Oil-Dri Corporation of America (ODC) Post Earning Analysis

Oil-Dri Corporation of America, founded in 1969 and based in Chicago, specializes in developing, manufacturing, and marketing a variety of sorbent products. The company operates through two main segments: Business to Business Products Group and Retail and Wholesale Products Group. These groups serve diverse markets, including pet care, industrial cleanup, agriculture, and consumer products, catering to an extensive range of customers from different sectors.

Oil-Dri Corporation of America recently reported its fiscal fourth-quarter earnings, marking the company’s strongest annual financial results in its history. This performance was highlighted by robust fourth-quarter results, as detailed in reports from Associated Press Finance and GlobeNewswire. The success of this quarter has played a significant role in achieving the historic annual results. Additionally, the company’s Board of Directors has declared quarterly dividends, reflecting confidence in the ongoing financial health and operational stability of the company. This decision to issue dividends is likely a response to the strong financial performance and could positively influence investor confidence. Furthermore, Oil-Dri’s involvement in industry events, such as sponsoring the LPN Congress & Expo 2025, indicates an ongoing commitment to visibility and leadership in its sector. Overall, these developments could have a favorable impact on Oil-Dri’s stock, potentially attracting more investors and positively influencing its market valuation.

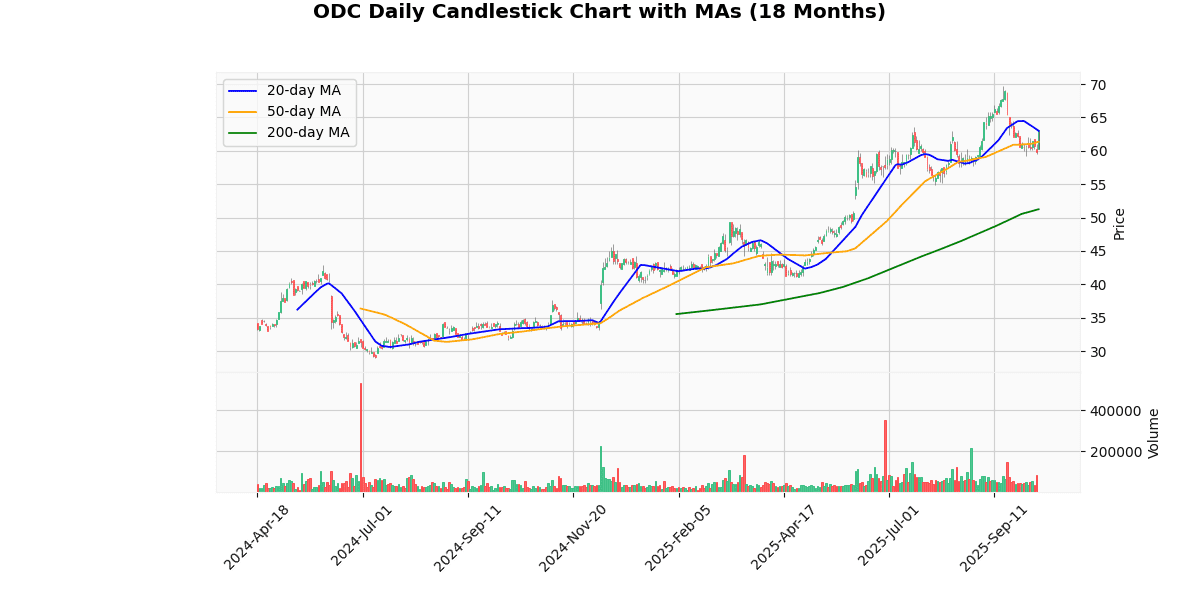

The current price of the asset is $63.08, showing no change from the previous day. The price is at the week’s high and has increased by 6.11% from the week’s low of $59.45, indicating a positive short-term trend. Over the year, the price has significantly rebounded from its 52-week low of $32.04 to $63.08, reflecting a 96.88% increase, but it still remains 9.58% below the 52-week and YTD high of $69.76.

The moving averages suggest a bullish trend in the longer term, with the price above the 20-day MA by 0.13%, 50-day MA by 2.82%, and notably above the 200-day MA by 23.09%. This points to a strong upward momentum over the past year.

The Relative Strength Index (RSI) at 54.29 indicates neither overbought nor oversold conditions, suggesting a stable market sentiment. However, the MACD at -0.4 implies a potential bearish divergence in the short term, signaling caution despite the overall positive trend. This mixed signal requires careful monitoring to gauge if the bearish MACD will impact the bullish trajectory indicated by the moving averages and recent price recovery.

Price Chart

Oil-Dri Corporation of America (NYSE: ODC) reported robust financial results for the fourth quarter and full fiscal year 2025 on October 9, 2025. The company achieved a record $125.2 million in net sales for Q4, marking a 10% increase from the previous year, and $485.6 million for the fiscal year, up 11% from 2024. Notably, Q4 net income surged by 53% to $13.1 million, and annual net income rose by 37% to $54 million.

Diluted earnings per share (EPS) for Q4 significantly increased by 51% to $0.89, while the annual EPS grew by 36% to $3.70. The company also reported a 17% increase in Q4 EBITDA to $21.4 million and a 29% increase for the year to $90 million.

The Business to Business (B2B) segment saw a substantial 24% rise in Q4 net sales to $48.1 million, while the Retail and Wholesale (R&W) segment reported a modest 3% increase to $77.1 million. Despite challenges, Oil-Dri’s strategic investments in manufacturing and operational efficiencies, along with a data-driven approach termed “Miney ball,” have positioned it for continued growth. The company also enhanced its financial stability by repaying $11 million in debt and increasing cash reserves to $50.5 million, up from $23.5 million the previous year.

Dividend Payments Table

| Date | Dividend |

|---|---|

| 2025-08-08 | 0.18 |

| 2025-05-09 | 0.155 |

| 2025-02-21 | 0.155 |

| 2024-11-08 | 0.155 |

| 2024-08-09 | 0.155 |

| 2024-05-09 | 0.145 |

| 2024-02-22 | 0.145 |

| 2023-11-09 | 0.145 |

The examination of the dividend trends over the last eight recorded payments reveals a pattern of gradual increase. Starting from November 2023, the dividend was consistently set at $0.145 for three consecutive quarters. A marginal increase occurred in May 2024, elevating the dividend to $0.155. This increment indicates a strategic adjustment, potentially reflecting improved company performance or a revised payout policy aimed at providing greater shareholder value.

The dividend remained stable at $0.155 through four payment cycles spanning from May 2024 to February 2025, suggesting a phase of consolidation where the company possibly assessed the sustainability of the higher dividend rate. Notably, a further increase was observed in August 2025, with the dividend rising to $0.18. This recent adjustment might be indicative of continued positive financial health and a robust outlook, supporting a higher distribution to shareholders. Overall, the trend shows a cautious yet upward trajectory in dividend payments, reflecting a potentially positive business environment and a commitment to returning value to shareholders.

As of the latest data, the stock is trading at a current price of $63.08. This pricing scenario presents a significant discussion point when juxtaposed against the average target price provided by analysts. Unfortunately, the specific average target price is not mentioned here, so a direct comparison in this context isn’t possible. However, understanding whether this current price stands above or below the average target would be crucial for investors looking to gauge market sentiment and potential future movement.

Disclaimer: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice, investment recommendations, or trading guidance. Markets involve risk, and past performance is not indicative of future results. You should always conduct your own research and consult with a qualified financial advisor before making any investment decisions. By acting, you accept full responsibility for your choices.