KOSPI Soars 2.78% Amid Strong Performance in Asian Markets

Note: This analysis covers the Asian trading session close for November 03, 2025. All times are in US Eastern Time (ET).

📊 Asian Indices Performance

| Index | Price | Daily Change (%) |

|---|---|---|

| Shanghai Composite | 3976.52 | +0.55 |

| Nikkei 225 | 52411.34 | +2.12 |

| Hang Seng Index | 26158.36 | +0.97 |

| Shenzhen Component | 13404.06 | +0.19 |

| KOSPI | 4221.87 | +2.78 |

| S&P/ASX 200 | 8894.80 | +0.15 |

| NIFTY 50 | 25763.35 | +0.16 |

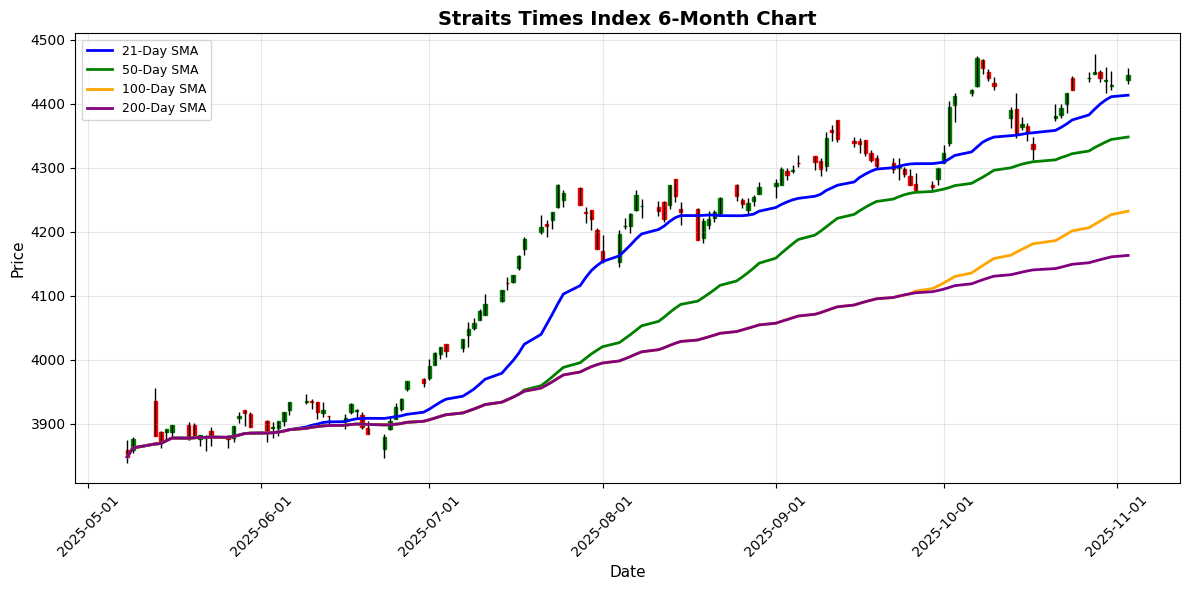

| Straits Times Index | 4444.33 | +0.35 |

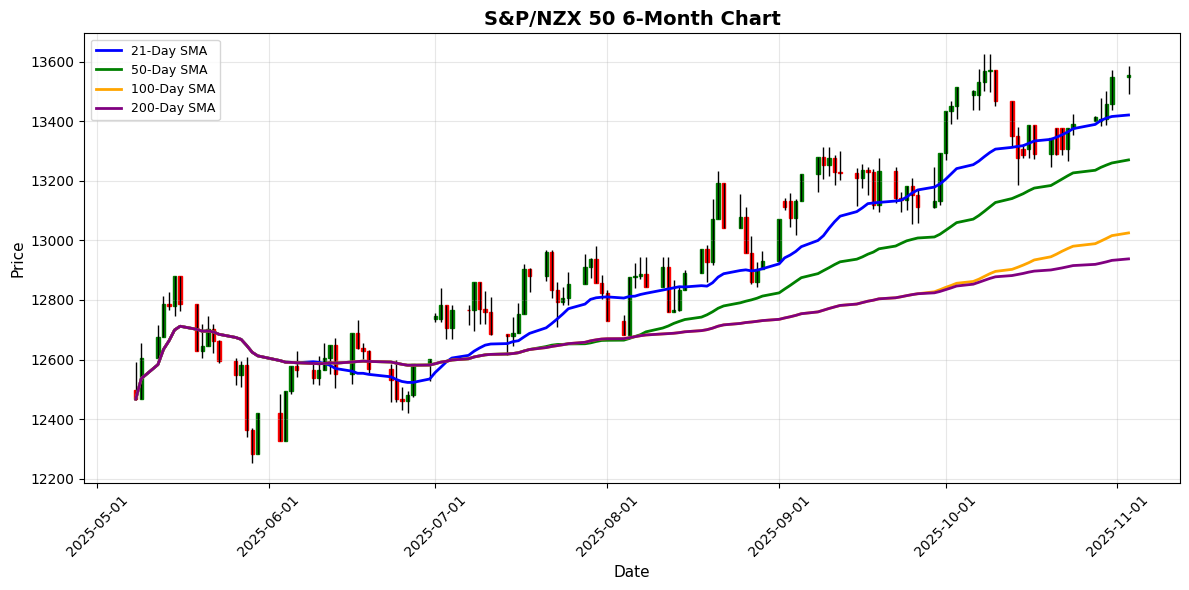

| S&P/NZX 50 | 13556.30 | +0.06 |

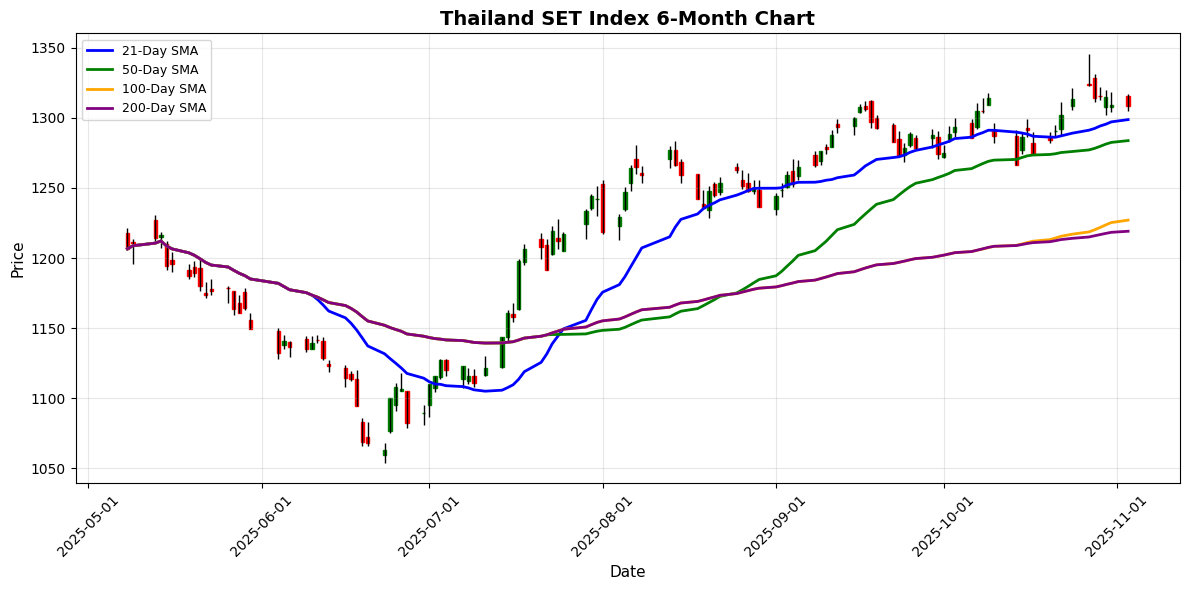

| Thailand SET Index | 1308.86 | -0.05 |

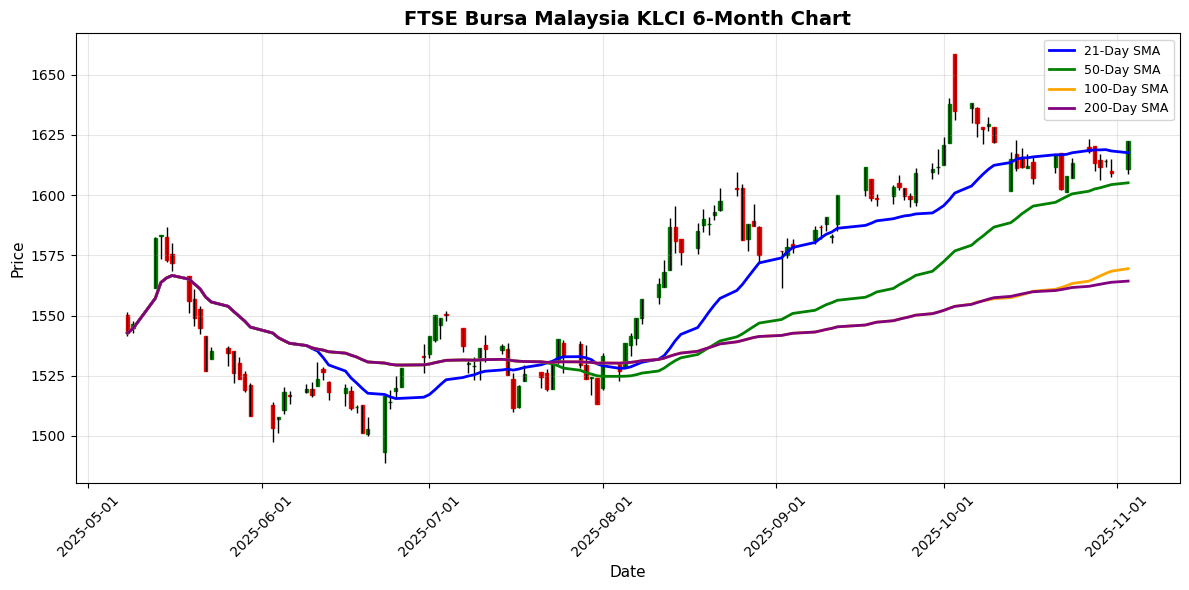

| FTSE Bursa Malaysia KLCI | 1622.42 | +0.82 |

| TAIEX | 28334.59 | +0.36 |

📰 Market Commentary

On November 03, 2025, Asian markets exhibited a mixed performance, influenced by a combination of regional political developments and economic indicators. The Shanghai Composite Index rose by 0.55% to 3,976.52, while the Nikkei 225 surged 2.11% to 52,411.34, reflecting a positive sentiment in Japan. The KOSPI also saw a notable gain of 2.78%, closing at 4,221.87, driven by optimism surrounding manufacturing data and easing geopolitical tensions.

A significant event impacting market sentiment was the removal of Yi Gang, China’s former central bank chief, along with nine other senior officials from leadership roles in the Chinese People’s Political Consultative Conference. This reshuffle, interpreted as a further sidelining of influential figures, raised concerns about the stability of economic policy formulation in China. Concurrently, a private survey revealed that China’s factory activity slowed in October, missing expectations, which added to worries about the economic recovery trajectory.

Despite these concerns, a trade truce between China and the U.S. reached last week has somewhat stabilized relations, alleviating fears of a global economic downturn. Investors are keenly awaiting manufacturing activity figures from China, with expectations that they will provide clearer insights into the health of the economy.

In Hong Kong, the market sentiment was buoyed by the announcement of a new balloon-themed festival in the West Kowloon Cultural District, aimed at boosting the local economy through tourism and cultural engagement. Financial Secretary Paul Chan highlighted the growing influence of women in leadership roles within the financial sector, emphasizing their contribution to economic growth and talent development in the region.

The Asian Infrastructure Investment Bank (AIIB) announced plans to establish an office in Hong Kong, marking a strategic expansion to meet growing business needs. This move is expected to enhance investment opportunities in infrastructure across Asia, reinforcing Hong Kong’s status as a financial hub.

Overall, while the Asian markets showed resilience with positive movements in several indices, underlying economic challenges and political shifts in China continue to create a cautious atmosphere among investors. The interplay of these factors will be crucial in shaping market dynamics in the near term.

📅 Economic Calendar – Asian Session

All times are in US Eastern Time (ET)

| Date | Time | Cur | Imp | Event | Actual | Forecast |

|---|---|---|---|---|---|---|

| 2025-11-02 | 20:45 | 🇨🇳 | Medium | Caixin Manufacturing PMI (MoM) (Oct) | 50.6 | 50.7 |

On November 03, 2025, traders should note the release of the Caixin Manufacturing PMI for China, which came in at 50.6 for October, slightly below the forecast of 50.7. This reading indicates a marginal expansion in the manufacturing sector, as values above 50 signal growth. The slight miss against expectations may raise concerns about the resilience of China’s manufacturing amid ongoing global economic uncertainties.

The lower-than-expected PMI could lead to cautious sentiment among investors, particularly impacting Asian indices that are sensitive to China’s economic performance. A weaker manufacturing outlook may prompt speculation about further monetary easing from the People’s Bank of China, which could influence the CNY and regional currencies.

Traders should monitor how this data influences market sentiment, particularly in relation to major Asian indices such as the Hang Seng and Nikkei, which often react to shifts in Chinese economic indicators. Overall, the Caixin Manufacturing PMI’s underperformance could lead to increased volatility in Asian markets as investors reassess growth prospects in the region.

📈 Individual Index Charts

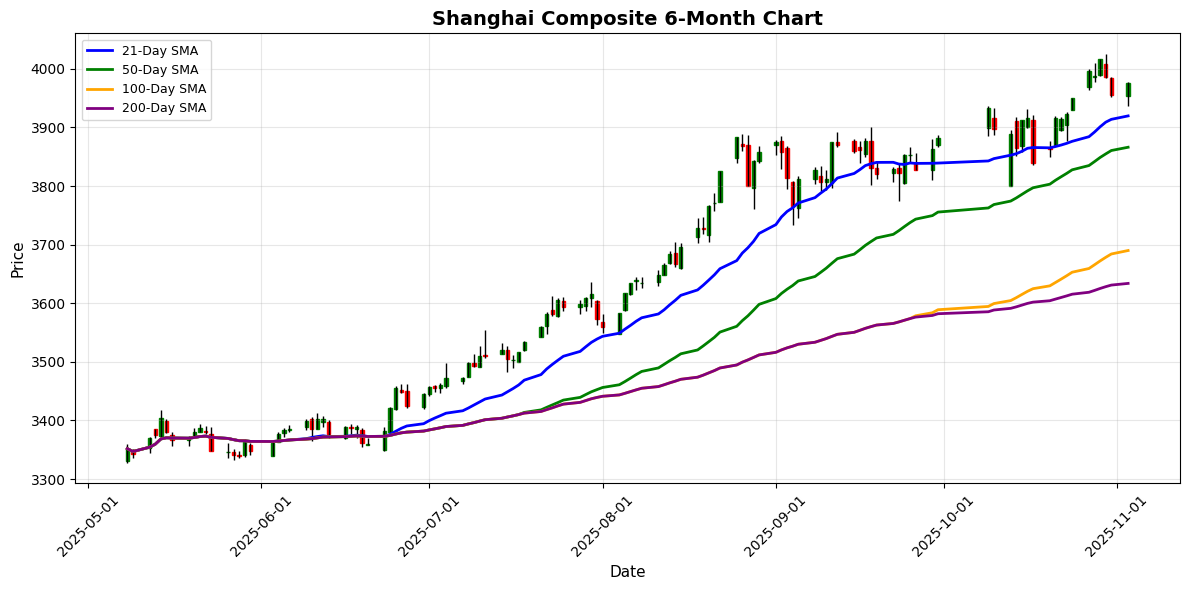

Shanghai Composite

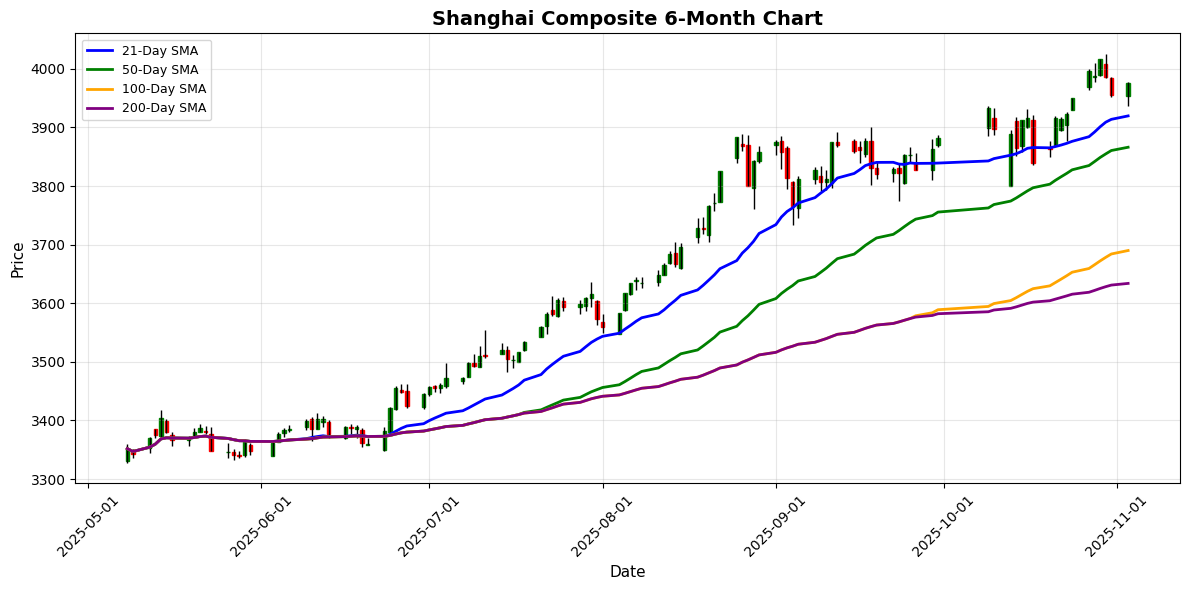

Nikkei 225

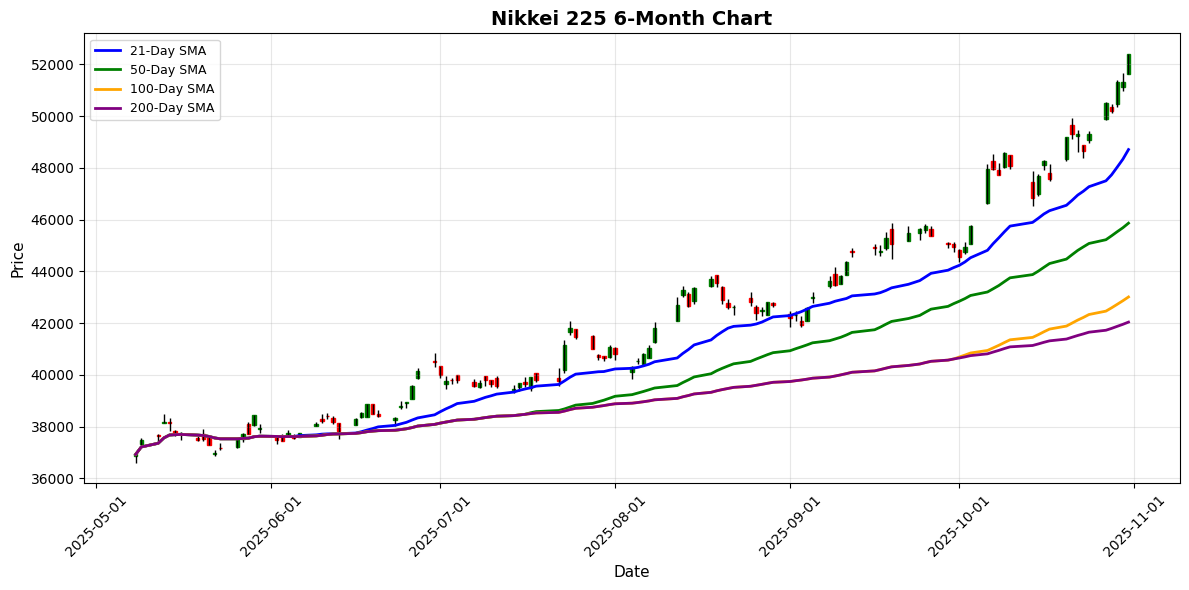

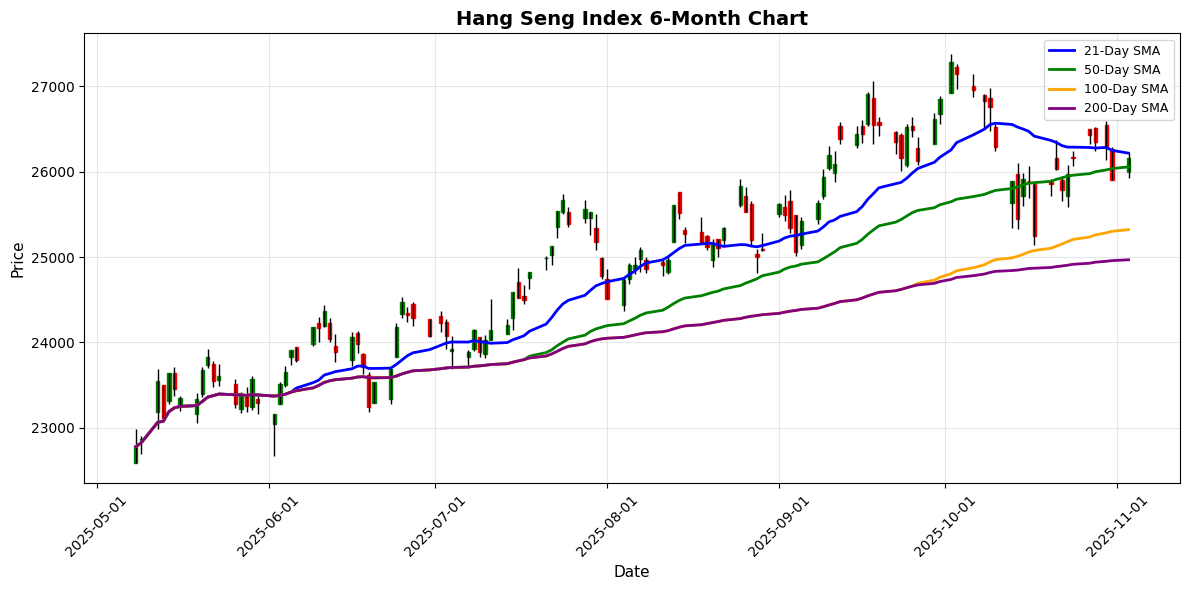

Hang Seng Index

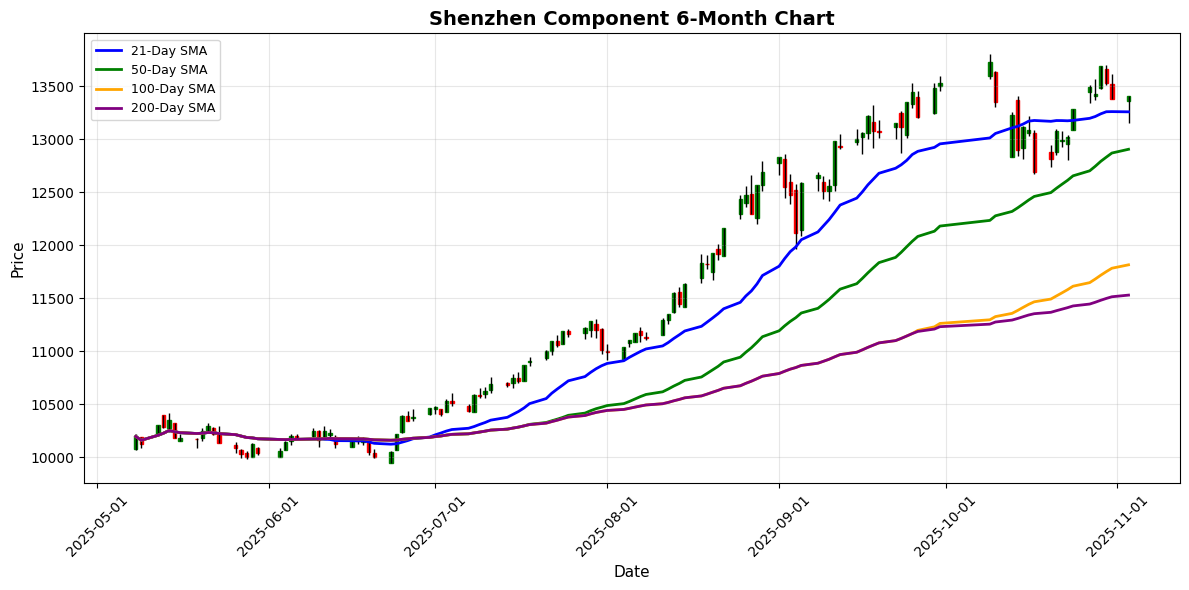

Shenzhen Component

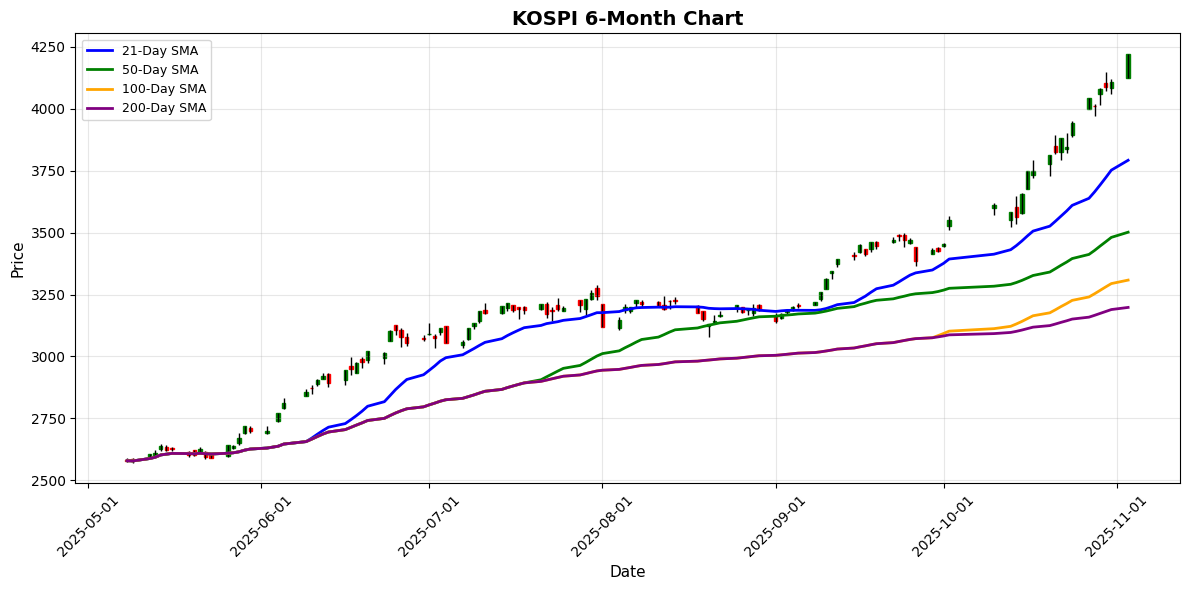

KOSPI

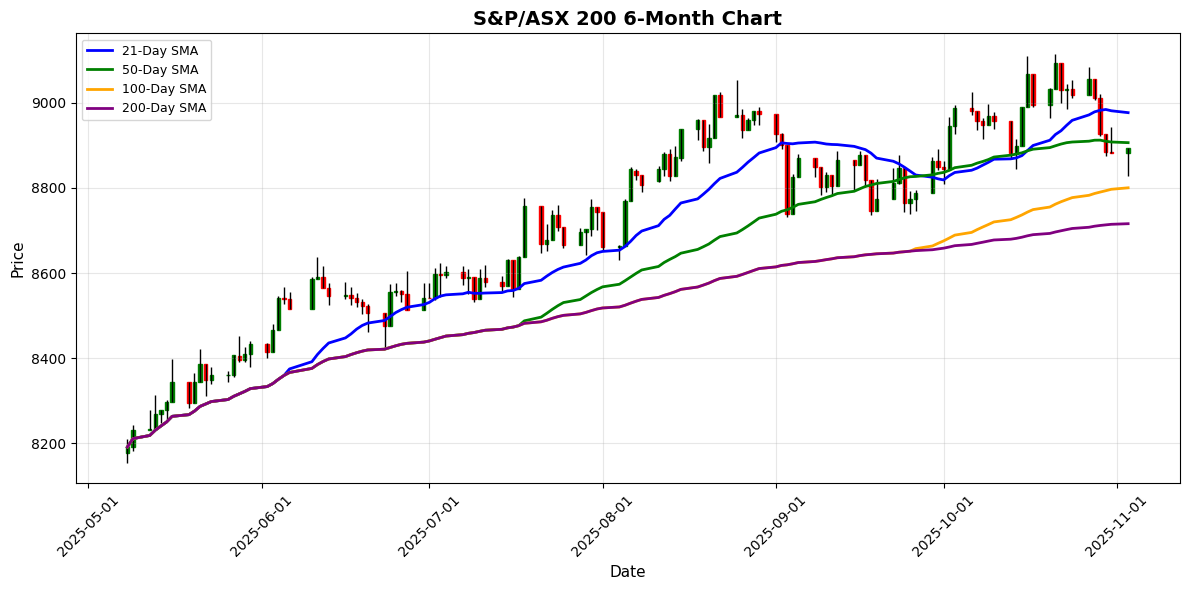

S&P/ASX 200

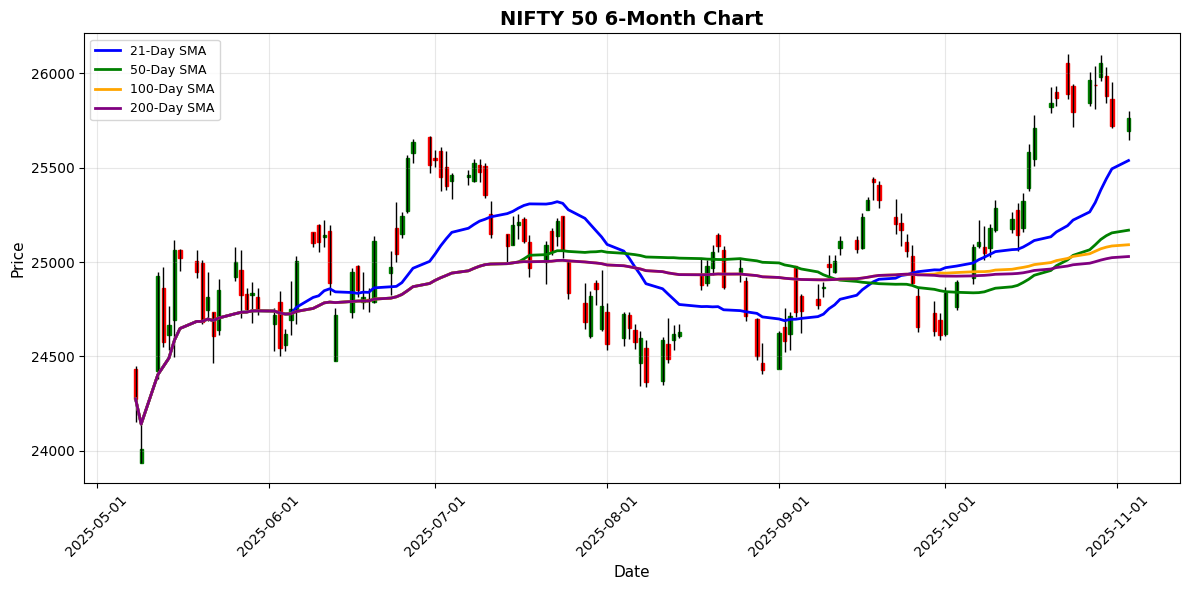

NIFTY 50

Straits Times Index

S&P/NZX 50

Thailand SET Index

FTSE Bursa Malaysia KLCI

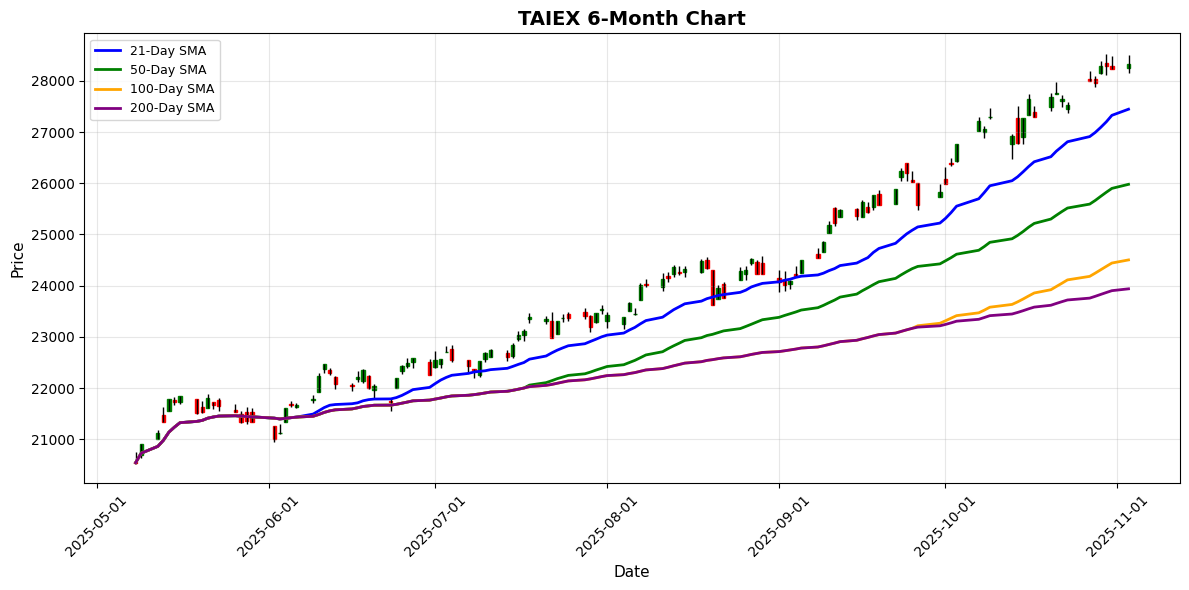

TAIEX

💱 FX, Commodities & Crypto

In the foreign exchange market, the USD/JPY pair showed a slight increase, rising by 0.14% to 154.1540, driven by ongoing interest rate differentials between the U.S. and Japan. The USD/CNY and USD/SGD pairs also experienced minor gains, reflecting stable economic conditions. Conversely, the NZD/USD declined by 0.10%, influenced by weaker commodity prices and economic concerns in New Zealand.

In the cryptocurrency sector, Bitcoin fell by 2.79% to $107,498.36, while Ethereum dropped 5.30% to $3,700.67. These declines were attributed to market volatility and regulatory uncertainties, which have dampened investor sentiment. Overall, FX pairs exhibited modest movements, while cryptocurrencies faced downward pressure amid broader market challenges.

Currency Pairs

| Currency Pair | Price | Daily Change (%) |

|---|---|---|

| USD/JPY | 154.15 | +0.14 |

| USD/CNY | 7.12 | +0.06 |

| USD/SGD | 1.30 | +0.23 |

| AUD/USD | 0.66 | +0.03 |

| NZD/USD | 0.57 | -0.10 |

| USD/INR | 88.74 | +0.02 |

Cryptocurrencies

| Crypto | Price | Daily Change (%) |

|---|---|---|

| Bitcoin | 107498.36 | -2.79 |

| Ethereum | 3700.67 | -5.30 |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.