NVIDIA Corporation, founded in 1993 and headquartered in Santa Clara, California, specializes in the design and manufacture of computer graphics processors, chipsets, and multimedia software. The company operates through two main segments: Graphics Processing Unit (GPU) and Compute & Networking. NVIDIA’s products cater to a diverse range of applications, from gaming and enterprise workstations to automotive infotainment systems and AI-driven computing platforms.

The current price of the asset is $173.37, marking a significant decline of 3.33% today. This price is at the lower end of the weekly range, matching the week’s low and significantly below the week’s high of $184.47, indicating a sharp recent drop. The asset has experienced substantial volatility over the year, ranging from a low of $86.61 to a high of $184.48, with the current price near the upper half of this spectrum.

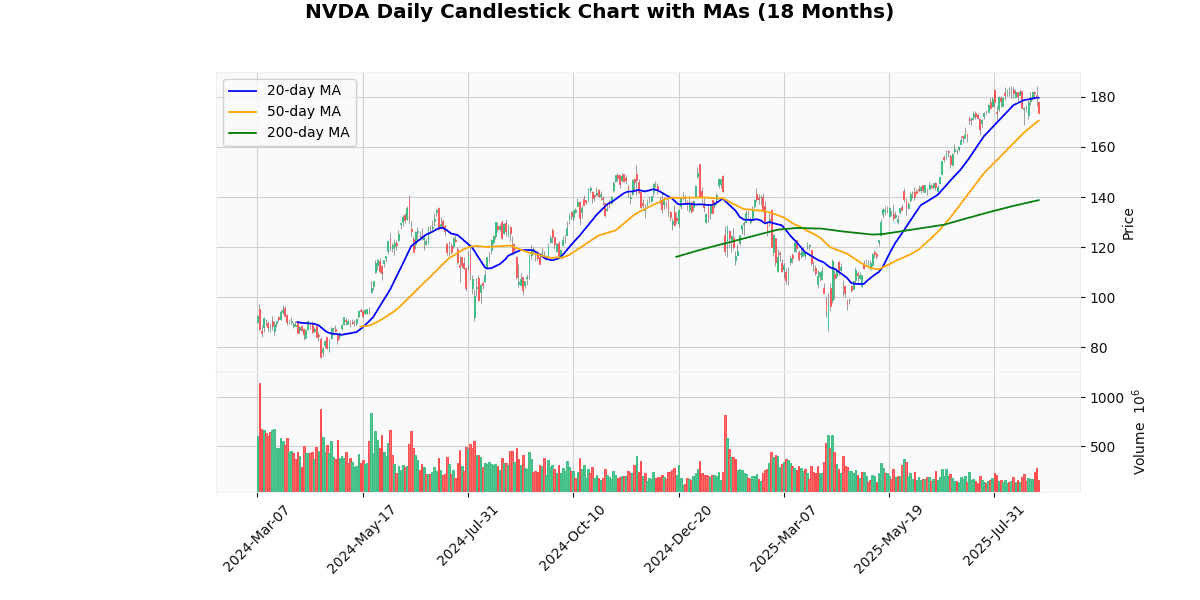

The price is currently below the 20-day moving average by 3.5%, suggesting a short-term bearish trend. However, it remains above the 50-day and 200-day moving averages by 1.68% and 24.96%, respectively, indicating a stronger position in the medium to long term.

The RSI at 45.03 suggests the asset is neither overbought nor oversold, providing a neutral momentum signal. The MACD of 2.04, being positive, hints at underlying bullish momentum, although this contrasts with the recent price drop.

Overall, the asset shows mixed signals with recent bearish short-term movements but maintains a relatively stronger position in a longer-term perspective. Investors might watch for stabilization or a reversal in the short-term downtrend for potential buying opportunities, especially given the asset’s performance against its moving averages and MACD indications.

## Price Chart

NVIDIA (NASDAQ: NVDA) reported a robust financial performance for the second quarter of fiscal 2026, with total revenue reaching $46.7 billion, marking a 6% increase from the previous quarter and a significant 56% rise year-over-year. The company’s Data Center revenue was a major contributor, totaling $41.1 billion, reflecting a 5% sequential increase and a 56% increase from the same quarter last year. Notably, Blackwell Data Center revenue surged by 17% sequentially.

The company’s GAAP gross margin improved to 72.4%, although it saw a slight decline from 75.1% in the same period last year. Operating income and net income also showed strong growth, with figures of $28.4 billion and $26.4 billion, respectively, both showing substantial increases from both the previous quarter and year-over-year.

Earnings per share (EPS) were impressive, with GAAP EPS at $1.08 and Non-GAAP EPS at $1.05, showing significant increases from both the previous quarter and the same quarter last year. NVIDIA also highlighted its shareholder returns, with $24.3 billion returned through share repurchases and dividends in the first half of fiscal 2026.

Looking ahead, NVIDIA expects revenue to be around $54.0 billion for the next quarter, with projected GAAP and Non-GAAP gross margins of 73.3% and 73.5%, respectively. Operating expenses are anticipated to be approximately $5.9 billion on a GAAP basis and $4.2 billion on a Non-GAAP basis, with an expected tax rate of around 16.5%.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-08-27 | 1.01 | 1.05 | 3.96 |

| 1 | 2025-05-28 | 0.93 | 0.96 | 2.84 |

| 2 | 2025-02-26 | 0.84 | 0.89 | 5.50 |

| 3 | 2024-11-20 | 0.75 | 0.81 | 8.58 |

| 4 | 2024-08-28 | 0.64 | 0.68 | 6.03 |

| 5 | 2024-05-22 | 0.56 | 0.61 | 9.48 |

| 6 | 2024-02-21 | 4.64 | 5.16 | 11.32 |

| 7 | 2023-11-21 | 3.37 | 4.02 | 19.21 |

Over the past eight quarters, the company has consistently surpassed EPS estimates, indicating robust financial performance and effective management strategies. A clear upward trend in both estimated and reported EPS values is evident, reflecting ongoing growth.

Starting from November 2023, the reported EPS saw a significant jump from 4.02, surpassing the estimate by 19.21%, to a peak of 5.16 in February 2024, which exceeded expectations by 11.32%. This period likely reflects a seasonal strength or a successful implementation of strategic initiatives. Subsequently, the EPS normalized but continued to show growth, with the estimates adjusting closer to the actual figures, suggesting analysts are aligning their forecasts more accurately with the company’s performance trajectory.

The percentage surprises have generally been substantial, particularly in earlier quarters, indicating possible conservative estimates or exceptional company performance. By the latest quarter in August 2025, the surprise percentage has moderated to 3.96%, which could imply that the market is now better at predicting the company’s financial outcomes, or that growth is stabilizing.

Overall, the consistent outperformance against estimates and the upward trend in EPS highlight the company’s strong profitability and potential for sustained growth. This trend is crucial for investor confidence and suggests a positive outlook for the company’s financial health.

## Dividend Payments Table

| Date | Dividend |

|---|---|

| 2025-06-11 | 0.01 |

| 2025-03-12 | 0.01 |

| 2024-12-05 | 0.01 |

| 2024-09-12 | 0.01 |

| 2024-06-11 | 0.01 |

| 2024-03-05 | 0.004 |

| 2023-12-05 | 0.004 |

| 2023-09-06 | 0.004 |

The dividend data over the last eight quarters shows a clear pattern of stability in the most recent six quarters, with a consistent dividend payout of $0.01. This stability suggests a steady financial position for the company during this period. However, prior to this phase of consistency, there was a notable change in the dividend amount. Specifically, the dividends for the three quarters starting from September 2023 through March 2024 were set at $0.004, which is significantly lower than the subsequent quarters. This increase from $0.004 to $0.01, observed in June 2024, indicates a positive adjustment in the company’s dividend policy, possibly reflecting improved profitability or a strategic decision by the management to distribute more wealth to shareholders. The consistency observed post-increase could be indicative of the company’s confidence in maintaining a higher dividend payout amidst its operational and financial planning.

On August 28, 2025, four prominent financial firms provided updated ratings and target prices for the company Outer, reflecting a positive consensus on its stock performance.

1. **Wolfe Research** maintained an “Outperform” rating and increased the target price from $220 to $230. This adjustment suggests Wolfe Research’s analysts anticipate stronger performance and potentially higher profitability or market share than previously estimated.

2. **Truist** also reiterated a “Buy” rating, with a significant target price increase from $210 to $228. This upward revision indicates Truist’s confidence in Outer’s operational efficiency and future growth prospects, possibly driven by recent company developments or market conditions.

3. **The Benchmark Company** continued with a “Buy” rating, raising their target from $190 to $220. This substantial increase implies that The Benchmark Company has observed factors that could enhance Outer’s market position or financial health, warranting a more optimistic valuation.

4. **Rosenblatt** maintained a “Buy” rating and adjusted their target price from $200 to $215. This revision, while more modest compared to others, still reflects a positive outlook on Outer’s future earnings and strategic initiatives.

Overall, these reiterated ratings with increased target prices collectively suggest a bullish sentiment among analysts regarding Outer’s market performance and underlying business fundamentals. This could influence investor confidence and positively impact the stock’s trading behavior in the near term.

The current price of the stock stands at $173.37. Recent analyses from notable research firms suggest a positive outlook, with target prices being adjusted upwards. Wolfe Research raised their target from $220 to $230, Truist from $210 to $228, The Benchmark Company from $190 to $220, and Rosenblatt from $200 to $215. These adjustments indicate a consensus that the stock may be undervalued, with the average target price now at approximately $223.25, suggesting a potential upside of about 28.8% from the current price.

This optimistic projection aligns with a broader positive sentiment in the market regarding the stock, reflecting expectations of strong future performance. However, the summary does not provide specific details on EPS (Earnings Per Share) trends or dividend policies, which are also critical factors for comprehensive investment analysis. Investors should consider these aspects alongside target price adjustments to make informed decisions.