Precious Metals Market Update: Palladium Soars 5.35%

📊 Market Overview

The precious metals market on October 22, 2025 shows dynamic activity amid evolving economic conditions and safe-haven demand. Below is a comprehensive breakdown of each metal’s performance, technical indicators, market news, and outlook.

Performance Summary

| Metal | Price | Daily Change (%) | MA21 | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|

| Gold | $4116.60 | +0.18% | $3991.41 | $3720.88 | $3535.79 | $3288.11 | 59.02 | 138.09 |

| Silver | $48.18 | +1.00% | $47.97 | $43.56 | $40.32 | $36.39 | 53.50 | 1.77 |

| Platinum | $1577.90 | +3.86% | $1607.93 | $1473.28 | $1402.29 | $1192.59 | 50.87 | 36.86 |

| Palladium | $1511.50 | +5.35% | $1396.07 | $1249.00 | $1199.65 | $1079.82 | 59.90 | 82.29 |

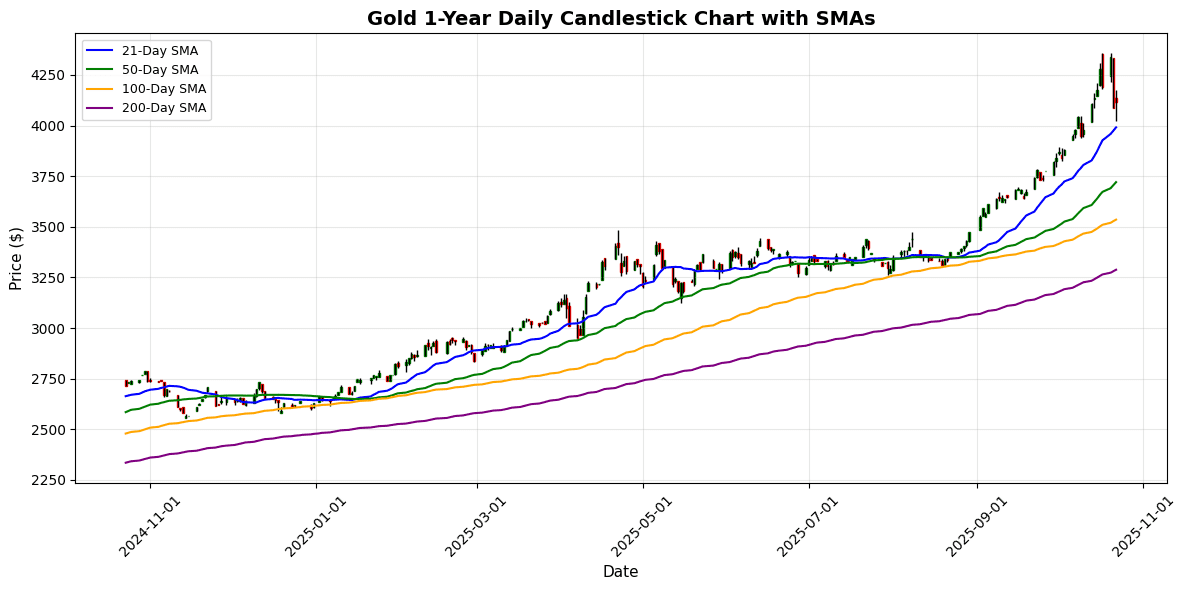

🥇 Gold

Current Price: $4116.60 (+0.18%)

📈 Technical Analysis

Gold is currently trading at $4116.60, reflecting a modest daily gain of 0.18%. The price stands well above key moving averages, with the 21-day MA at $3991.41, indicating a strong bullish trend. The proximity of the price to the MA21 suggests continued upward momentum, while the MA50 ($3720.88) and MA100 ($3535.79) provide additional support.

The Relative Strength Index (RSI) at 59.02 indicates that gold is approaching the overbought territory but still has room for further upward movement. The MACD at 138.09 confirms bullish momentum, as it remains above the signal line.

Potential resistance is identified at psychological and previous high levels, with support likely positioned around the MA21. A sustained breach above $4150 could signal a rally towards $4200, while a drop below $3990 may challenge the bullish outlook. Overall, the technical indicators suggest a positive near-term outlook for

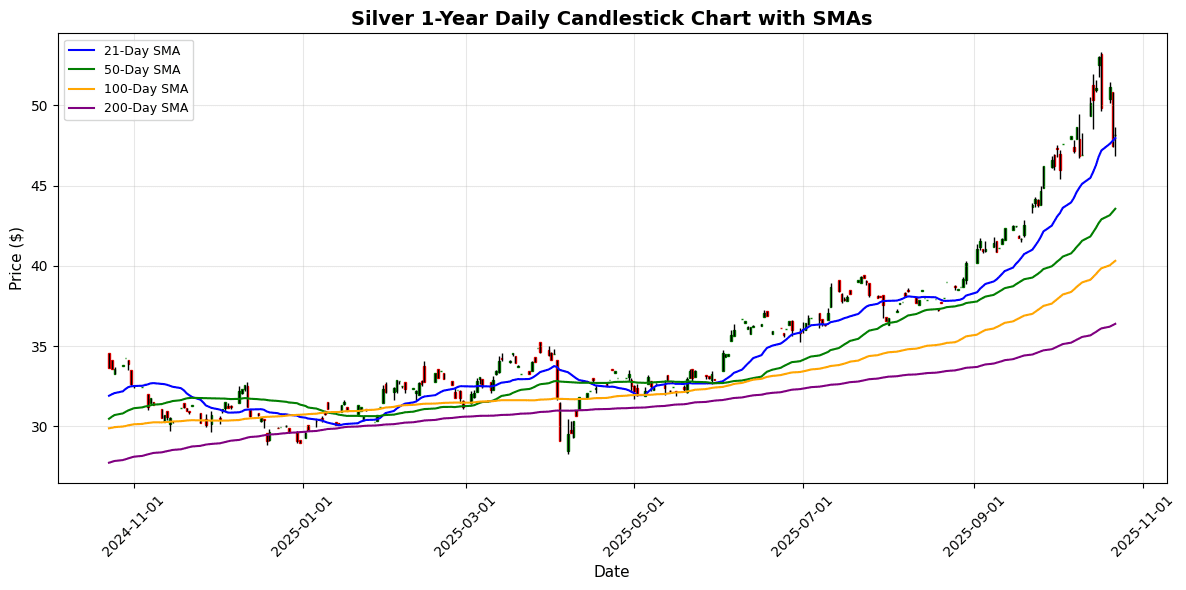

🥈 Silver

Current Price: $48.18 (+1.00%)

📈 Technical Analysis

Silver is currently trading at $48.18, reflecting a daily increase of 1.00%. The price is above key moving averages, with the 21-day MA at $47.97 indicating short-term bullish momentum, while longer-term support levels remain established at the 50-day MA of $43.56, the 100-day MA of $40.32, and the 200-day MA of $36.39.

The Relative Strength Index (RSI) is at 53.50, suggesting that silver is neither overbought nor oversold, indicating a balanced market sentiment. Meanwhile, the MACD value of 1.77 confirms the prevailing bullish trend, as it is above zero and shows positive momentum.

Support is likely found at the MA21 and psychological levels near $47.00, while resistance is anticipated around recent highs above $48.50. Overall, silver appears to be in a solid uptrend with a favorable outlook, contingent on sustained demand and

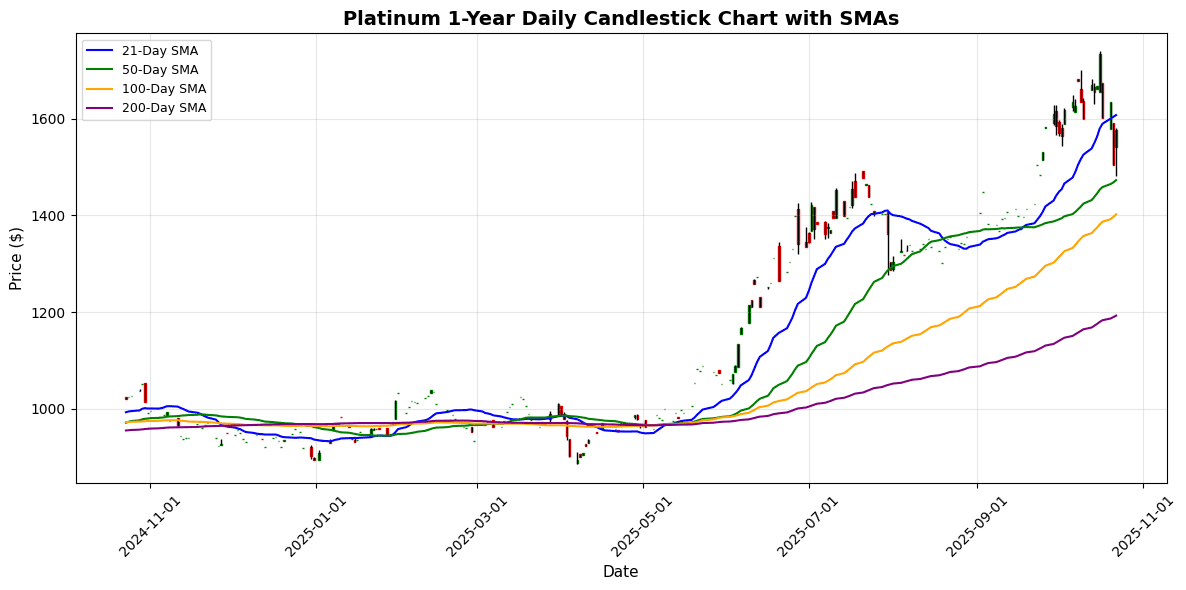

⚪ Platinum

Current Price: $1577.90 (+3.86%)

📰 Market News & Drivers

📈 Technical Analysis

Platinum is currently trading at $1577.90, showing a daily increase of 3.86%, which indicates a positive short-term momentum. The price is situated below the 21-day moving average (MA21) of $1607.93, suggesting a potential resistance level at this point. However, the significant gap between the MA21 and the 50-day moving average (MA50) at $1473.28 indicates robust bullish sentiment in the medium term.

The relative strength index (RSI) stands at 50.87, signaling neutrality without strong overbought or oversold conditions. The MACD at 36.86 reinforces this momentum, indicating a bullish crossover potential.

Key support levels can be identified around the MA50 at $1473.28, while resistance remains at the MA21. Overall, the outlook appears cautiously optimistic as platinum maintains a strong technical basis for potential gains, contingent upon overcoming the $1607.93 resistance. Enhanced buyer interest could position

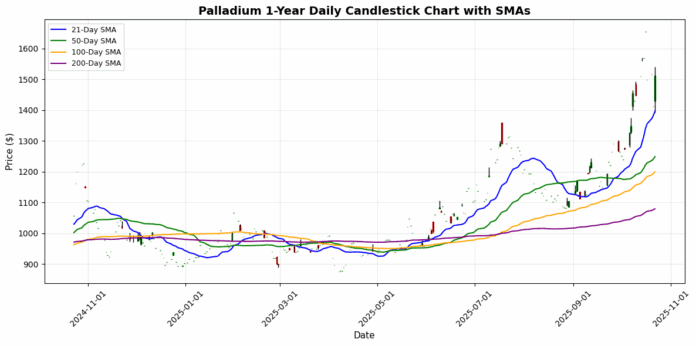

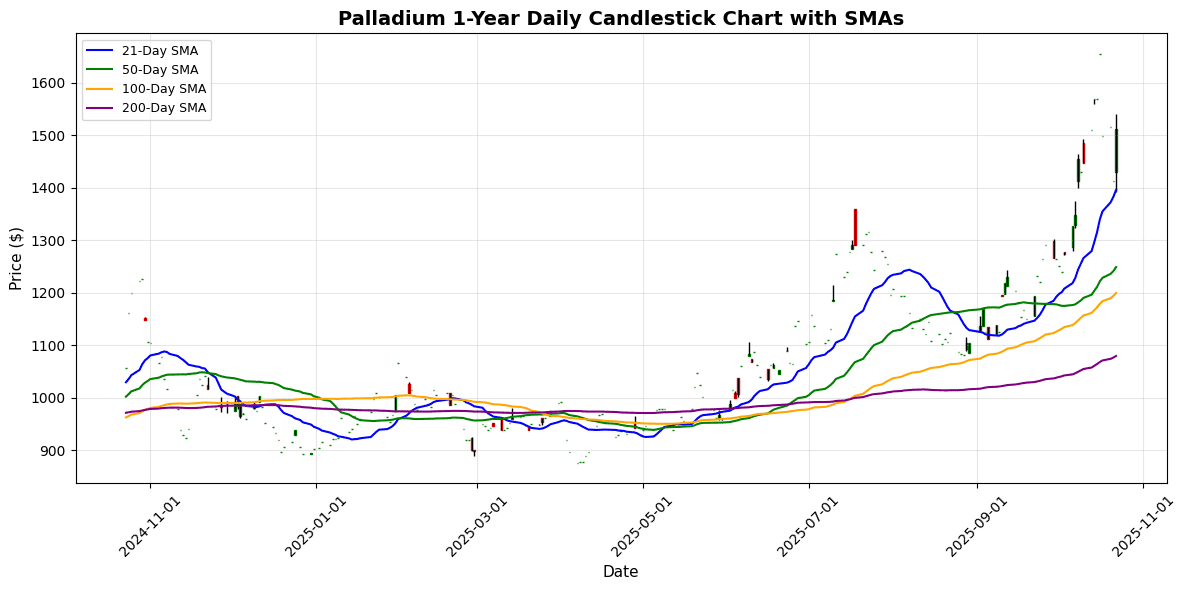

💎 Palladium

Current Price: $1511.50 (+5.35%)

📈 Technical Analysis

Palladium is currently trading at $1511.50, reflecting a significant daily increase of 5.35%. The price has notably surpassed the 21-day moving average (MA21) of $1396.07, indicating bullish momentum in the short term. The upward trajectory is supported by higher moving averages; the 50-day (MA50) at $1249.00, the 100-day (MA100) at $1199.65, and the 200-day (MA200) at $1079.82, all suggest robust long-term support.

The Relative Strength Index (RSI) of 59.90 indicates that Palladium is approaching overbought territory, but still has room for further gains. The MACD at 82.29 reaffirms positive momentum. Key resistance levels are likely near the emotional $1600 mark, while support can be anticipated around the MA21.

Overall, the technical outlook for Palladium appears strongly bullish, provided

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.