Nikkei 225 Soars 2.17% Amid Optimism Over Japan’s Economic Recovery

Note: This analysis covers the Asian trading session close for October 29, 2025. All times are in US Eastern Time (ET).

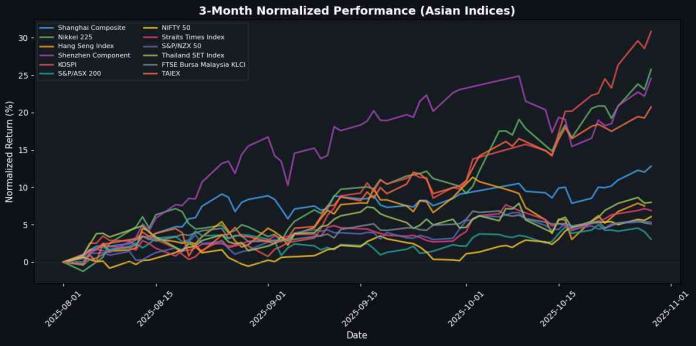

📊 Asian Indices Performance

| Index | Price | Daily Change (%) |

|---|---|---|

| Shanghai Composite | 4016.33 | +0.70 |

| Nikkei 225 | 51307.65 | +2.17 |

| Hang Seng Index | 26346.14 | -0.33 |

| Shenzhen Component | 13691.38 | +1.95 |

| KOSPI | 4081.15 | +1.76 |

| S&P/ASX 200 | 8926.20 | -0.96 |

| NIFTY 50 | 26053.90 | +0.45 |

| Straits Times Index | 4440.21 | -0.23 |

| S&P/NZX 50 | 13409.21 | -0.04 |

| Thailand SET Index | 1315.64 | +0.10 |

| FTSE Bursa Malaysia KLCI | 1611.54 | -0.13 |

| TAIEX | 28294.74 | +1.24 |

📰 Market Commentary

As of October 29, 2025, Asian markets displayed a mixed performance influenced by various macroeconomic factors and geopolitical developments. Key drivers affecting the region include Japan’s moderate economic recovery, tempered by concerns over potential impacts from U.S. tariffs. This uncertainty is coupled with renewed optimism surrounding Nvidia’s discussions with China regarding its Blackwell chip, which may enhance technology cooperation amid strained U.S.-China relations.

In terms of index movements, the Nikkei 225 led the gains with a significant increase of 2.17%, reflecting investor confidence in Japan’s economic outlook despite tariff concerns. The Shenzhen Component and KOSPI also performed well, rising by 1.95% and 1.76%, respectively, indicating robust market sentiment in China and South Korea. Conversely, the Hang Seng Index declined by 0.33%, reflecting ongoing challenges in Hong Kong’s economic landscape.

Regional trends highlight a divergence in performance, with UBS reporting that Asia and EMEA are leading growth while the Americas lag behind. This aligns with the broader narrative of shifting economic power towards Asia, where markets are adapting to new realities shaped by geopolitical tensions and technological advancements.

Despite some declines in indices like the S&P/ASX 200 and Straits Times Index, the overall sentiment remains cautiously optimistic, particularly in the context of potential military spending increases urged by Donald Trump to Asia allies. The landscape remains dynamic, with ongoing developments in U.S.-China relations and local economic policies likely to influence market trajectories moving forward.

📈 Main Index Charts

💱 FX, Commodities & Crypto

In the FX market, the USD/JPY pair showed a slight increase of 0.11%, reflecting ongoing investor sentiment towards the U.S. dollar amid interest rate expectations. The USD/CNY and USD/SGD pairs exhibited minimal changes, while the AUD/USD rose by 0.21%, driven by positive economic data from Australia. Conversely, the NZD/USD declined by 0.02%, and the USD/INR fell slightly, indicating mixed performance among currencies.

In commodities, gold prices surged by 1.42%, supported by safe-haven demand amid geopolitical tensions and inflation concerns. Crude oil prices increased modestly by 0.35%, influenced by supply constraints and OPEC+ production decisions.

In the cryptocurrency market, Bitcoin rose by 0.13%, while Ethereum experienced a more substantial increase of 0.54%, driven by growing institutional interest and broader adoption of blockchain technology. Overall, market dynamics reflect a blend of economic indicators and investor sentiment across asset classes.

Currency Pairs

| Currency Pair | Price | Daily Change (%) |

|---|---|---|

| USD/JPY | 152.27 | +0.11 |

| USD/CNY | 7.10 | +0.01 |

| USD/SGD | 1.29 | +0.10 |

| AUD/USD | 0.66 | +0.21 |

| NZD/USD | 0.58 | -0.02 |

| USD/INR | 88.16 | -0.02 |

Commodities

| Commodity | Price | Daily Change (%) |

|---|---|---|

| Gold | 4040.30 | +1.42 |

| Crude Oil | 60.36 | +0.35 |

Cryptocurrencies

| Crypto | Price | Daily Change (%) |

|---|---|---|

| Bitcoin | 113060.54 | +0.13 |

| Ethereum | 4002.65 | +0.54 |

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.