The Reserve Bank of Australia (RBA) kept the cash rate steady at 3.60% during its November meeting, marking another cautious pause in the country’s monetary policy cycle. The decision came as the Bank grapples with a mixed economic picture—declining inflation from last year’s peaks, yet persistent signs that price pressures are proving more resilient than policymakers had hoped.

According to the statement released on November 4, trimmed mean inflation rose by 1.0% in the September quarter, lifting the annual rate to 3.0%, up from 2.7% in June. Headline inflation also ticked higher to 3.2% year-on-year, partly reflecting the expiration of temporary electricity rebates in several states. The RBA noted that while some of the recent acceleration is driven by one-off factors, it underscores how progress toward the 2–3% target range remains fragile.

Governor Michele Bullock and the Board emphasized that some components of inflation—particularly services—remain elevated due to strong domestic demand and tight labour conditions. The central bank’s latest projections, included in the November Statement on Monetary Policy, suggest that underlying inflation will rise above 3% in the near term before easing toward 2.6% by 2027. Although the longer-term trajectory remains encouraging, policymakers see little reason to rush into additional rate cuts until inflation expectations are more firmly anchored.

Domestically, economic activity has shown modest signs of recovery. Household consumption, which had been subdued for much of 2024, is beginning to stabilize as consumer confidence improves. The housing market is also regaining momentum, with dwelling prices climbing and construction activity showing renewed life. These developments, together with more favorable credit conditions, point to a resilient private sector—though one that risks re-igniting inflationary pressures if demand continues to strengthen too rapidly.

The labour market, a central pillar of Australia’s post-pandemic recovery, remains tight by historical standards. Unemployment rose slightly to 4.5% in September, from 4.3% in August, but job vacancies remain high and many employers still report difficulty finding suitable staff. Wage growth has eased from earlier highs, yet weak productivity growth continues to push up unit labour costs—an uncomfortable trend for a central bank seeking sustained disinflation without damaging employment.

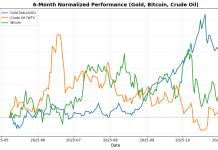

The RBA’s latest communication highlights the delicate balancing act it faces. On one hand, maintaining the cash rate provides stability, ensuring that the effects of earlier monetary easing continue to filter through the economy. On the other, stronger-than-expected demand could exacerbate capacity constraints and allow firms to pass higher costs onto consumers, potentially derailing the disinflation process. Global uncertainties—from commodity price swings to geopolitical tensions—add another layer of caution.

Financial markets had largely anticipated the RBA’s decision to hold. Government bond yields edged higher following the release, reflecting investors’ reassessment of the timing for future rate cuts. Equities were little changed, though rate-sensitive sectors such as property and infrastructure showed muted reactions, signaling that investors now expect the central bank to remain on hold well into 2026.

For businesses, the environment remains a mix of opportunity and challenge. Demand is improving and access to credit has eased, yet input costs, particularly for labour and construction materials, remain elevated. Households, meanwhile, continue to face the dual pressure of persistent price growth and higher borrowing costs, even as wealth effects from a stronger housing market offer some offset.

Looking ahead, the RBA will remain data-dependent. Future policy decisions will hinge on the trajectory of core inflation, wage growth, and productivity, as well as on global developments that could either ease or reignite imported inflation. For now, the message from Martin Place is one of patience. The central bank is prepared to wait for clearer evidence that inflation is sustainably returning to target before taking the next step in its policy journey.

Disclaimer

The content on MarketsFN.com is provided for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or trading guidance. All investments involve risks, and past performance does not guarantee future results. You are solely responsible for your investment decisions and should conduct independent research and consult a qualified financial advisor before acting. MarketsFN.com and its authors are not liable for any losses or damages arising from your use of this information.