Precious Metals Update: Silver Advances 1.60%

📊 Market Overview

Report Date: October 30, 2025

| Metal | Price | Daily Change (%) | MA21 | MA50 | MA100 | MA200 | RSI | MACD |

|---|---|---|---|---|---|---|---|---|

| Gold | $4013.90 | +0.32% | $4056.36 | $3803.26 | $3576.67 | $3328.20 | 52.18 | 62.60 |

| Silver | $48.71 | +1.60% | $48.51 | $44.74 | $41.04 | $36.90 | 55.04 | 0.83 |

| Platinum | $1605.50 | +0.29% | $1614.12 | $1503.54 | $1428.37 | $1211.29 | 53.66 | 18.66 |

| Palladium | $1465.50 | +1.42% | $1444.61 | $1286.37 | $1223.86 | $1094.69 | 56.49 | 43.11 |

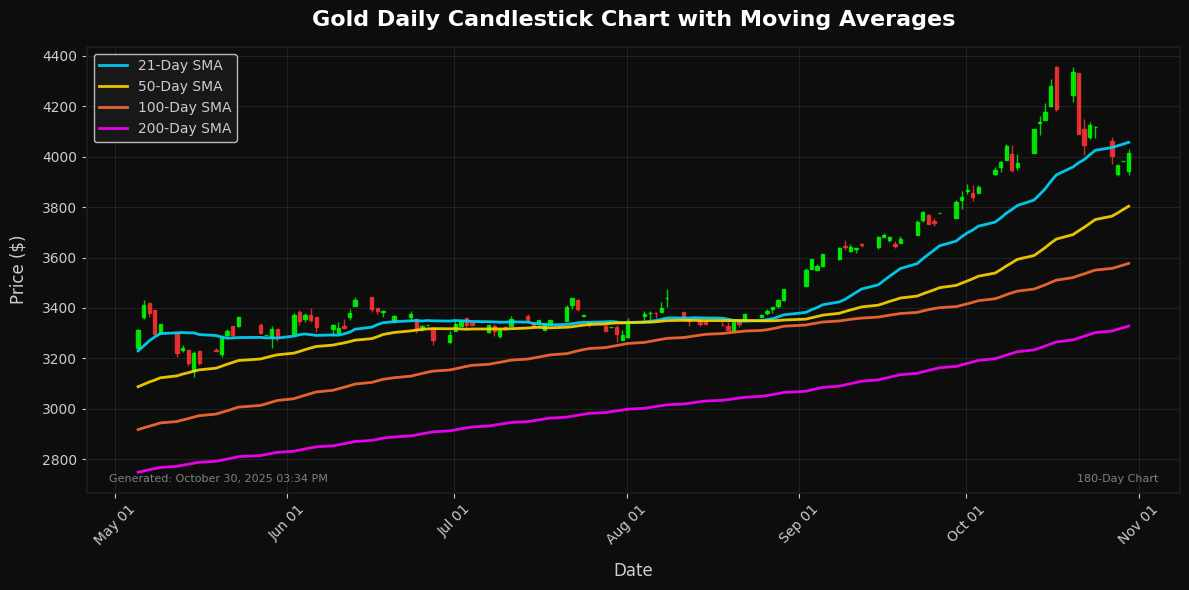

🔸 Gold

Market News

In the last 12 hours following October 30, 2025, 03:33 AM, no significant developments have emerged in the gold market. Prices have remained stable without notable fluctuations, as trading volumes stay subdued amid a quiet period for major economic indicators. Investor sentiment appears cautious but unchanged, with no fresh geopolitical escalations or supply disruptions reported to influence demand trends. This lull follows earlier consolidations below key resistance levels, leaving the market in a holding pattern. Near-term implications suggest continued sideways movement unless new catalysts, such as unexpected policy shifts, arise to drive volatility.

Technical Analysis

Gold is currently trading at $4013.90, reflecting a modest daily increase of 0.32%. The metal remains within a consolidative phase, with its price sitting below the 21-day moving average (MA21) of $4056.36. This level serves as immediate resistance. The lower moving averages, notably the MA50 at $3803.26, act as significant support, providing a foundation for potential rebounds. The Relative Strength Index (RSI) at 52.18 indicates neutrality in momentum, suggesting a balanced market sentiment. Meanwhile, the MACD at 62.60 points to potential bullish momentum if Gold can break above the MA21. Overall, should the price sustain above the MA50, a retest of the MA21 could be on the horizon; however, a drop below the MA50 may signal a bearish shift, targeting the MA100 and MA200 as possible support zones. Investors should closely monitor these levels for trade opportunities in the upcoming sessions.

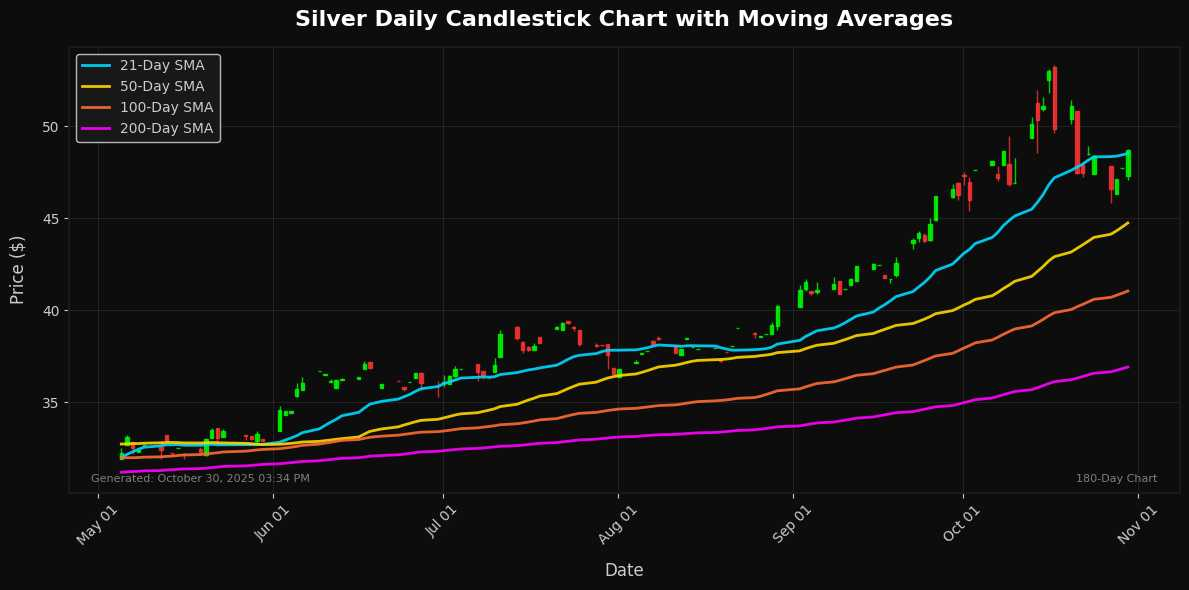

🔸 Silver

Market News

No significant recent developments in the past 12 hours.

Technical Analysis

Silver is currently trading at $48.71, reflecting a daily increase of 1.60%. The price is positioned above key moving averages: MA21 at $48.51 indicates short-term bullish momentum, while the MA50 at $44.74 and higher MAs suggest a solid medium to long-term uptrend. The Relative Strength Index (RSI) at 55.04 indicates that silver is in a neutral zone, with potential for further upward momentum without being overbought.

Key support levels emerge at the MA21 and MA50, while resistance can be anticipated near the recent peak around $50. The MACD at 0.83 supports the positive momentum, indicating that buying interest may be gaining traction.

Overall, the technical outlook for silver remains optimistic, especially if it maintains prices above $48.51. A sustained push above $50 may trigger further upside, while a drop below $44.74 could signal a potential reversal.

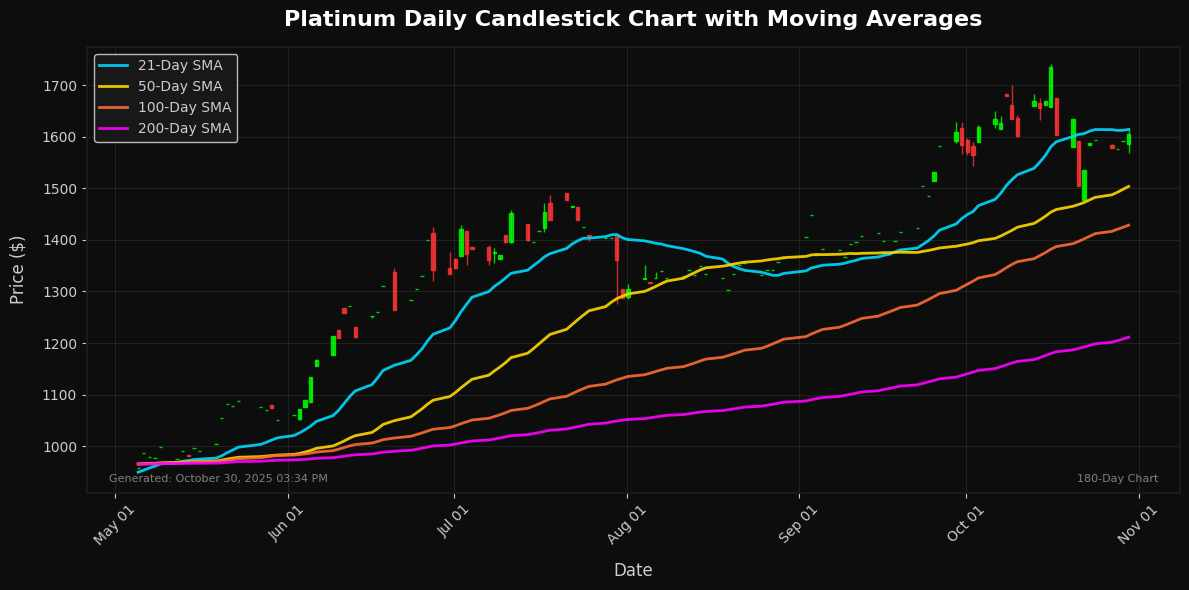

🔸 Platinum

Market News

No significant recent developments in the past 12 hours.

Technical Analysis

Platinum is currently trading at $1,605.50, reflecting a modest daily increase of 0.29%. The price is situated just below the 21-day moving average (MA21) at $1,614.12, indicating a resistance level. The upward trend suggested by significant support at the 50-day MA ($1,503.54) and long-term support at the 200-day MA ($1,211.29) reinforces the bullish sentiment in the medium to long term.

Momentum indicators show an RSI of 53.66, indicating neutral to bullish momentum without overbought signals. The MACD value of 18.66 supports this view, suggesting potential for upside movement.

Overall, if Platinum can maintain above the MA50 and push past the MA21, it may target key resistance areas, potentially reopening pathways to test the next resistance at the $1,700 mark. Traders should monitor for breakouts around these key levels for further directional confirmation.

🔸 Palladium

Market News

No significant recent developments in the past 12 hours.

Technical Analysis

Palladium is currently priced at $1465.50, reflecting a daily change of 1.42%. The short-term momentum appears positive, especially with the price trading above the 21-day moving average (MA21) of $1444.61, indicating a bullish sentiment. The strength of this upward trend is further supported by the Relative Strength Index (RSI) at 56.49, suggesting the market is neither overbought nor oversold, allowing for continued upside potential.

However, while the MACD at 43.11 signals bullish momentum, it remains crucial to monitor resistance near $1500 and support around the MA21. Should Palladium maintain its position above the MA21, a potential retest of resistance levels is feasible. Overall, the outlook for Palladium shows a cautiously optimistic trend, favoring further gains in the near term as long as it sustains above key support levels.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.