Reddit, Inc., founded by Steven Ladd Huffman and Alexis Ohanian in 2005, is a prominent social networking, entertainment, and news platform based in San Francisco, CA. The platform allows registered users to submit content and engage in discussions. Reddit personalizes content feeds based on user interactions, optimizing the discovery of news and stories tailored to individual interests.

Recent news highlights several key developments that could impact stock performance across various sectors. Notably, MarketBeat’s article on August 25, 2025, warns investors about three overbought stocks poised for a pullback, suggesting potential volatility or corrections in these areas. Concurrently, Zacks provided insights on identifying strong buy opportunities in the computer and technology sectors, which could guide investors towards stocks with better growth prospects.

Additionally, Zacks also spotlighted five top-ranked stocks likely to outperform earnings expectations, potentially signaling profitable investment opportunities. In contrast, a piece from Motley Fool on August 24, 2025, discusses two growth stocks that could significantly increase investor wealth, indicating ongoing interest in high-growth potential stocks despite market uncertainties.

Moreover, Reddit’s stock has been a focal point, with Zacks reporting a 50% surge in its value within a month by August 21, 2025, followed by a sharp decline reported by Motley Fool on August 22. This volatility underscores the dynamic nature of tech stocks and could influence investor sentiment and strategies in the tech sector. These fluctuations, combined with strategic insights from financial analysts, suggest a cautious yet opportunistic approach for investors navigating the current stock market landscape.

The current price of the asset is $219.55, marking a 1.45% increase today. This price is relatively close to the week’s high of $222.27, indicating a short-term upward trend. The asset has shown significant growth from the 52-week low of $55.02, with a staggering increase of approximately 299%. This year, the price has surged from a low of $79.75 to a high of $253.14, reflecting a robust gain of 175.3% YTD.

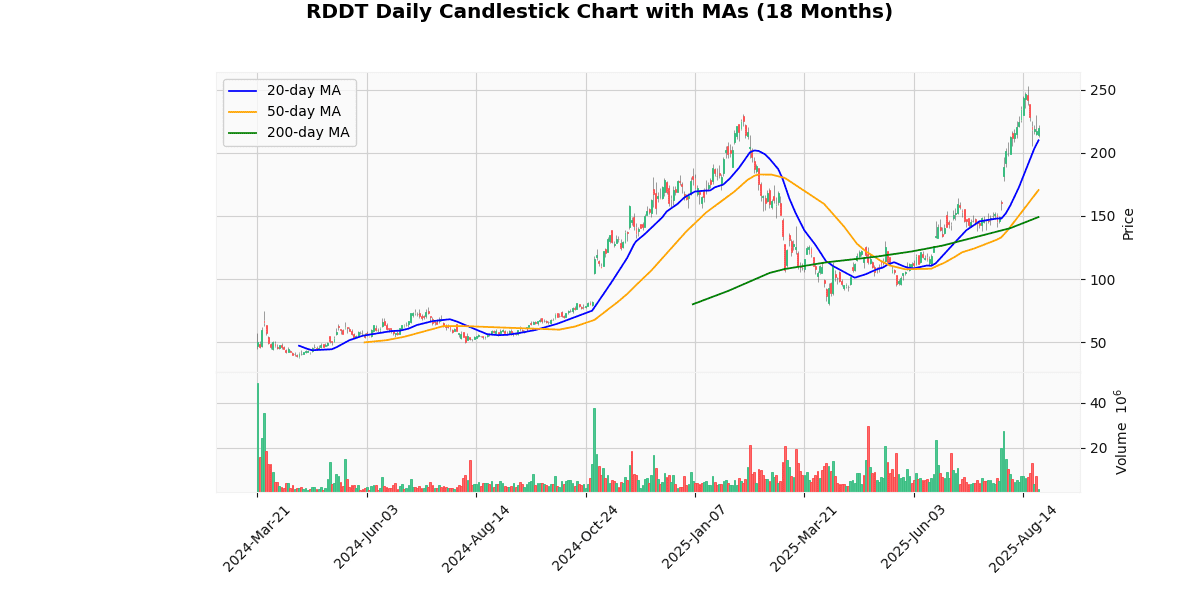

The asset’s price is above all key moving averages (20-day, 50-day, 200-day), suggesting a strong bullish trend in the medium to long term. The moving averages show increases of 4.61%, 28.75%, and 47.18% respectively, reinforcing the asset’s upward momentum.

The Relative Strength Index (RSI) at 63.22 indicates that the asset is neither overbought nor oversold, supporting a stable market condition. The positive MACD value of 17.68 further confirms the bullish momentum, suggesting that the current trend might continue.

Overall, the asset exhibits a strong bullish trend across different time frames, with technical indicators supporting ongoing positive momentum. However, it remains below the year’s and 52-week high, suggesting there might be resistance approaching these levels.

## Price Chart

Reddit, Inc. (RDDT) reported a robust financial performance for Q2 2025, with significant year-over-year growth in key metrics. The company’s revenue surged by 78% to $500 million, driven by an 84% increase in advertising revenue, which reached $465 million. Other revenue streams also grew, contributing $35 million, a 24% rise from the previous year. Daily Active Users expanded by 21%, totaling 110.4 million.

Net income showed a remarkable improvement, with Reddit posting $89 million, a significant recovery from a $10 million loss in Q2 2024. This resulted in a net margin of 17.9%. Earnings per share were positive, with basic EPS at $0.48 and diluted EPS at $0.45, compared to a loss per share of $(0.06) last year.

The company’s gross margin widened to 90.8%, and adjusted EBITDA increased to $167 million, reflecting an adjusted EBITDA margin of 33.4%. Operating cash flow and free cash flow both showed substantial gains, standing at $111 million.

Looking ahead to Q3 2025, Reddit anticipates revenue to be in the range of $535 million to $545 million and adjusted EBITDA to be between $185 million and $195 million. This guidance underscores the company’s continued growth trajectory and operational efficiency improvements.

## Earnings Trend Table

| Date | Estimate EPS | Reported EPS | Surprise % | |

|---|---|---|---|---|

| 0 | 2025-07-31 | 0.19 | 0.45 | 136.59 |

| 1 | 2025-05-01 | 0.02 | 0.13 | 504.65 |

| 2 | 2025-02-12 | 0.25 | 0.36 | 42.99 |

| 3 | 2024-10-29 | -0.07 | 0.16 | 319.60 |

| 4 | 2024-08-06 | -0.33 | -0.06 | 81.65 |

| 5 | 2024-05-07 | -8.71 | -8.19 | 6.01 |

The analysis of EPS trends over the last eight quarters reveals significant volatility and notable surprises in reported earnings compared to estimates. Starting from the most recent quarter (Q2 2025), there has been a substantial positive surprise with reported EPS of $0.45 against an estimate of $0.19, marking a 136.59% surprise. This trend of positive surprises continues from Q1 2025 and Q4 2024, where the reported EPS exceeded estimates by 504.65% and 42.99%, respectively.

A particularly interesting quarter is Q3 2024, where despite a negative estimate of -$0.07, the company reported a positive EPS of $0.16, resulting in a surprise of 319.60%. This indicates a significant turnaround in performance expectations. The trend of surpassing negative expectations is also visible in Q2 2024, where the actual EPS of -$0.06 was much better than the estimated -$0.33, showing an improvement of 81.65%.

However, Q1 2024 stands out with a minimal positive surprise of 6.01% when the actual EPS of -$8.19 was slightly better than the deeply negative estimate of -$8.71. This quarter likely represents a period of substantial challenges for the company, possibly due to exceptional external factors or internal disruptions.

Overall, the data suggests a recovery trajectory in recent quarters, moving from deeply negative estimates to consistently beating positive EPS forecasts, indicating improving operational efficiency or market conditions.

The most recent rating changes include two initiations and two reiterated ratings from various financial firms, reflecting diverse perspectives and expectations for the company’s stock performance.

1. **Argus – August 18, 2025**: Argus initiated coverage on Reddit with a “Buy” rating, setting a notably optimistic target price of $250. This initiation suggests a strong bullish outlook from Argus, indicating their expectation of significant growth or positive developments for Outer that could drive the stock’s value considerably higher.

2. **Needham – July 23, 2025**: Needham reiterated their “Buy” rating but adjusted their target price from $145 to $165. This upward revision in the target price by $20 indicates that Needham has observed factors or received updates that bolster their confidence in Reddit potential to outperform, justifying a higher valuation.

3. **Wells Fargo – July 1, 2025**: Wells Fargo reiterated an “Equal Weight” rating, slightly increasing their target price from $115 to $118. This minor adjustment suggests a stable outlook with modest expectations for stock performance. The small increase in the target price could reflect minor positive adjustments in Reddit’s valuation metrics or market conditions.

4. **Cleveland Research – June 25, 2025**: Cleveland Research initiated coverage with a “Buy” rating, setting a target price of $166. This initiation indicates a positive outlook, albeit less aggressive than Argus’s target. Cleveland Research’s initiation at this level suggests confidence in the company’s fundamentals and market position but with a more conservative expectation compared to Argus.

These recent ratings demonstrate a generally positive sentiment, with varying degrees of optimism about the company’s future stock performance. The differences in target prices and status updates highlight the diverse analytical approaches and market expectations from these financial institutions.

The current price of the stock stands at $219.55. This price is notably higher than the average target price provided by various analysts. For instance, Argus recently initiated coverage with a “Buy” rating and a target price of $250, which suggests a potential upside. Conversely, Needham reiterated a “Buy” rating, adjusting their target from $145 to $165, while Wells Fargo maintained an “Equal Weight” rating, slightly increasing their target from $115 to $118. Cleveland Research also initiated coverage with a “Buy” rating, setting a target price at $166.

This disparity in target prices, with the current price exceeding several analysts’ expectations, indicates a mixed consensus on the stock’s future movement. The higher target by Argus might reflect a more optimistic view of the stock’s potential, contrasting with more conservative estimates from other analysts. This variation underscores the importance of considering a range of perspectives when evaluating investment opportunities in this stock.

Disclaimer: The information provided here is for educational and informational purposes only and should not be interpreted as financial advice, investment recommendations, or trading guidance. Markets involve risk, and past performance is not indicative of future results. You should always conduct your own research and consult with a qualified financial advisor before making any investment decisions. By acting, you accept full responsibility for your choices.