KOSPI Soars 2.50% as Asian Markets Rally Ahead of Trump-Xi Meeting

Note: This analysis covers the Asian trading session close for October 24, 2025. All times are in US Eastern Time (ET).

📊 Asian Indices Performance

| Index | Price | Daily Change (%) |

|---|---|---|

| Shanghai Composite | 3950.31 | +0.71 |

| Nikkei 225 | 49299.65 | +1.35 |

| Hang Seng Index | 26160.15 | +0.74 |

| Shenzhen Component | 13289.18 | +2.02 |

| KOSPI | 3941.59 | +2.50 |

| S&P/ASX 200 | 9019.00 | -0.15 |

| NIFTY 50 | 25795.15 | -0.37 |

| Straits Times Index | 4422.21 | +0.13 |

| S&P/NZX 50 | 13391.59 | +0.11 |

| Thailand SET Index | 1313.91 | +0.89 |

| FTSE Bursa Malaysia KLCI | 1613.27 | +0.33 |

| TAIEX | 27532.26 | -0.42 |

📰 Market Commentary

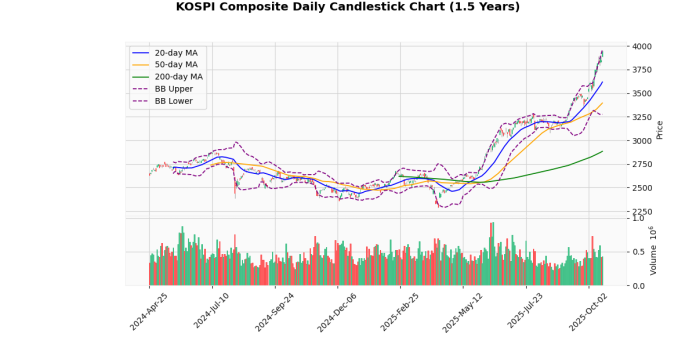

On October 24, 2025, Asian markets exhibited a generally positive sentiment, buoyed by anticipated diplomatic discussions between U.S. President Donald Trump and Chinese President Xi Jinping, scheduled for next week. This news significantly influenced investor confidence, contributing to notable gains across various indices. The South Korean KOSPI surged by 2.5%, reaching a record high, while the Shanghai Composite and Hang Seng Index also experienced substantial increases of 0.71% and 0.74%, respectively. Conversely, the Nifty 50 in India and the TAIEX in Taiwan faced slight declines, reflecting regional disparities in market performance.

A key highlight from the day was a report from DWS indicating that Hong Kong remains one of the least affordable rental markets globally, ranking fourth. This issue, alongside high demand and limited supply, underscores ongoing economic challenges in the region. Bangkok and Mumbai topped the list, raising concerns about housing affordability across Asia, which could impact consumer spending and overall economic growth.

In Japan, inflation data showed a slight uptick for the first time since May, aligning with forecasts and indicating ongoing economic pressures. The core inflation metric, which excludes fresh food prices, rose, suggesting that inflationary trends may persist, influencing monetary policy considerations.

Additionally, significant corporate developments were reported, including a restructuring at BNP Paribas Wealth Management aimed at enhancing its investment services in Asia. The bank’s reorganization reflects a strategic shift to better align its advisory and discretionary portfolio management offerings, indicating a broader trend of financial institutions adapting to changing market dynamics.

UBS also made headlines with a reshuffle of its executive board following the nomination of Markus Ronner as vice chairman. This transition represents a generational shift in leadership, highlighting the ongoing evolution within major financial institutions as they navigate a complex global landscape.

Overall, the market’s positive momentum today was tempered by underlying economic concerns, particularly regarding housing affordability in key Asian cities and inflationary pressures in Japan. Investors remain watchful of geopolitical developments, particularly the upcoming Trump-Xi meeting, which could further influence market dynamics in the region.

📅 Economic Calendar – Asian Session

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-10-23 | 01:00 | 🇸🇬 | Medium | Core CPI (YoY) (Sep) | 0.40% | 0.20% |

| 2025-10-23 | 01:00 | 🇸🇬 | Medium | CPI (YoY) (Sep) | 0.7% | 0.6% |

| 2025-10-23 | 19:30 | 🇯🇵 | Medium | National Core CPI (YoY) (Sep) | 2.9% | 2.9% |

| 2025-10-23 | 19:30 | 🇯🇵 | Medium | National CPI (MoM) (Sep) | 0.1% | |

| 2025-10-23 | 20:30 | 🇯🇵 | Medium | au Jibun Bank Services PMI (Oct) | 52.4 |

On October 24, 2025, key economic data from Asia revealed mixed signals for traders. In Singapore, the September Core Consumer Price Index (CPI) showed a notable increase, coming in at 0.40%, significantly above the forecast of 0.20%. Similarly, the overall CPI also exceeded expectations, registering at 0.7% versus a forecast of 0.6%. These stronger-than-expected inflation figures may prompt the Monetary Authority of Singapore to consider tightening monetary policy, which could positively impact the Singaporean index.

In Japan, the National Core CPI for September matched forecasts at 2.9%, indicating stable inflation levels. However, the monthly CPI showed minimal growth at 0.1%, suggesting that inflationary pressures may not be accelerating significantly. The au Jibun Bank Services PMI for October reported at 52.4, indicating continued expansion in the services sector, although the absence of a forecast makes it difficult to gauge the market’s reaction.

Overall, while Singapore’s inflation data could bolster market confidence, Japan’s stable yet modest inflation may lead to cautious trading in Japanese indices. Traders should remain vigilant as these developments unfold, impacting regional market sentiment.

💱 FX, Commodities & Crypto

In the foreign exchange market, the USD/JPY pair saw a slight increase of 0.23%, driven by ongoing interest rate differentials and economic data releases. Conversely, the AUD/USD and NZD/USD pairs declined by 0.21% and 0.17%, respectively, reflecting concerns over slowing economic growth in Australia and New Zealand. The USD/CNY remained stable with a marginal decrease.

In commodities, gold prices fell by 1.63%, influenced by a stronger dollar and rising bond yields, while crude oil prices edged down slightly by 0.05%, amid fluctuating supply concerns.

In the cryptocurrency market, Bitcoin rose by 0.90%, supported by institutional interest, while Ethereum outperformed with a 2.39% increase, buoyed by developments in decentralized finance and network upgrades. Overall, market sentiment remains mixed across these asset classes, influenced by macroeconomic factors and investor risk appetite.

Currency Pairs

| Currency Pair | Price | Daily Change (%) |

|---|---|---|

| USD/JPY | 152.91 | +0.23 |

| USD/CNY | 7.12 | -0.00 |

| USD/SGD | 1.30 | +0.10 |

| AUD/USD | 0.65 | -0.21 |

| NZD/USD | 0.57 | -0.17 |

| USD/INR | 87.76 | +0.02 |

Commodities

| Commodity | Price | Daily Change (%) |

|---|---|---|

| Gold | 4078.10 | -1.63 |

| Crude Oil | 61.76 | -0.05 |

Cryptocurrencies

| Crypto | Price | Daily Change (%) |

|---|---|---|

| Bitcoin | 111102.89 | +0.90 |

| Ethereum | 3950.07 | +2.39 |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.