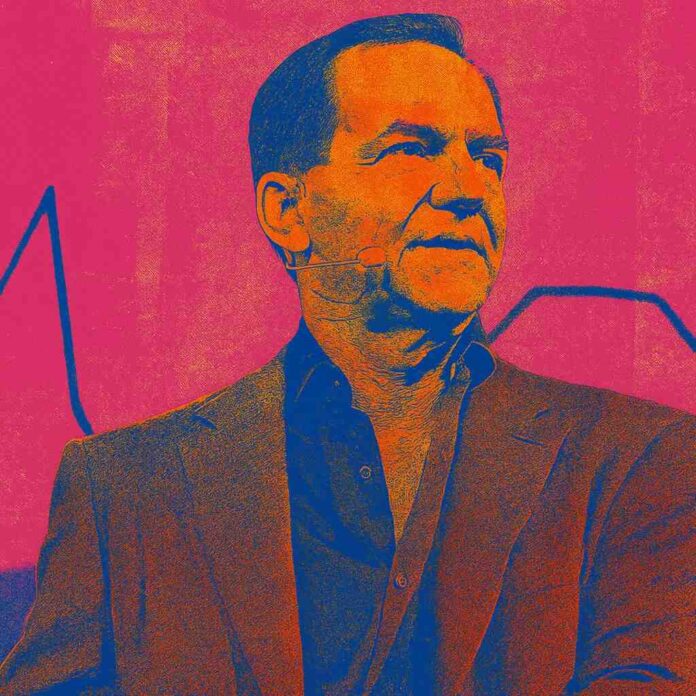

Few figures in modern finance embody the blend of boldness, discipline, and philanthropy quite like Paul Tudor Jones II. Known worldwide as the hedge fund manager who predicted and profited from the 1987 Black Monday crash, Jones has spent over four decades at the pinnacle of global macro trading.

His story is not just about outsized returns but about capital preservation, adaptability, and responsibility. From trading cotton futures in New Orleans to managing billions at Tudor Investment Corporation and founding the Robin Hood Foundation, Jones has become both a market legend and a social force.

Early Life: From Memphis to the Trading Floors

Paul Tudor Jones was born in Memphis, Tennessee, in 1954. His father, Paul Tudor Jones Sr., was a prominent lawyer, instilling in him the value of discipline and rigorous thinking.

Jones attended the University of Virginia, where he studied economics and graduated in 1976. During his college years, he was also an amateur boxer — an experience he later credited with teaching him resilience and focus, traits that would serve him well on volatile trading floors.

After graduation, Jones began his career as a clerk at the New York Cotton Exchange, where he worked for the legendary cotton trader Eli Tullis. Tullis became his first major mentor, exposing him to the intricacies of commodity markets and instilling the importance of risk management. Jones later recalled that Tullis fired him for falling asleep on the job, but the experience left an indelible mark on his trading mindset: discipline mattered more than raw talent.

Founding Tudor Investment Corporation

In 1980, at just 26 years old, Paul Tudor Jones launched Tudor Investment Corporation with $1.5 million in seed capital. The fund specialized in global macro trading — a style that takes positions across currencies, interest rates, commodities, and equities based on macroeconomic and political trends.

Global macro required bold vision and rigorous analysis. Unlike stock pickers who focused on individual companies, Jones looked at entire economies, interest rate cycles, and central bank policy decisions. This approach suited his analytical yet adaptive mindset, allowing him to anticipate broad market shifts and position accordingly.

By the mid-1980s, Tudor Investment was gaining recognition as one of the sharpest hedge funds in the world.

The 1987 Black Monday Crash

Jones’s reputation as a market wizard was cemented on October 19, 1987 — the day of the infamous Black Monday crash.

Anticipating the Crisis

Jones and his team had carefully studied historical market analogues, including the 1929 crash. Technical analysis, valuation models, and sentiment indicators convinced him that U.S. equities were dangerously overextended. He believed the market was heading for a catastrophic decline.

The Bet

Armed with conviction, Jones positioned his fund aggressively short U.S. equities using futures and options. Unlike many traders, who hesitated or second-guessed themselves, Jones executed with precision.

The Outcome

When the Dow Jones Industrial Average collapsed by 22% in a single day, Jones’s fund delivered staggering profits. Reports suggest Tudor Investment earned over 100% returns for the year, and Jones personally became a multimillionaire.

The 1987 trade became legendary — not just for the profits but for the foresight and discipline it displayed. While many traders were wiped out, Jones thrived by preparing for the worst and managing risk with military-like precision.

Trading Philosophy: Discipline Above All

Paul Tudor Jones’s approach blends macro insights, technical analysis, and risk management. Several core principles define his philosophy:

- Capital Preservation

- Jones has always prioritized survival over aggressive profit-seeking. His mantra:

“Don’t focus on making money; focus on protecting what you have.”

- Jones has always prioritized survival over aggressive profit-seeking. His mantra:

- Cut Losses Quickly

- He stresses the importance of humility in trading. If a position goes against him, he exits without hesitation. Small losses are acceptable; catastrophic ones are not.

- Flexibility

- Jones avoids dogma. He adapts his views as data and circumstances change. This flexibility has allowed him to thrive across different economic eras — from inflationary shocks to deflationary fears.

- Trend Following with a Macro Overlay

- He often rides big market trends, but always with an eye on the global macro context.

- Psychological Mastery

- Jones emphasizes emotional control. Markets test discipline daily, and those who cannot control fear and greed are doomed to fail.

Beyond Markets: Philanthropy and Robin Hood

Jones’s success in finance has been matched by his dedication to philanthropy. In 1988, he co-founded the Robin Hood Foundation, a non-profit focused on fighting poverty in New York City.

Over the decades, Robin Hood has raised billions of dollars to support education, housing, job training, and healthcare initiatives. Its annual gala is one of the most prominent fundraising events in the financial industry, attracting hedge fund titans and Wall Street leaders.

Jones’s philosophy of giving reflects his belief that wealth comes with responsibility. He has said:

“You are not a good investor if all you do is make money. The true test is what you do with it.”

In addition to Robin Hood, Jones has supported numerous conservation initiatives, particularly in Africa, focusing on wildlife preservation and sustainable development.

Tudor Investment’s Evolution

Over the years, Tudor Investment Corporation has adapted to changing markets. While the fund continues to engage in global macro trading, it has also incorporated quantitative strategies and diversified across asset classes.

Though Jones himself has become more conservative in recent years, preferring risk-adjusted stability over headline-grabbing bets, Tudor remains one of the most respected hedge funds in the world, managing billions in assets.

Influence and Legacy

Paul Tudor Jones stands alongside peers such as George Soros, Bruce Kovner, and Louis Bacon as one of the architects of modern global macro hedge funds. His influence extends beyond markets:

- Inspiration to Traders: His 1987 success remains a case study in preparation and conviction.

- Risk Culture: Many hedge funds today emphasize risk controls and capital preservation, a philosophy Jones helped pioneer.

- Philanthropic Standard: Through Robin Hood, Jones set the example that hedge fund success should translate into community impact.

Lessons for Modern Investors

- Protect Capital First

Survival is the foundation of long-term success. Big wins mean nothing if one catastrophic loss wipes out your capital. - Stay Flexible

Markets change. Successful traders adjust quickly rather than clinging to outdated views. - Combine Tools

Jones used both technical analysis and macro fundamentals, proving that no single approach is enough. - Think Globally

In an interconnected world, opportunities lie across asset classes and geographies. - Balance Wealth with Responsibility

Financial success without social responsibility is incomplete.

Conclusion

Paul Tudor Jones is more than just a trader who predicted a crash. He is a pioneer who showed that discipline, adaptability, and foresight could turn market chaos into opportunity. He built a hedge fund empire, influenced generations of traders, and used his wealth to fight poverty and preserve the environment.

For today’s investors, his career offers timeless lessons: protect your capital, adapt to changing conditions, and let discipline guide your path. In a world where markets constantly shift and crises emerge without warning, the principles of Paul Tudor Jones remain as relevant as ever.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.