still indicates stability. The consistent performance, with surprises mostly above 1%, suggests a solid foundation for future growth, making the company an appealing option for investors looking for reliable earnings growth.

💵 Dividend History

| Date | Dividend |

|---|---|

| 2025-09-26 | 0.23 |

| 2025-06-27 | 0.23 |

| 2025-03-28 | 0.23 |

| 2025-01-03 | 0.23 |

| 2024-09-27 | 0.23 |

| 2024-06-28 | 0.215 |

| 2024-03-27 | 0.215 |

| 2024-01-04 | 0.215 |

The dividend data presented reflects a steady trend in dividend payouts, particularly for the years 2024 and 2025. Notably, the company maintained a consistent dividend of $0.230 per share in the latter half of 2025, indicating a commitment to shareholder returns amidst potentially fluctuating market conditions. This consistency can be a positive signal to investors, suggesting financial stability and confidence in future earnings.

In 2024, however, there was a slight decrease in the dividend from $0.230 to $0.215 in the first half of the year. This reduction could imply a cautious approach by the company in response to market uncertainties or operational challenges. Nevertheless, the return to $0.230 in subsequent quarters might indicate a recovery or improved financial outlook.

Overall, the trends suggest a company that is balancing the need to reward shareholders while navigating the complexities of the economic landscape. Investors may view this as a stable investment, although they should remain vigilant about the underlying factors influencing these dividend decisions.

⭐ Analyst Ratings

| Date | Status | Outer | Rating | Price |

|---|---|---|---|---|

| 2025-10-01 00:00:00 | Reiterated | TD Cowen | Hold | $36 → $28 |

| 2025-09-24 00:00:00 | Downgrade | Barclays | Overweight → Equal Weight | $26 |

| 2025-09-22 00:00:00 | Downgrade | BNP Paribas Exane | Neutral → Underperform | $24 |

| 2025-08-26 00:00:00 | Downgrade | HSBC Securities | Buy → Hold | $30 |

Recent rating changes across various financial institutions indicate a cautious outlook for the companies involved. TD Cowen reiterated a “Hold” rating while significantly reducing its price target from $36 to $28, suggesting a lack of confidence in the stock’s short-term performance. Similarly, Barclays downgraded its rating from “Overweight” to “Equal Weight,” with a price target of $26, reflecting a more neutral stance amid potential market headwinds. BNP Paribas Exane’s downgrade from “Neutral” to “Underperform” with a price target of $24 further emphasizes a bearish sentiment, signaling concerns about the company’s ability to meet expectations. Lastly, HSBC Securities shifted from a “Buy” to a “Hold” rating, lowering its price target to $30. Collectively, these downgrades highlight a trend of increased skepticism in the market, likely driven by macroeconomic factors, sector-specific challenges, or company performance issues, suggesting investors should proceed with caution.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.